- ARB recently recorded a significant net outflow chain, a trend that often leads to price declines.

- However, both whales and retail investors have absorbed selling pressure, betting on ARB’s potential for further gains.

After a month-long decline of 19.37%, Arbitrum [ARB] has reversed course. Over the past week, it surged by 24.03% and has extended its upward momentum with a 4.85% gain in the last 24 hours.

Recent data suggests that ARB’s recovery is being driven by strong participation from whales and retail traders. While current market sentiment supports further growth, potential risks to this trend remain.

Massive chain outflow poses a risk to ARB gains

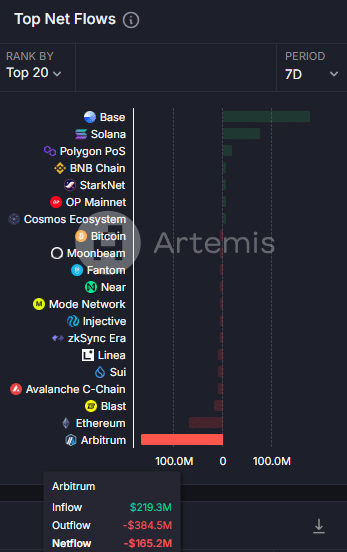

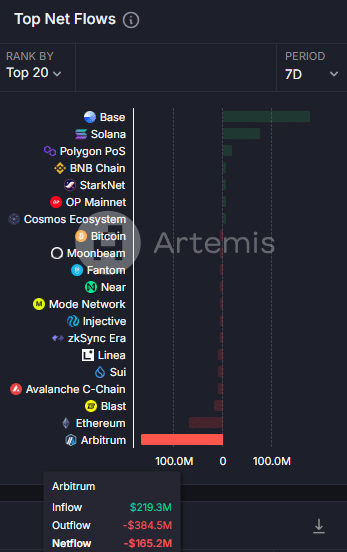

ARB faces a significant challenge as it recorded the largest negative chain netflow in the past seven days, surpassing Ethereum, Avalanche, SUI, and Injective.

Data from Artemis revealed that ARB’s chain netflow stood at -$165.2 million, marking the most substantial outflow recorded during this period.

Source: Artemis

Chain netflow reflects the total movement of assets across a blockchain. It is calculated as the difference between total inflows (assets received) and outflows (assets sent) across all addresses.

A negative chain netflow, as seen with ARB, typically indicates reduced user activity and waning confidence in the asset, which can lead to price declines.

Despite this, AMBCrypto reports that whales have mitigated the potential downside by absorbing selling pressure and stabilizing the market for now.

Whales prevent further ARB decline

Despite ARB’s significantly negative chain netflow, a single whale transaction has helped stabilize the asset, preventing a sharp price drop. A whale is an address controlling 1% or more of an asset’s total supply.

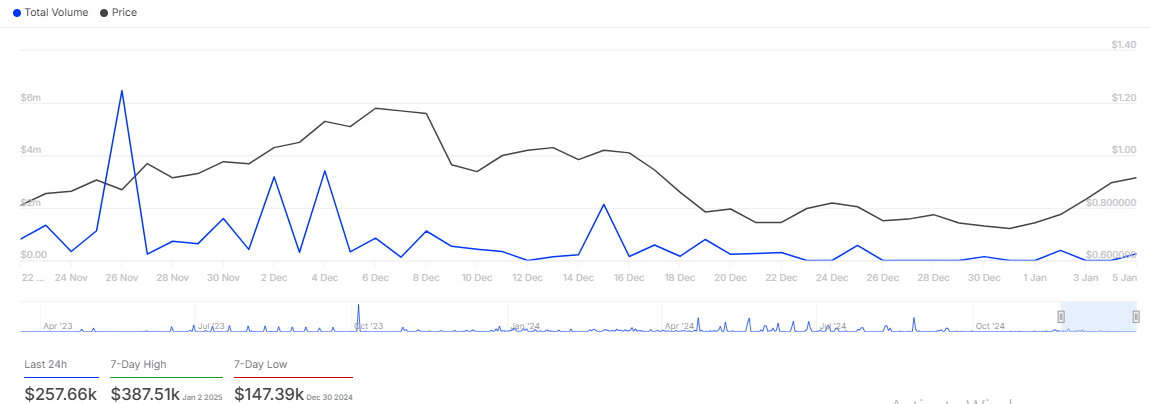

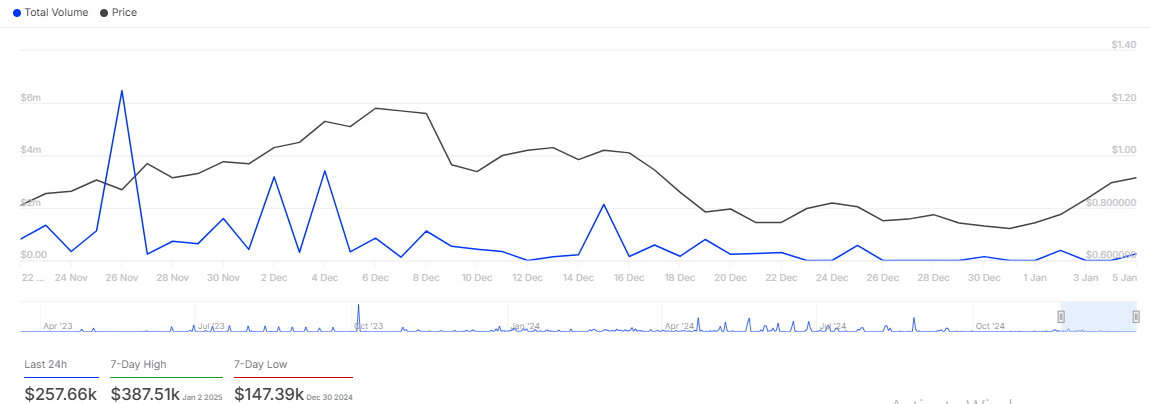

Data from IntoTheBlock shows a surge in large transaction volume over the past 24 hours. One transaction involved 281,420 ARB, valued at $257,660. This likely buy order coincided with a 4% price increase during the same period.

