- Despite recent market volatility, TRUMP could be poised for a price uptrend in the long term.

- Technical analysis signaled a bullish reversal, and a move past $11.50 could trigger a rally toward $17.95.

Official Trump’s [TRUMP] has surged in trading volume despite the crypto market crash and price fluctuations.

TRUMP surged 70.74% in trading volume and was trading at $11.33 per CoinMarketCap data, at press time. With the market facing bearish pressure, traders question whether TRUMP’s successful breakout could start its uptrend rally.

TRUMP’s breakout on the chart

After prolonged bearish momentum, TRUMP tested and bounced off the $10.23-$10.50 demand zone, signaling a potential reversal. Buyers attempt to “buy the dip,” while the memecoin retested its descending resistance trendline multiple times.

A breakout above the $11 key resistance level has occurred, indicating a shift in market dynamics. If TRUMP confirms a breakout above $11.50, it could rally toward the $13.01-$14.81 resistance zone in the short term.

Depending on market momentum and sustained buying pressure, the rally may even aim for $17.95. However, rejection at this level could lead to a retest of $11 support above its falling wedge.

A breakdown below $11 support might push TRUMP back toward the $10.50 demand zone.

Source: TradingView

Are the bulls in charge now?

Looking at the technical indicators,

TRUMP’s oscillators and MACD (12,26) signaled ‘buy,’ indicating a trend reversal and short-term bullish momentum. At the time of writing, the 24-hour Relative Strength Index (RSI) was at 35 and rose to 41 in the 4-hour timeframe. Cryptowaves data confirmed this trend.

