- Bitcoin could decline by 6.5% to reach its next support at $77,400 if it remains below the 200 EMA.

- Ethereum could decline by 15% if it breaches a key level of $1,780.

The tariff tension is already impacting the cryptocurrency market, with assets experiencing a massive price decline as investors take strategic action ahead of today’s announcement.

Tariff fears in the crypto market

Since Donald Trump’s presidential inauguration in the United States, the overall cryptocurrency market has fallen significantly and is set for further decline as his tariffs show no signs of ending soon.

On the 2nd of April, a crypto analyst shared a post on X (formerly Twitter) stating that spot Bitcoin ETFs saw a $157.8 million outflow, while spot Ethereum ETFs saw a $3.6 million outflow on the 1st of April.

This indicates that investors are withdrawing their money from these assets. Large outflows are often seen as a bearish sign, as they can create selling pressure and lead to further price declines.

Meanwhile, the post on X also noted that institutions are reducing risk ahead of today’s tariff announcement.

Current price momentum

Despite these uncertainties, BTC and ETH remain positive, holding gains of 1% and 0.35%, respectively, over the past 24 hours, unlike other cryptocurrencies.

According to CoinMarketCap data, BTC was trading near $84,300, while ETH traded near $1,860. However, the asset’s price gains appeared to be fading, as the daily chart flashed signs of a potential decline.