IntoTheBlock

Such significant purchases by whales often have a ripple effect on the broader market. In this case, the move sparked increased demand among retail traders, further supporting ARB’s recovery.

Retail demand surges higher

While whales cushion Arbitrum’s price, retail traders are driving bullish momentum. Key market metrics indicate growing confidence and activity among smaller investors.

One notable metric is the funding rate, which has risen steadily and now sits at 0.0082%. This indicates bullish market sentiment, with long traders paying a premium to keep their contracts active.

Simultaneously, open interest has jumped 8.81% to $256.01 million, reflecting an increase in unsettled derivative contracts. This suggests heightened speculative activity in the market that favors ARB.

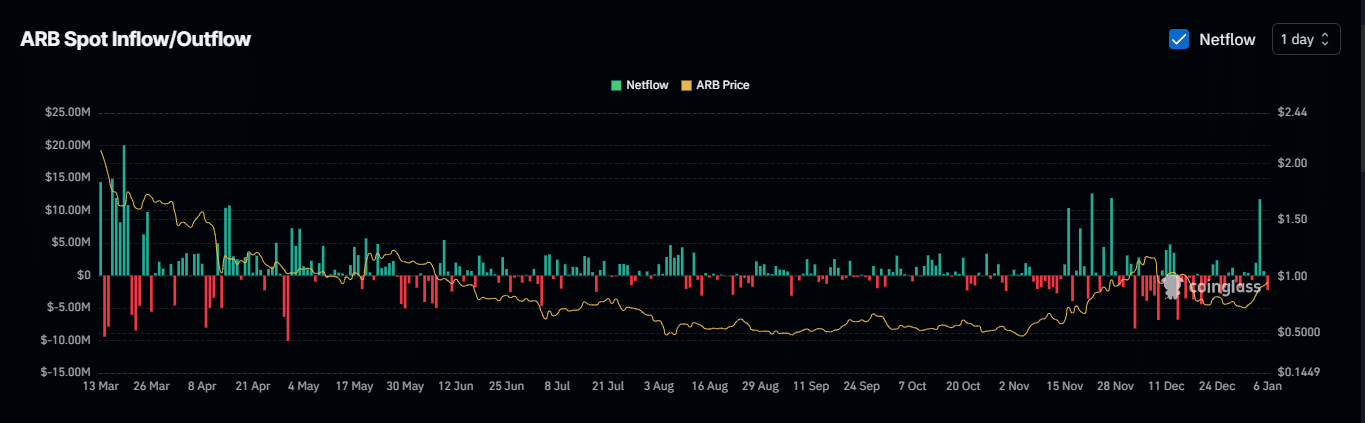

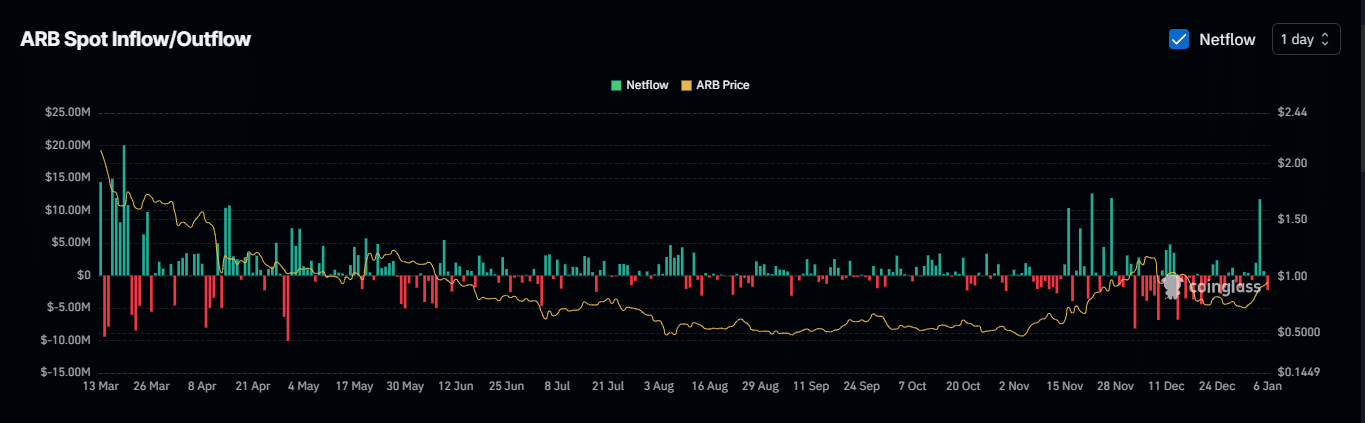

Additionally, spot traders are increasingly transferring ARB from exchanges to private wallets for long-term holding. Over $2.39 million worth of ARB has been moved off exchanges in the past 24 hours, potentially leading to a supply squeeze.

Source: Coinglass

Read Arbitrum’s [ARB] Price Prediction 2024–2025

This simply implies that there’s reduced availability of Arbitrum on the exchange, and this could drive prices higher as demand outpaces supply.

If these trends persist, Arbitrum is well-positioned to sustain its upward momentum and register further gains in the near term.