- Over the past day, Pepe declined by 6.5% as bearish sentiments took hold.

- A Pepe whale has sold 150 billion tokens worth $1.14 million.

Over the past day, Pepe [PEPE] has been the latest victim of the strengthening negative sentiments across the crypto markets. The current conditions have seen whales turn to selling.

According to Lookonchain, a Pepe whale has made a massive deposit to exchange.

As per the report, this whale has sold 150 billion Pepe tokens worth $1.14 million. The whale had spent only $2,184 to buy 1.5 trillion tokens at $43 million in the early stages.

So far, the whale has sold 1.02 trillion tokens worth $6.6 million.

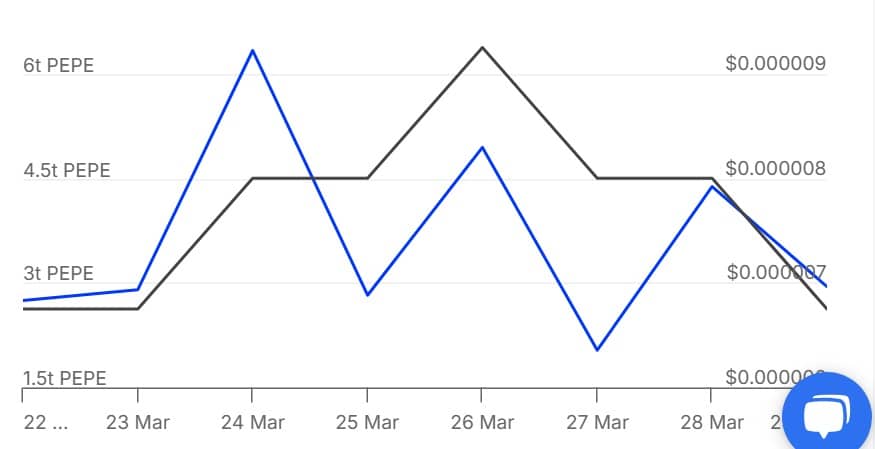

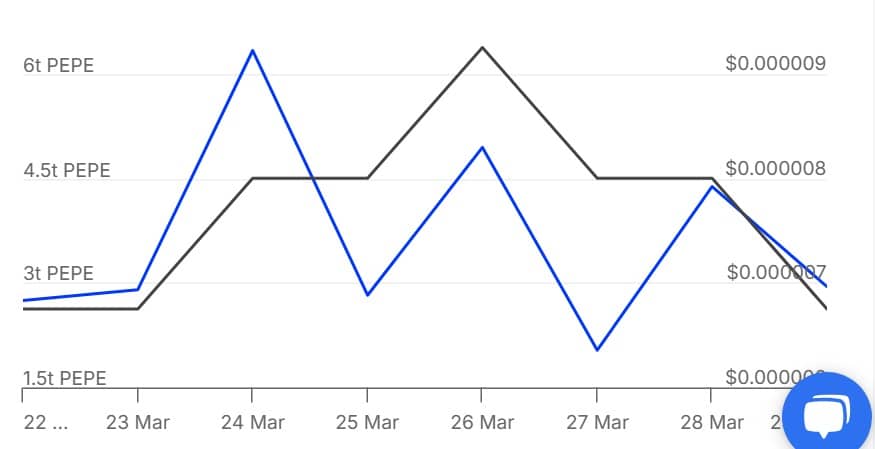

Source: IntoTheBlock

Besides these transactions, whales have sold over 2.95 trillion Pepe tokens over the past day, according to IntoTheBlock.

Although this is a drop from 4 trillion, selling activity from large holders still remained significantly high.

When whales turn to selling an asset, it shows a lack of market confidence, reflecting strong bearishness. This transaction may further dampen the memecoin’s negative perception.

Impact on price charts

As expected, such a strong sell-side activity has negatively impacted the memecoin’s price charts. In fact, as of this writing, Pepe was trading at $0.00000719. This marked a 6.5% decline on daily charts.

Equally, the memecoin has dropped on weekly and monthly charts, dropping by 1.2% and 3.87% respectively.

The continued dip has left long position holders at a loss. As such, a trader who went long on PEPE with 10x leverage is now down over $3.36M, according to Lookonchain.

Will the memecoin see more losses?

Source: Tradingview

According to AMBCrypto’s analysis, Pepe experienced strong bearish sentiments as sellers dominated the market.

This was evident by the RSI, which made a bearish crossover over the past day. A bearish crossover here suggests that there’s aggressive selling across all market participants, thus displacing buyers.

