- TON is flashing a rare undervaluation signal – One that has historically preceded strong rebounds

- With the price at a deep discount, will bulls capitalize on this opportunity?

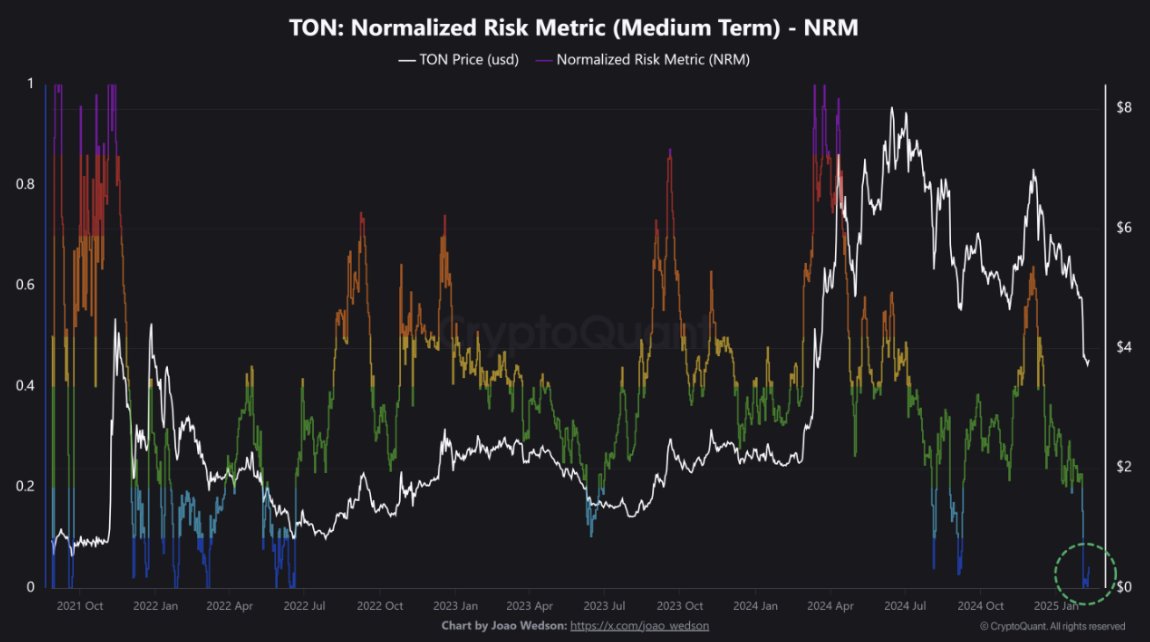

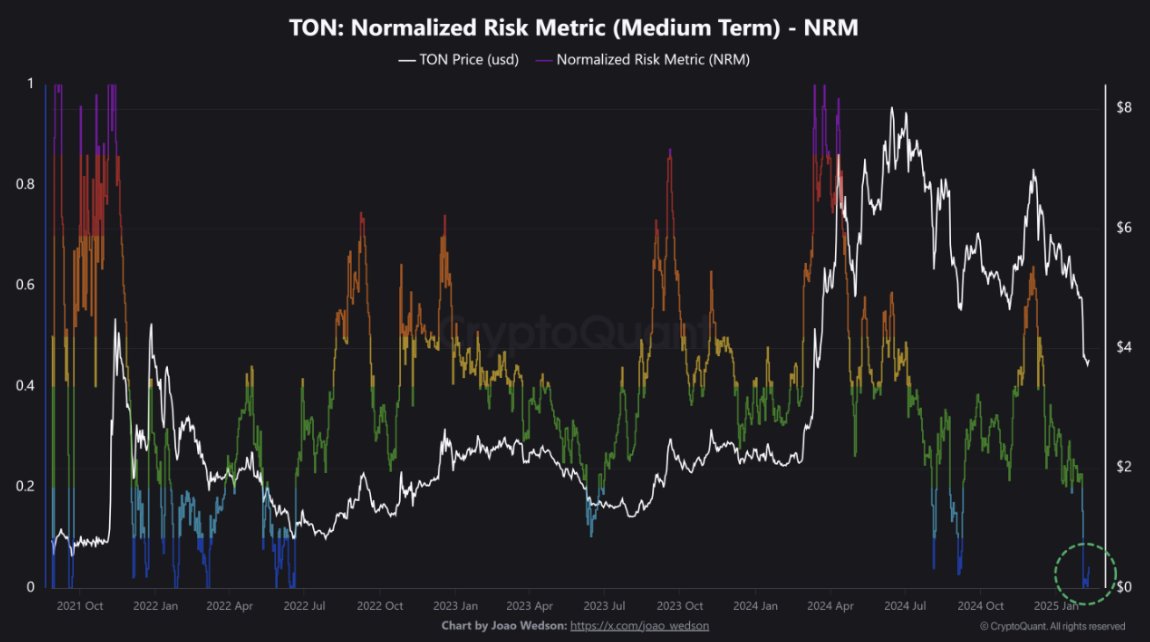

With a value of just $3.80 at press time, Toncoin [TON] seemed to be quietly signaling opportunity. With its NMR metric suggesting undervaluation, the stage might be set for a major price surge.

