- Whale accumulation and rising large transactions hint at institutional interest.

- UNI maintains consolidation range as Funding Rates and user growth increase.

Uniswap [UNI] has rebounded from its multi-month downtrend, bouncing off the $5.60 support level with a 5.40% daily gain, backed by rising volume and bullish momentum.

This move suggests a potential trend reversal as trading activity increases near critical support zones.

The recovery comes amid strengthening technical signals and growing confidence among market participants.

Source: X

Can rising network activity reignite UNI’s demand?

On-chain data highlighted a sharp rise in user activity. New addresses surged by 66.12%, while active addresses rose 19.39% in the past week.

This uptick signals growing interest in the Uniswap ecosystem, despite recent price stagnation. Increased address creation often reflects expanding user adoption or reinvigorated investor participation.

Furthermore, the rise in zero-balance addresses suggests churn, possibly as holders reposition. Overall, the address growth provides a fundamental backbone for UNI’s short-term price resilience.

Source: IntoTheBlock

Are institutional players making a strong comeback?

A clear shift has emerged in transaction sizes. Large transaction counts saw massive increases: +174.9% in the $10k–$100k range, +168.75% for $100k–$1m, and a 200% surge for $1m–$10m transfers.

Conversely, smaller transactions—particularly those under $1k—dropped over 20%, suggesting declining retail participation. This realignment points to growing institutional or high-net-worth interest.

The contrast between dropping small activity and rising large transfers emphasizes a market leaning toward smart money accumulation.

Source: IntoTheBlock

Building pressure for a breakout?

