- Top institutional investors—Grayscale, Fidelity, and Ark Invest—have been accumulating Bitcoin.

- The market could see a bullish move once Bitcoin recovers the short-term holder fiat basis.

Bitcoin [BTC], which has failed to establish a notable market movement in either direction, appears to now be leaning toward the bullish end.

The asset has gained 0.92% as market confidence is gradually being restored. Recent market action from whales and the potential of Bitcoin reclaiming key levels remain high.

Top investors prioritize BTC amidst minimal gains

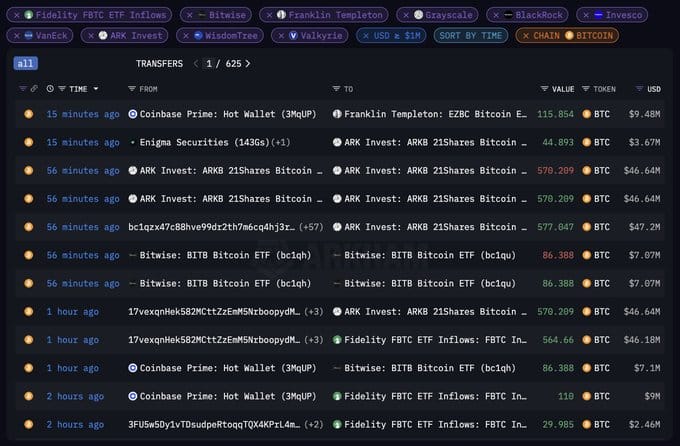

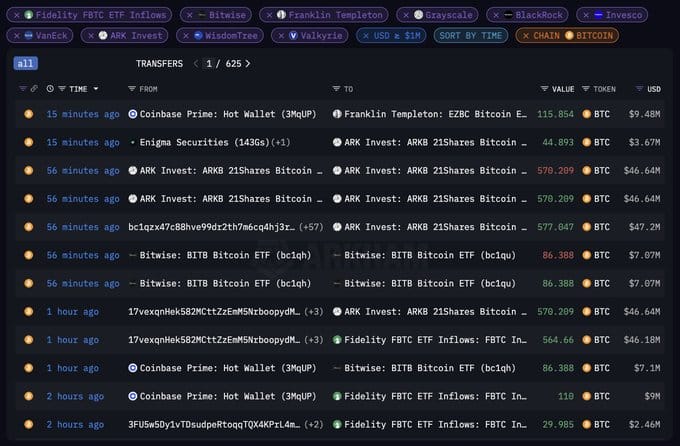

There has been a notable purchase of Bitcoin in the past 24 hours from top institutional investors in the market, adding to their existing portfolios despite market-shaking tariffs implemented by President Trump.

According to a report from Arkham, Grayscale, Fidelity, and Ark Invest are the main investors involved in this trade. Institutional investors have purchased at least 2,099 BTC as of press time.

Source: Arkham Intelligence

When large investors known to drive liquidity in the market choose to buy—especially when the market remains at lower levels—it implies a price rally could be near, with the asset trending higher.

Are the bulls fully in on BTC’s rally?

