- UNI rallied 17% to $7.67, flipping its $7.5 resistance and posting a two-month price high.

- A golden cross near $7.818 may validate the uptrend—failing to hold $6.87 could trigger a retrace.

Over the past day, Uniswap [UNI] made a strong upswing on its price charts. UNI has surged from a low of $6.2 to a high of $7.67, breaking out from a downtrend.

Two weeks ago, UNI faced a rejection at $7.50 while trying to break out of the descending channel.

Now, it has successfully surpassed this resistance, defending support at $5.60 and rising 17% to a two-month high of $7.60. This time, however, buyers appeared far more aggressive.

We can see this demand as Uniswap volume surged by 89.5%, hitting a total of $1.53 billion with a Daily Trading Volume of $901.6 million.

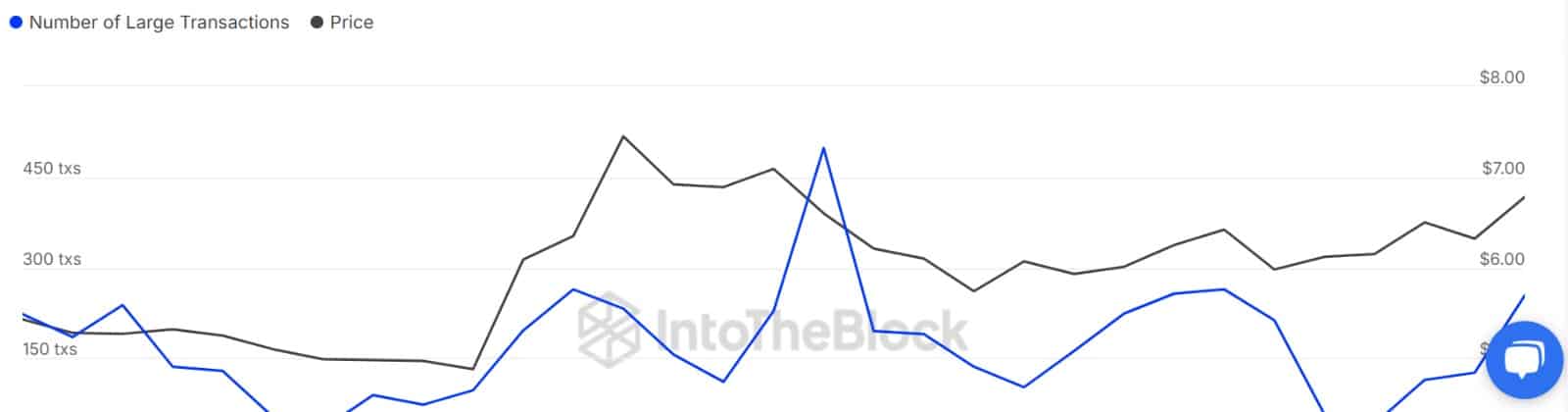

Whale activity returns in force

Source: IntoTheBlock

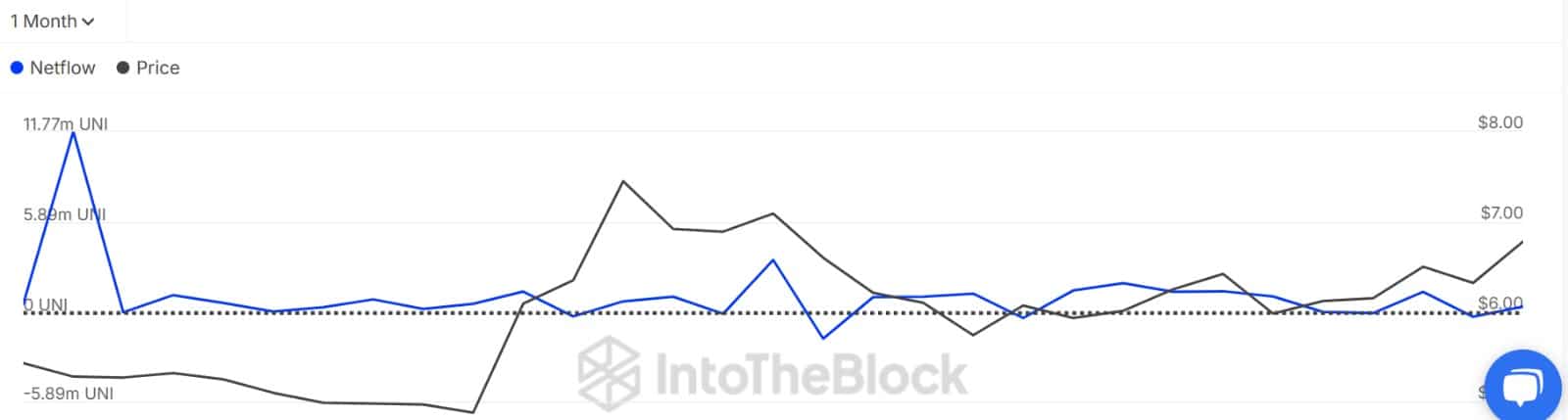

This demand has been driven not only by rising retail activity but high whale activity over the past day.

