- Solana faced a crucial resistance at $240, with key support at $196, determining its next move.

- Market sentiment remained negative, though social volume and technical indicators show potential reversal signs.

Solana [SOL] is at a critical juncture, with traders watching closely as the cryptocurrency’s price faces a crucial test. At $202.94 at press time, showing a 1.58% decline, the cryptocurrency is experiencing fluctuations that could either push it higher or send it lower.

As the price tests critical levels, traders are debating whether SOL will break resistance and target $350 or drop toward $150.

This article delves into the technical indicators, social volume, and sentiment to determine Solana’s next potential direction.

Source: X

Will Solana break through a key resistance?

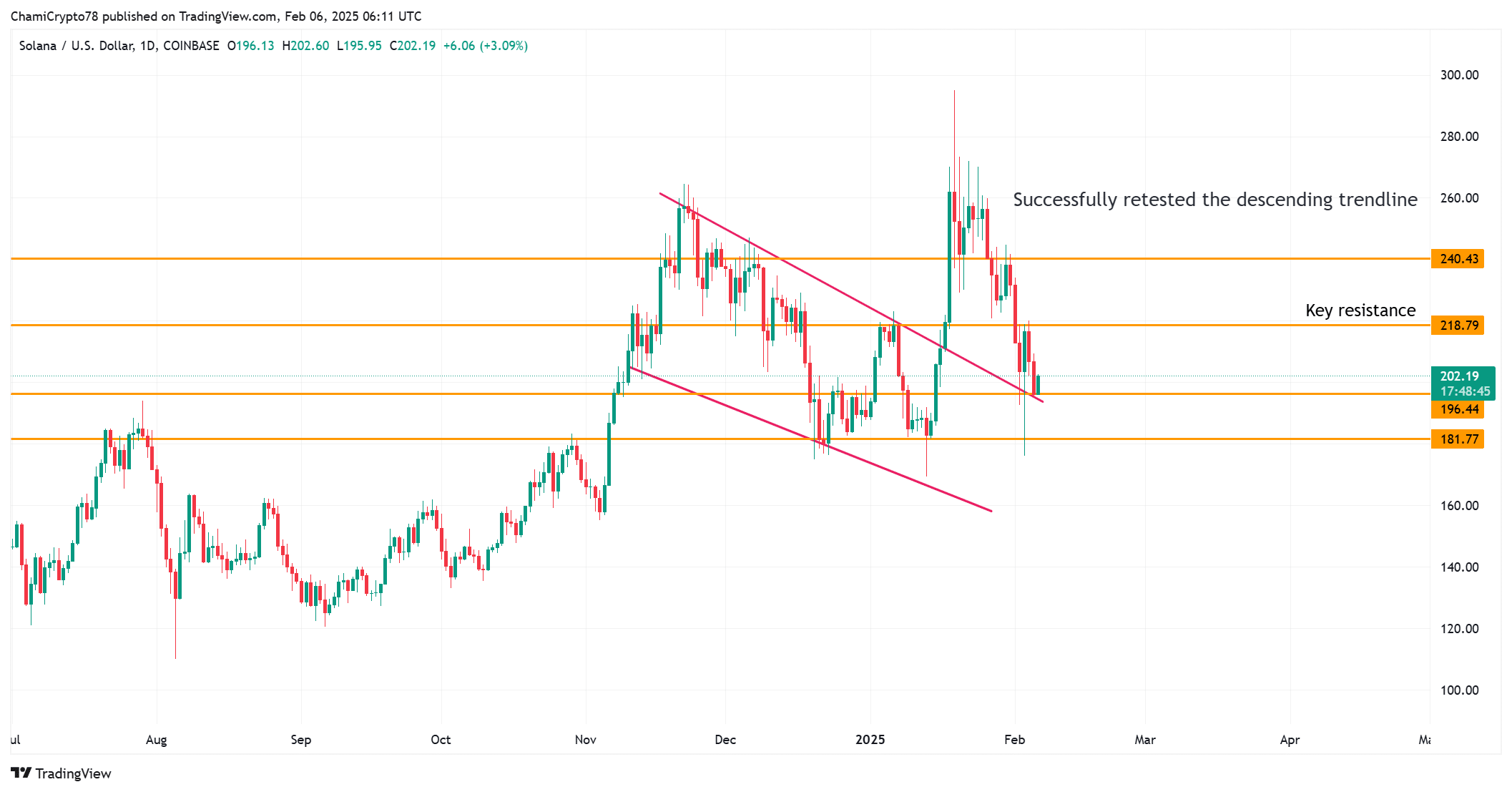

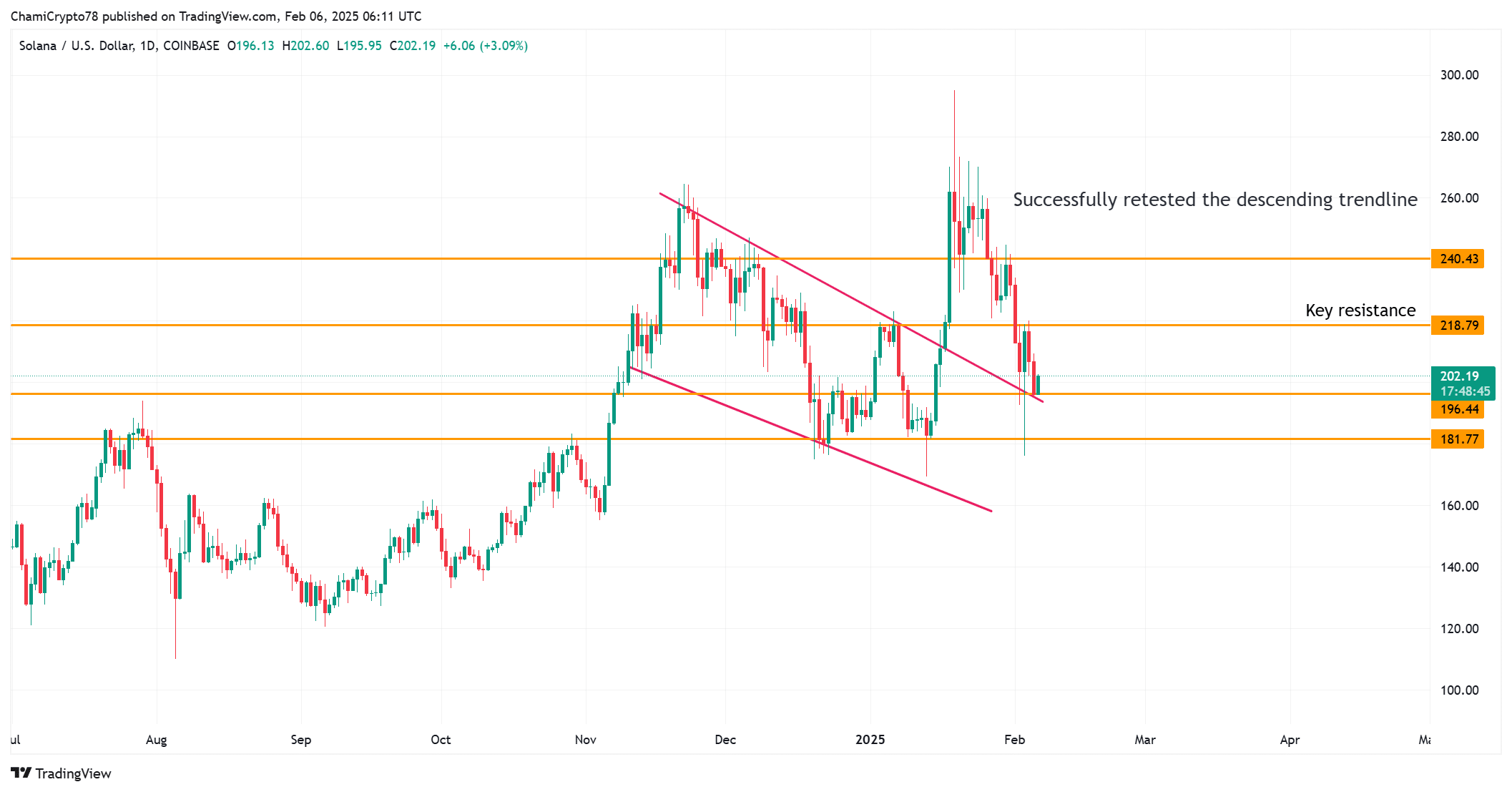

At the time of writing, Solana’s price was moving within a well-defined channel, with support around $196.44 and resistance at $240.43.

