- VIRTUAL dropped 12% in a day, with geopolitical tensions adding to market risk.

- Aerodome LPs dumped $7.3 million worth of VIRTUAL, signaling declining confidence.

Virtuals Protocol [VIRTUAL] dropped by 12.03% in the last 24 hours, at press time, falling from $1.56 to $1.37.

This decline continued a broader downtrend that has stretched across June, despite the AI token still holding a 106% gain on the 90-day Altseason Index, just ahead of SPX6900 [SPX].

However, that lead now seems shaky.

The confirmation of U.S.–Israel airstrikes on Iran on the late 21st of June introduced fresh geopolitical volatility, rattling speculative assets across crypto markets.

Source: CoinMarketCap

Market analysis suggests that VIRTUAL’s bearish trend may intensify over the next few trading sessions, with the asset potentially trending even lower.

VIRTUAL Spot and DEX activity point to fading investor interest

Spot trading activity declined across both centralized and decentralized exchanges, reflecting weaker interest in the token.

At the time of writing, selling had resumed in the spot markets of centralized cryptocurrency exchanges, with $680,000 worth of VIRTUAL sold in the past 24 hours.

Source: CoinGlass

This sell-off follows two days of buying activity between the 19th and 20th of June, but comes amid falling prices and lower investor demand.

Meanwhile, DEX activity also slumped. Active traders on decentralized exchanges fell to just 1,600, a steep drop that echoed the token’s declining utility.

Bybit and Aerodome lead $7.8M sell-off

AMBCrypto traced the recent sell-off to traders on ByBit and liquidity providers from the on-chain protocol Aerodrome Finance [AERO].

Source: Arkham

At the time of analysis, Funding Rates turned sharply negative on Bybit, dropping to -6.0%. In contrast, Binance and OKX posted positive Funding Rates of 5.0% and 1.0%, respectively.

This negative rate implies that most traders on Bybit’s derivatives market are shorting the asset—an important detail since Bybit controls the second-largest trading volume of VIRTUAL, worth $82 million, according to CoinGlass.

Source: CoinGlass

Similarly, Aerodome Finance removed $7.3 million worth of VIRTUAL from its liquidity pool, according to Arkham Intelligence.

That exit hinted at an urgent repositioning by LPs. The move likely reflects an attempt to avoid further downside as trust erodes.

