- South Korea may follow Japan’s lead on Bitcoin ETFs.

- Asia’s BTC ETF race is expected to heat up as Japan’s eyes legislation in the second half of 2025.

South Korea may jump on the Bitcoin[BTC] ETF bandwagon following a softer stance by Japan on the cryptocurrency.

According to a report by the South Korean-based publisher Maeil Business Newspaper, Seoul could approve BTC ETFs if Tokyo greenlights them.

The media outlet reported that South Korea’s regulator, the Financial Supervisory Service (FSS), monitored Japan’s virtual asset trends and noted its openness to crypto ETFs.

Additionally, the report stated that Japan’s ongoing discussion on virtual assets will be done in the first half of 2025, and legislation will be crafted in the second half. By 2026, Japan’s national assembly will be ready to vote for the framework.

Bitcoin ETF: Will South Korea follow Japan?

Japan’s intention is crucial because South Korean authorities have hesitated about the products, citing Japan and the UK’s lackluster. In February, Kim So Young, Vice Chairman of South Korea’s FSS, stated,

“I will carefully review (Bitcoin spot ETFs), and it is still similar in a big context…There are some countries that have not yet introduced them, there is the UK or Japan.”

How Seoul will respond to Japan’s move remains to be seen. However, several jurisdictions have become open to BTC ETFs since the U.S. approved the products last year.

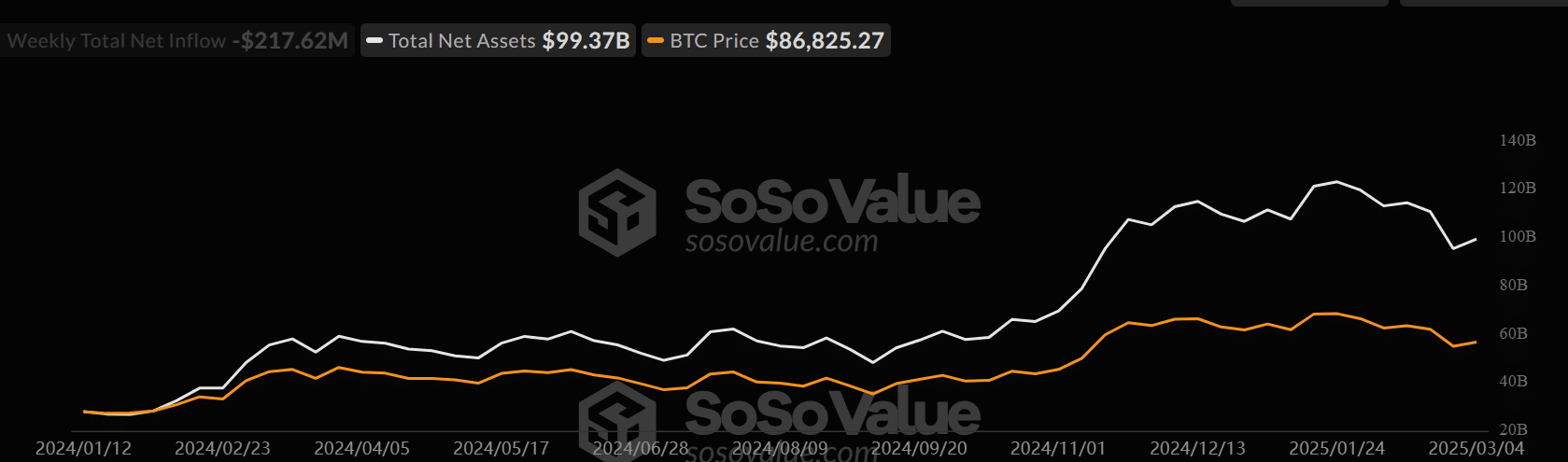

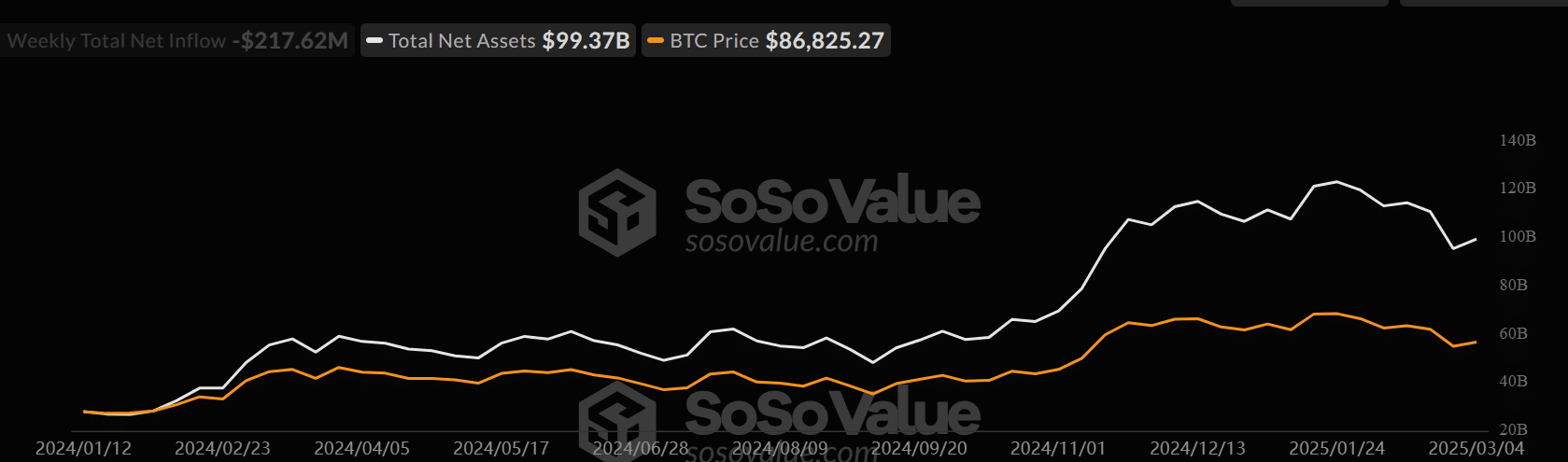

This made it easier to buy or sell BTC via traditional stock markets. In fact, the U.S. spot BTC ETFs now have $100 billion in assets under management (AUM).

Source: Soso Value

Hong Kong, followed the U.S., greenlighted the products last April, and now has $354M in AUM.

BTC surged from $40K to $70K with stock market integration, then surpassed $100K due to the ‘Trump trade.’

State Street predicts crypto ETF AUM could exceed precious metals ETF AUM by late 2025, reflecting growing market confidence.

In the 2025 ETF outlook report, BlackRock’s digital asset research head, Robert Mitchnick, stated that U.S. fiscal debt and nation-state adoption of BTC as an alternative reserve asset could drive the cryptocurrency’s value.

“An increasing focus on U.S. debt and deficit challenges has the potential to serve as a catalyst for Bitcoin adoption, while the possibility of higher-for-longer interest rates represent a potential price headwind.”