- A Pump.fun wallet has made nearly $40 million, even as Solana’s memecoin volume continues to decline.

- Market data shows a sharp drop in memecoin capitalization, with major tokens like TRUMP losing billions in value.

The Solana [SOL] memecoin market has cooled off, but one trader on Pump.fun has still managed to secure nearly $40 million in profit.

According to Dune Analytics, this comes even as trading volume declines across both Solana-based memecoins and Pump.fun itself.

Pump.fun volume drops, but profits persist

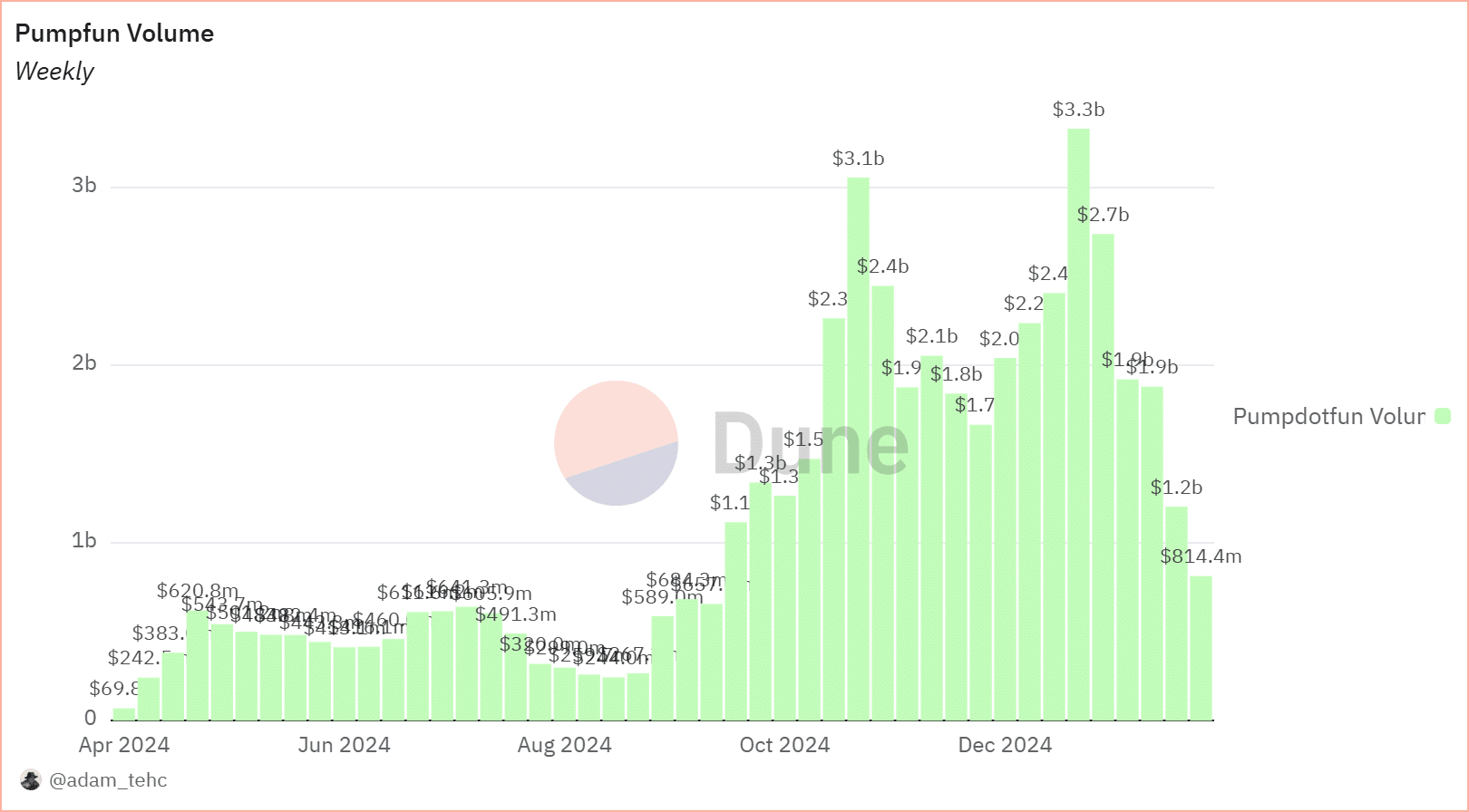

Data showed a sharp decline in Pump. fun’s weekly trading volume. At the time of writing, the figure stood at approximately $814 million, down from $1.2 billion the week before.

This decline continues a broader downtrend that started after Pump.fun’s record-breaking week in early January when volume peaked at $3.2 billion.

Source: Dune Analytics

Despite the decline, traders are still actively using the platform to launch new tokens, with over 8 million memecoins created.