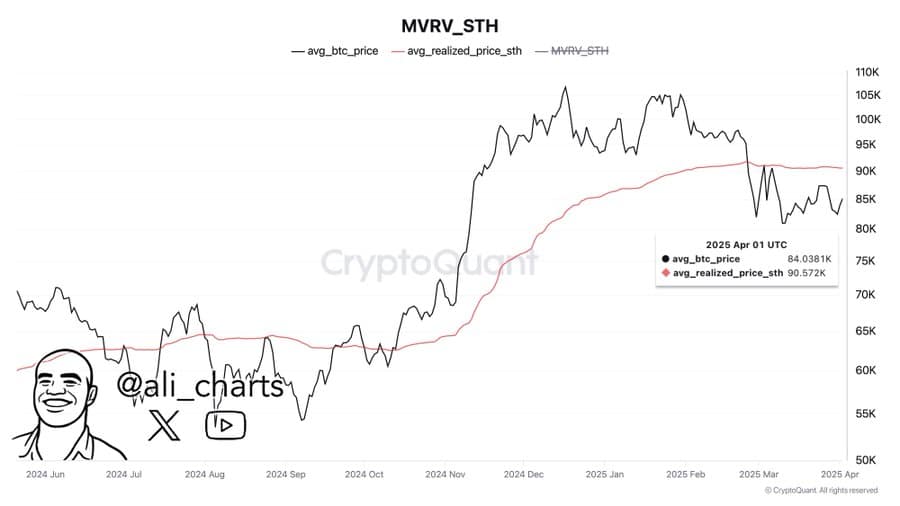

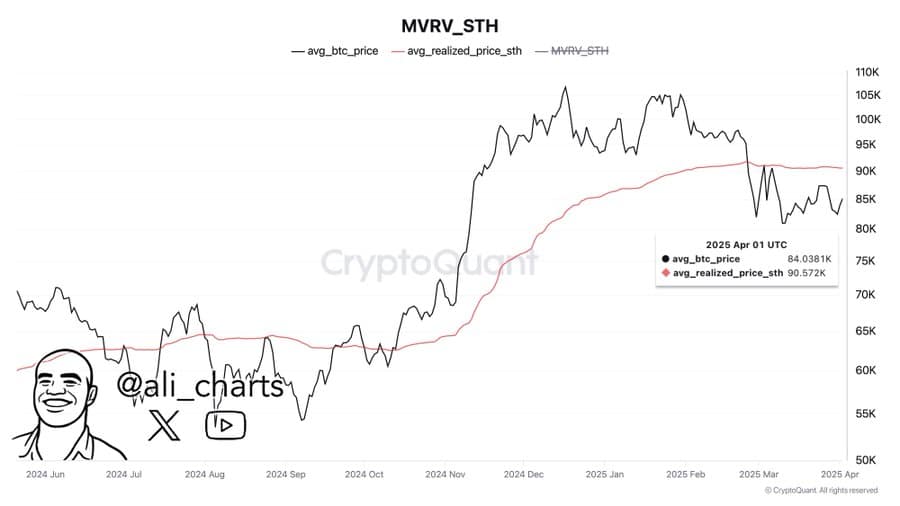

To confirm whether the bulls are fully supporting a Bitcoin rally, AMBCrypto analyzed the short-term holders’ realized price—a historic reference point used to determine whether the market is bullish or bearish.

Source: CryptoQuant

Currently, the market value realized by short-term holders remains at $90,570. This means that for Bitcoin to resume its rally, it would need to reclaim this level.

As seen on the chart, Bitcoin is attempting to reclaim this level, with its current price at $84,580, pointing to the upside.

Analysis of other key metrics suggests the rally could come sooner than anticipated.

