- Solana’s Open Interest hit an all-time high in November.

- SOL surged over 10% in two days, yet bearish pressure from shorts dominates with a 52% share.

Solana’s [SOL] derivatives market is heating up and attracting traders worldwide. Its Open Interest (OI) has reached unprecedented levels as the tug-of-war between bulls and bears intensifies.

After sharply bouncing off a key support level, the question now is whether Solana can sustain the momentum and climb toward $264 or if bearish sentiment will force it to retreat.

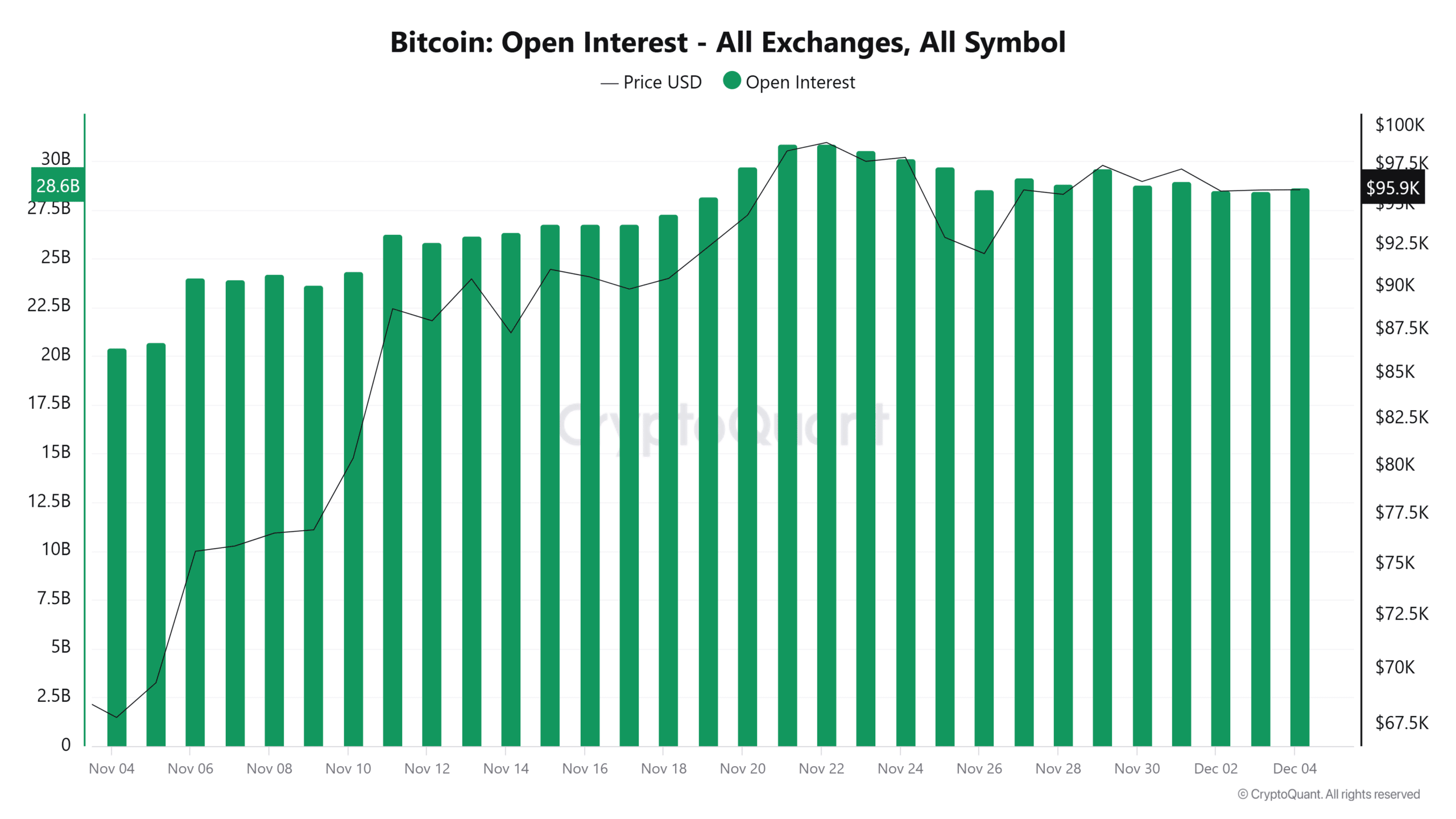

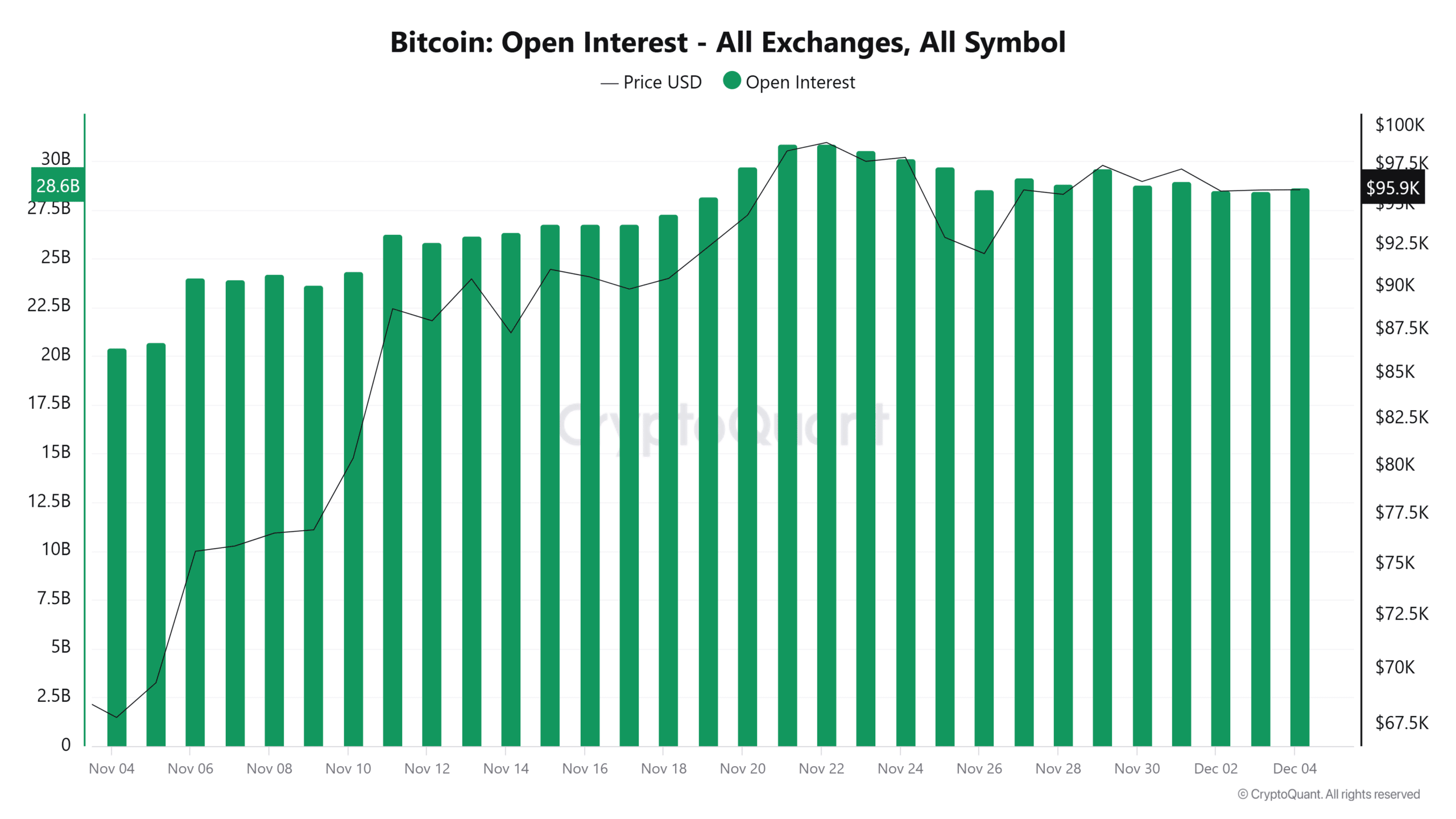