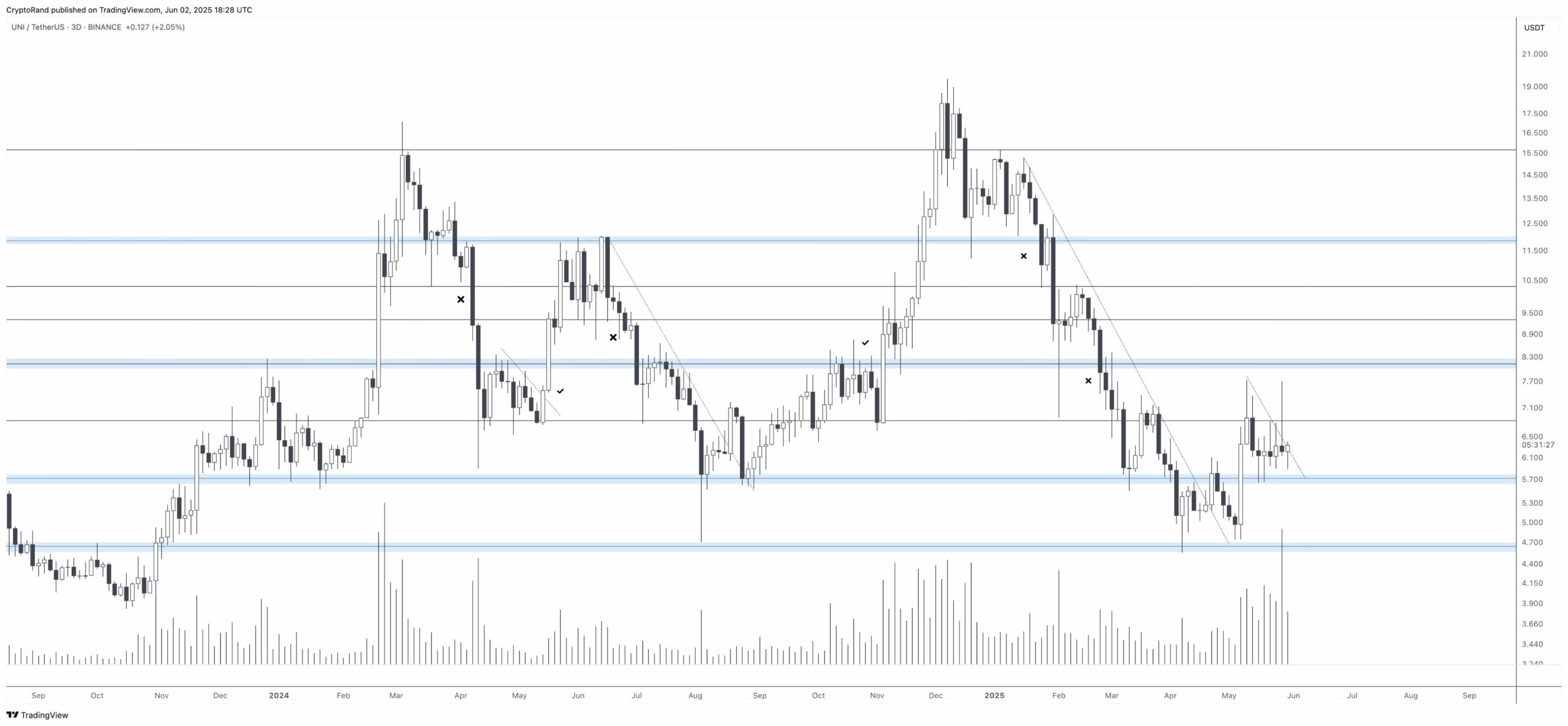

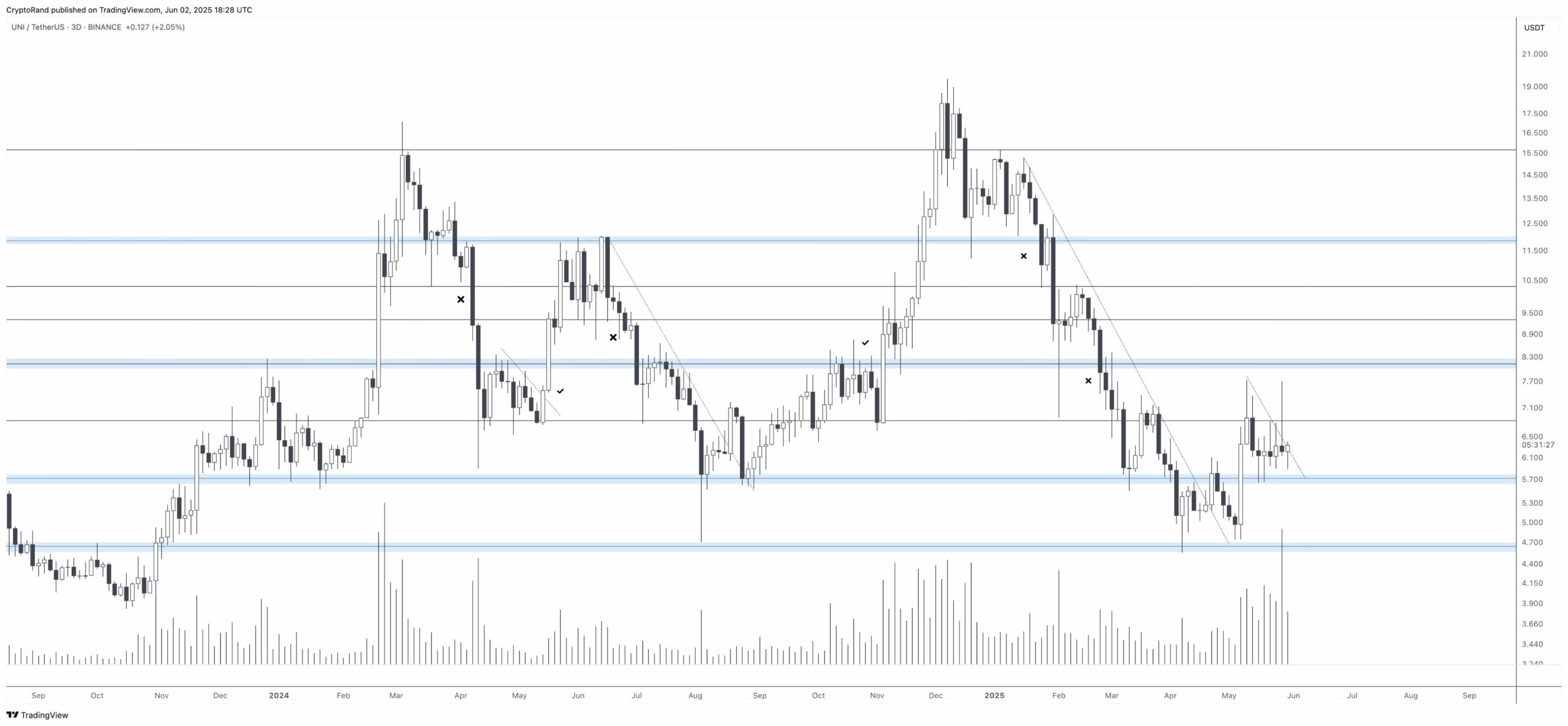

UNI has traded between $5.50 and $7.50 for over two months, showing a well-defined range after breaking a long-term downtrend.

The MACD indicator shows convergence between signal lines, hinting at a potential bullish crossover.

This technical behavior suggests that buyers are quietly gaining ground while sellers show signs of exhaustion. Range-bound conditions like this often precede breakout moves—either upward or downward.

However, given the volume increase and address growth, the probability now leans toward an upside breakout, especially if the $7.50 level is tested with momentum.

Source: TradingView

Are whales silently accumulating as smaller players exit?

The last 30 days show a 2.40% increase in whale holdings, while investor and retail holdings declined by -2.74% and -1.70% respectively.

This divergence indicates a transfer of tokens from smaller holders to whales, a common pattern observed before upward price movements.

Historically, such shifts suggest confidence from large holders in future price performance. Therefore, this concentration shift strengthens the argument for mid-term accumulation.

Source: IntoTheBlock

Is the Funding Rate signaling bullish bias?

The OI-Weighted Funding Rate for UNI remains positive, recently recorded at +0.0056%. This suggests that traders are increasingly willing to pay to maintain long positions.

Such behavior is generally a bullish indicator, especially when aligned with price stability and increasing volume.

While not extreme, the consistent green funding rate shows a market leaning toward optimism. However, if this persists without a significant price move, long positions may become overcrowded.

Source: Coinglass

Is UNI gearing up for a breakout or another range-bound cycle?

All key indicators—technical rebound, address growth, whale accumulation, and rising Funding Rates—support a bullish setup.

However, UNI must break decisively above $7.50 to confirm a full trend reversal. Until then, the range remains intact, but conditions suggest mounting pressure for a breakout.