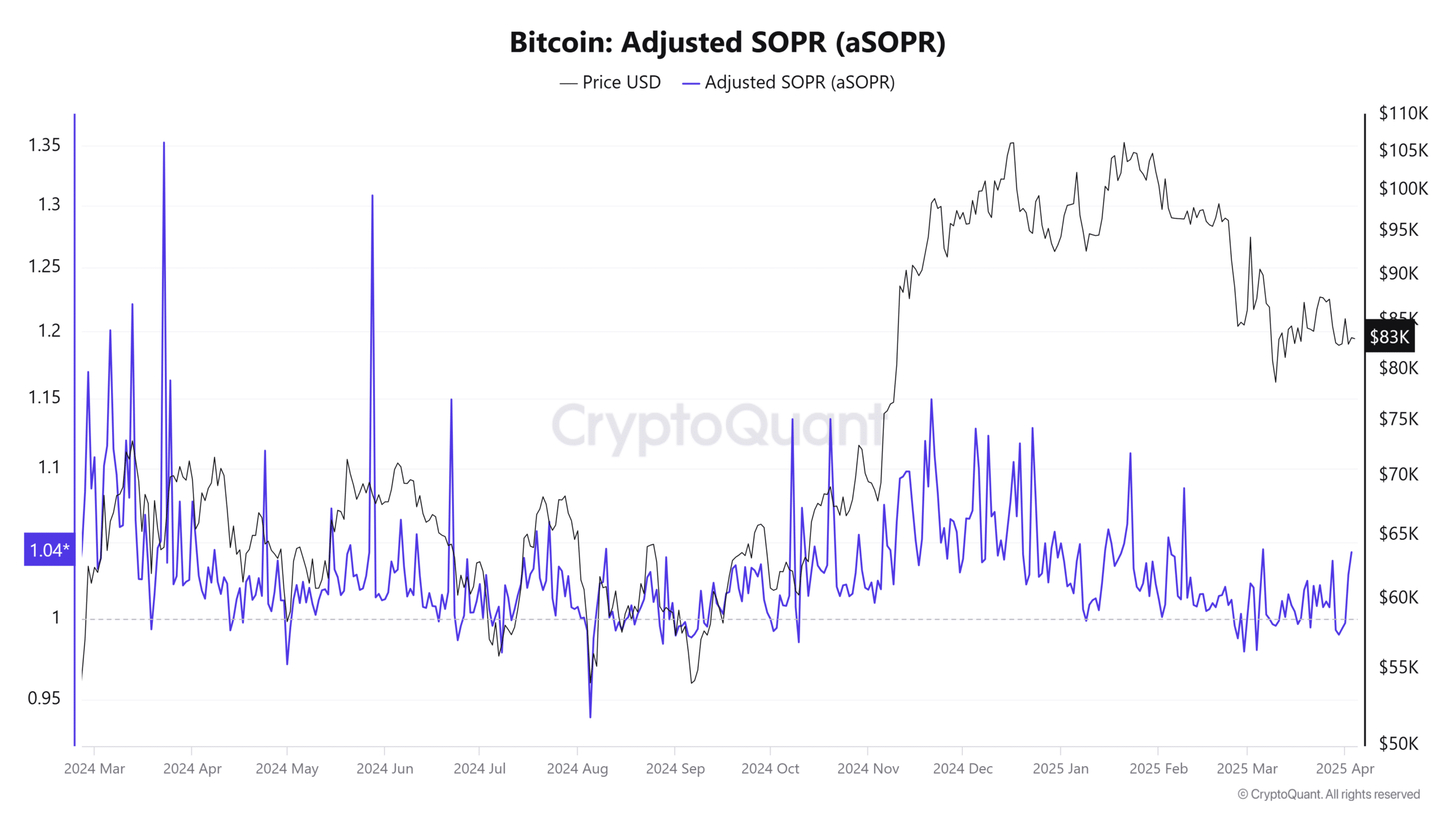

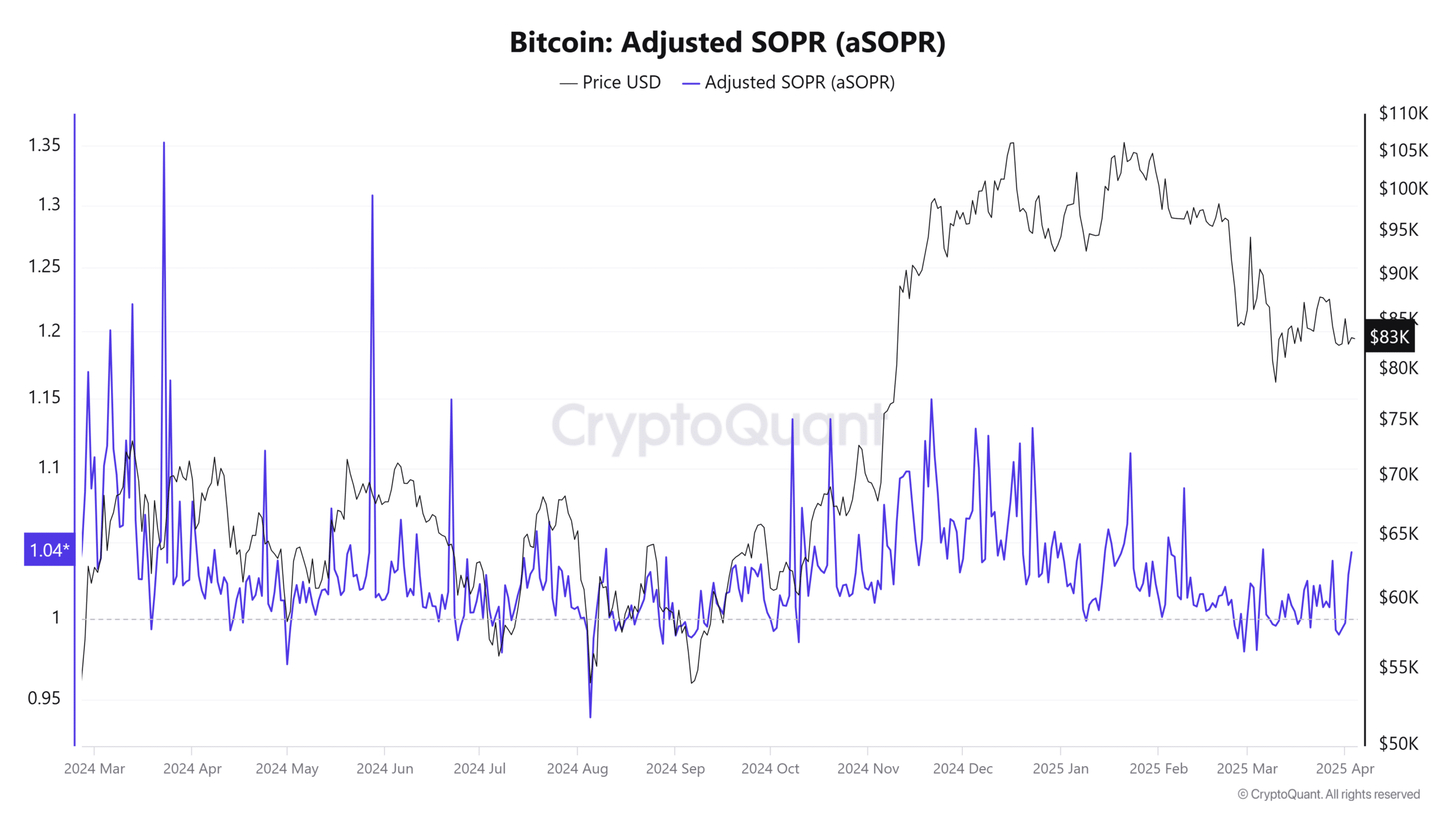

The Adjusted Spent Output Profit Ratio (aSOPR), which tracks whether investors are selling at a profit or loss, shows that investors are selling at a profit.

Source: Cryptoquant

Selling at a profit implies there could be downward pressure on Bitcoin, as more tokens are expected to be sold with limited demand.

However, analysis of Bitcoin’s Net Unrealized Profit/Loss (NUPL)—a metric used to determine the number of investors in profit or loss—shows that only a small percentage are currently in profit.

The Bitcoin NUPL is slightly above 0, with a reading of 0.4, indicating that only a small percentage of traders are in profit. This suggests that profit-taking could slow down soon, thus having little impact on the overall market.