Open interest signals high market activity

Solana’s derivatives market saw a significant surge in November, reaching historic open interest levels. This increase indicates heightened trading activity and could signal major price swings.

Additionally, the rise in OI reflects growing trader confidence in Solana’s market movements.

Source: CryptoQuant

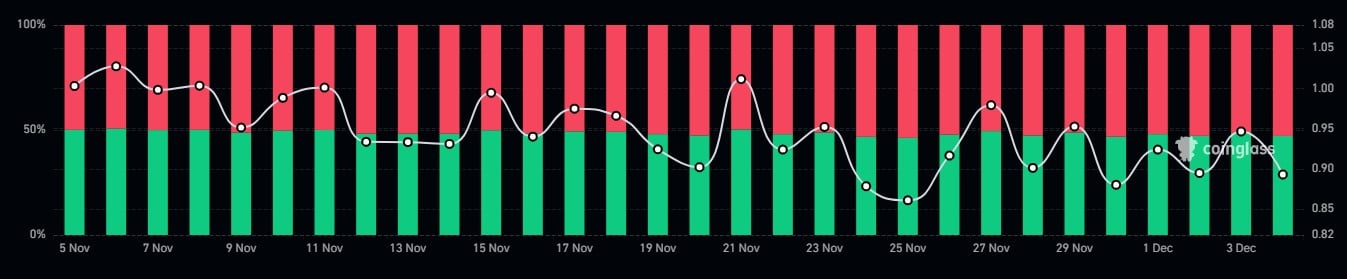

Funding rate hints at market sentiment

Despite the rally, SOL’s funding rates tell a different story. The chart showed periods of both positive and negative funding rates, indicating that uncertainty persists.

