- BTC bounced +10% after Trump’s 90-day tariff pause.

- Per analysts, a China tariff deal could rally BTC or cap it.

Bitcoin [BTC] jumped 10% on the 9th of April to $83.5K after President Donald Trump announced a 90-day pause on tariffs against other countries, except China.

The relief rally was seen across U.S. equities, too. But the U.S.-China tariff woes could affect BTC. Trump hiked tariffs on Chinese imports to 125% after Beijing played hardball with an 84% retaliatory tariff increase against the U.S.

Now, the tariff showdown could determine the next BTC movement, per analysts, but some views were mixed.

Navigating BTC’s tariff woes

It’s worth noting that China was ready for a deal, according to the latest update by President Trump. Per analyst Joe McCann, a likely ‘deal’ would send BTC higher, noting that such an outcome wasn’t priced in.

“If a China deal comes, market explodes. If it doesn’t, it’s already priced. Trump has signaled max pain for China and is willing to negotiate. Market can only re-price higher.”

McCann added that an indicator of such a positive agreement with China would be the Yuan (CNY) currency rallying higher against the US dollar (USD).

Unfortunately, China was pushing for the opposite outcome — a weak CNY. Bitwise’s head of alpha, Jeff Park, was worried that this would be ‘negative to risk assets,’ including BTC.

“With what irreversibly happened with weakened yuan now exporting deflation + 10% tariff creating growth drag, the net outcome is still negative for risk assets especially if 10yr stays above 4%.”

For his part, BitMEX founder Arthur Hayes echoed similar contention but added that it would end up in money printing by the Fed and boost BTC.

“No deal, PBOC continues a very gradual Yuan weakening. Shit ‘bout to get spicy. Luckily, $BTC loves money printing and associated CNY weakness.”

That said, the tariff fallout has reportedly made the case for BTC, especially in international trade settlements between Russia and China, noted VanEck.

BTC breakout prospects

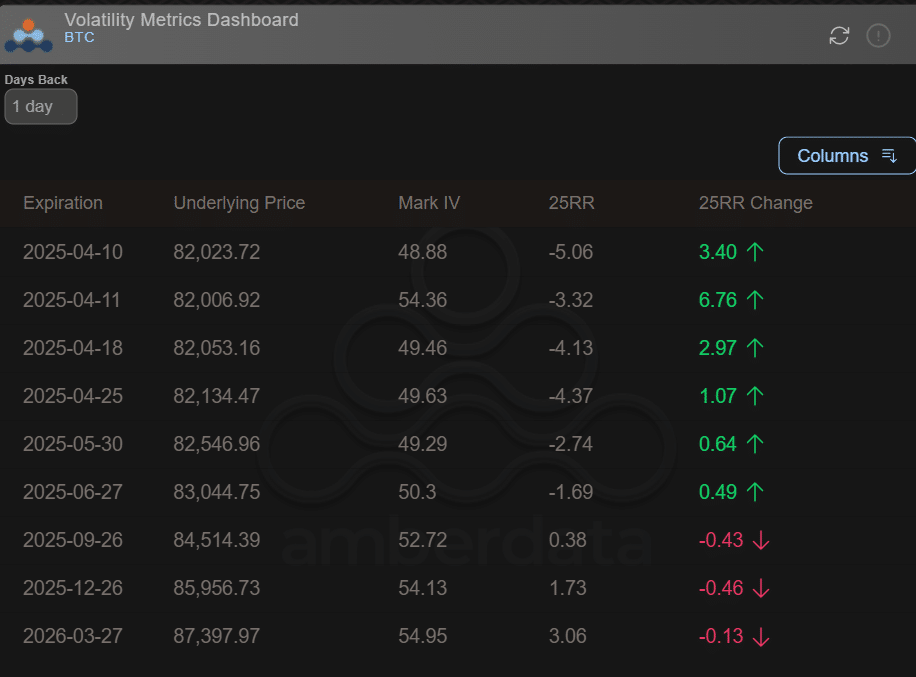

Meanwhile, heavy hedging was still in play for the second half of April, as illustrated by the negative readings on the 25RR (25 delta risk reversal) indicator. This suggested an increased demand for put options (bearish bets) for further downside protection.

Simply put, the market was still cautious amid the ongoing tariff showdown between the US and China.