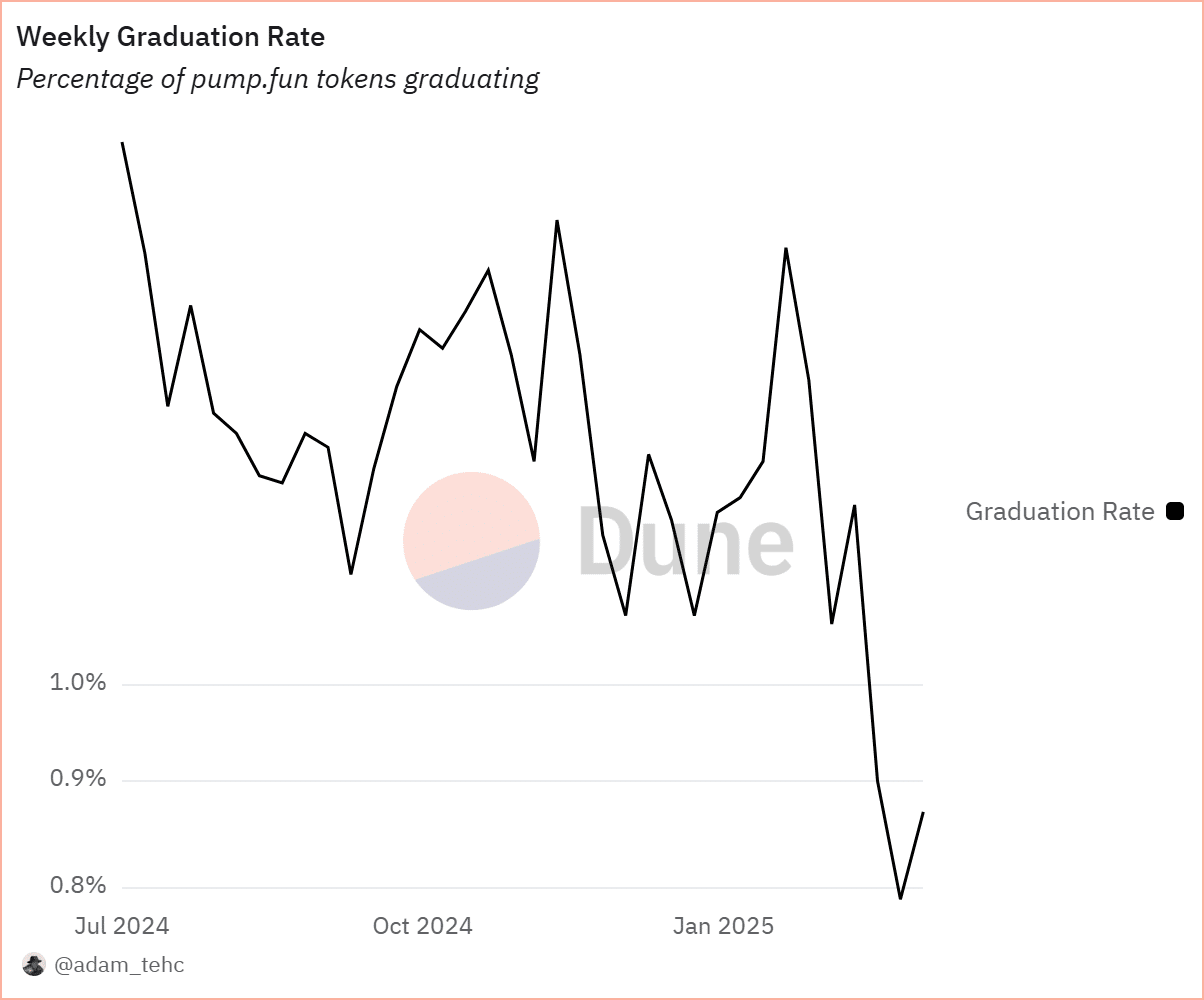

However, the Graduation Rate—the percentage of tokens achieving sustained traction—remains low.

While occasional spikes in activity occur, fewer than 1% of launched tokens progress into successful projects. This trend indicates declining investor enthusiasm and an increasing rate of unsuccessful launches.

Source: Dune Analytics

The lower Graduation Rate also aligns with decreasing speculative interest. Early-year hype led to massive volume surges, but as fewer memecoins gain lasting traction, short-term speculative trading has slowed.

Also, as the Dune Analytics data showed, the top-ranked trader has a profit of about $40 million despite this slump.

Solana memecoins mirror the decline

The broader Solana memecoin market reflects the trend seen on Pump.fun. Data from CoinGecko shows that after reaching a market cap of $30 billion in January, the sector has now dropped to around $8 billion.

Official Trump [TRUMP], one of the biggest memecoins, exemplifies the crash. Once valued at over $14 billion, it has since plummeted to around $2.5 billion. This steep decline highlights reduced demand and shifting sentiment within the memecoin space.

The drop in memecoin market capitalization suggests investors are taking profits or rotating funds into other sectors. While memecoins remain speculative, declining participation raises concerns about sustainability.

What next?

Despite falling memecoin trading volume, some traders continue to make substantial gains. The Pump.fun trader with $40 million in profit proves that even in a cooling market, opportunities still exist.

The key question is whether this downturn is a temporary dip or a signal of fading hype in the Solana memecoin sector.