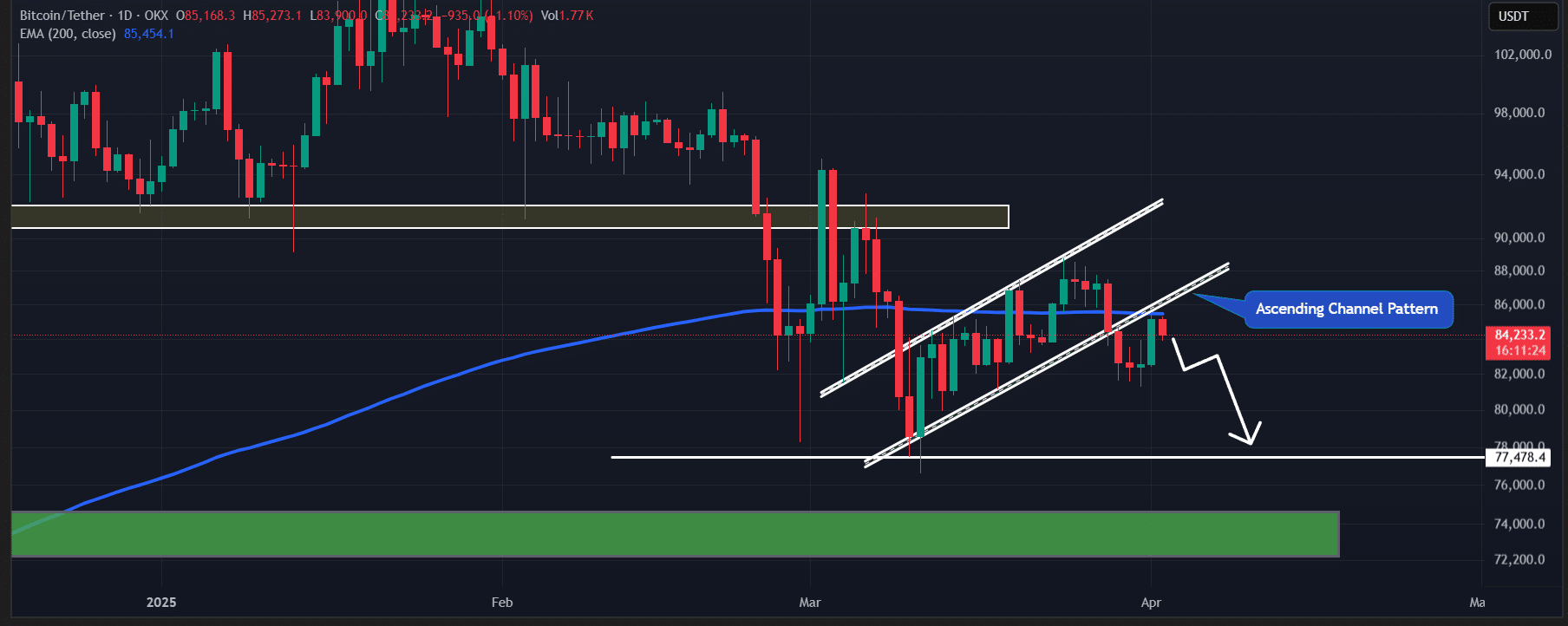

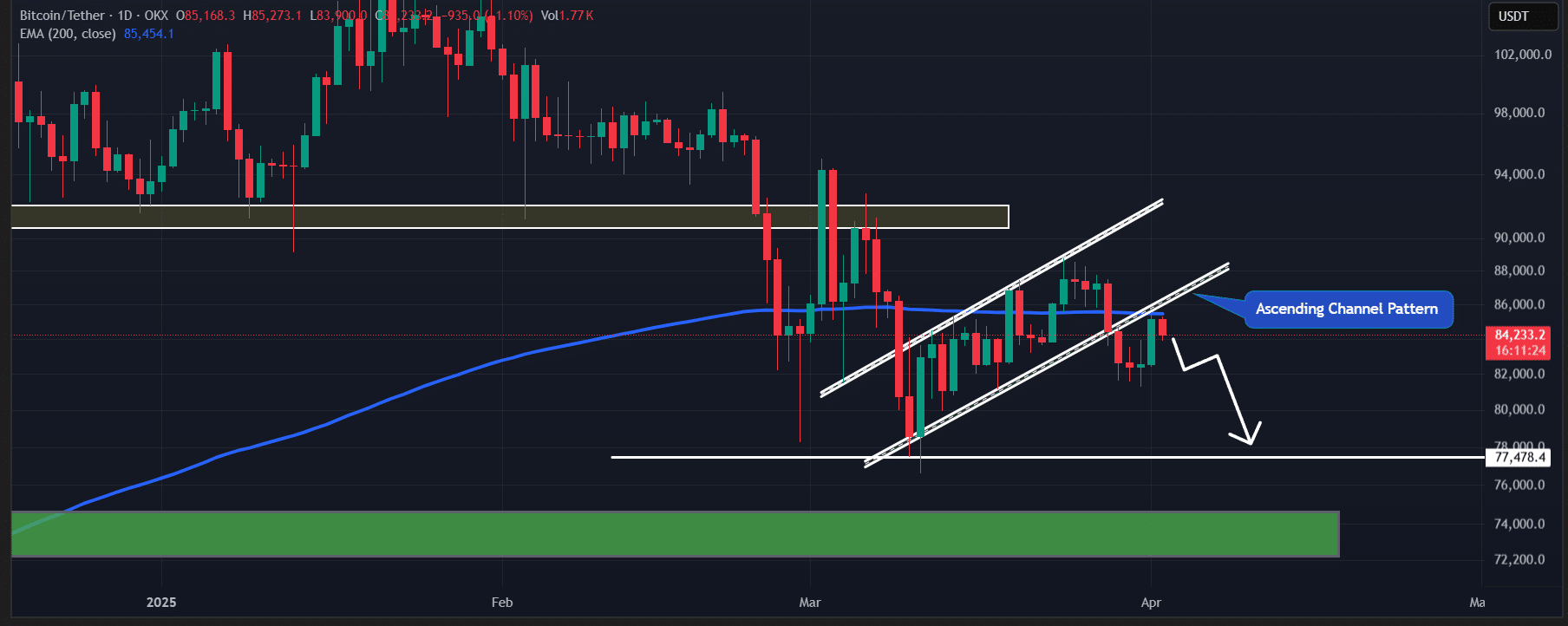

The king coin has successfully retested the breakdown of the ascending channel pattern and is now facing a price drop after encountering resistance at the 200-day Exponential Moving Average (EMA) on the daily timeframe.

