- Derivative traders drove significant sell-offs in the last 24 hours, leading to a sharp drop in CRO’s value

- Whales appeared to be stepping back too, while spot traders’ interest showed signs of waning

Earlier this month, CRO registered a major rally on the charts, surging by 124.41% amid heightened market interest. However, this momentum has since reversed sharply. In fact, over the last 24 hours alone, the crypto lost 12.07% of its value.

With derivative traders maintaining selling pressure and whales largely inactive, what does AMBCrypto’s assessment tell us about CRO’s latest decline?

Derivative traders drive CRO’s sharp decline

Derivative traders seemed to be at the forefront of CRO’s prevailing price drop, with market indicators signaling the potential for even deeper losses.

On 12 November, CRO’s Open Interest peaked at $23.73 million—Its highest level this year. However, this momentum quickly reversed itself, with Open Interest plunging by 13.74% in the last 24 hours alone to stand at $16.21 million.

This steep decline reflected a bearish shift, as traders increasingly favored short positions.

Source: Coinglass

The long-to-short ratio, with a reading of 0.9209, reflected this sentiment better.

Here, it’s worth pointing out that a ratio below 1 indicates that sell positions outnumber buy positions, meaning further downward pressure on the price. If this ratio continues to fall, CRO could face deeper fall from its press time levels.

Market trends made it clear that bears have been in control, with derivative traders amplifying the selling momentum as sentiment grew increasingly negative.

Liquidation gap intensifies sell pressure on CRO

A significant liquidation gap seemed to be adding further selling pressure on CRO – Showing a deeply bearish market sentiment.

In fact, according to the latest liquidation data from Coinglass, $108,410 worth of long CRO contracts were forcefully closed, while only $7.26 worth of short contracts were liquidated.

This stark disparity highlighted a market that has turned decisively against the bulls. It may point to the potential for sustained downward momentum, with short derivative traders set to profit.

When this liquidation imbalance is analyzed through the lens of the long-to-short ratio, the figures are striking – Approximately $14,930 worth of long positions were liquidated for every dollar of short positions closed. This significant imbalance signaled heightened volatility, especially as the market remained heavily skewed in favor of bearish sentiment.

