- Binance’s Richard Teng suggests that Bitcoin could thrive as a hedge against economic instability.

- Despite short-term volatility, long-term optimism remains strong for Bitcoin amid economic uncertainty.

As global markets reel from renewed trade tensions under Donald Trump’s tariff proposals, the crypto sector finds itself at a volatile crossroads.

Binance CEO outlines his faith in Bitcoin

Amid this uncertainty, Binance CEO Richard Teng has weighed in, suggesting that while the immediate impact might trigger short-term market swings, Bitcoin [BTC] could ultimately benefit from the broader economic instability.

According to Teng, investors may increasingly view digital assets as a hedge against macroeconomic disruptions—potentially driving demand and strengthening the case for decentralized finance in the long run.

Remarking on the same, Teng noted,

“The resurgence of trade protectionism is introducing significant volatility across global markets — and crypto is no exception.”

He added,

“In the short term, this kind of macro uncertainty tends to trigger a risk-off response, with investors pulling back as they wait to see how things unfold around growth, policy, and trade.”

Bitcoin’s price action post-tariff shock

Trump’s tariff shock has dealt a significant blow to Bitcoin, which once traded above $100K but is now below $80,000.

As of the last CoinMarketCap update, Bitcoin was trading at $77,879.02, marking a 1.97% decline in the past 24 hours.

However, despite these short-term fluctuations, Teng remains optimistic, as he said,

“Looking further ahead, though, this environment could also accelerate interest in crypto as a non-sovereign store of value.”

He added,

“Many long-term holders continue to view Bitcoin and other digital assets as resilient during periods of economic stress and shifting policy dynamics.”

What are the metrics hinting at?

Additionally, despite Bitcoin’s current price dip and bearish signals from indicators like RSI and MACD, a closer look at the data shows optimism.

