- On-chain metrics signaled a potential sell-off brewing beneath the surface.

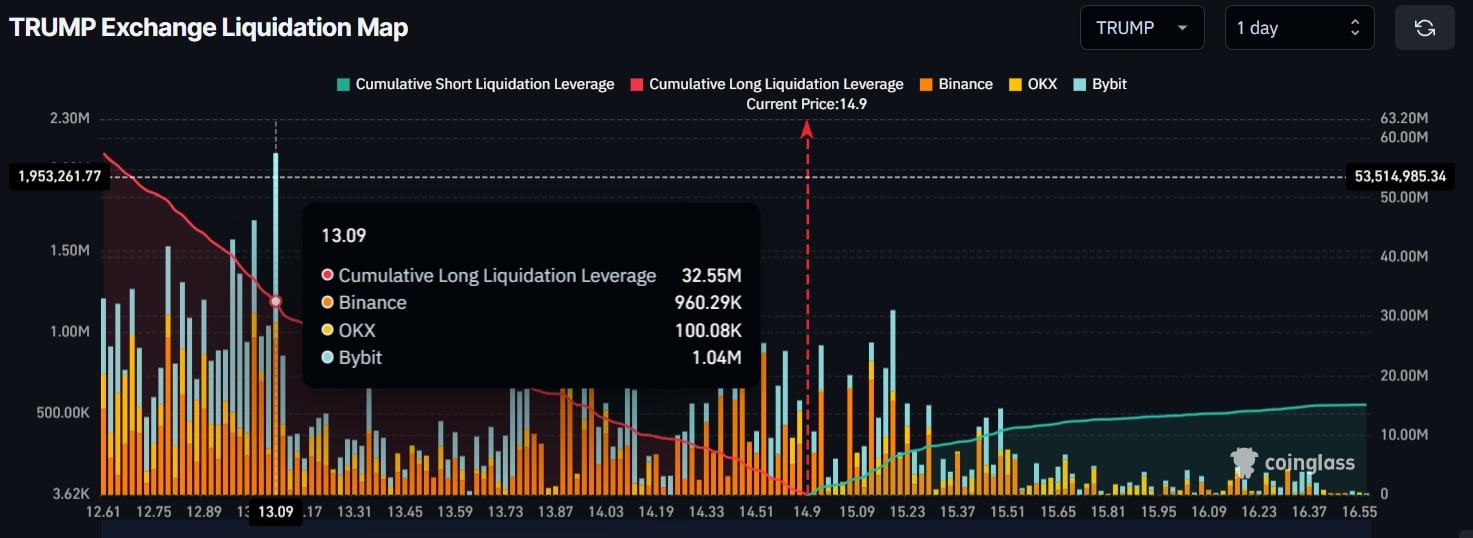

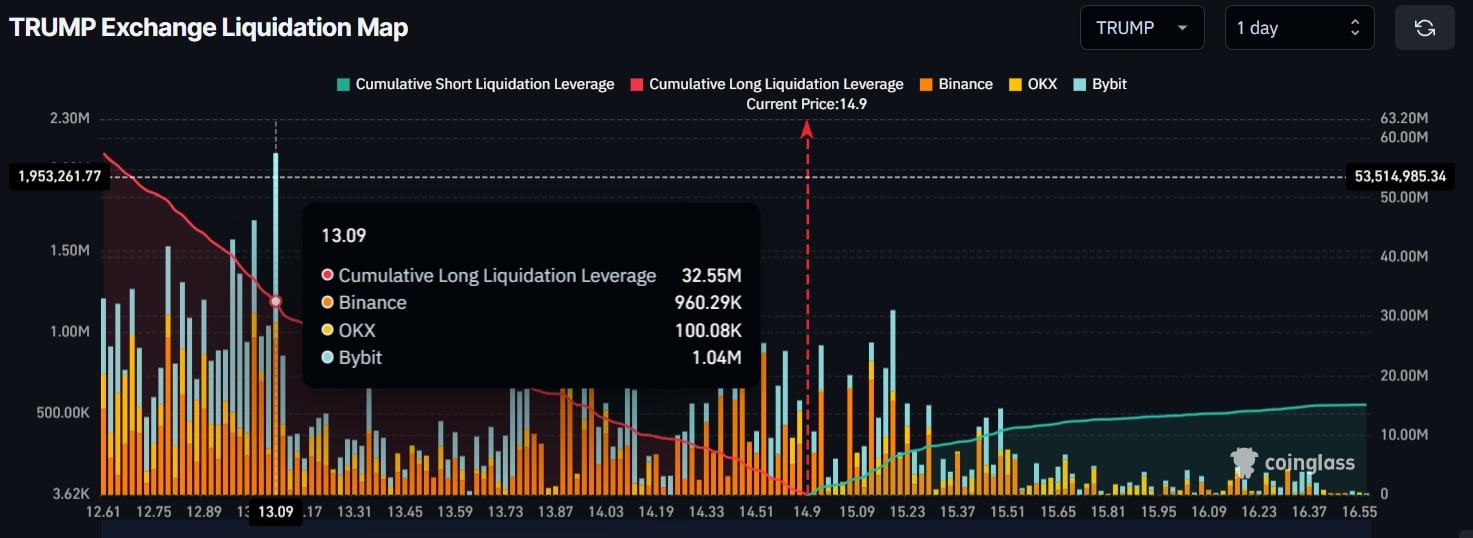

- Traders remained over-leveraged between $13.09 and $15.19.

The Official Trump [TRUMP] memecoin has been making waves with its impressive upside rally.

The memecoin soared over 70% in a few days, hitting a crucial $15 mark. Naturally, exchanges also recorded $28.51 million in inflows, hinting at brewing sell pressure.

Market sentiment and TRUMP price momentum

The price boom, of course, followed news that TRUMP’s top 220 holders could join a private gala with the president.

Scheduled for the 22nd of May, the announcement triggered a breakout beyond multiple resistance levels. At press time, TRUMP hovered near $15, having climbed 16.10% in the past 24 hours.

Due to its continuous upside rally, participation from traders and investors has also skyrocketed, leading to a 45% jump in the asset’s trading volume.

$28.51 million worth of TRUMP inflow

However, not all investors stayed bullish. On-chain analytics suggested some investors booked profits, even as others doubled down on bullish bets.

In fact, Spot Inflow metrics revealed $28.51 million worth of TRUMP entered exchanges over the past 48 hours.

Source: CoinGlass

This substantial Inflow into Exchanges indicates potential dumping, which can create selling pressure and lead to a further price decline. However, given the current market sentiment, such a scenario seems unlikely.