Over the past three days, the number of large transactions jumped from 41 to 254. Naturally, that kind of spike raised questions—buying spree or exit dump?

Looking deeper, Netflow data clarified the picture.

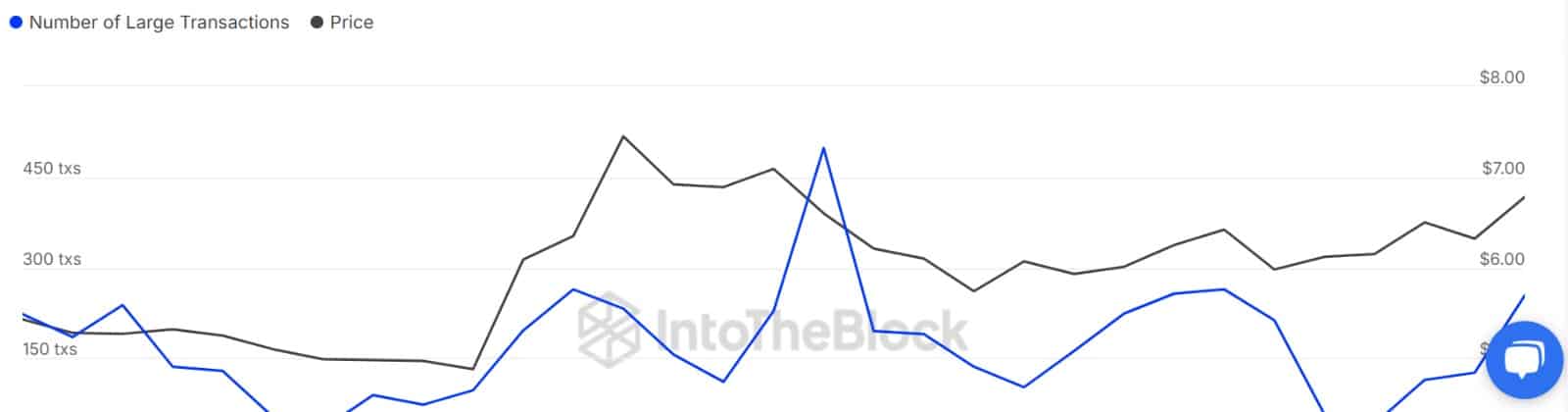

Whales are net buyers—for now

Source: IntoTheBlock

Per the Large Holders’ Netflow, most of the whales were accumulating the altcoin at press time. Thus, Large Holders’ Capital Inflow surged to 6.75 million UNI.

On the sell side, whales have been actively offloading 6.3 million tokens. This leaves the market with a positive Large Holders Netflow of 339k.

Thus, whales are buying more than they are selling.

Source: CryptoQuant

The same case can be said when we look at activities on the spot market.

UNI saw 6.96 million tokens bought via taker orders, flipping the CVD (Cumulative Volume Delta) into buyer-dominant territory. Clearly, the bulls weren’t sitting out this rally.

Can Uniswap maintain the uptrend?

As observed above, demand for Uniswap surged significantly over the past day, with whales and small traders all getting into the market to buy.

That said, a new risk emerged—profit realization.

As such, Uniswap Exchange Netflow remained positive for two consecutive days. A positive netflow indicates higher exchange inflows than outflows.

Source: CryptoQuant

It’s possible that investors who’ve been underwater since early April used this bounce to exit, capping upside in the near term.

For Uniswap to maintain the uptrend, UNI needs to complete a golden cross on the short-term MA.

Looking at this indicator, short-term 9DMA is almost crossing 21 DMA from the downside to the upside. Completion of this move will validate the uptrend.

Source: TradingView

If this cross completes and price holds above $7.818 (200 EMA), UNI may extend gains.

However, failure to hold $6.87 (21DMA) could open the door to a pullback toward $6.4.

In short, demand has returned across the board—but whether the rally sticks depends on how UNI navigates the next profit wave.