Based on recent price action and current market sentiment, if BTC remains below the 200-day EMA, there is a strong possibility it could decline by 6.5% to reach its next support at $77,400.

The chart indicates that BTC’s key level is the 200-day EMA on the daily timeframe.

Source: Tradingview

Ethereum price analysis and key levels

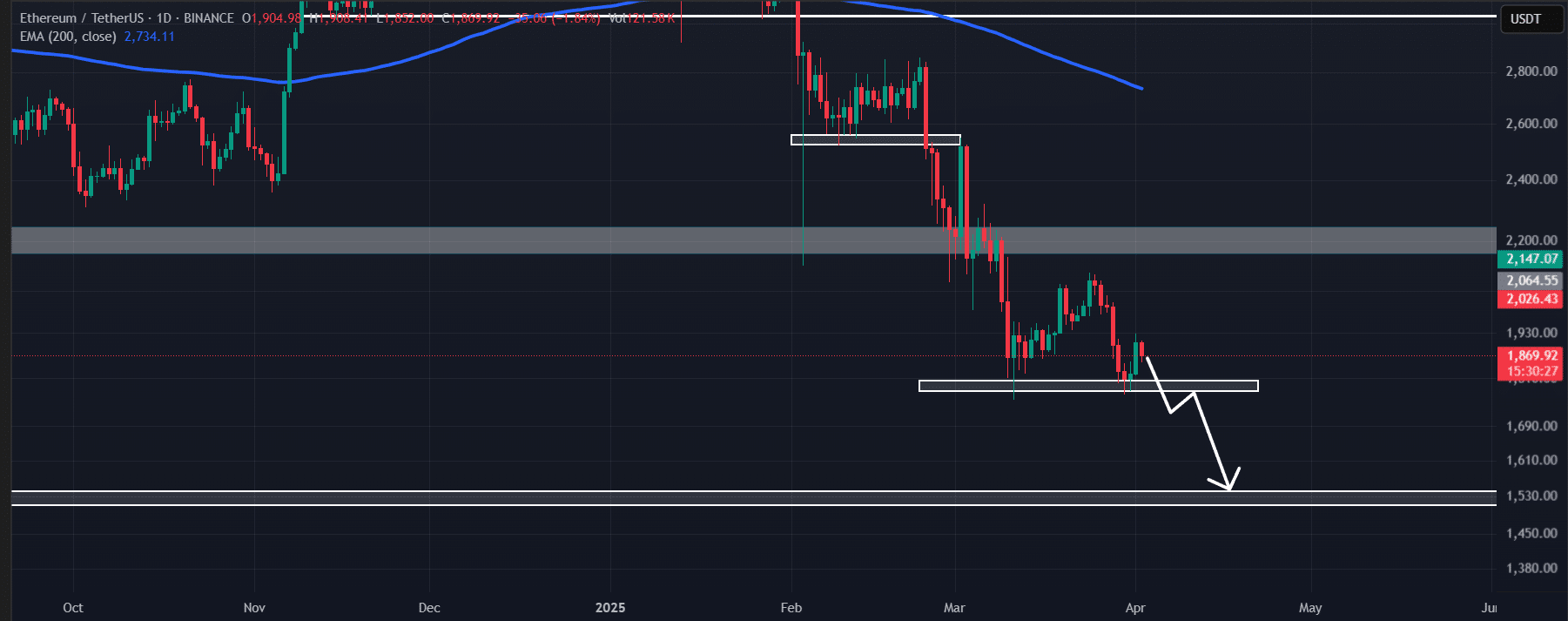

