- As Bitcoin slides 22%, Strategy follows.

- Will deep-pocket investors step in to buy the dip, or will the uncertainty force them to slow down?

Strategy [MSTR] has crashed 57% to $230, hitting a four-month low – closely following Bitcoin’s [BTC] 22% plunge. Given MSTR’s massive Bitcoin holdings, the correlation is no surprise.

With Trump ruling out BTC in the U.S. strategic reserve, concerns are growing about its impact on institutional adoption. Could this shake confidence in Bitcoin and altcoins?

Institutional fallout: Trillions erased

Risk-on assets reacted negatively to the recent crypto summit – Bitcoin shed $100 billion in market value in a single day, while the S&P 500 wiped out $1.4 trillion.

Strategy saw an even steeper decline.

With 499,096 BTC in its treasury, Strategy had positioned itself for Bitcoin’s long-term appreciation, especially amid speculation that the U.S. government might add BTC to its strategic reserves.

However, Trump’s outright dismissal of this idea dealt a heavy blow to MSTR’s strategy, triggering a wave of sell-offs. But the fallout didn’t stop there.

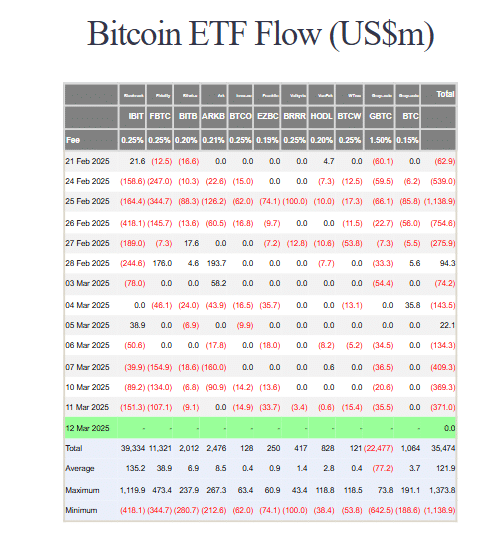

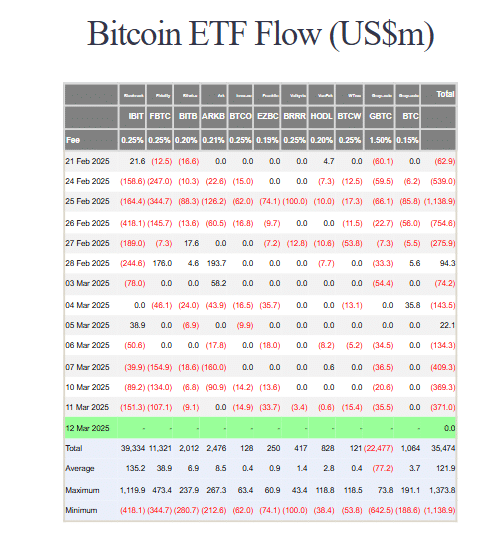

Bitcoin Exchange-Traded Funds (ETFs) witnessed over $500 million in outflows on the same day, reinforcing bearish sentiment.

Since February, institutional outflows have dominated, with billions leaving exchanges – a trend that shows no signs of reversal yet.

Source: Farside Investors

Bitcoin dominance vs. altcoin liquidity crisis

Despite the absence of institutional capital inflows into BTC, Bitcoin dominance (BTC.D) remains above 60%, signaling that capital isn’t flowing into altcoins.

Historically, Bitcoin downturns triggered rotation into high-cap alternatives, but this cycle appears different.

Instead of risk redistribution, liquidity is leaving the market entirely.