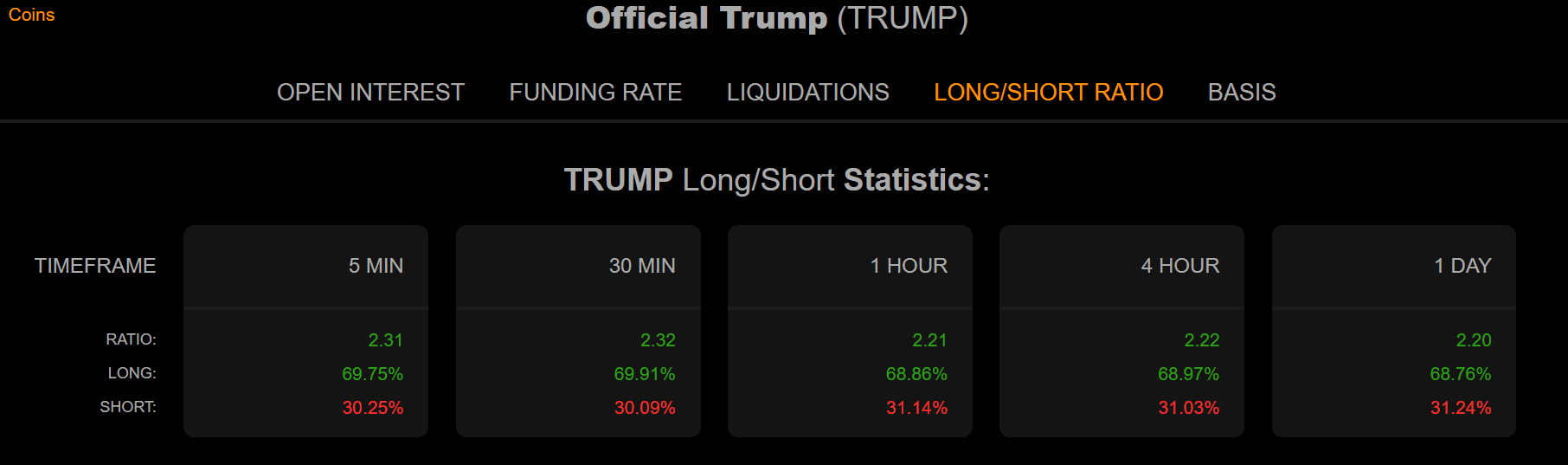

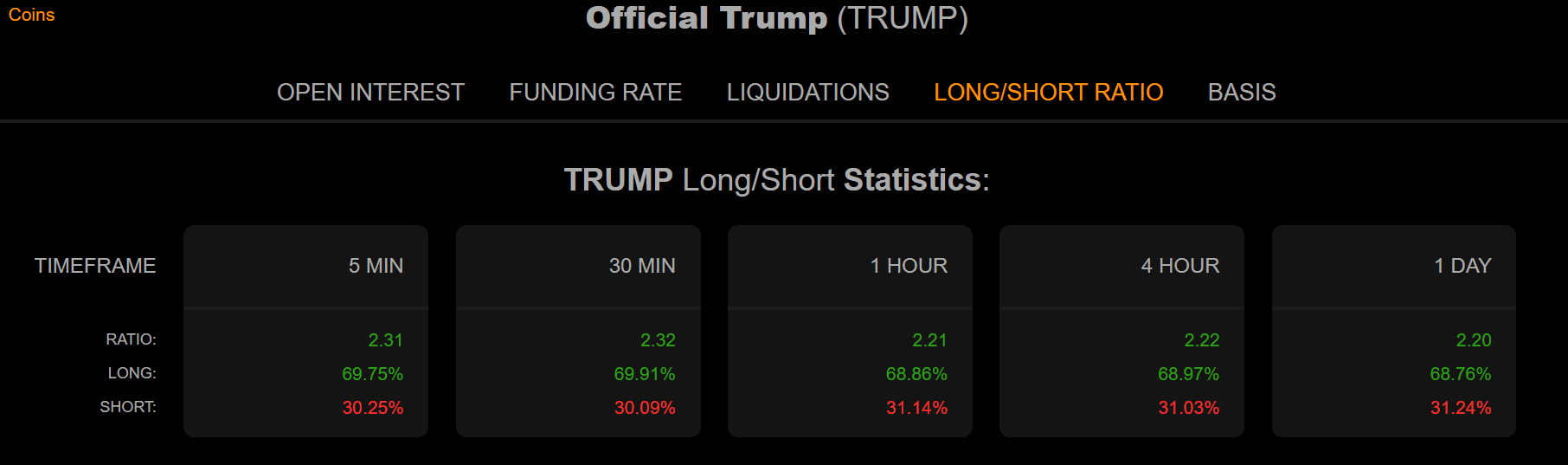

TRUMP’s Long-Short Ratio stood at 2.20 and increased in lower timeframes, reflecting heightened buying pressure. The memecoin rebounded from a key demand zone, reinforcing its bullish trajectory.