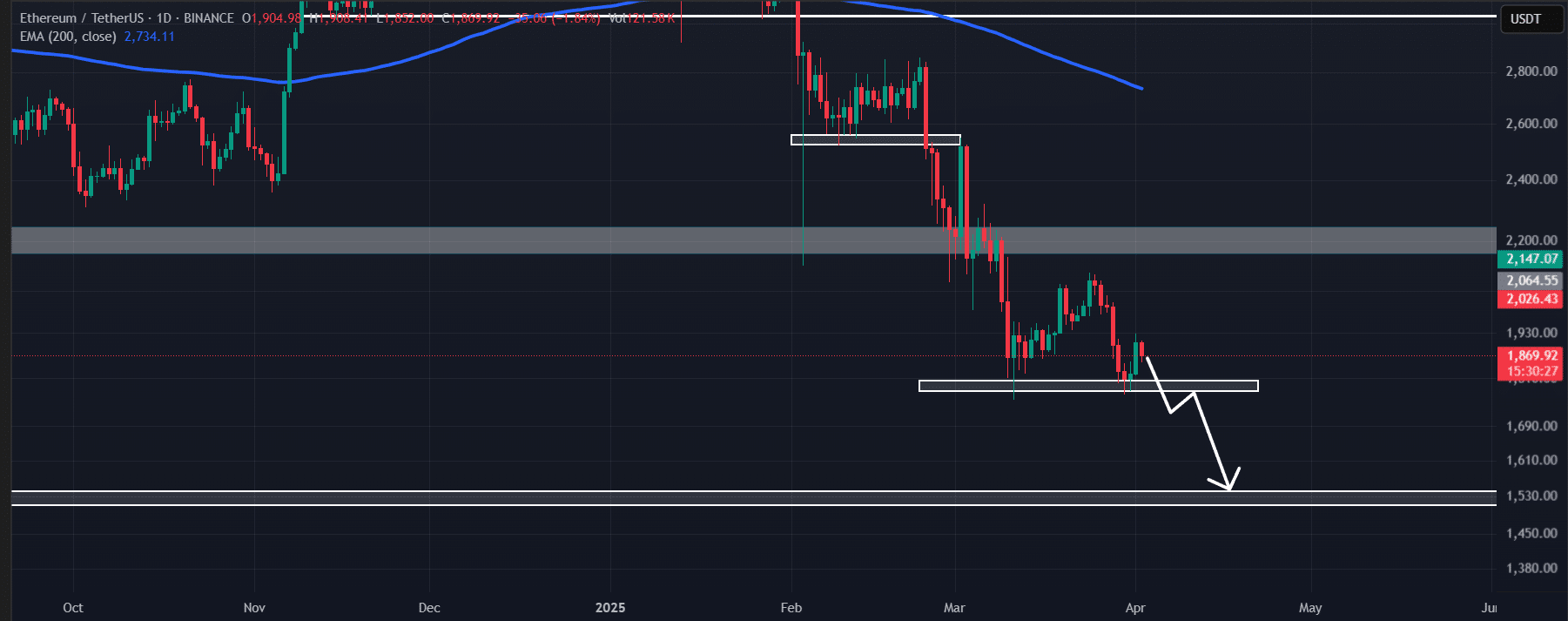

Meanwhile, Ethereum was also near a key level at $1,780. If ETH continues to decline and breaches this level, there is a strong possibility of a sharp 15% drop, potentially bringing the price down to $1,550.

The Ethereum daily chart indicates that $1,780 is a key level that could determine ETH’s next move.