Source: IntoTheBlock

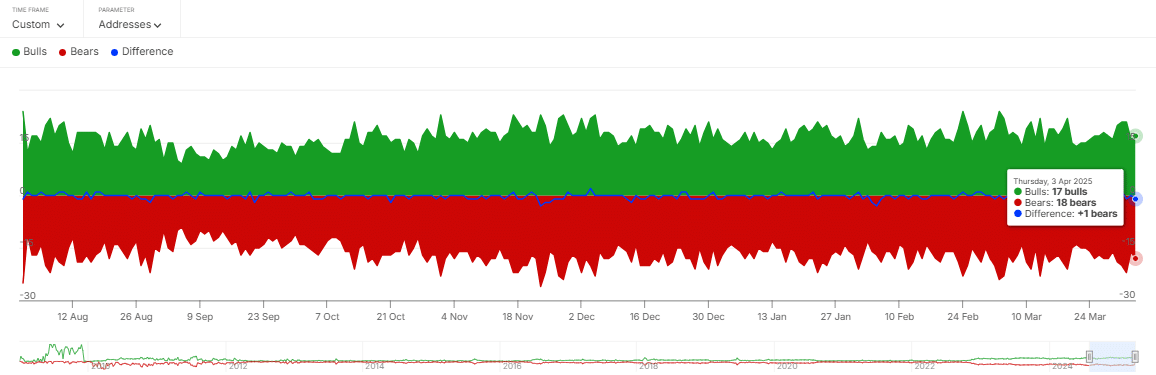

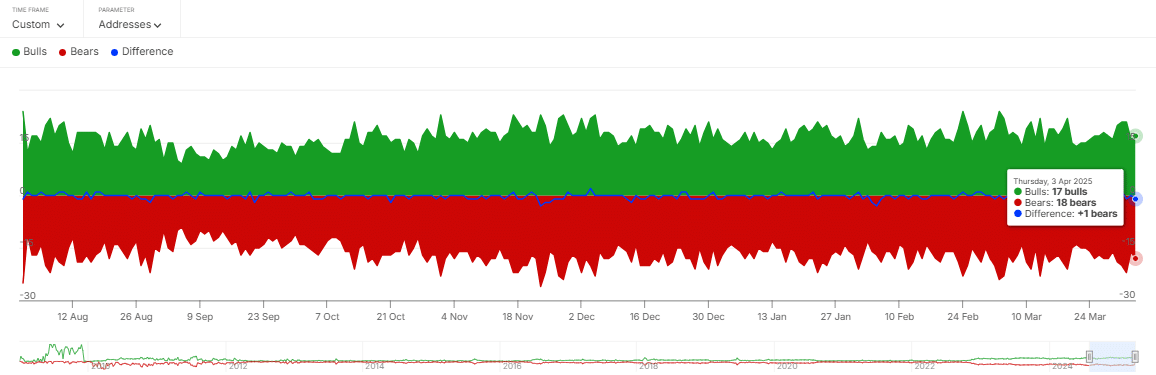

In addition, the Bull-Bear Ratio—an indicator used to determine the number of bullish and bearish large investors in the market—shows there are 17 bulls and 18 bears.

This minimal difference suggests the bulls are closing in on the bears, and it’s only a matter of time before the market balances or the bulls overtake the bears.

Overall, analysis shows that the chances for a rally remain high, with selling pressure gradually waning. Should this trend continue, it presents an opportunity for a major price breakout as buying sentiment grows.