- If XRP can break above $3, it will invalidate the current head-and-shoulders pattern, potentially flipping the outlook bullish.

- XRP’s flip to bullish is hindered as stablecoin reserves across exchanges increased, signaling profit-taking in the market.

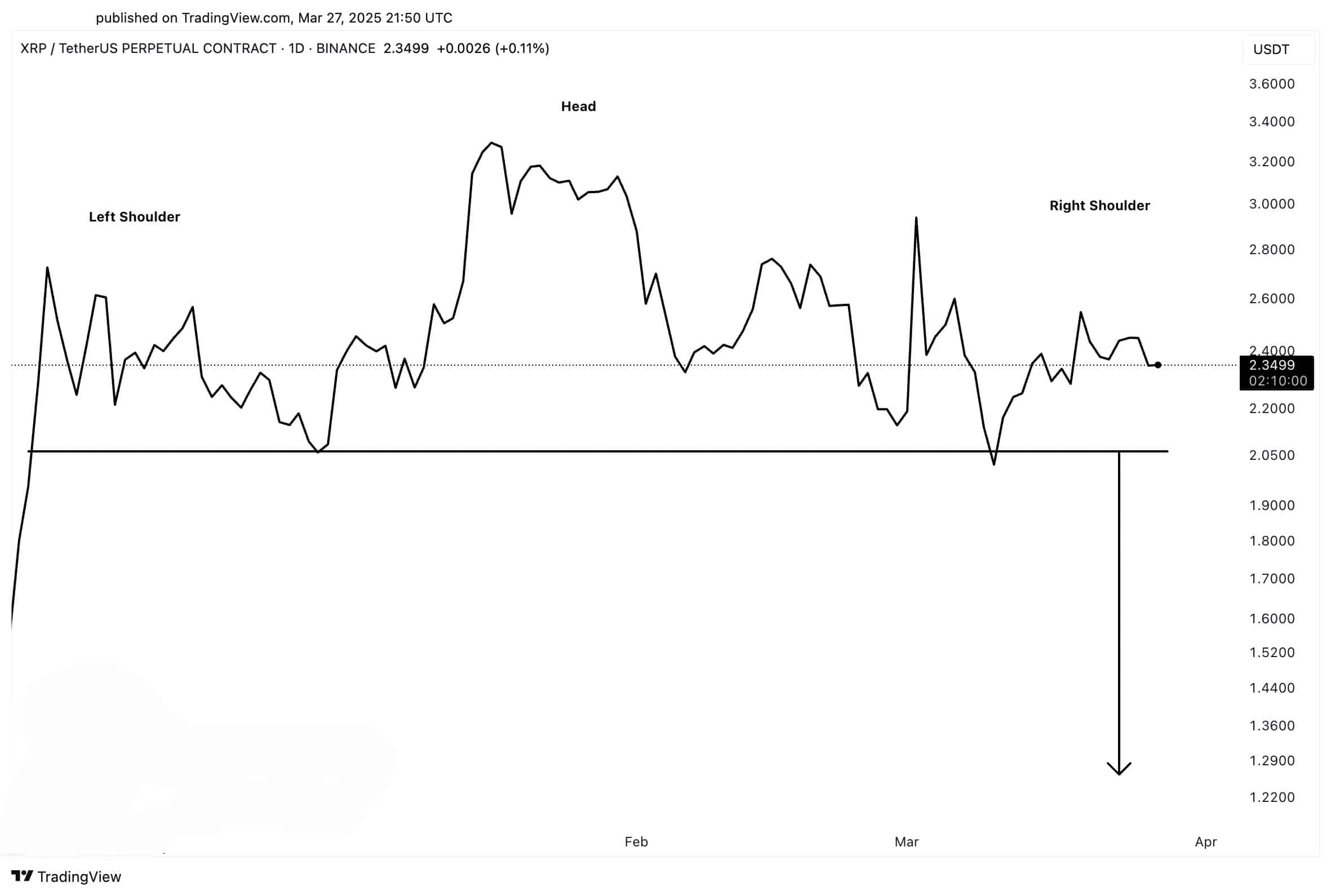

Ripple[XRP] developed a traditional bearish pattern, head-and-shoulders signaling of an oncoming bearish trend that had its main support point at $2.05.

A proven breakdown under this section could induce fast depreciation to push XRP prices toward the $1.30-$1.20 region, which matched a previous turning point.

XRP sustaining above $2.05 would possibly delay the bearish breakdown, as brief upward movements may occur between $2.40-$2.60 before the price continues its descent.

Source: TradingView

A price move above $3 would cancel out the validity of the head-and-shoulders structure, thus changing the general market sentiment to bullish. XRP price could test this point as resistance at $3.40 and $3.60 before it displays increased upward movement potential.

The upcoming trading sessions could prove essential because continuous bulk buying is needed to both cancel the bearish pattern and validate exceeding important resistance levels.

