- Chart patterns suggest that if the recent executive order—expected to make BTC rally—follows past trends, a decline is likely.

- For now, investors—U.S. retail and traditional institutions—have been selling the asset as it fails to spark optimism in the market.

In the past 24 hours, Bitcoin’s [BTC] movement hasn’t aligned with market expectations, particularly with the executive order bringing a strategic BTC reserve to life.

Over this period, the asset has dropped by 4.05%, interrupting last week’s 10% surge in BTC’s performance. High trader skepticism currently dominates market sentiment, contributing to BTC’s underwhelming performance.

Trump’s past influence on Bitcoin is fading

President Donald Trump previously influenced BTC’s price positively, but this effect is diminishing as investor skepticism increases.

After his 2024 U.S. presidential election victory, BTC surged from $66,780 to $109,350, marking a 63.75% increase. Since then, BTC has struggled to deliver additional rally opportunities, reflecting a shift in market dynamics and sentiment.

Source: TradingView

After Trump announced a Presidential Working Group on January 23 to create a BTC regulatory framework, the asset fell 27.08%.

This decline is unusual for such a phase and reflects growing investor skepticism, likely keeping many on the sidelines. If BTC mirrors trading patterns seen after previous executive orders, it could drop another 33% to the $58,000 range.

What’s driving the decline?

Bitcoin’s recent decline stems from skepticism among U.S. retail and institutional investors, typically expected to act as major buyers.

This skepticism persists despite the establishment of a strategic Bitcoin reserve tied to their country. The Coinbase Premium Index, which monitors retail investor activity, confirms that retail investors are selling instead of buying.

The index remains in a historically bearish range, recording a negative 0.01, commonly recognized as a selling indicator.

