- Trump’s tariffs may shift mining rig supply and boost operations outside the U.S.

- U.S. Bitcoin mining stocks lost $12B amid falling confidence and market instability.

Donald Trump’s proposed tariff plans have sent ripples through the crypto sector, with the mining industry now bracing for a potential fallout.

In a recent analysis by Hashlabs Mining CEO Jaran Mellerud, it’s suggested that the U.S. market could see a sharp decline in demand for Bitcoin [BTC] mining rigs due to soaring equipment costs.

As American miners face higher prices, manufacturers may shift surplus inventory to global markets. This could create a boom for international mining operations.

The report added,

“As machine prices rise in the U.S., they could paradoxically decrease in the rest of the world. The demand for shipping machines to the U.S. is set to plummet, likely nearing zero.”

U.S. loses, but other countries gain

Mellerud noted reduced interest from U.S. miners, leaving manufacturers with an oversupply of rigs meant for America.

To address this surplus, manufacturers may cut prices and focus on emerging markets abroad.

Previously, producers like Bitmain, MicroBT, and Canaan moved operations to Southeast Asia to avoid earlier tariffs on China.

Ironically, these countries now face new tariffs. Thailand, Indonesia, and Malaysia are hit with rates of 36%, 32%, and 24%, respectively.

Tariffs push U.S. rig prices up

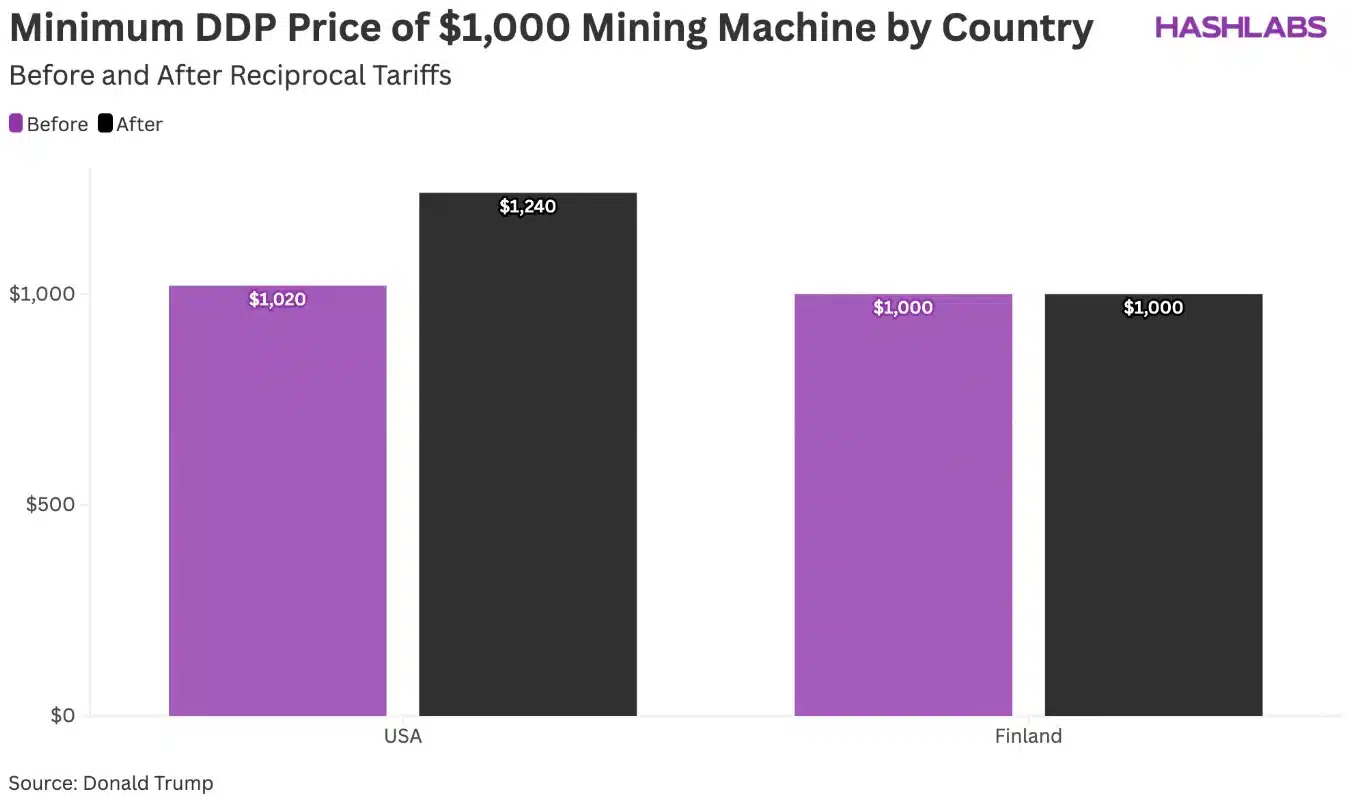

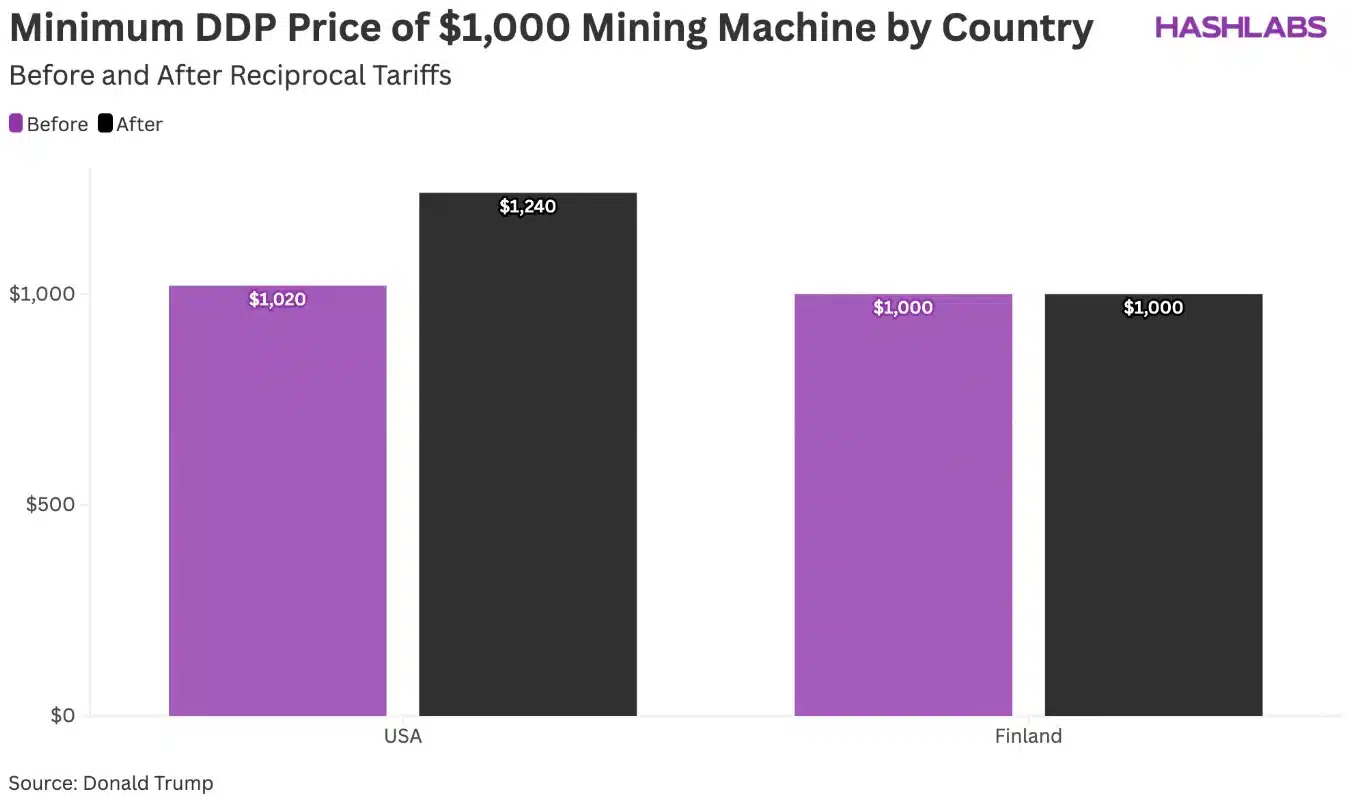

