- Solana’s new proposal could reduce inflation by 80%.

- Options traders eyed $120 amid increased bearish pressure.

A section of Solana[SOL] insiders has drummed support for the new proposal (SIMD-0228), stating that it would cut inflation significantly.

In fact, according to Ryan Watkins crypto VC partner at Syncracy Capital, the move will slash inflation by 80%.

“Potential 80% inflation reduction coming to SOL soon.”

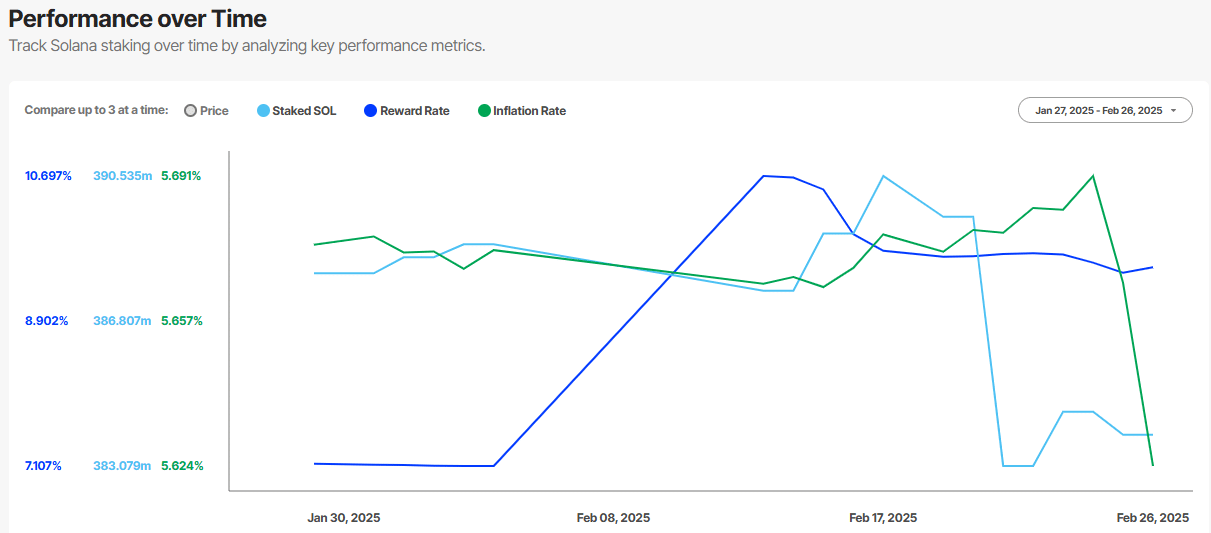

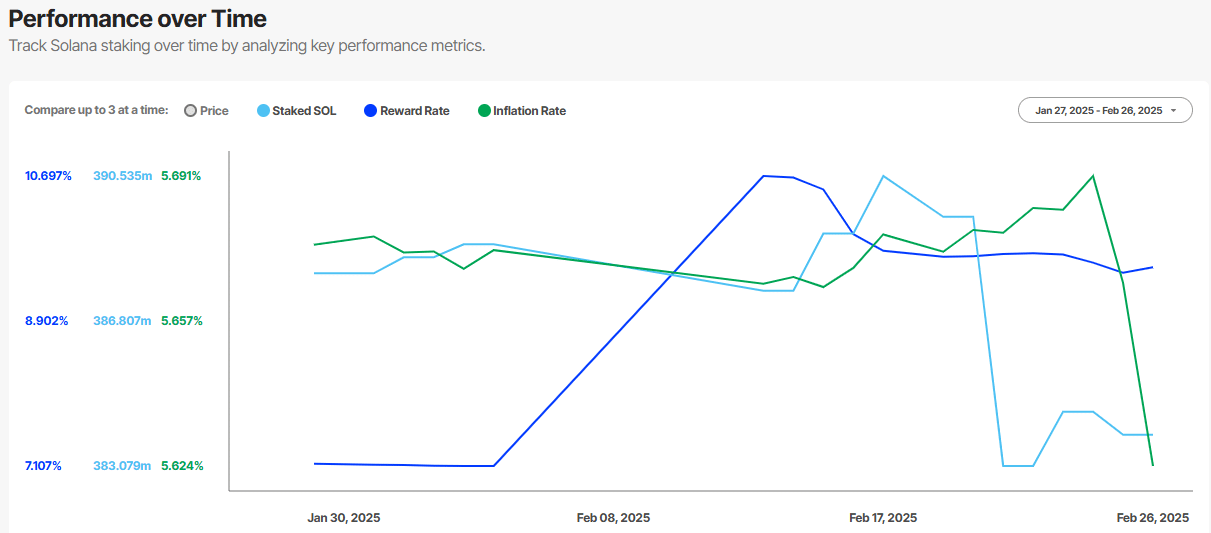

Souce: Solana Inflation

Is Solana overpaying for security?

The SIMD (Solana Improvement Document)-0228 proposal aims to peg the Solana issuance rate to staking participation.

