- Saylor wants the U.S to own 1M-4.2M BTC in 10 years

- Bitcoin’s price has been muted, despite potential nation-state FOMO.

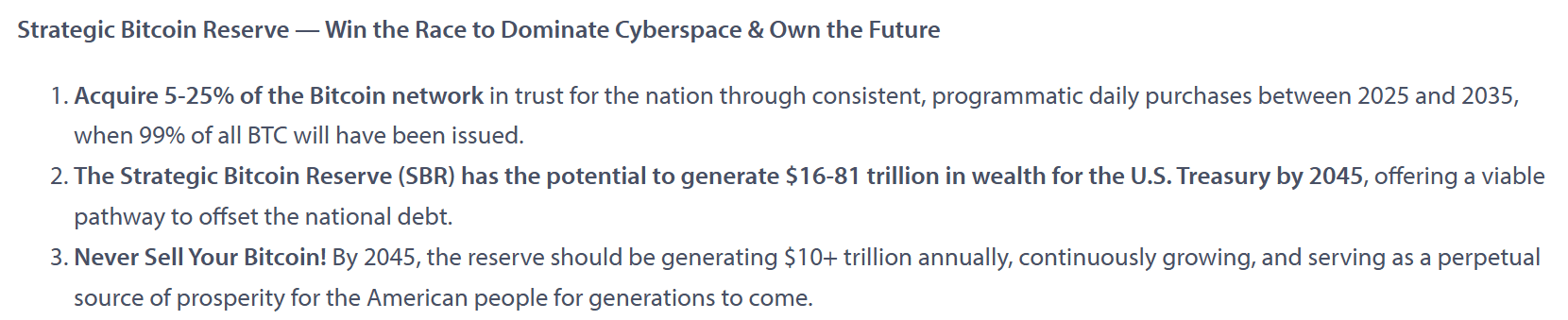

Michael Saylor, Founder of Strategy (formerly MicroStrategy), has doubled his calls for the United States to acquire 5%-20% of the total Bitcoin [BTC] supply.

During the inaugural crypto summit at the White House, Saylor shared his framework for U.S digital dominance in the 21st century. Part of the proposal outlined a 10-year BTC acquisition plan.

According to Saylor’s plan, if the U.S acquires 5%-20% supply (1.05M-4.2M BTC), it could generate $16-$81 trillion in the next 20 years and help alleviate the sticky fiscal debt problem. However, the plan would cost $90 billion – $362 billion at current prices.

Worth pointing out though that it isn’t the first time the exec has called for the United States to control 20% of Bitcoin’s market. Last month, Saylor warned that another country would seize the opportunity if the U.S doesn’t, citing aggressive bids from UAE, Russia, and China.

Bitcoin – Nation-state FOMO likely?

Brian Armstrong also echoed the potential FOMO on Bitcoin by other countries after the President established the U.S strategic BTC reserve. He said,

“The rest of the G20 are looking at America on offense in this industry (Bitcoin, crypto), and will be likely to follow suit.”

According to Arkham data, the U.S government currently owns 198k BTC, worth $17 billion at current prices. However, market analysts have stated that some of the forfeitures could be returned to Bitfinex, potentially reducing the stash to 88k BTC.

How the U.S. government would adopt ‘budget-neutral strategies’ to acquire more BTC, as instructed by executive order, remains to be seen.

However, the nation-state FOMO could pick up soon. In fact, according to recent reports, South Korea’s top financial insiders want authorities to consider a strategic BTC reserve, too. Such FOMO could positively affect BTC’s value.

On the contrary, the short-term reaction to the U.S strategic BTC reserve has been a typical “sell the news” event. Despite the bullish update, the world’s largest cryptocurrency declined from $92.8k to $86.8k – An 8% drop.

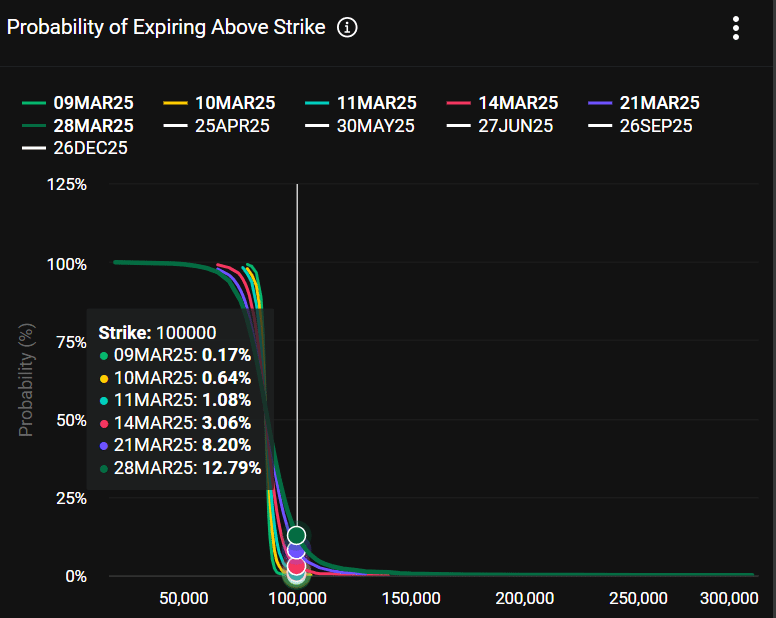

Even the end-March price projection didn’t look positive at press time. According to predictions site Polymarket, the market is expecting a likely dump to $70k rather than a strong rally above $100k. A similar outlook was evident among Options traders too.

According to Deribit data, Options traders have been pricing only a 12% chance that BTC would reclaim $100k by the end of March.

Source: Deribit