- Solana’s network activity is fading fast, with transaction fees plunging to a six-month low.

- Unless activity rebounds, Solana risks deeper price corrections.

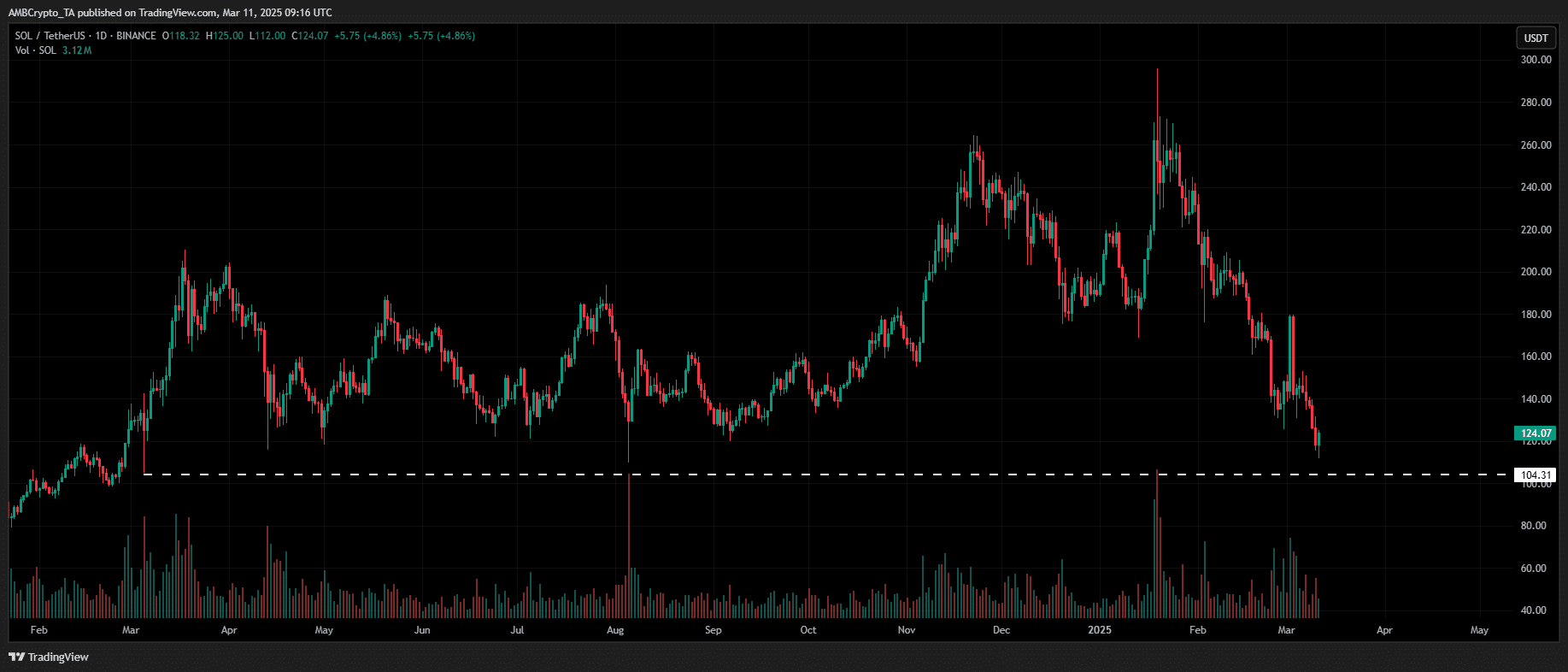

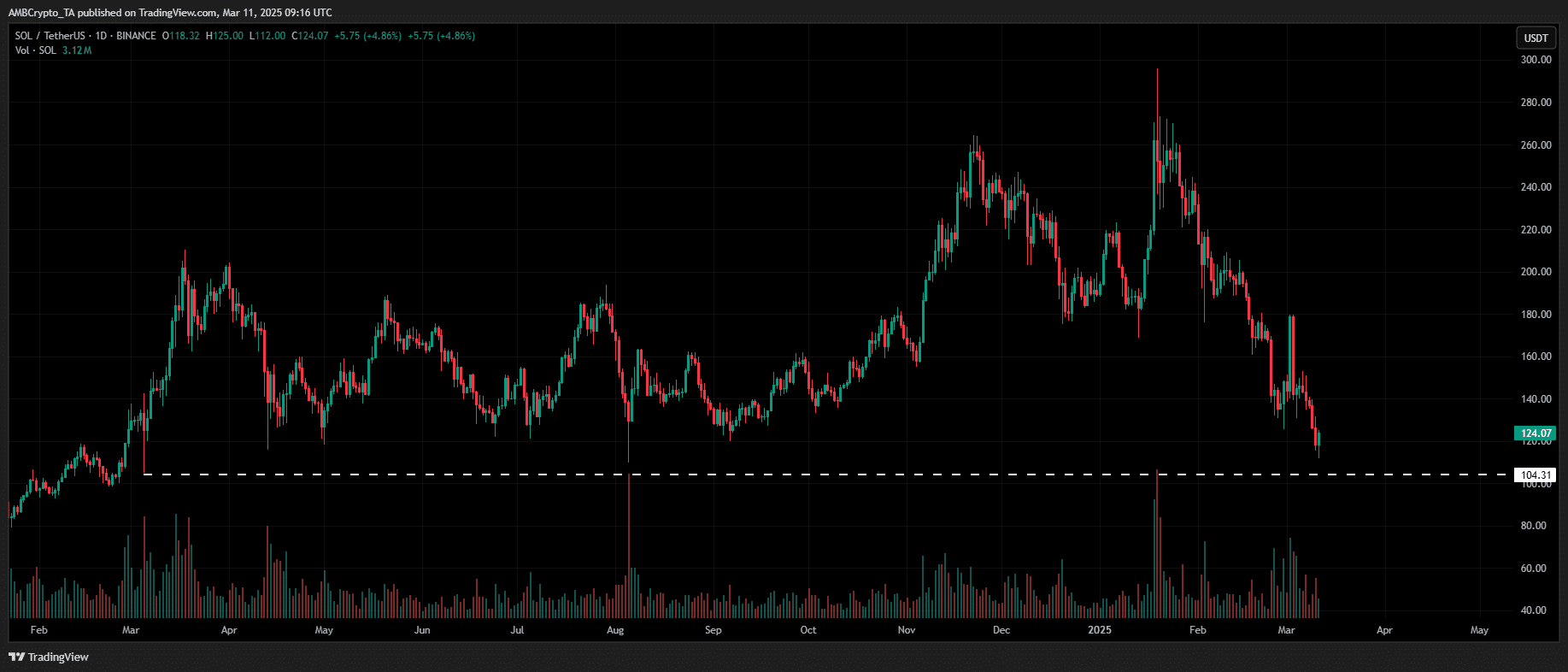

Solana [SOL] has dropped to a seven-month low, losing the $120 support with a 10% weekly decline.

With the FTX unlocking flooding supply and weak hands exiting, clearly the sell-side pressure has dominated.

Notably, no strong demand zones have formed on Solana’s 1D price chart since its fall from $270, making deeper corrections almost inevitable. But the pain may not be over yet.

Solana’s network activity hit multi-month lows

Solana’s network activity is fading fast, with transaction fees plunging to a six-month low of 53,800 SOL last week – an 85% collapse from January’s peak during the TRUMP and MELANIA meme coin frenzy.

Source: Artemis Terminal

With fewer traders interacting on-chain, demand for SOL is shrinking. Solana’s Total Value Locked (TVL) has also dropped to $8.15 billion from $14.50 billion in mid-January, signaling a major liquidity exit.

The impact goes beyond fees – active addresses have dropped 35% to 3.8 million.

With Solana’s network activity on a decline, no key demand zones on its price chart, massive unwinding in both Futures and DeFi trade, holding $120 looks increasingly difficult.

Is a deeper drop to new yearly lows next?

Key levels to watch

The factors above align with SOL’s 55% price drop since mid-January, just a day after hitting its $270 all-time high.

The surge in Solana’ network activity driven by the TRUMP and MELANIA memecoin frenzy has clearly faded.

With the crypto market shedding over $200 billion and Bitcoin sliding below $80K, high-cap assets like SOL are struggling to hold key levels.

Sell-side liquidity has driven $40.75 million in long liquidations, reinforcing downside pressure.

Given weak on-chain demand on Solana network, heavy liquidations, and continued unstaking, SOL risks extending losses toward $100 – $112 – especially if Bitcoin fails to reclaim critical support.

Source: TradingView (SOL/USDT)

This level previously acted as a strong demand zone a year ago, sparking a rebound to $180.

However, given the deterioration in Solana’s network activity and the broader risk-off sentiment, a FOMO-driven recovery remains distant, potentially exposing SOL to a deeper drop toward $100.