Currently, bearish funding rates slightly outnumber the bullish ones. This imbalance could trigger a dramatic price move as market participants adjust their positions.

Source: Coinglass

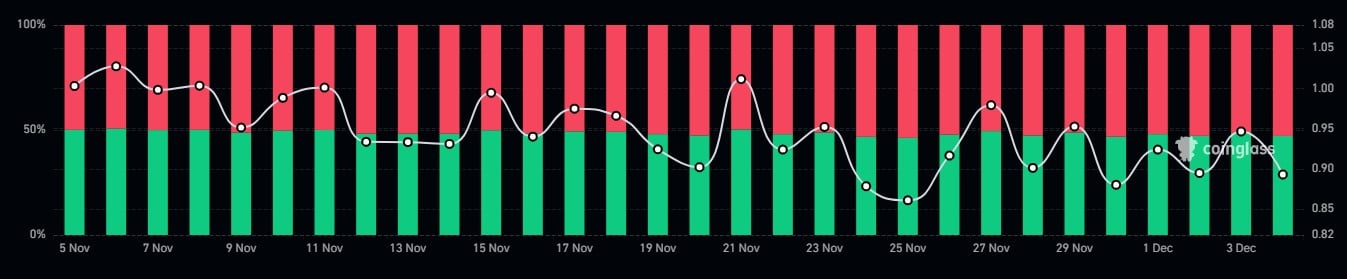

SOL shorts dominate despite recovery

At the time of writing, the Long/Short Ratio for SOL stood at 0.89, underlining a bearish dominance. Short positions make up 52% of the market, indicating skepticism of the sustained upward momentum.

However, the 10% SOL recovery in less than 48 hours challenges such doubts, signaling that buyers are stepping in at crucial levels.

