- Bitcoin as a treasury asset is still evolving, forcing companies to choose between risk management and blindly chasing MSTR’s success

- Today, 90 publicly traded companies hold BTC on their balance sheets

Bitcoin [BTC] as a treasury reserve asset is still a bold, unproven move, but more companies are jumping on board. The idea? BTC hedges against inflation and adds diversification to corporate balance sheets.

MicroStrategy kicked off this trend in 2020, seeing massive gains, but newer adopters like GameStop are joining the list.

With 90 companies already holding BTC, the big question is – Will this become the norm? Some analysts predict that by 2030, a quarter of the S&P 500 will have BTC exposure.

Market under pressure – Is Bitcoin the new play?

2025 is all about macro trends shaping the markets, and stocks are feeling the pressure. The S&P 500 closed Q1 down $2 trillion in market value, inflation ticked up to 2.8%, and a 25% auto industry tariff is shaking things up.

Even Tesla couldn’t escape the heat, with a weaker-than-expected Q1 performance. With all this uncertainty, it’s no surprise Bitcoin’s growing role in corporate balance sheets is making headlines.

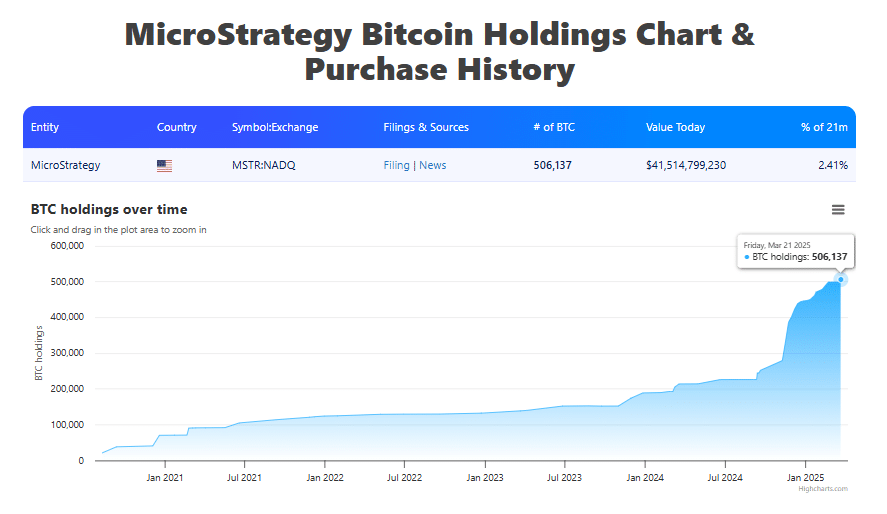

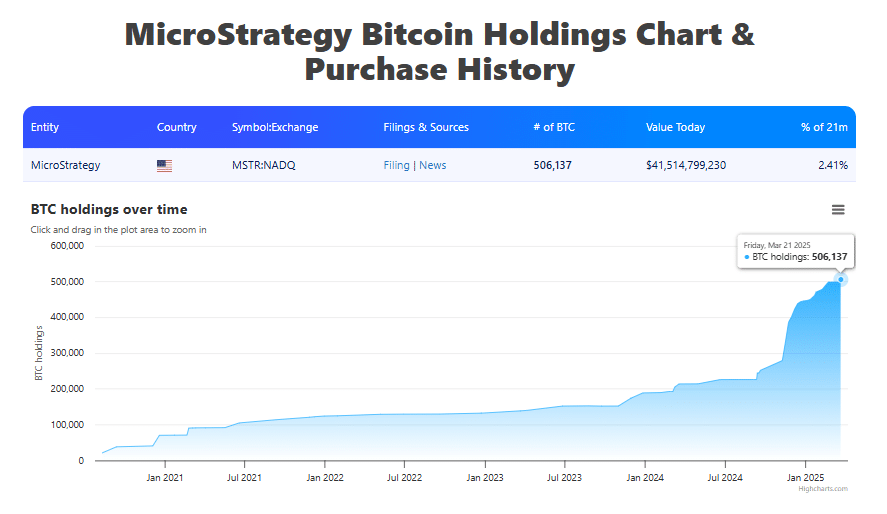

However, there’s another big reason for the buzz – MicroStrategy (MSTR) bet on BTC as its primary treasury asset back in 2020, and the results have been massive.

