In brief

- El Salvador’s Bitcoin Office said it had moved its crypto holdings to new addresses for security reasons.

- Blockchain data shows that the country is still adding more Bitcoin to its reserve, but the IMF says they aren’t new buys.

- The country, under a deal with the IMF, was supposed to scale back its Bitcoin ambitions.

El Salvador’s government has moved its Bitcoin stash to new addresses, just months after telling the International Monetary Fund that it wouldn’t buy more of the cryptocurrency.

The country’s National Bitcoin Office said on X Friday that it had moved its funds from a single Bitcoin address into new addresses “as part of a strategic initiative to enhance the security and long-term custody of the National Strategic Bitcoin Reserve.”

El Salvador’s Bitcoin Office noted the security threat posed by the advent of quantum computing as the primary motivation for moving its coins. “Quantum computers have the theoretical capability to break public-private key cryptography using Shor’s algorithm,” the office posted on X. “When a Bitcoin transaction is signed and broadcast, the public key becomes visible on the blockchain, potentially exposing the address to quantum attacks that could discover private keys and redirect funds before the transaction confirms.”

El Salvador is moving the funds from a single Bitcoin address into multiple new, unused addresses as part of a strategic initiative to enhance the security and long-term custody of the National Strategic Bitcoin Reserve. This action aligns with best practices in Bitcoin…

— The Bitcoin Office (@bitcoinofficesv) August 29, 2025

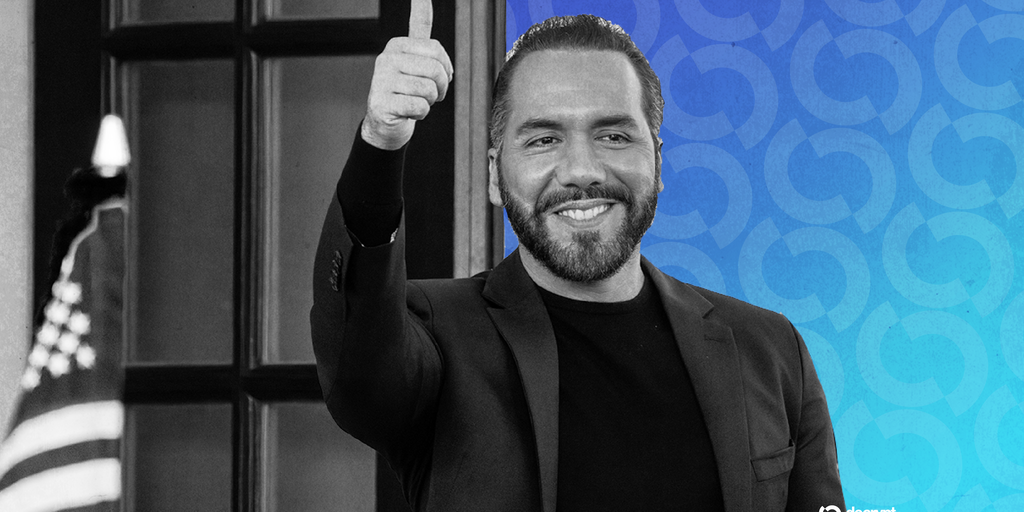

El Salvador’s president Nayib Bukele in 2022 said his government would buy 1 BTC per day for its national reserve. The country’s coffers currently hold 6,286 BTC, according to Arkham Intelligence data. That’s $686 million in crypto at today’s price of $109,204 per coin.

The office noted over the weekend that it had previously used just one address for transparency but would now use multiple addresses as a way of “enhancing security.” Data from Arkham Intelligence shows that the country last bought 1 BTC on Sunday. “The reserve is being redistributed into multiple addresses, each holding up to 500 BTC. Limiting funds in each address reduces exposure to quantum threats because an unused Bitcoin address with hashed public keys remains protected,” the country’s account posted.

“Once funds are spent from an address, its public keys are revealed and vulnerable. By splitting funds into smaller amounts, the impact of a potential quantum attack is minimized,” the account said.

The Salvadoran government now has a public dashboard showing its transactions and addresses. Crypto privacy experts advise against using one address to hold Bitcoin and other digital coins and tokens.

El Salvador’s announcement comes after the country said in July it would not continue to accumulate Bitcoin, according to the IMF.

The body in May started disbursing the first part of the loan to help the Salvadoran economy grow on the condition that El Salvador would change some of its Bitcoin policies.

A July statement from the IMF said that “authorities continue to comply with commitments not to voluntarily accumulate Bitcoin.” In late July, an IMF spokesperson told Inner City Press that El Salvador was not, in fact, purchasing Bitcoin on a weekly basis but was instead simply moving funds around from internal wallets. “The total amount of Bitcoin held across government-owned wallets remains unchained,” the spokesperson said.

The Salvadoran government’s press office confirmed to Decrypt that it would continue to buy 1 BTC per day. The IMF did not immediately respond to Decrypt‘s request for comment.

El Salvador in 2021 made Bitcoin legal tender along with the U.S. dollar. The new law meant that businesses had to accept the cryptocurrency if they had the technological means to do so. The Salvadoran government even launched a state-backed wallet for its citizens.

President Bukele would also frequently buy the cryptocurrency, drawing criticism from IMF and other institutions.

But despite President Bukele’s enthusiasm for Bitcoin, polls show that Salvadorans are largely indifferent to the cryptocurrency, and don’t use it. Still, the Salvadoran leader is largely popular with citizens thanks to his tough-on-crime position and the nationwide crackdown on gang activity.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.