- Exchanges witnessed an outflow of $60 million worth of SOL.

- At press time, 77% of top Solana traders on Binance held long positions.

Solana [SOL], the world’s fifth-largest cryptocurrency by market cap, is poised for an upside rally due to bullish price action and increasing interest from traders and investors.

However, overall sentiment in the cryptocurrency market is unpredictable, with major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] continuing to struggle.

Bullish on-chain metrics

Despite the market’s ups and downs, traders and investors have shown strong interest in SOL, as on-chain analytics firm Coinglass revealed.

The Spot Inflow/Outflow indicated that exchanges witnessed a significant outflow of $60 million worth of SOL, suggesting potential accumulation that could create buying pressure and drive a price rally.

This substantial outflow further suggested that long-term holders were capitalizing on the current market sentiment to accumulate the token and take advantage of the price drop.

In addition to the rising interest from long-term holders, Binance traders were going wild, with the majority taking long positions.

Data from Binance’s SOL/USDT Long/Short Ratio was 3.35 at press time, indicating strong bullish sentiment among traders.

Source: Coinglass

According to the data, 77% of top SOL traders on Binance took long positions, while 23% held short positions at press time.

When traders and investors show strong interest in a token, it often leads to impressive results, as experts and enthusiasts expect.

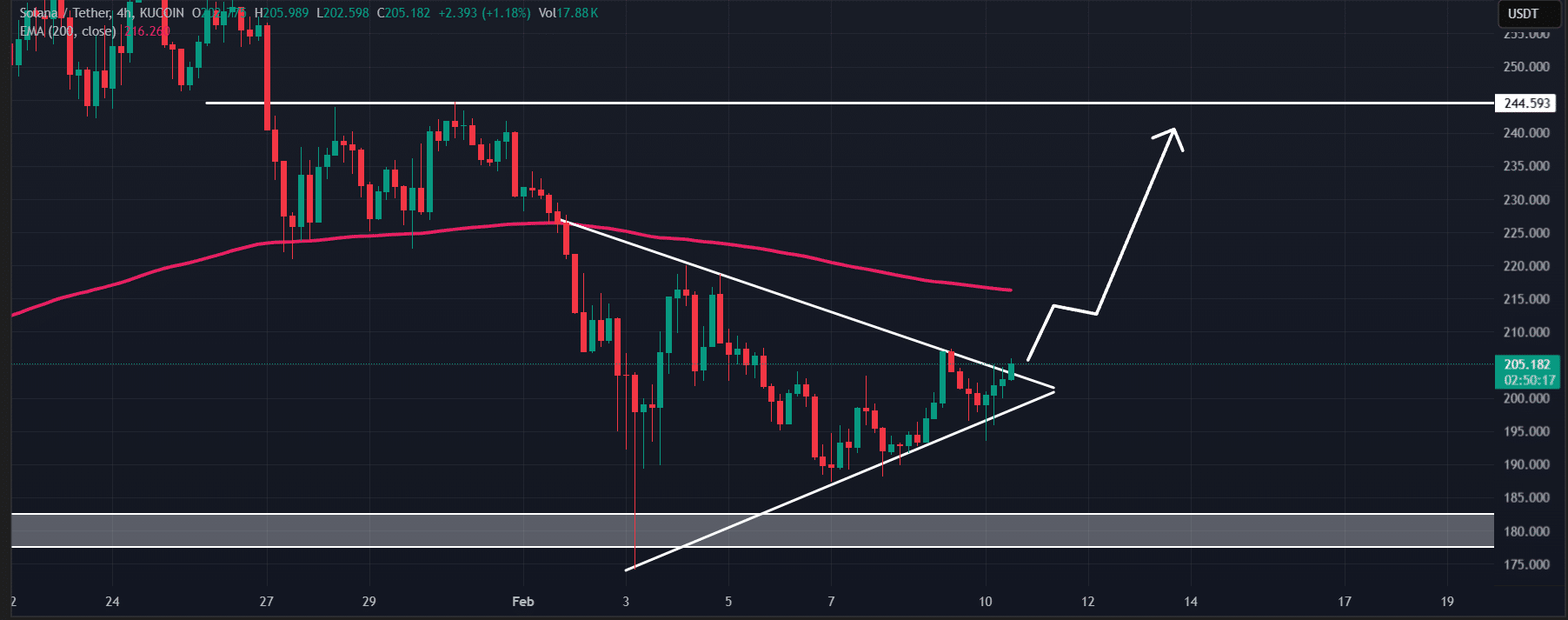

Solana price action and upcoming level

At press time, SOL was trading near $204.65 after a modest 1% upside momentum in the past 24 hours.

During the same period, strong interest from investors and traders drove its trading volume up by 45% compared to the previous day.

According to AMBCrypto’s technical analysis, SOL has broken out from a symmetrical triangle price action pattern in the four-hour timeframe.

However, the breakout will only be considered successful if SOL’s four-hour candle closes above the $207 mark.

Source: TradingView

Read Solana’s [SOL] Price Prediction 2025–2026

Based on historical price patterns, if SOL successfully closes above $207, there is a strong possibility it could rally 17% to reach the $243 mark in the coming days.

At the time of writing, SOL was trading below the 200 Exponential Moving Average (EMA) — thus, the asset was in a downtrend.