Source: Coinglass

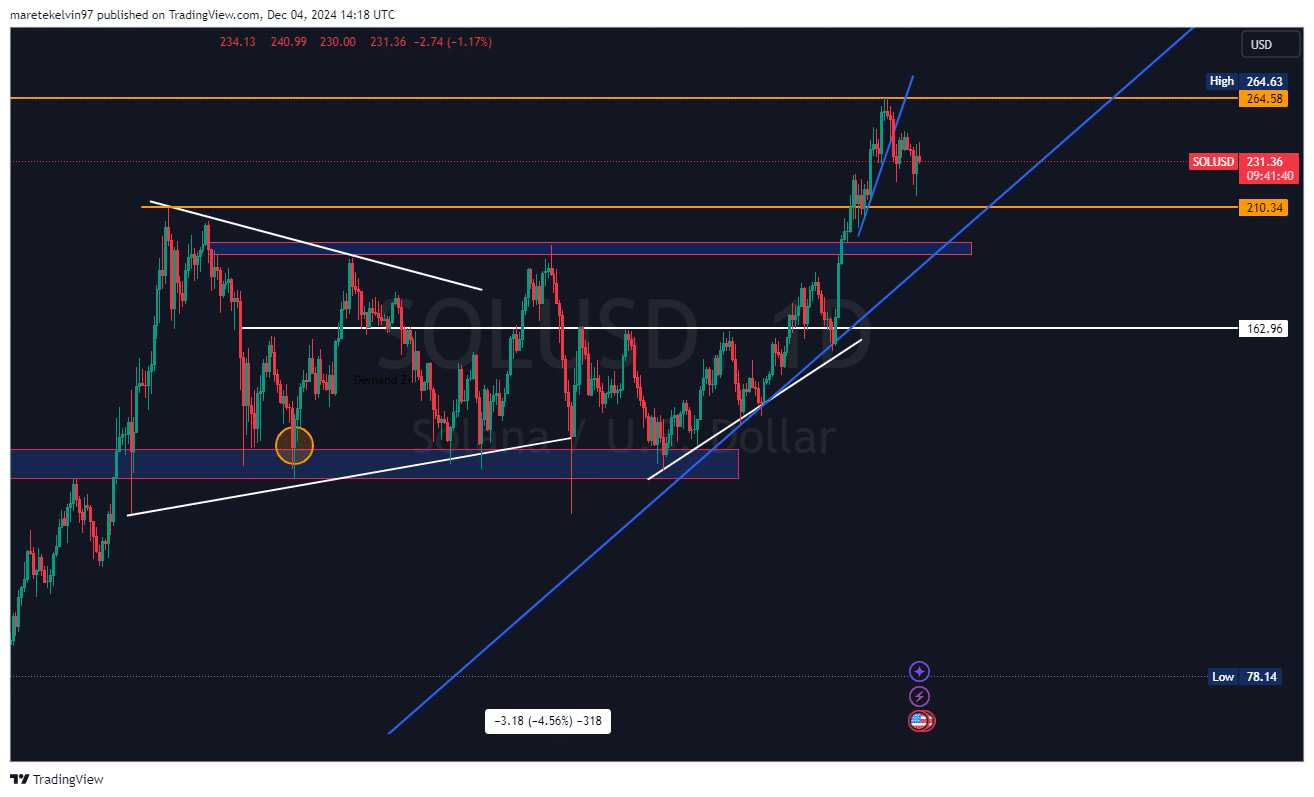

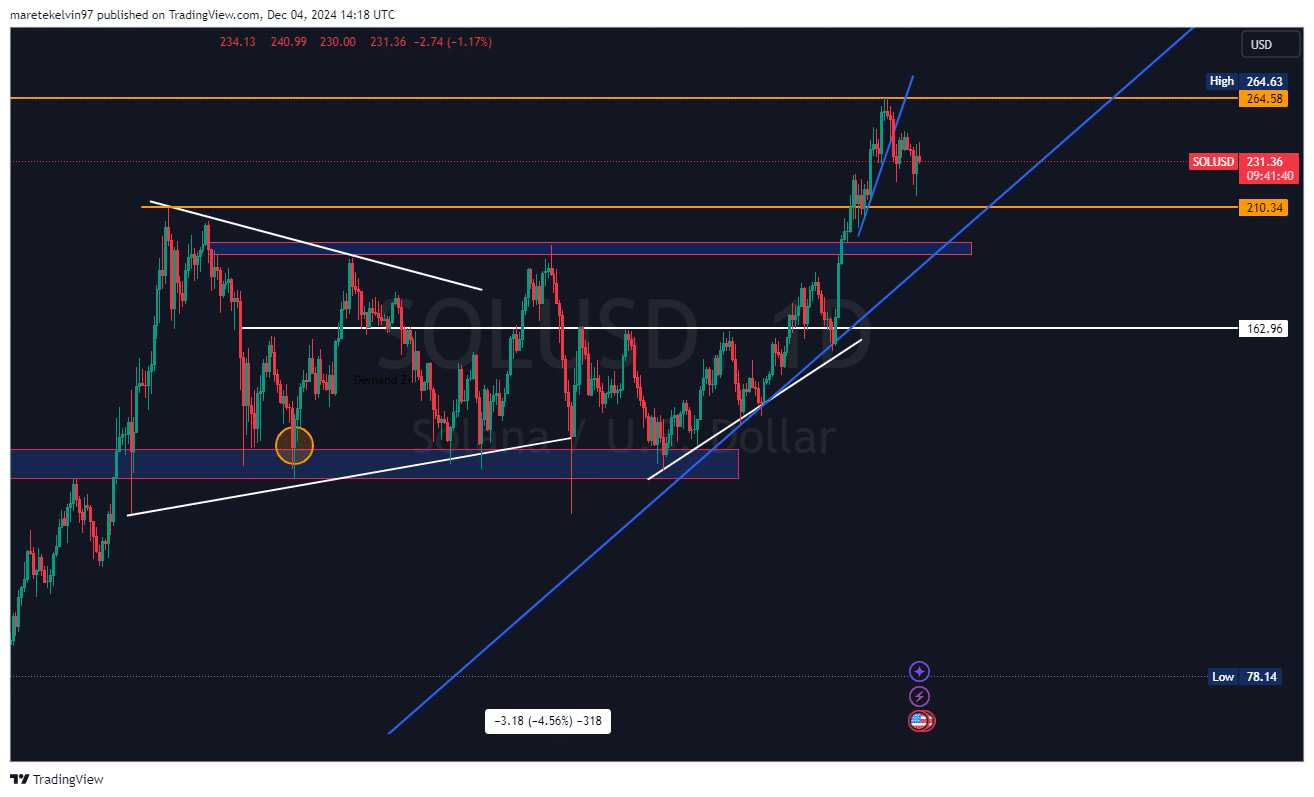

SOL’s strong recovery from the key support level

Solana saw a sharp reversal from a crucial support zone that sparked a swift rally. This has been quite the opposite of the short-heavy sentiment, underlining strong buyer conviction.

If this momentum is sustained, SOL could breach psychological and technical resistance around $240, opening up a path towards $264.

Source: Tradingview

Read Solana’s [SOL] Price Prediction 2024–2025

The combination of OI and dominant short positions creates a setup for increased volatility.

If buying pressure continues and shorts begin to cover their positions, a rally toward $264 could be on the horizon.