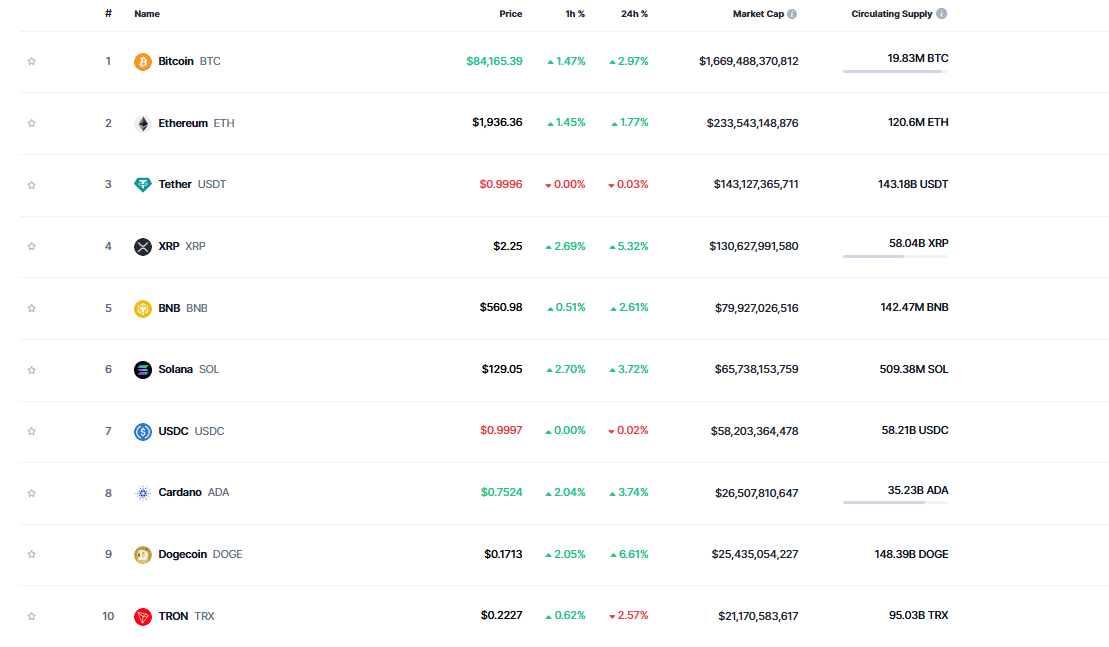

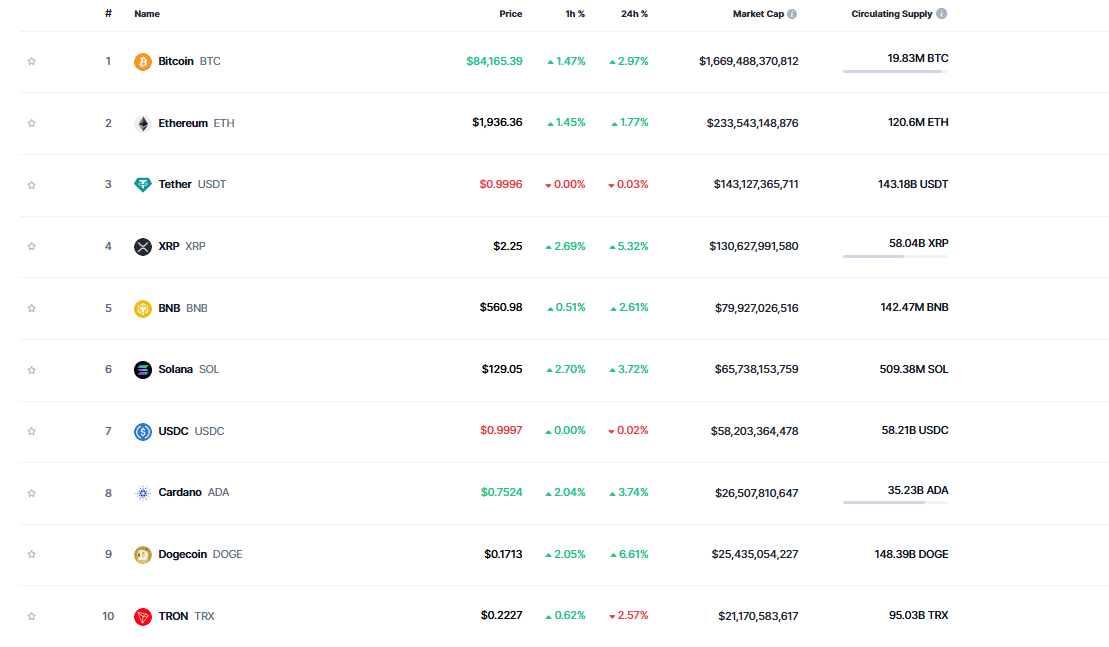

The top 10 cryptocurrencies have all dropped below key price zones, with Ethereum [ETH] losing the $2,000 level for the first time since 2023.

Source: CoinMarketCap

This shift underscores the market’s dependency on Bitcoin for capital influx. In bearish conditions, altcoins suffer as BTC turns into a risk asset.

MSTR stands as a critical case study, illustrating the broader impact of macro trends. With institutional capital drying up, BTC’s short-term volatility persists, dampening altcoin’s overall appeal.