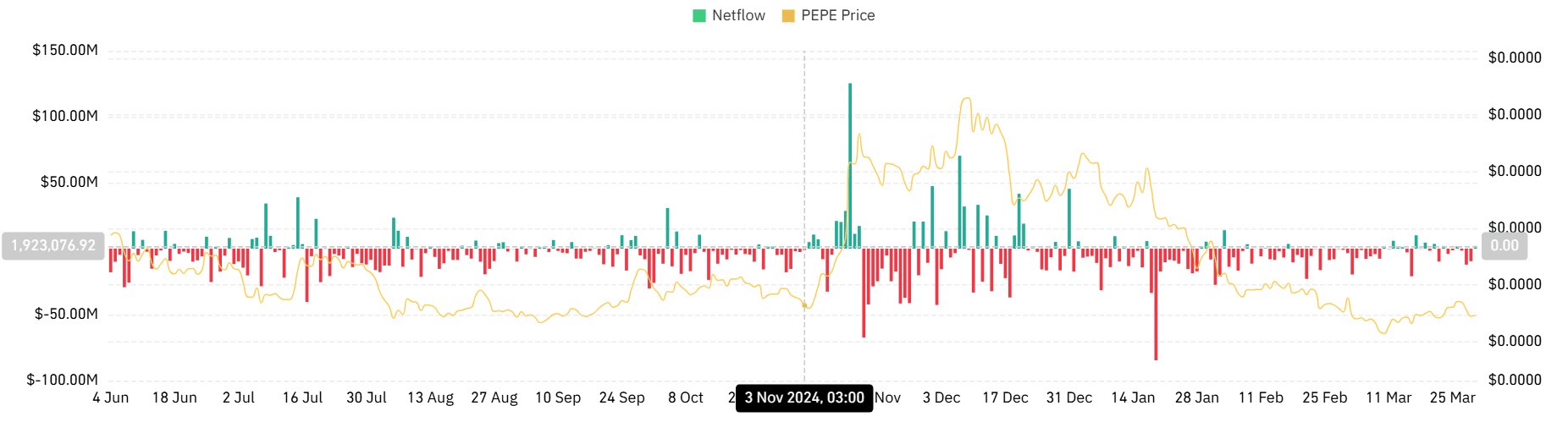

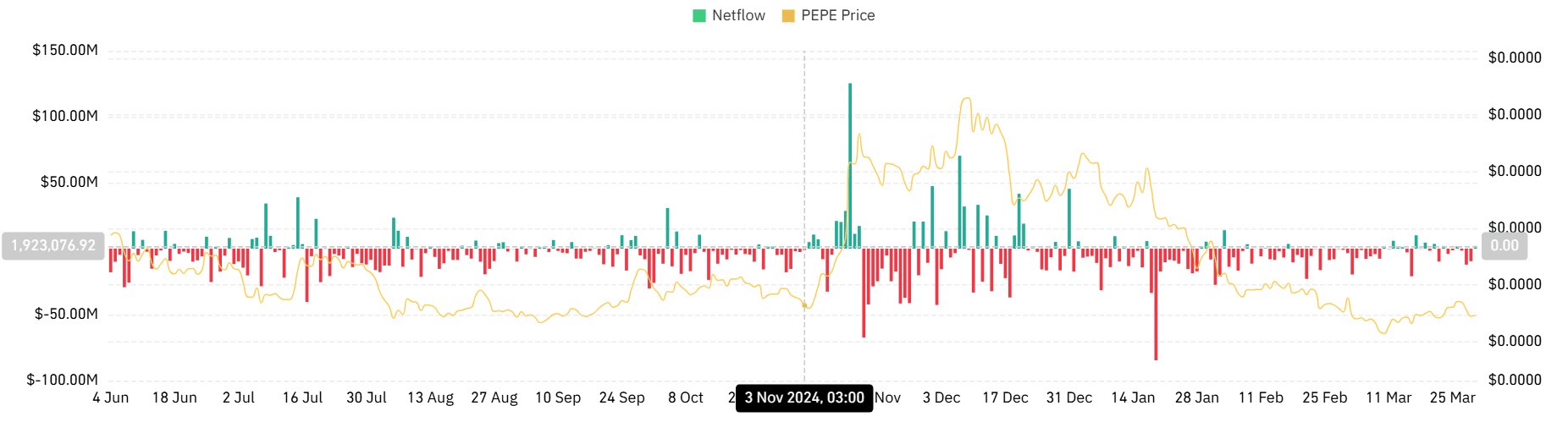

Source: Coinglass

This sell-side pressure is further evidenced by a positive spot netflow. According to Coinglass data, Pepe’s netflow has turned positive, hitting $1.87 million for the first time in four days.

This shift implies there’s more exchange inflow than outflows, reflecting strong bearish sentiments.

In conclusion, Pepe is experiencing strong bearish sentiments as investors close their positions. Therefore, with whales and retailers both selling, it reflects a lack of confidence among all market participants.

When these two combine, the memecoin is likely to see more losses on its price charts. Thus, prolonged selling activity could see the memecoin drop below $0.0000070 to $0.0000069.

However, a reversal here, with buyers reentering the market, will see the memecoin reclaim $0.0000073.