Source: TradingView

Traders’ bearish view on BTC and ETH

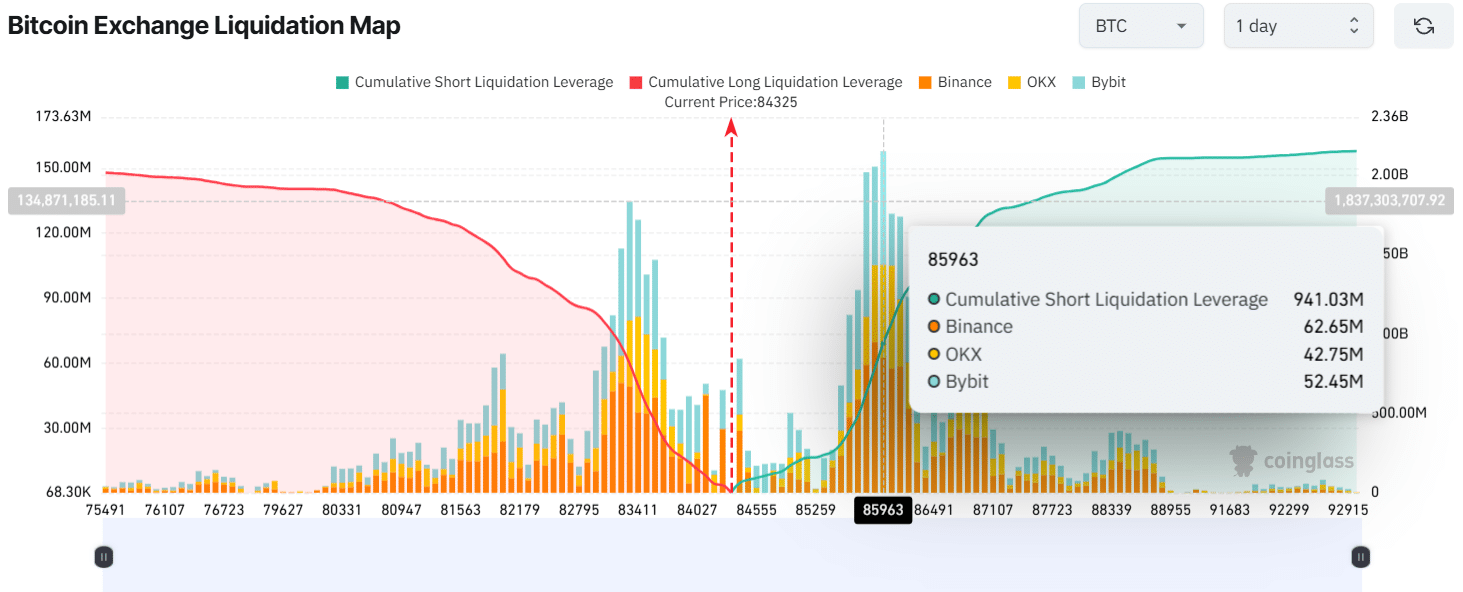

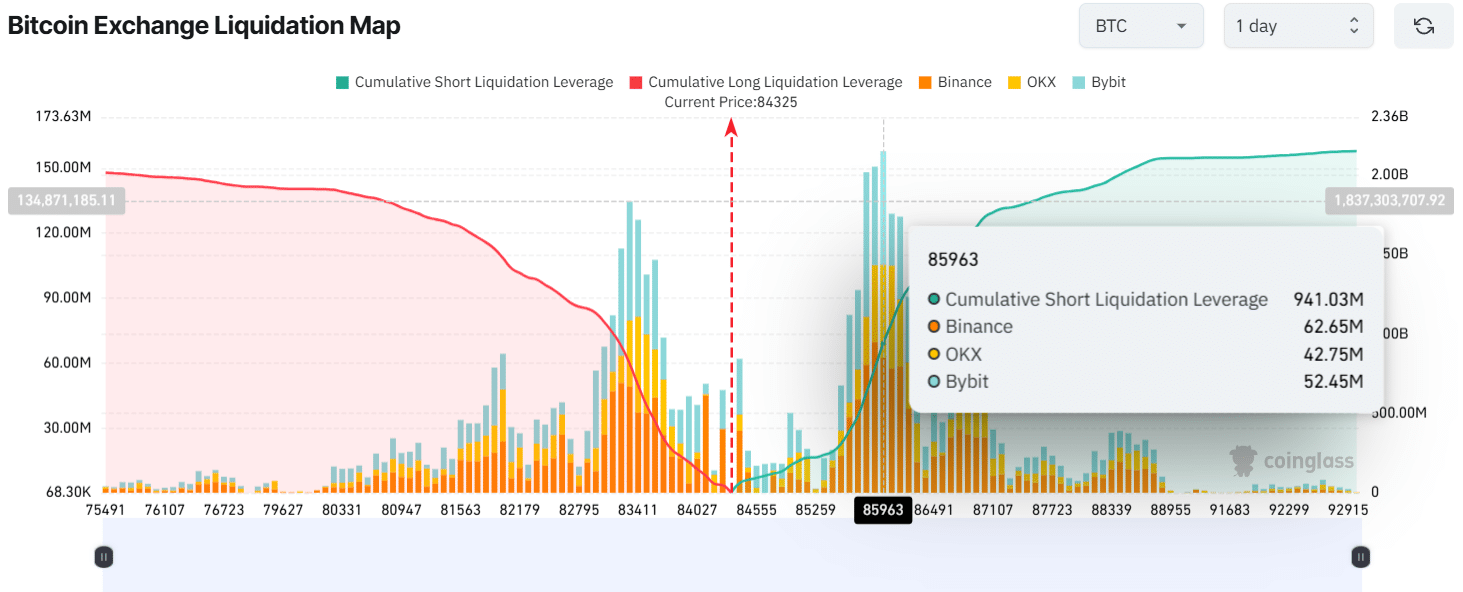

Data from the on-chain analytics firm Coinglass reveals that traders were over-leveraged at press time, with key levels at $83,320 on the lower side and $85,960 on the upper side.

They have built $811 million and $941 million worth of long and short positions, respectively, indicating that bears are currently in control.

Additionally, the higher bets on short positions have the potential to push the price lower, which is a red flag for BTC.