Source: CryptoQuant

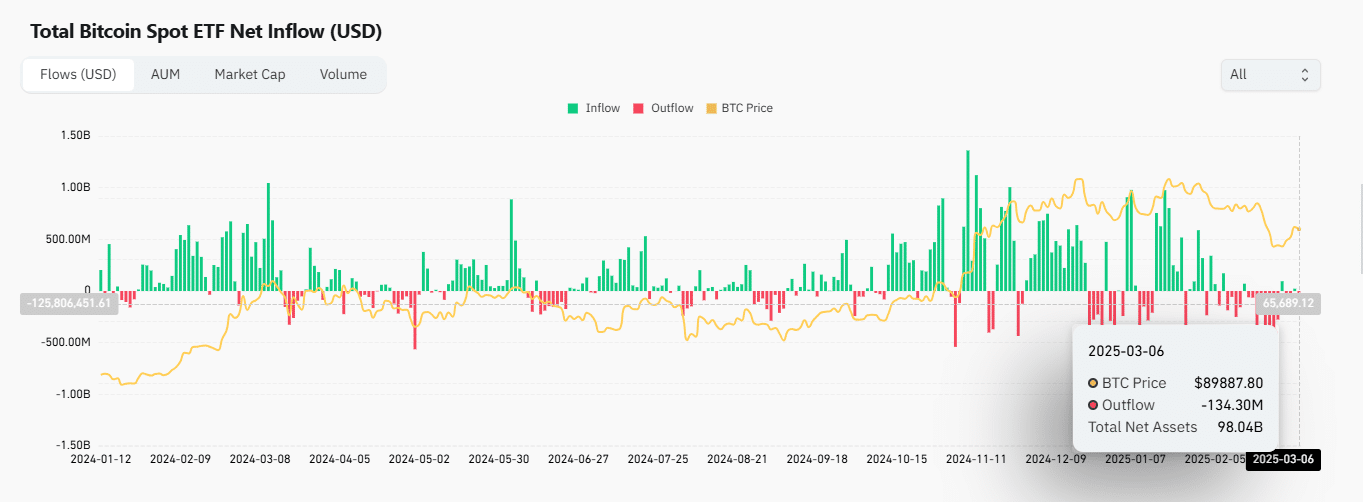

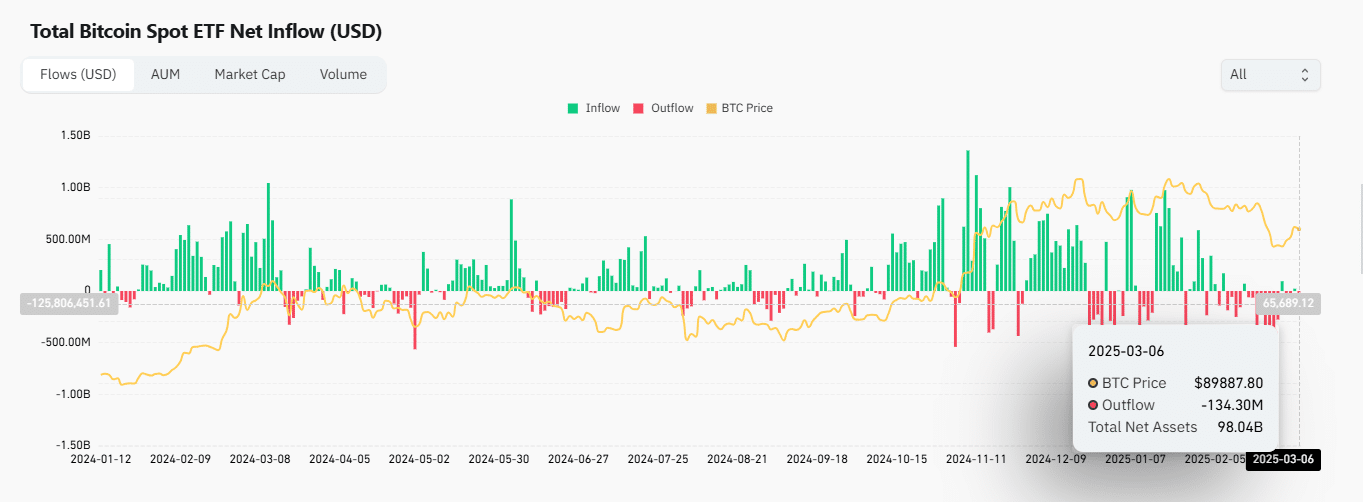

Meanwhile, BTC Exchange-Traded Fund (ETF) netflow data reveals that institutional investors are also selling in the current market environment.

Within the last day, the exchange netflow turned negative as institutional holders sold $134 million worth of BTC. This is surprising, as profit-driven investors would typically view BTC’s $88,200 price, at press time, as a buying opportunity during significant events.

However, contrary to expectations, they are opting to sell, further contributing to bearish market activity.

Source: Coinglass

Bulls remain, but with low momentum

Some market segments remain bullish, but momentum appears weak.

In the derivatives market, the Funding Rate indicates a slightly bullish bias, tracking whether longs or shorts pay position premiums.

At the time of writing, it was at 0.011. This indicates that buyers are paying premiums, anticipating a price increase. However, enthusiasm seems to be waning.

The Funding Rate stands slightly above the bearish threshold (below 0) and has dropped from the previous day’s high of 0.0042.