Long liquidations and profit-taking surge

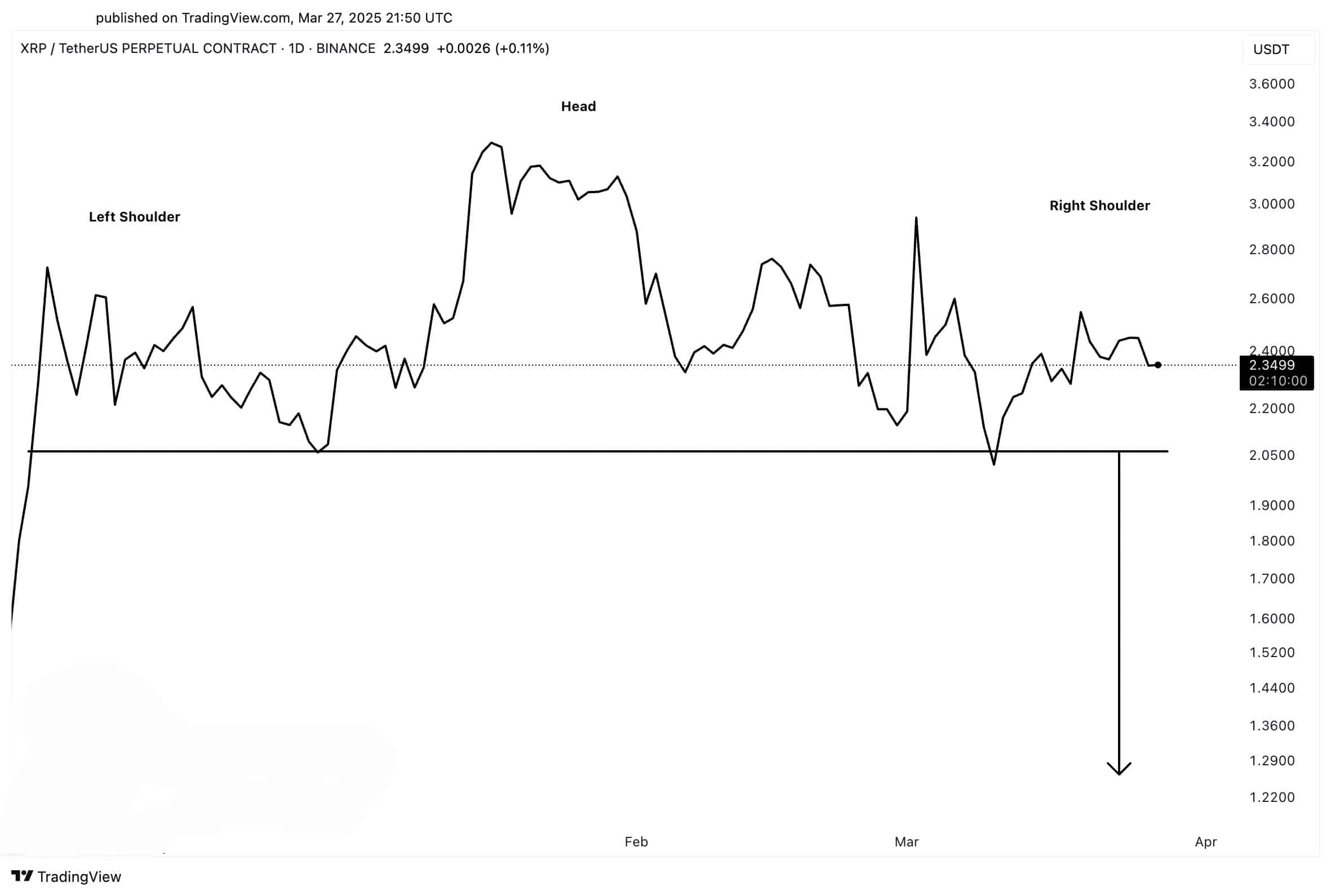

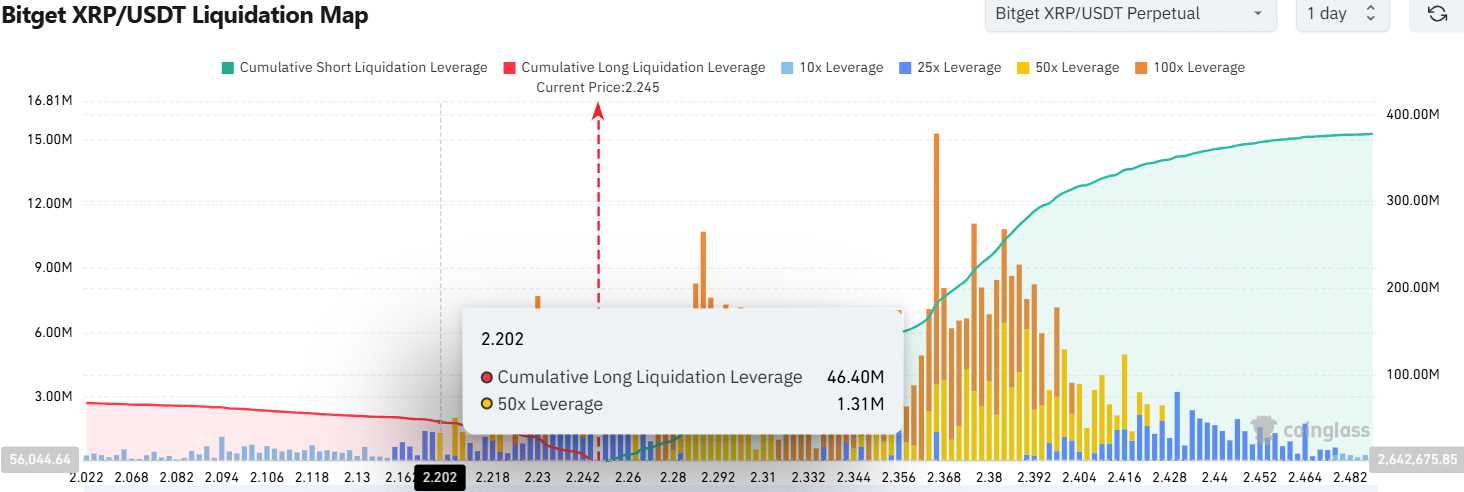

The bearish pattern is supported by the increase in cumulative long liquidation leverage value to $46.4 million at the $2.20 zone.

The number of forced liquidations among long traders could reach this high point, reinforcing the rising sell pressure in the market.

At the same time, leveraged short positions kept rising, demonstrating mounting negative sentiment and thereby increasing the probability of a continued downtrend.

XRP at $2.245 struggled to break support, which could trigger liquidations and push the price to $2.10 or lower.

Once XRP hits the $2.20 liquidity zone, liquidations could aggressively wipe out leveraged traders, accelerating the price decline.

Source: Coinglass

Also, Stablecoin reserves on all exchanges reached $32.8 billion in 24 hours, as of press time. This indicated multiple market participants were selling their holdings for profits, as Ali noted on X (formerly Twitter).

Strong selling pressure became more likely because of diminishing bullish indicators. The increasing reserve holdings of stablecoins could trigger XRP prices to break through its support at $2.05.