Source: Coinglass

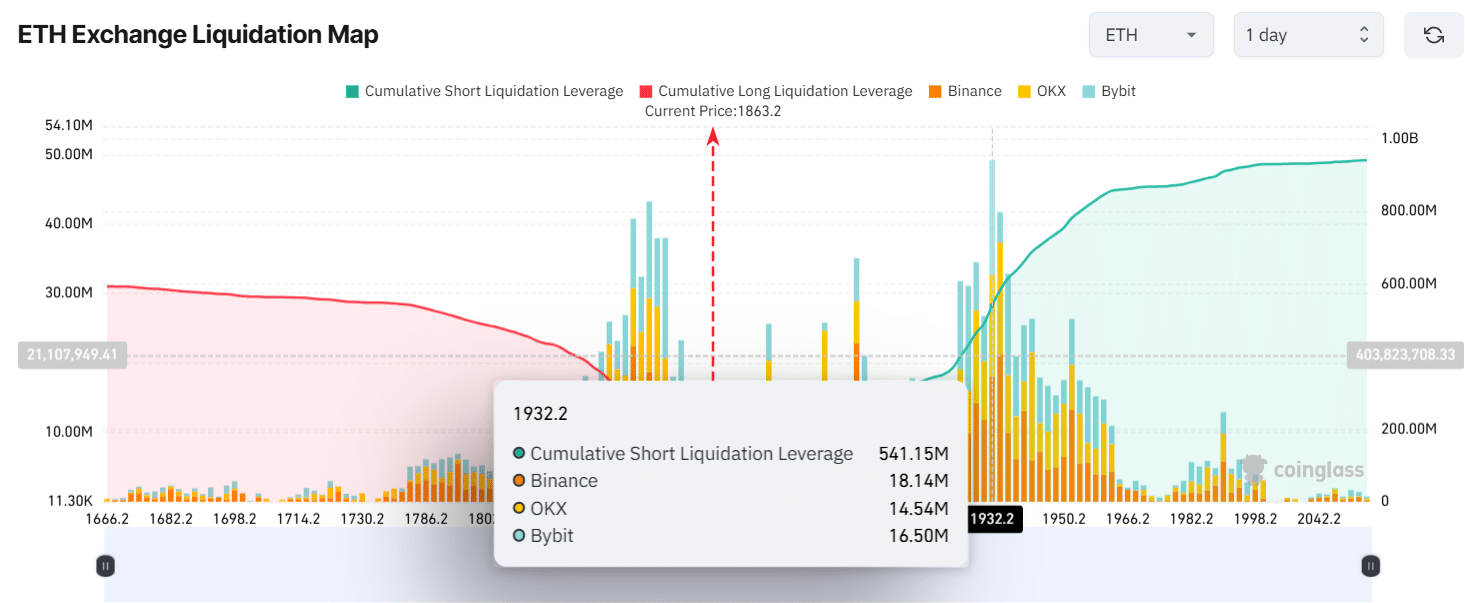

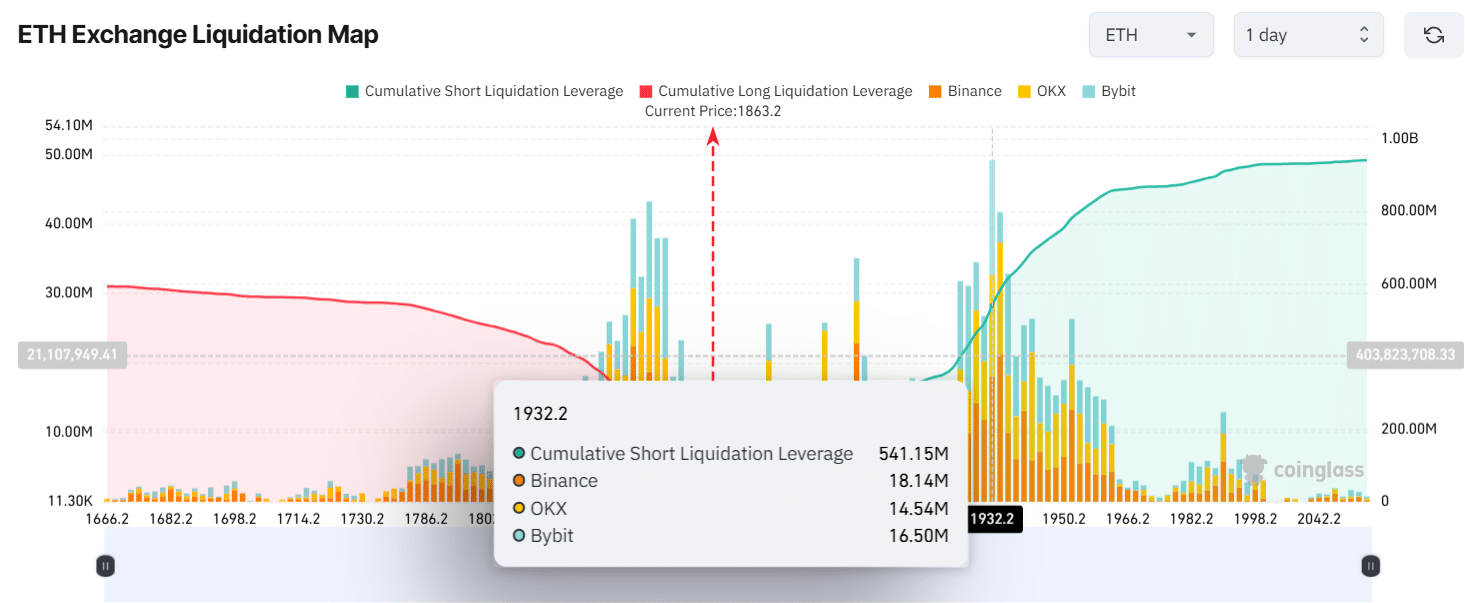

On the other hand, traders appeared to be strongly bearish on ETH.

Data shows that ETH’s over-leveraged levels were at $1,932 and $1,840, with traders building $541 million in short positions and $185 million in long positions over the past 24 hours.

This indicates that bears are currently in control, potentially due to the upcoming tariff announcement.

Source: Coinglass