On top of that, traders appear confident and are strongly betting on the bullish side. At press time, long positions worth $32.55 million dwarfed short positions totaling $6.36 million.

Moreover, traders aggressively built leveraged positions between $13.09 (support) and $15.19 (resistance).

Source: CoinGlass

Momentum favors bulls

While examining the traders’ bets, it appears that they have been strongly bullish and are currently dominating the memecoin. However, $15.19 seems to be a strong resistance level.

If this level is breached, a massive upside rally for TRUMP coin could occur in the coming days.

On-chain metrics further reveal that traders betting on the long side outnumber those on the short side, meaning more bullish trades are open in the market.

Additionally, traders continue to build more long positions, with Open Interest jumping by 15% and the long/short ratio rising to 1.08, indicating strong bullish sentiment among traders.

Source: Coinglass

TRUMP price action and key levels

According to AMBCrypto’s technical analysis, TRUMP appeared bullish and was near a key resistance level of $15.19 at press time.

Source: TradingView

This level has a strong history of support, but due to the tariff war, this support was breached and now acts as a key resistance level, which will determine the upcoming move.

Based on the current price action and historical patterns, if the memecoin breaches the key level and closes a daily candle above the $15.50 level, it could open the path for a 35% upside momentum until the price reaches the $21.25 level in the coming days.

However, TRUMP’s price prediction could turn bearish if the price remains below the $15.50 level.