A failure to defend the support level would lead to the price dropping between $1.30 and $1.20.

Can sentiment flip XRP’s bearish signals?

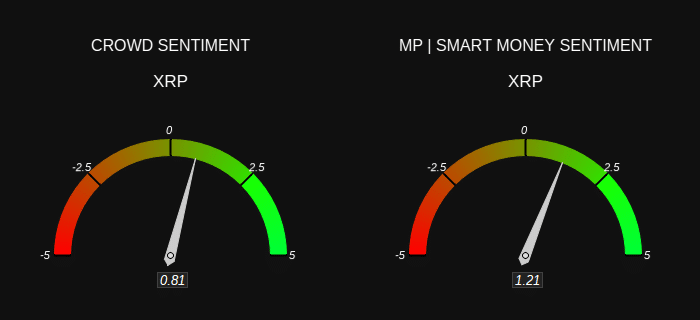

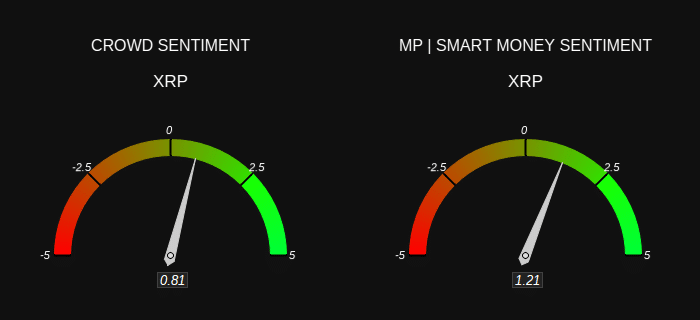

The bearish sentiment against XRP because of its head-and-shoulders pattern worsened due to liquidity flowing out of the market. However, sentiment for XRP pointed toward bullishness. The crowd sentiment reached a value of 0.81 while smart money sentiment stood at 1.21.

Data showed that retail and institutional traders had a preference for ascending price movement during this time. However, these might not be sufficient to alter the bear conditions.

This is because smart money frequently uses manipulation to lure investors ahead of significant price drops.

Source: CryptoQuant

XRP failing to break resistance may trigger a liquidity sweep, pushing prices down until experienced traders exit before market expansion starts.

Market sentiment showed optimism, although additional price drops remained likely because of liquidation risks.