Source: CryptoQuant

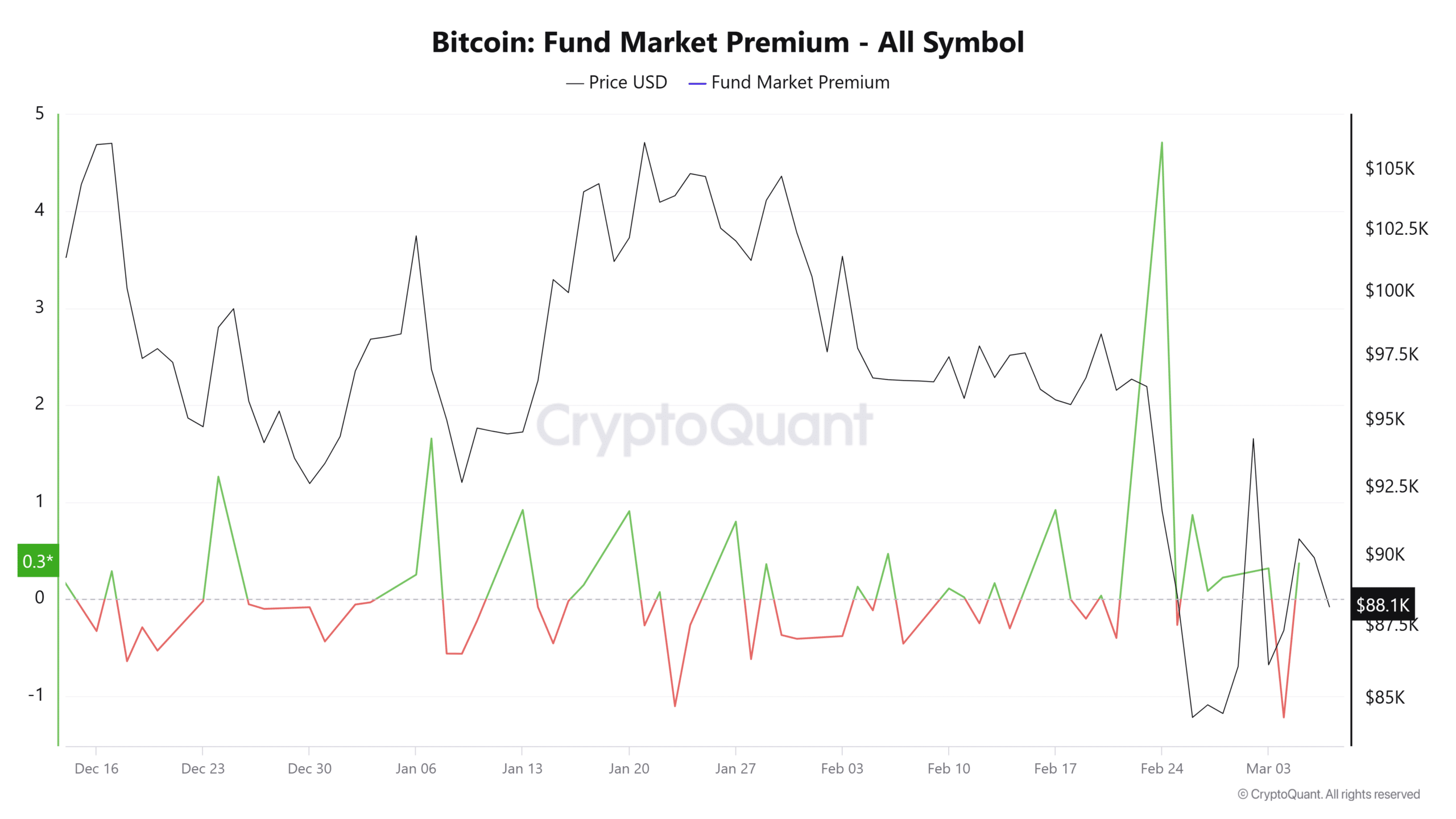

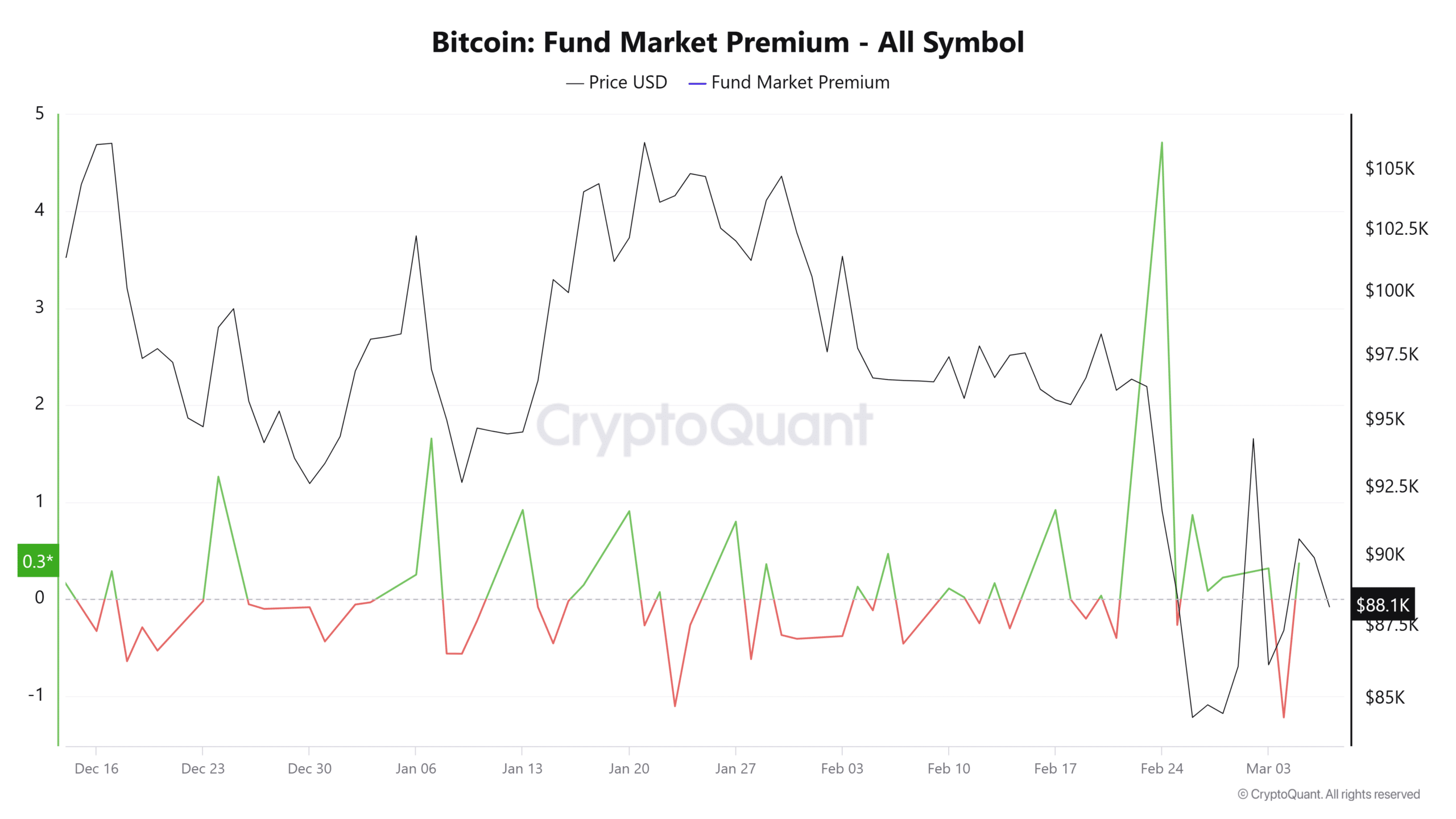

Similarly, the Fund Market Premium shows that crypto investment funds like GBTC are buying, although their pace remains slow.

Currently, the metric stands at 0.3, slightly above the neutral and bearish zone, signaling cautious investor behavior.

If the derivatives market and crypto investment funds turn bearish, Bitcoin’s price could experience further declines from its current level.