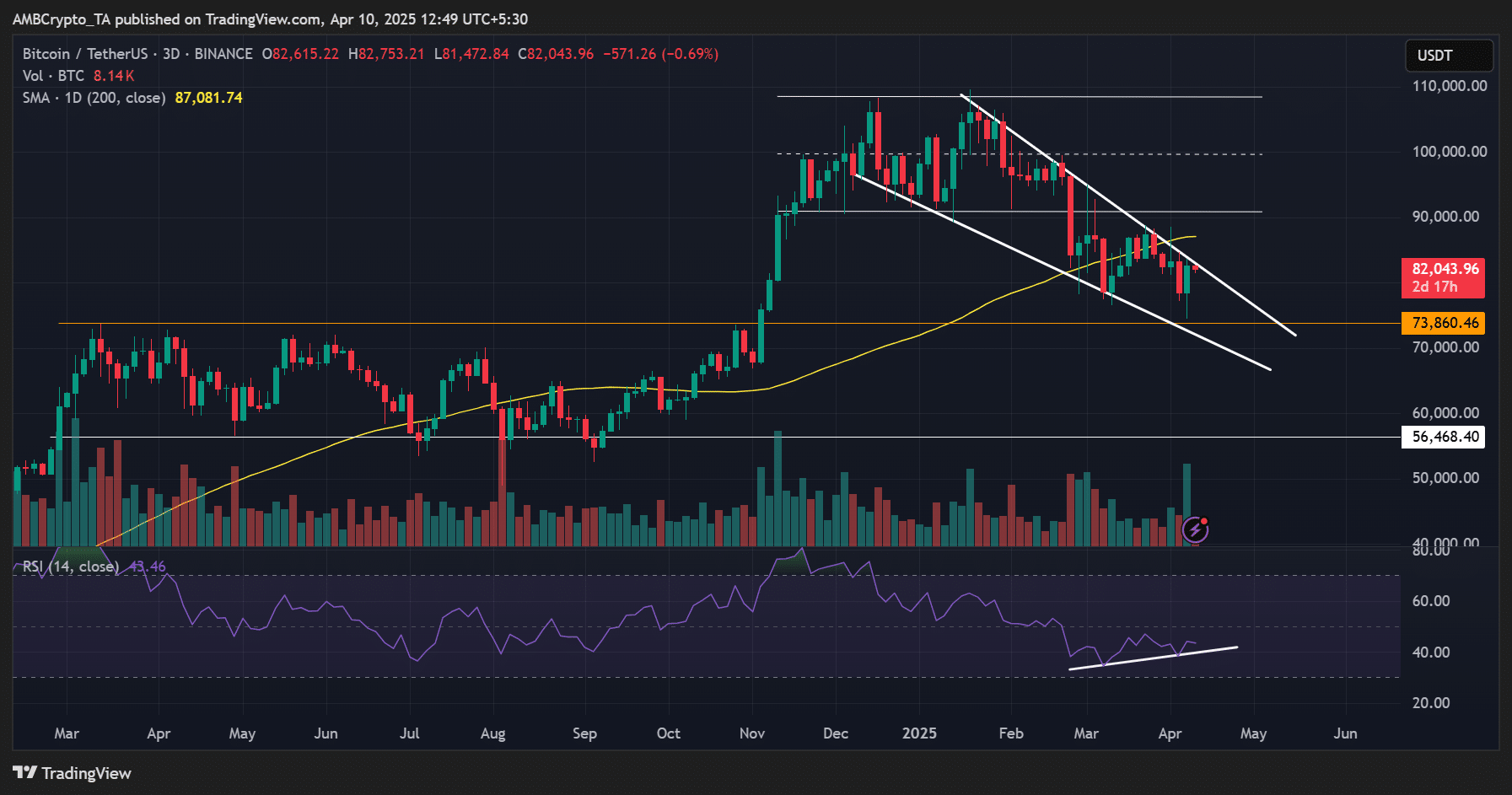

From a price chart perspective, though, BTC chalked a bullish falling wedge pattern, a signal that the downtrend momentum could lose steam soon and allow for a recovery.

Source: BTC/USDT, TradingView

The bullish RSI divergence also supported the breakout prospects. As such, last year’s range-high above $70K was a pivotal level to watch if macro conditions improve.