- Toncoin’s risk exposure ratio has been rising, signaling market confidence

- Market indicators suggested TON could see a trend reversal and make gains

On the weekly charts, Toncoin [TON] made a moderate recovery on the price charts. During this period, the altcoin surged from a local low of $4.7 to a high of $6.09. However, over the last 3 days, the altcoin retraced somewhat though. In fact, at the time of writing, Toncoin was trading at $5.66 – A decline of 0.98% over the last 24 hours.

This, after the altcoin depreciated by 10.81% on the monthly charts.

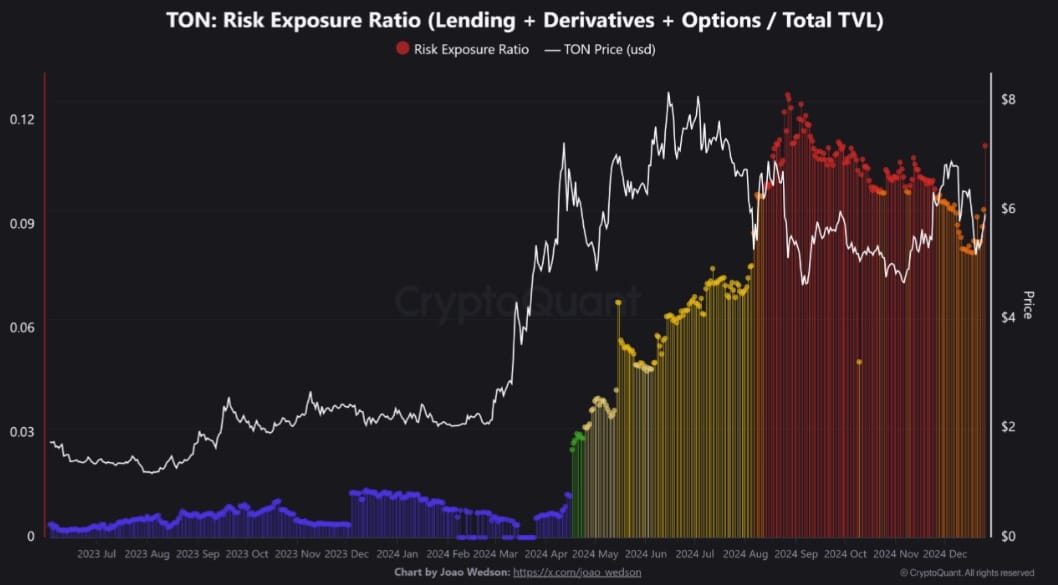

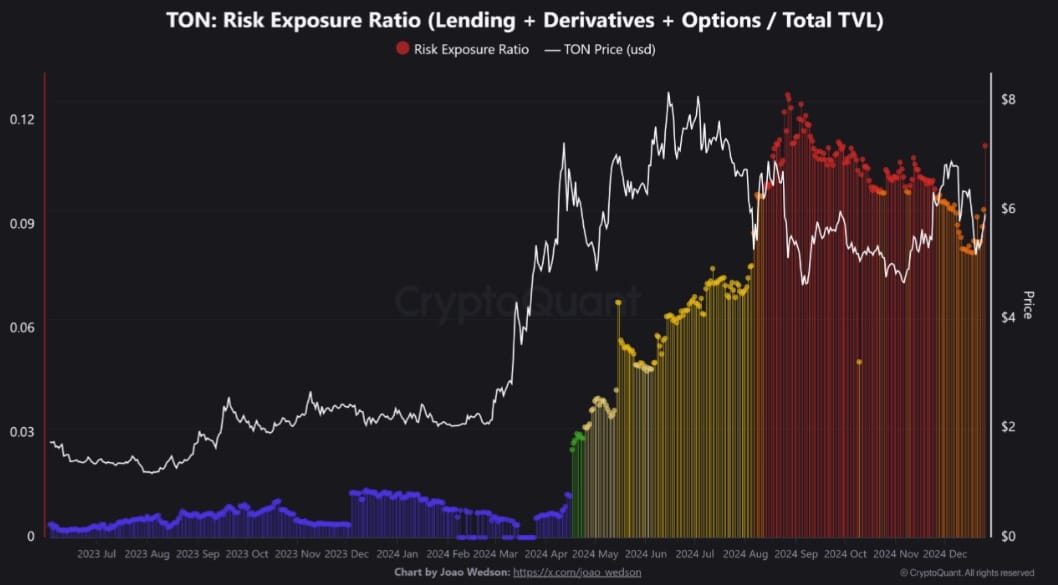

This market volatility has left analysts talking. One of them is Cryptoquant analyst Joao Wedson, with the analyst noting a spike in TON’s risk exposure ratio – A sign of potential bullishness.

Toncoin’s risk exposure ratio rises

In his analysis, Wedson posited that TON’s risk exposure ratio currently suggests that the risk level within the Toncoin network is moderately high.

Source: Cryptoquant

According to him, the reason behind this uptick is that a significant portion of TON’s TVL has been allocated to various areas such as lending, derivatives, and options which are highly exposed to market liquidity risks.

As such, since Toncoin’s last major price rally, the risk exposure ratio has seen a sustained uptrend. This upward movement is a sign of rising capital inflows into leveraged financial products such as loans and derivatives.

Although this hike may bring stability concerns, it can also signify market confidence. A rising demand for derivates and leverages means growing market optimism – A sign of confidence in market trend and investors’ bullish sentiments.

However, over-leveraged networks can magnify losses during bearish trends. Thus, this aspect can be viewed positively by speculative traders who take the rising demand to capitalize on derivative markets.

What does it mean for TON’s price?

While the uptick in the risk exposure ratio could signal caution as it correlates with higher volatility, it can also allude to market confidence and bullish sentiment.

Source: Santiment

We can see this bullish sentiment and market confidence through the sustained decline of supply on exchanges.

This has dropped from 1.9 million to 1.82 million over the past week – A sign of increased accumulation as investors transfer TON tokens into private wallets for self-custody.

Source: IntoTheBlock

Additionally, whales have turned bullish over the last 3 days, with the large holders’ netflow turning positive to 122.33 million TON tokens. This implied that whales are buying more tokens and accumulating, than they are selling.

A hike in capital inflows from whales shows market confidence.

Source: Santiment

Finally, Toncoin’s price DAA divergence has remained positive over the past week. A positive DAA divergence means that the recent price gains are supported by growing active addresses. Thus, the market is healthy with strong fundamentals.

In conclusion, it would seem that the uptick in the risk exposure ratio has been driving more speculative traders into the market. If this trend and capital inflows continue, Toncoin will see more gains. As such, TON could reclaim its $6.2 levels. However, if conservative investors avoid the market and close their positions fearing greater volatility, TON could dip to $5.4.