- PEPE rejecting off $0.00000891 level escalated the potential for more downside increases.

- A whale dumped $3.03M at a loss of $434K, while another leveraged trader lost $3.23M.

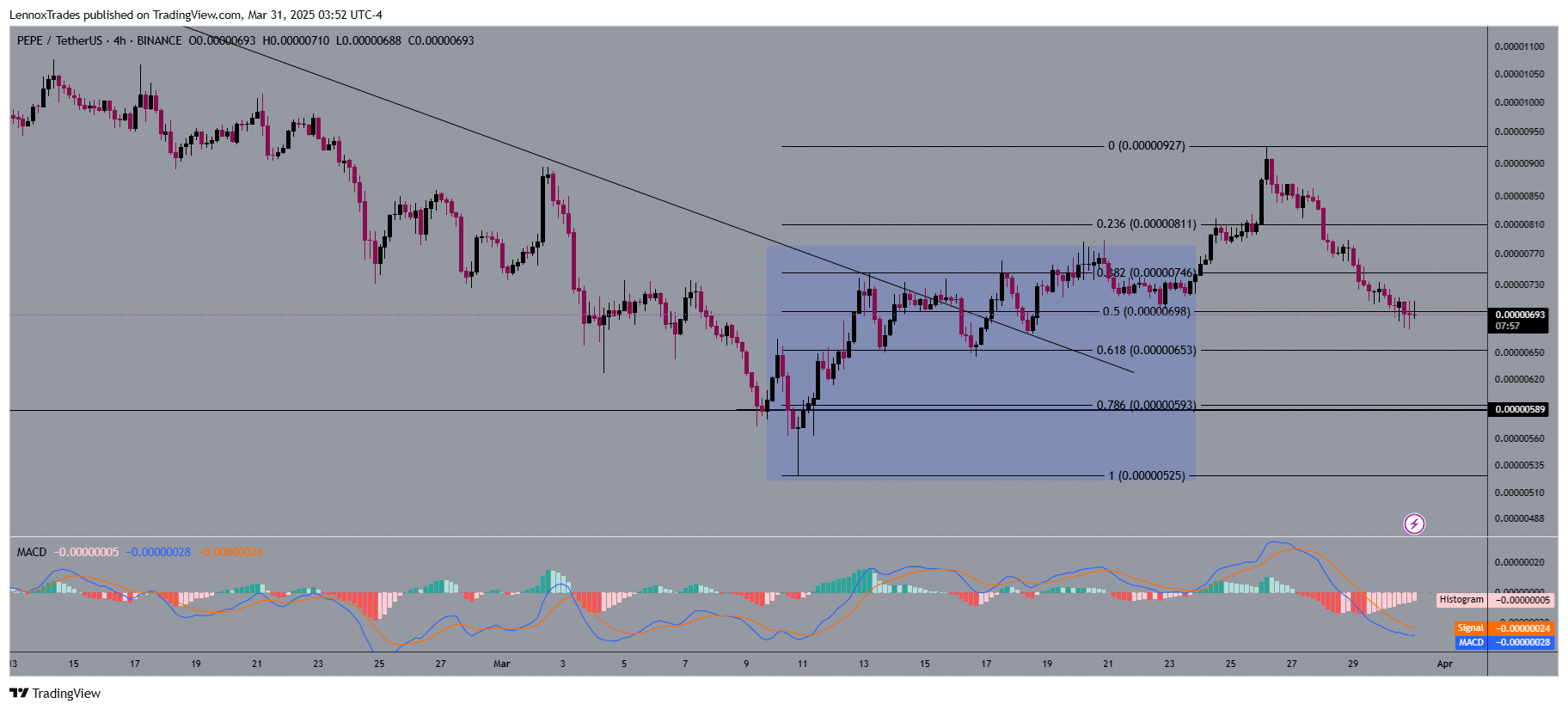

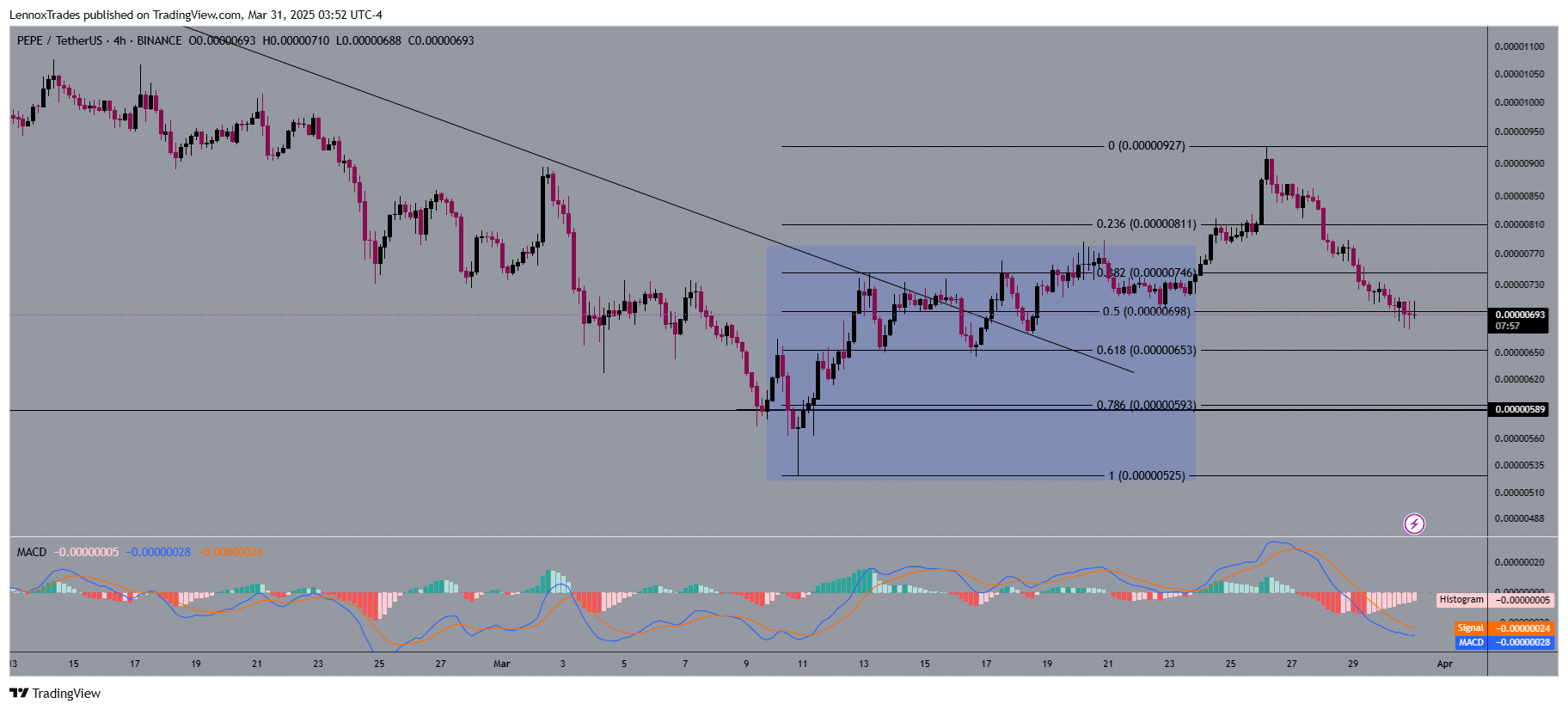

Pepe [PEPE] dropped from $0.00000927 which it had attained after breaking the descending trendline with the market failing to keep the uptrend through this resistance point.

After retracing to the 0.50 Fibonacci support level at $0.00000698 the price tried to find support.

PEPE dropped over 50% in five days from an uptrend that had lasted two weeks and could be retesting the breakout level.

PEPE’s support looked to access two resistance zones at $0.00000811 and $0.00000927 if it bounced from the $0.00000698 sitting at the 0.50 Fibonacci retracement level.

The price could experience an additional drop if the 0.50 Fibonacci support level fails to sustain. This would see PEPE revisit $0.00000653 and $0.00000593 at the 0.618 and 0.786 Fib levels respectively, establishing as primary support areas.