Could this be the perfect time for investors to dive in before the next big move?

Is TON undervalued?

TON’s NMR metric has flashed a rare signal – Historically tied to undervaluation. In simpler terms, TON might be trading below its true potential, setting up a prime “dip-buying” opportunity for strategic investors.

Source: CryptoQuant

Historically, a low NMR has preceded strong rebounds, hinting at a possible market bottom.

Undervaluation often translates into opportunity, as traders look to scoop up assets trading below their intrinsic worth. If momentum shifts, Toncoin could be primed for outsized returns.

TON is now 47% off its post-election peak of $7.20 and struggling below the $5 support zone, with the RSI plunging to an ‘extreme’ low too. Could this be the setup for a breakout?

Are investors digging the dip?

While the metric hinted at an optimal buying opportunity, other indicators tell a different story. TON’s trading volume, which soared past $1 billion after the election rally, has now plunged to just over $100 million.

Despite new capital flowing into the broader market, TON’s daily active addresses fell to a yearly low too.

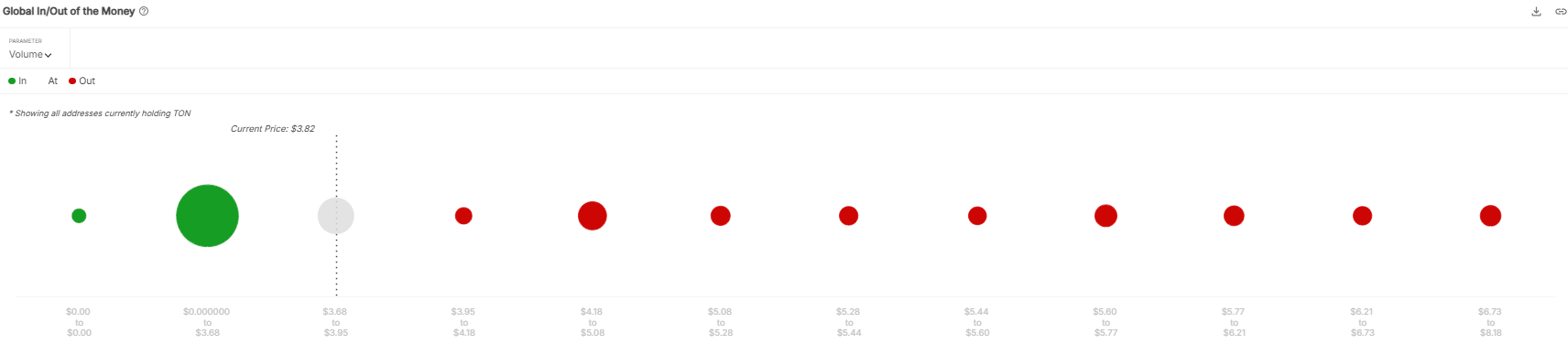

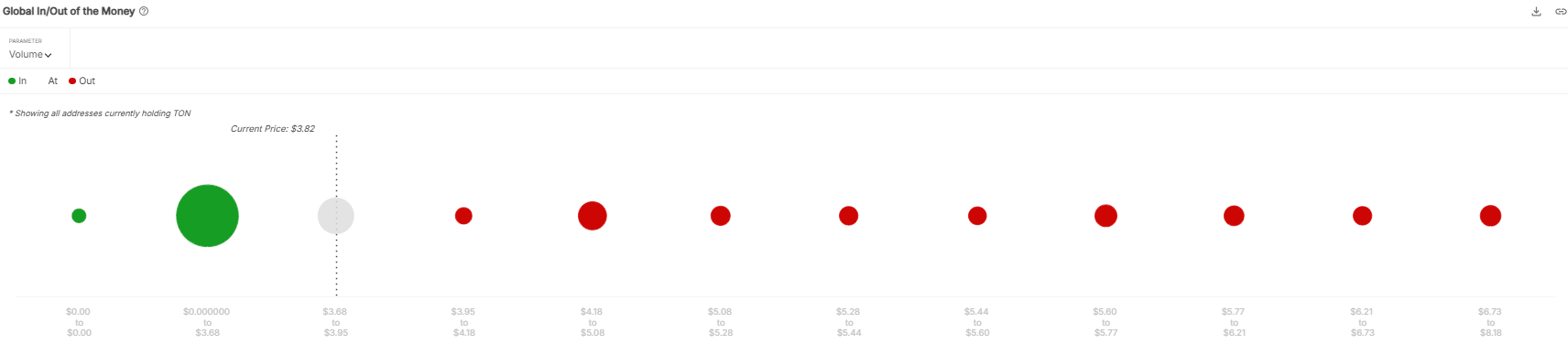

With over half of its “Trump pump” gains erased and only 4% of holders still in profit, TON is at a make-or-break moment. If it fails to hold above $2, $13.30 billion worth of TON could be at risk of a massive sell-off.

Source: IntoTheBlock

Read Toncoin’s [TON] Price Prediction 2025-26

While consolidation alluded to a bullish setup, buyers haven’t fully scooped the dip. Hence, a breakout to $5 might be a long shot. Right now, avoiding a deeper pullback is the real battle.