According to Mellerud, Trump’s new tariff policy could lead to a sharp price hike for mining hardware in the U.S., with a $1,000 rig now costing around $1,240 due to added import duties.

Source: Hashlabs report

He also expressed doubts when he said,

“Even if these tariffs are rolled back within a few months, the damage is done — confidence in long-term planning has been shaken. Few will feel comfortable making major investments when critical variables can change overnight.”

While many U.S. miners initially viewed Trump’s return as a sign of regulatory stability, the unexpected tariff announcement has shaken that confidence.

For those unware, the U.S.—which has led the global Bitcoin mining landscape since China’s 2021 crackdown—currently contributes around 36% of the total hashrate, per data from Hashrate Index.

However, Trump’s latest push for “reciprocal tariffs,” announced on the 2nd of April, threatens to disrupt this dominance.

Impact on crypto stocks and the global crypto market

Additionally, Bitcoin mining stocks have also collectively lost over $12 billion in value since February, wiping out early 2024 gains.

Leading mining firms have suffered steep double-digit losses, signaling widespread investor concern.

According to the latest CoinMarketCap data, the global crypto market cap has dipped to $2.44 trillion, reflecting a 3.02% daily decline.

Bitcoin, once soaring past the $100,000 mark, has now plummeted to $76,881.52, driven by an 8% weekly drop and over 3% fall in just the past day. This highlighted how policy decisions can rapidly destabilize the digital asset landscape.