Since then, while the S&P 500 has gained by 64.81% and BTC has surged 781.13%, MSTR’s valuation has skyrocketed by 2,074.85%. With over 500,000 BTC in its treasury, S&P 500 companies are now wondering – Can they pull off the same play?

Source: BitBo

MSTR’s stock says it all. In Q4 2024, Bitcoin crossed $100k, sending MSTR past $500 for the first time. But now? It’s down 45% to $277.

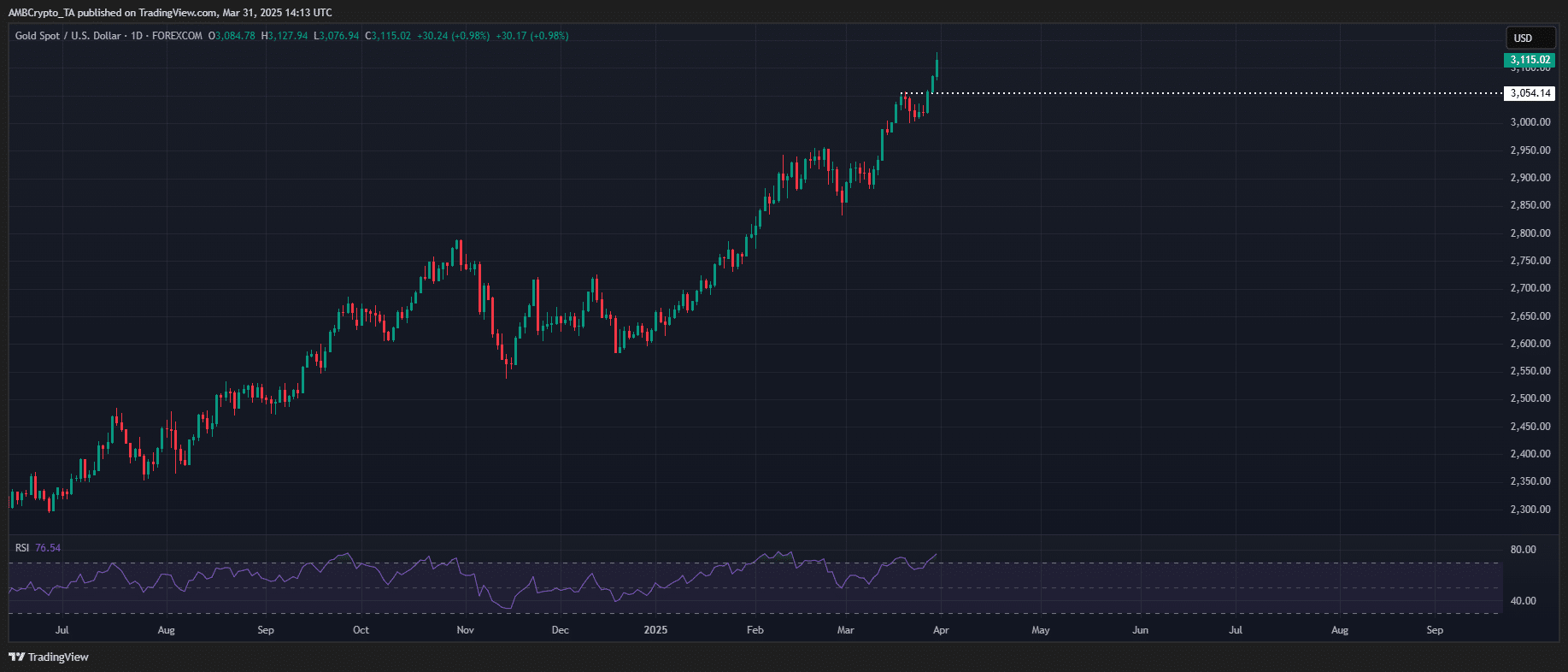

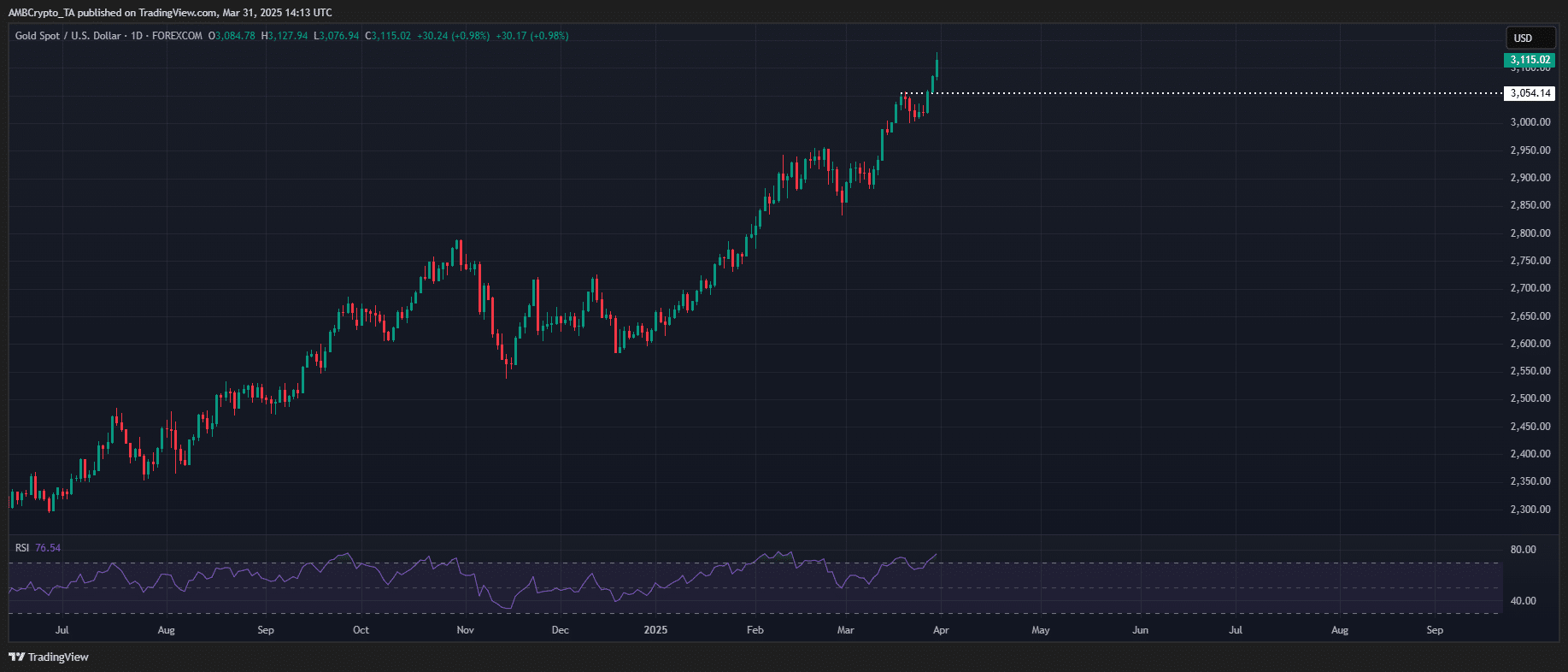

With Bitcoin swinging on macro volatility and gold hitting record highs, the big question remains – Does adding BTC to the S&P 500 balance sheet make for a smart treasury move or just a high-risk gamble?

BTC on corporate balance sheets – A smart move or a risky bet?

Recently, GameStop (GME) announced a $1.3 billion plan to adopt BTC as a treasury reserve asset. However, the market wasn’t convinced – GME stock dropped 20% after the news.

Why? As AMBCrypto pointed out, BTC’s long-term potential is big, but its short-term volatility is a major risk. And when Bitcoin falls, companies holding it take an even bigger hit.

In fact, skeptics ask – If companies don’t hold gold as a treasury asset, why would they hold BTC? Especially when gold remains the go-to safe haven in turbulent markets.

And the logic checks out – Gold just hit $3,100 while Bitcoin slipped to $77k. The numbers speak for themselves.

Source: TradingView (XAU/USD)

Still, with 90 S&P 500 companies already holding BTC, some see this as just the beginning. Tech executives predict that by 2030, 25% of S&P 500 companies will have BTC on their balance sheets.

But with Bitcoin’s wild swings, it’s a high-stakes move – One that could either pay off big or turn into a career risk.