Recently, the price retested the descending trendline, but the next move depends on whether it can break through the resistance. If the price surpasses $240.43, it could trigger a bullish move towards the $350 mark.

However, if SOL fails to maintain its momentum, it could fall back to lower levels, possibly near $150. Therefore, traders should focus on these key levels in the coming days to gauge the direction of Solana’s price action.

Source: TradingView

Is the market interested in SOL?

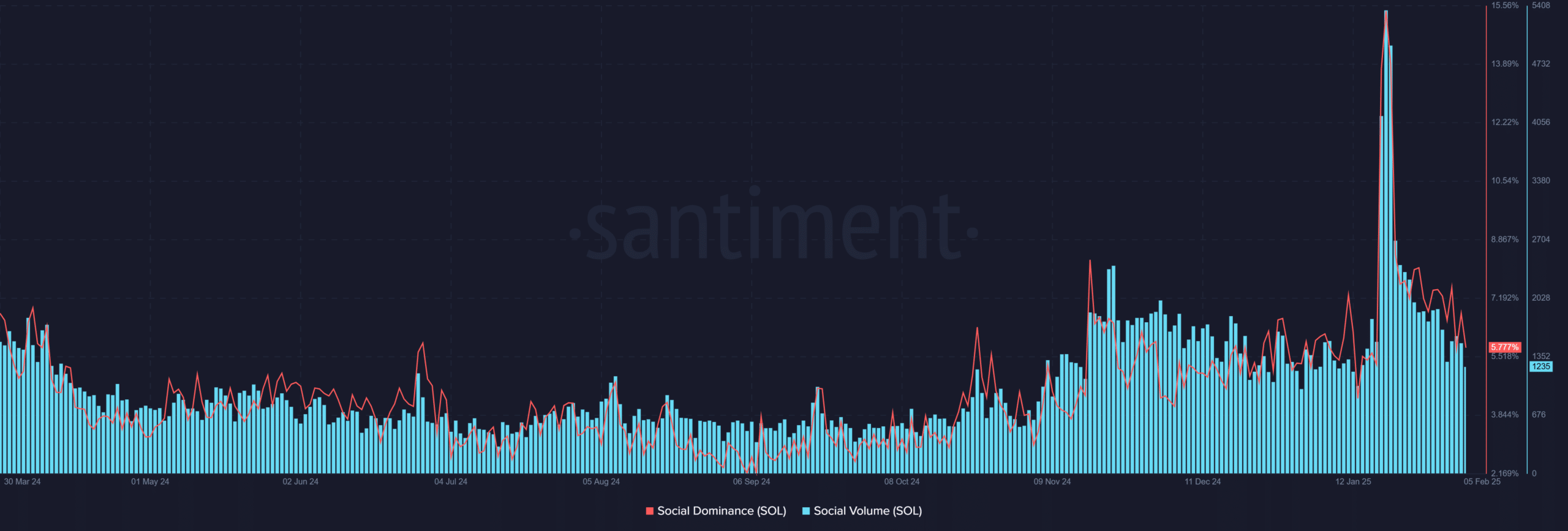

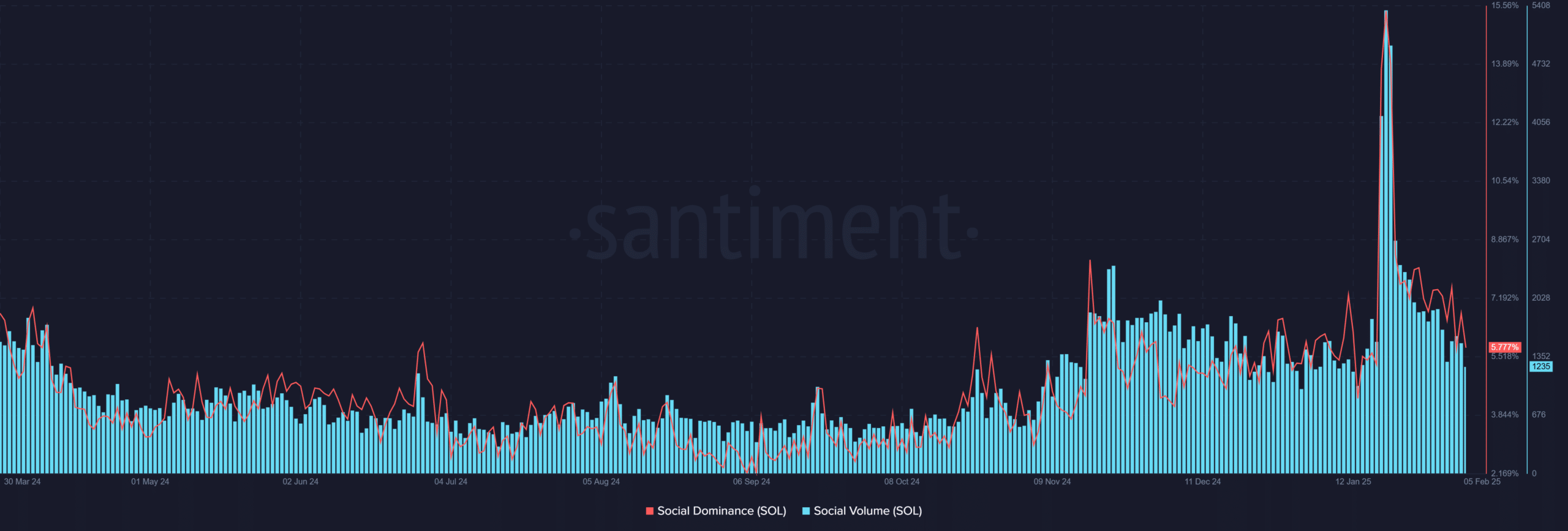

SOL’s Social Volume reached 1,235 mentions, showing a moderate increase in interest. However, its Social Dominance remains at 5.78%, indicating that SOL is not yet dominating discussions in the broader crypto space.

Despite this, the rise in social mentions suggests growing attention and sentiment around Solana.

If Social Volume continues to increase, it could signal stronger support for the price movement, whether bullish or bearish.

Therefore, traders should monitor social activity, as it could provide the necessary momentum for a price shift.

Source: Santiment

What do the RSI and MACD show?

The RSI for SOL stood at 42.41, approaching oversold conditions but not yet signaling an imminent reversal. Additionally, the MACD is showing a negative value of -3.61, suggesting bearish momentum in the short term.

However, the MACD line is beginning to approach a neutral position, which could indicate a potential reversal.

Therefore, traders should be cautious, as Solana could experience a short-term pullback before any significant move.

Source: TradingView

What’s the market feeling about SOL?

SOL’s total Weighted Sentiment was -0.54, indicating a slightly negative market sentiment. This aligns with the bearish indicators and suggests that there is more downside pressure than bullish momentum.

However, market sentiment can shift quickly, especially if Solana breaks through key resistance levels.

Therefore, if SOL can turn around the sentiment with a strong price move, it could signal a potential rally.

Source: Santiment

Conclusion: Will Solana rise or fall?

SOL’s price action presents a mixed outlook. While a breakout above the $240 resistance could lead to a rally towards $350, the technical indicators suggest a possible decline towards $150.

Read Solana’s [SOL] Price Prediction 2025–2026

Traders should closely monitor key support and resistance levels, as these will likely determine SOL’s next move.

Therefore, the next few days will be crucial in deciding whether Solana will rise or fall.