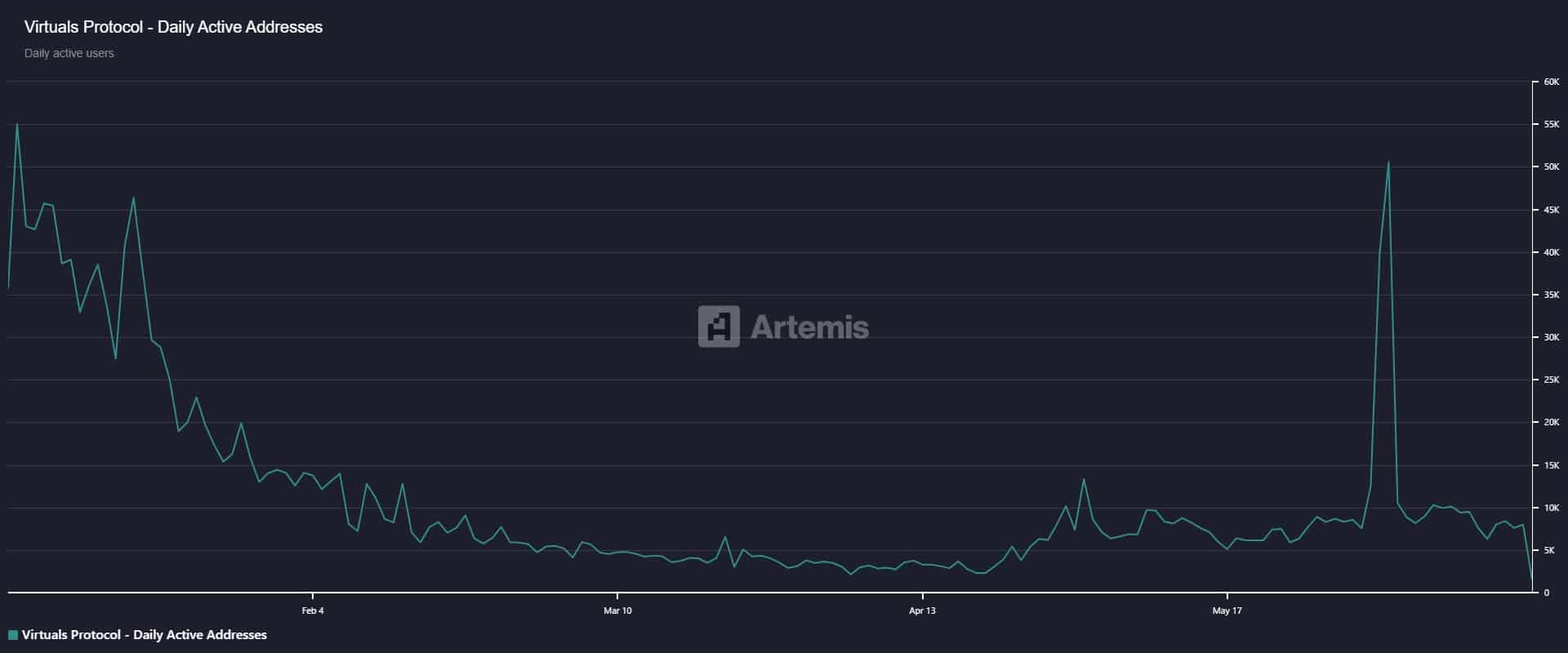

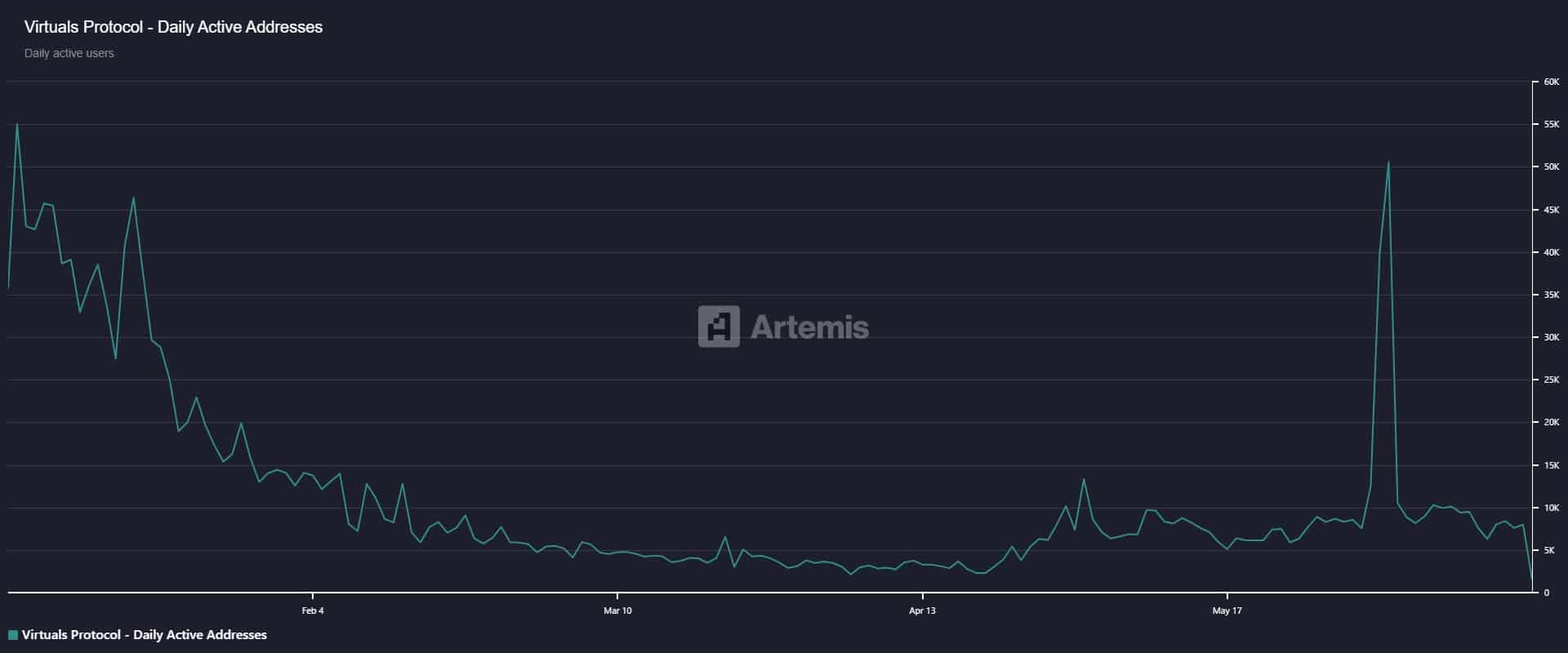

VIRTUAL Active Addresses plunge

Sentiment in the VIRTUAL market remains bearish, as addresses continue to exit. According to Artemis, Active Addresses dropped to 6,300, the lowest monthly level.

Source: Active addresses

That plunge confirms weakening participation, especially after May’s short-lived spike. Traders appear to be walking away rather than re-entering positions.

With global tensions on the rise and speculative assets facing broader selloffs, VIRTUAL’s short-term outlook remains fragile.

If the trend continues, VIRTUAL’s position on the 90-day index is likely to slip even further.