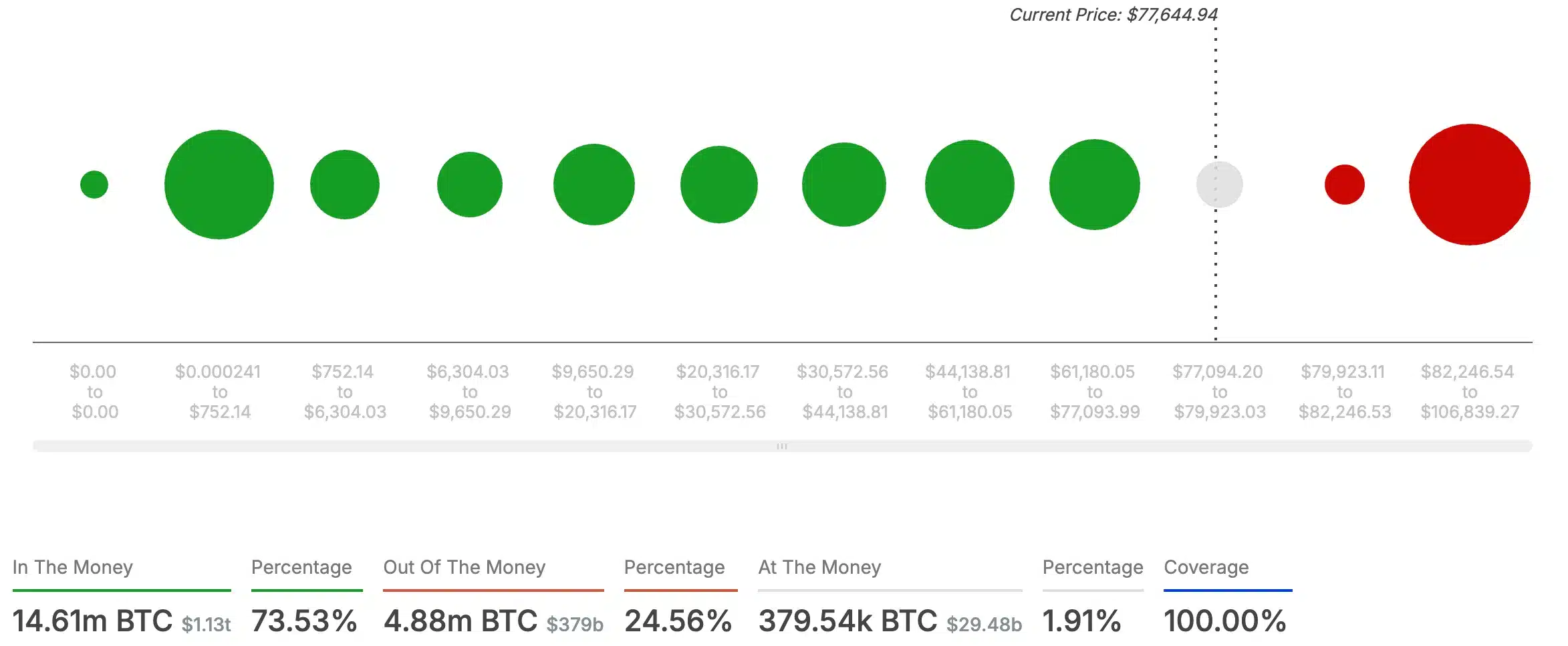

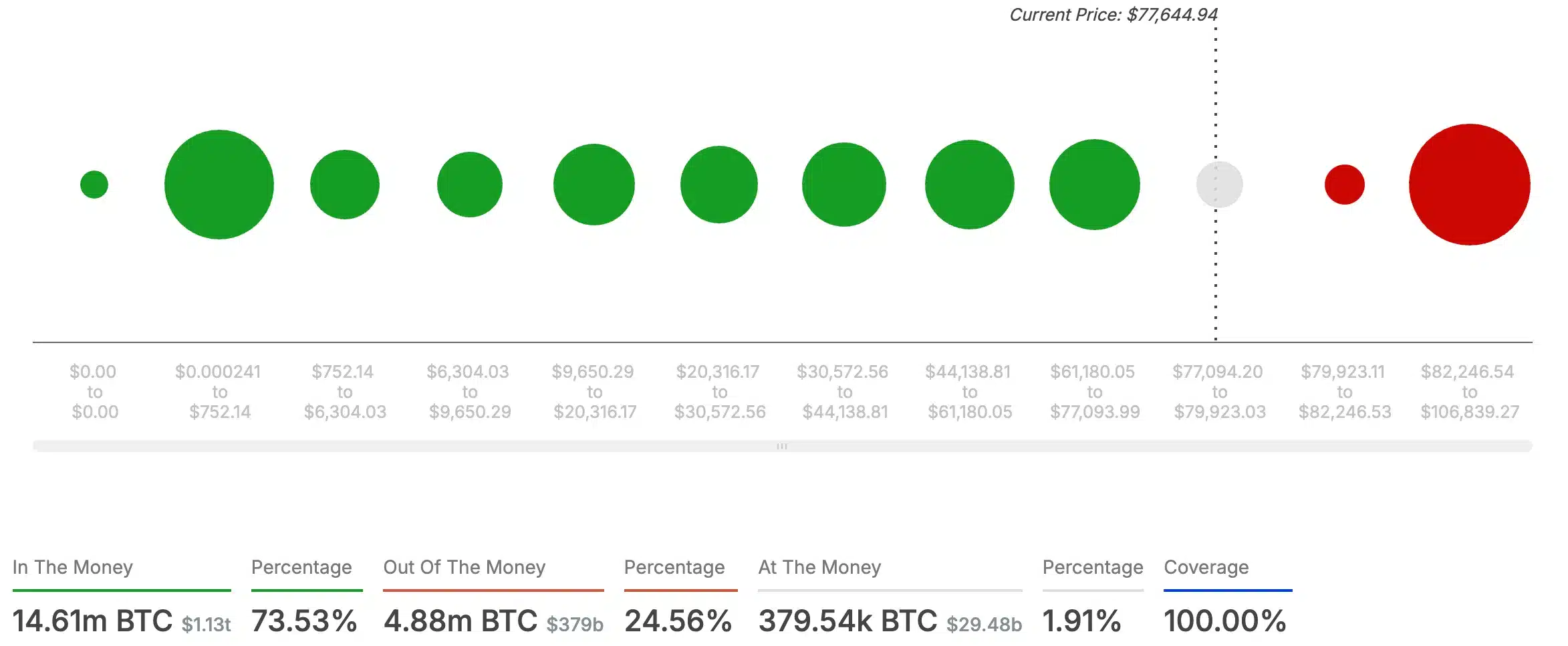

AMBCrypto’s analysis of IntoTheBlock metrics reveals that 73.53% of Bitcoin holders are “in the money,” meaning their tokens are worth more than their purchase price.

Only 24.56% are “out of the money,” suggesting underlying bullish sentiment and the potential for a price rally.

Source: IntoTheBlock

This followed recent rumors of a potential 90-day tariff pause, which briefly fueled hopes of a market rebound, only for the news to be debunked as false.

Nevertheless, the market responded with impressive gains.

Bitcoin mirrored this rally, spiking 6.5% and briefly surpassing $80,000 before retracting to its current levels.

Therefore, if a false rumor can trigger a significant Bitcoin surge, it clearly indicates the king currency’s strong resilience and market potential.