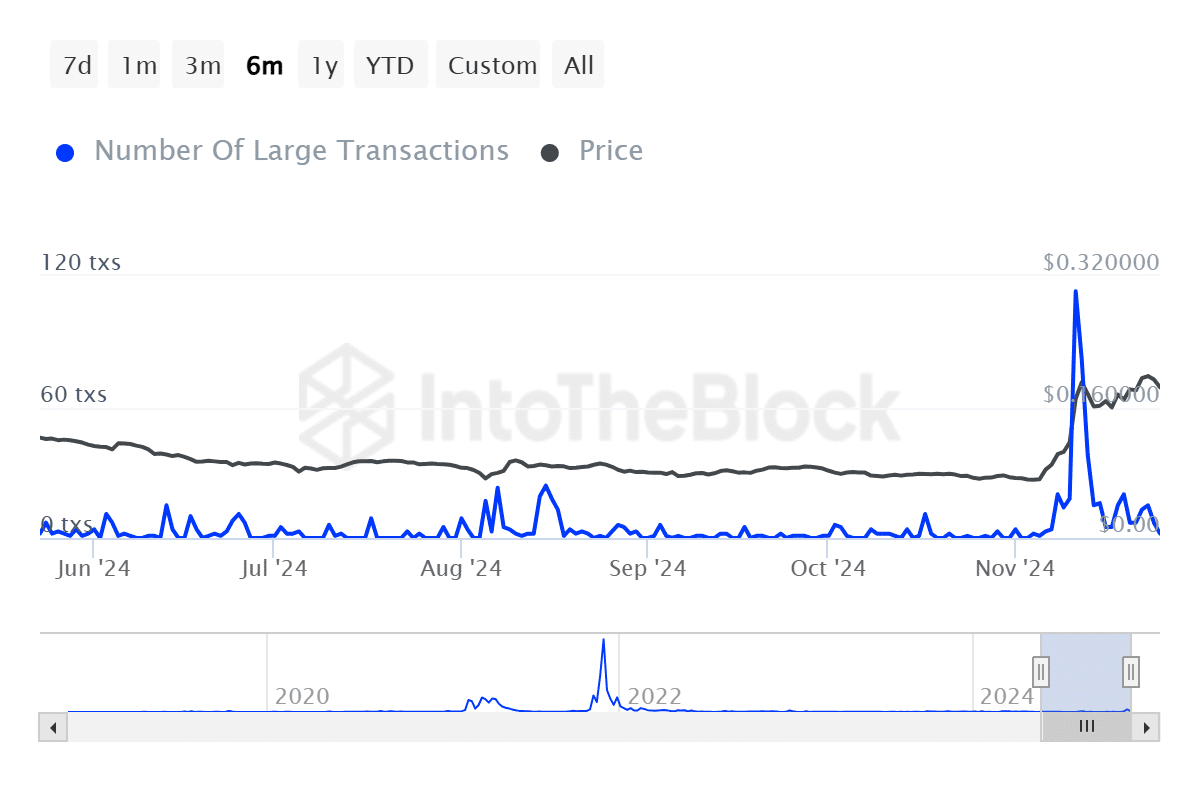

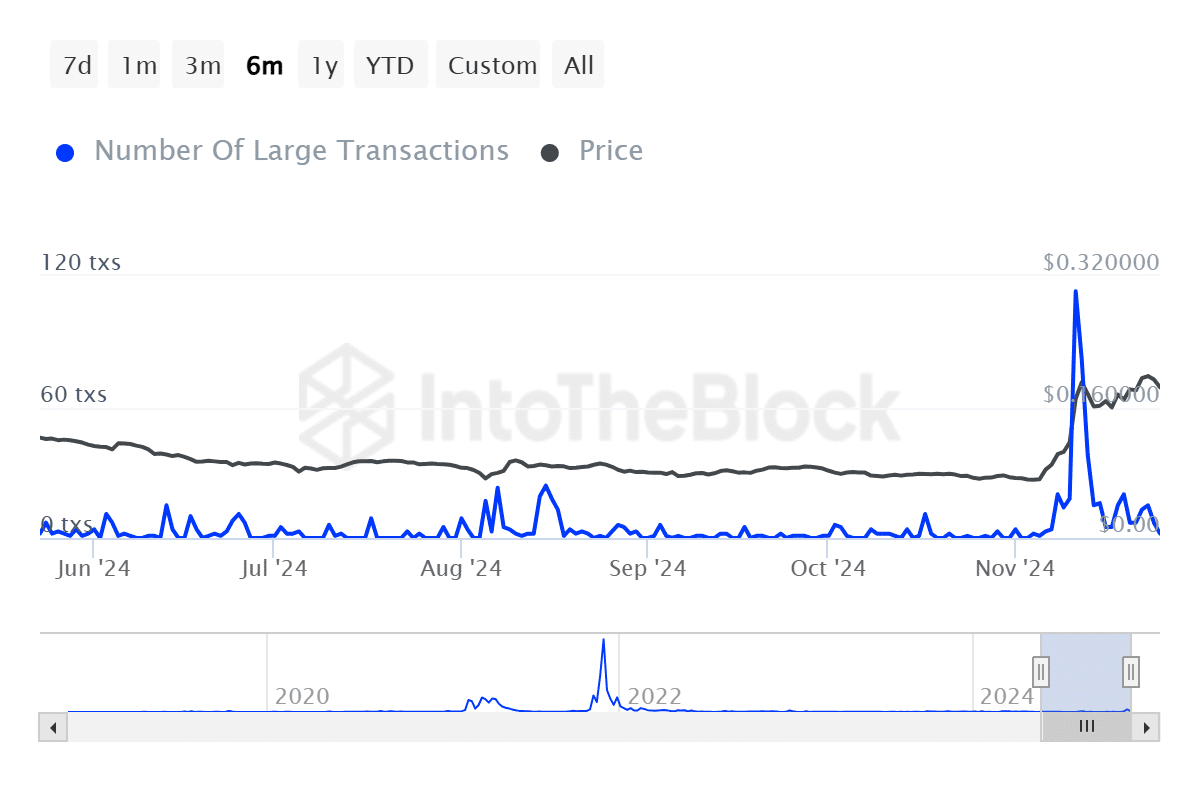

Whale inactivity and spot sales force CRO’s decline

Whale activity in CRO sharply declined over the last 24 hours, with only two large transactions recorded. This represented the lowest trading volume over the past week, with just 4.80 million CRO exchanged.

As significant holders of CRO, whales play a crucial role in the asset’s price movement. The drop in their transaction activity, coupled with the latest price dip, suggested that many likely liquidated their positions as the market interest diminished.

Source: IntoTheBlock

At the same time, spot traders seemed to be contributing to the sell-off too. This was evidenced by a 19.38% fall in active addresses over the past week.

Should these trends continue and the price continue to fall, CRO may face further losses and potentially set new lows.