According to Vishal Kankani, a partner at MultiCoin Capital, Solana was ‘overpaying for network security’ with its fixed issuance rate relative to Ethereum. He said,

“Currently, Solana releases about 4.5% new tokens yearly, reducing by 15% each year. For comparison, Ethereum, with less than 30% staked, emits under 1%.”

Kankani added that the current model also limits DeFi growth.

“High emissions from Solana not only push prices down by increasing tax-induced selling but also inflate staking returns unnecessarily, discouraging participation in its growing DeFi sector.”

However, staking rewards would be slashed by nearly 80% as well, a move some community members were unhappy with.

Stakers earn about 10% in rewards, but this would reduce significantly if the proposal is adopted.

Source: Staking Rewards

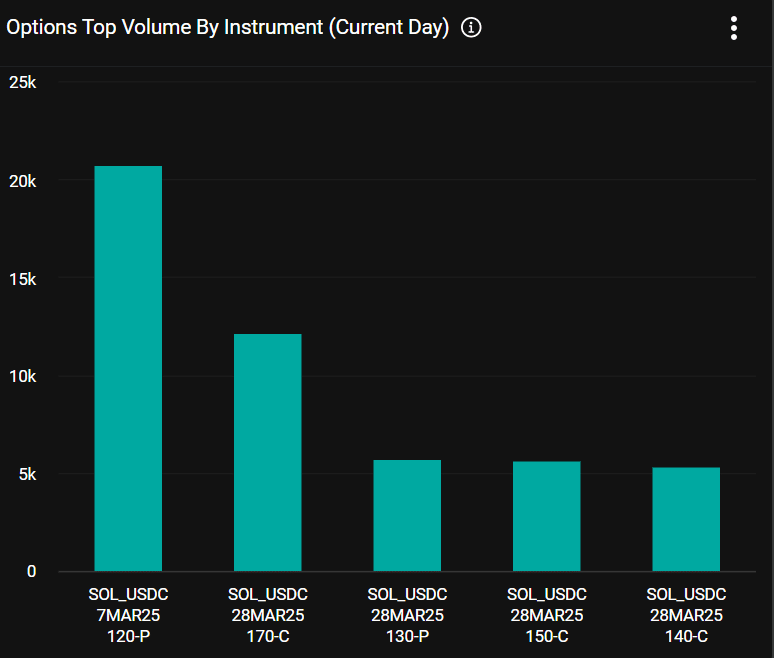

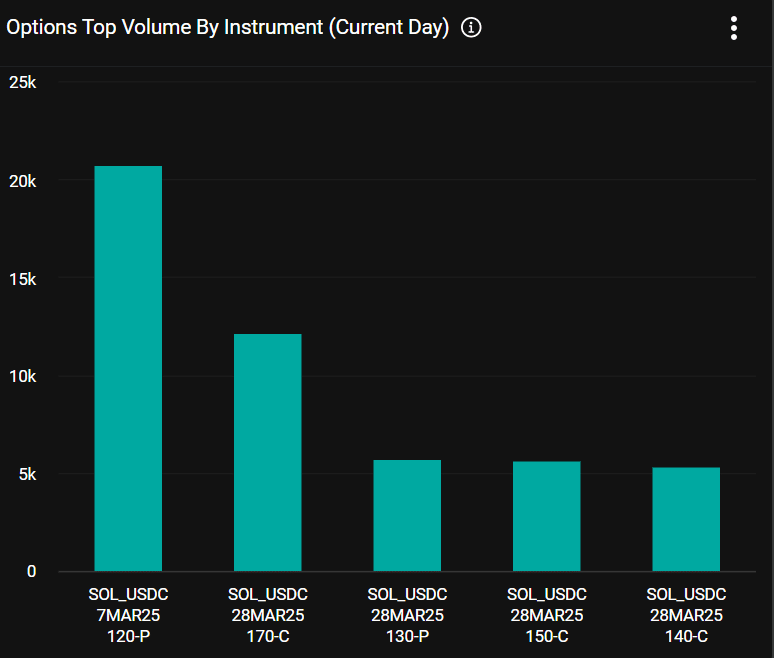

Will SOL drop to $120?

Interestingly, the voting timeline comes immediately after the March unlock of 11.2 million SOL from the FTX estate.

Scheduled for the 1st of March, the massive unlock has added bearish pressure on the token after the LIBRA memecoin fall-out.

SOL has since shed 53% from its record high of $295, dipping below $140.

However, Amberdata’s Greg Magadini stated that the unlock was already priced in and that a broader market rebound would boost SOL.

In a recent newsletter, Magadini said,

“There’s an argument to be made that a relief rally in SOL prices could bring positive spot/vol correlation, as the market is potentially overly crowded to the downside.”

The extended BTC dip to $86K soured market sentiment. The put options (bearish bets) for the $120 target were the most bought on Deribit in the past 24 hours.

This suggested that SOL traders expected further downside risks to this level in the first week of March.

Source: Deribit