Source: Coinalyze.net

A look into the on-chain insights

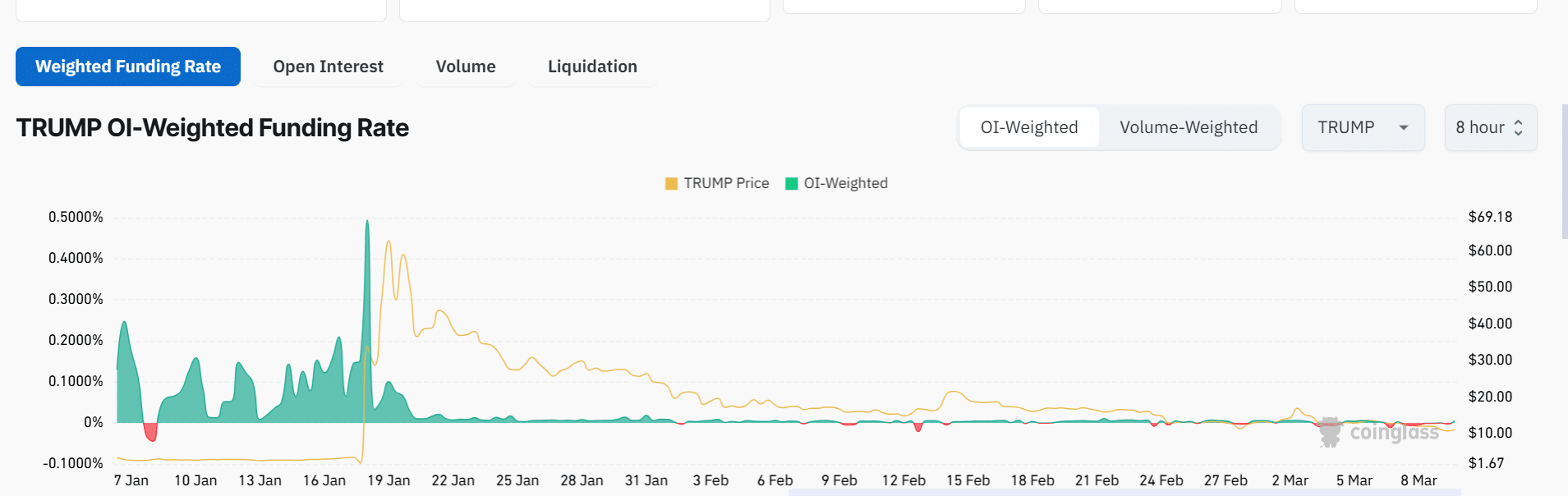

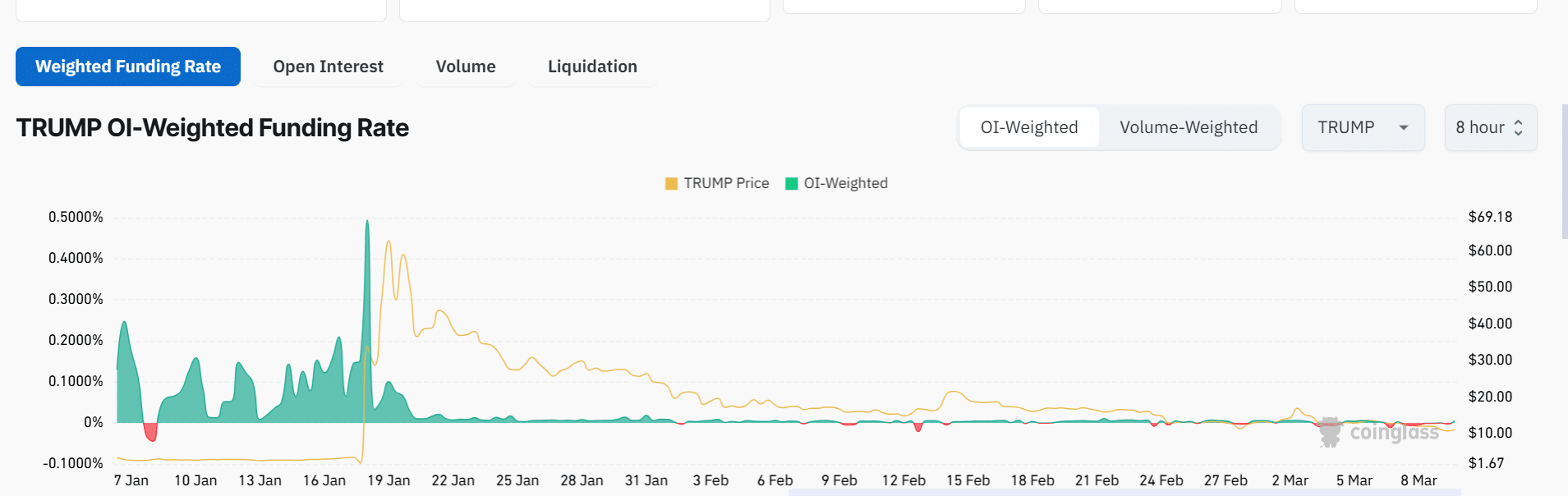

At the time of writing, the memecoin’s Open Interest (OI) Weighted Funding Rate had turned positive in the past 24 hours, per Coinglass data.

This suggested a trend reversal and renewed optimism as traders ‘bought the dip’ amid the market crash, as reflected by the 70.74% upsurge in trading volume.

Source: Coinglass

Will TRUMP’s bulls survive the bleeding market?

TRUMP may be set for a long-term bull rally after rebounding from a key demand zone. With an RSI of 35, the memecoin appears oversold, offering significant potential for buying.

However, ongoing bearish pressure in the crypto market could lead to mid-term price fluctuations. Traders should monitor TRUMP’s breakout signals and key levels for clearer insights.