Source: Trading View

The MACD indicator also showed declining momentum on its histogram, followed by a downward crossover between the MACD and signal lines.

PEPE could test $0.00000593 as a critical support area if the declining pattern continued.

However, the price movement of PEPE could improve as the potential bullish MACD crossover forms. This may enable the memecoin to pursue higher resistance zones.

The descending trendline breakout that resulted in the aforementioned uptrend. PEPE aimed for $0.00000927 until it met resistance, causing a pause, then a turn.

The 0.50 Fib level could become an entry point for buyers to initiate a rebound that could boost the movement toward $0.00000927.

PEPE whales selling at a loss

With the downward pressure, a PEPE whale sold 438 billion tokens resulting in a $434K financial loss and initiated broad market sell-offs as Lookonchain noted on X (formerly Twitter.)

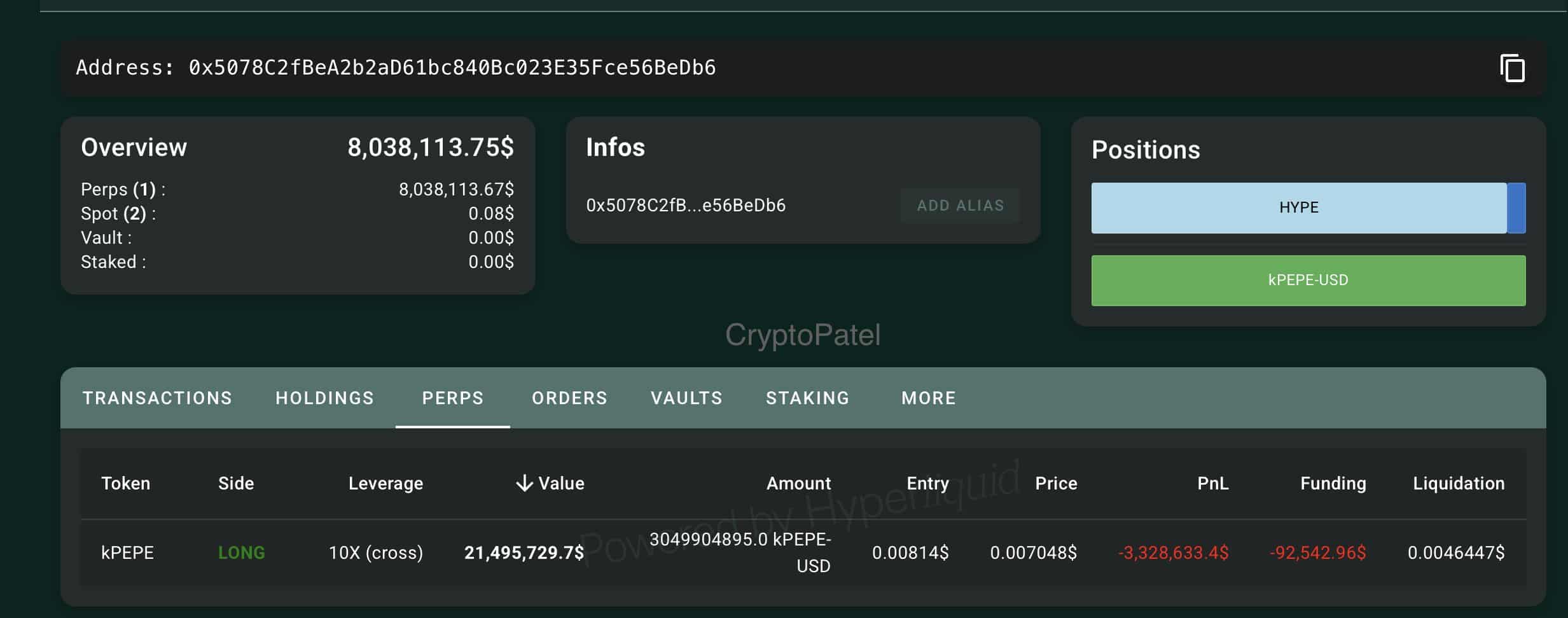

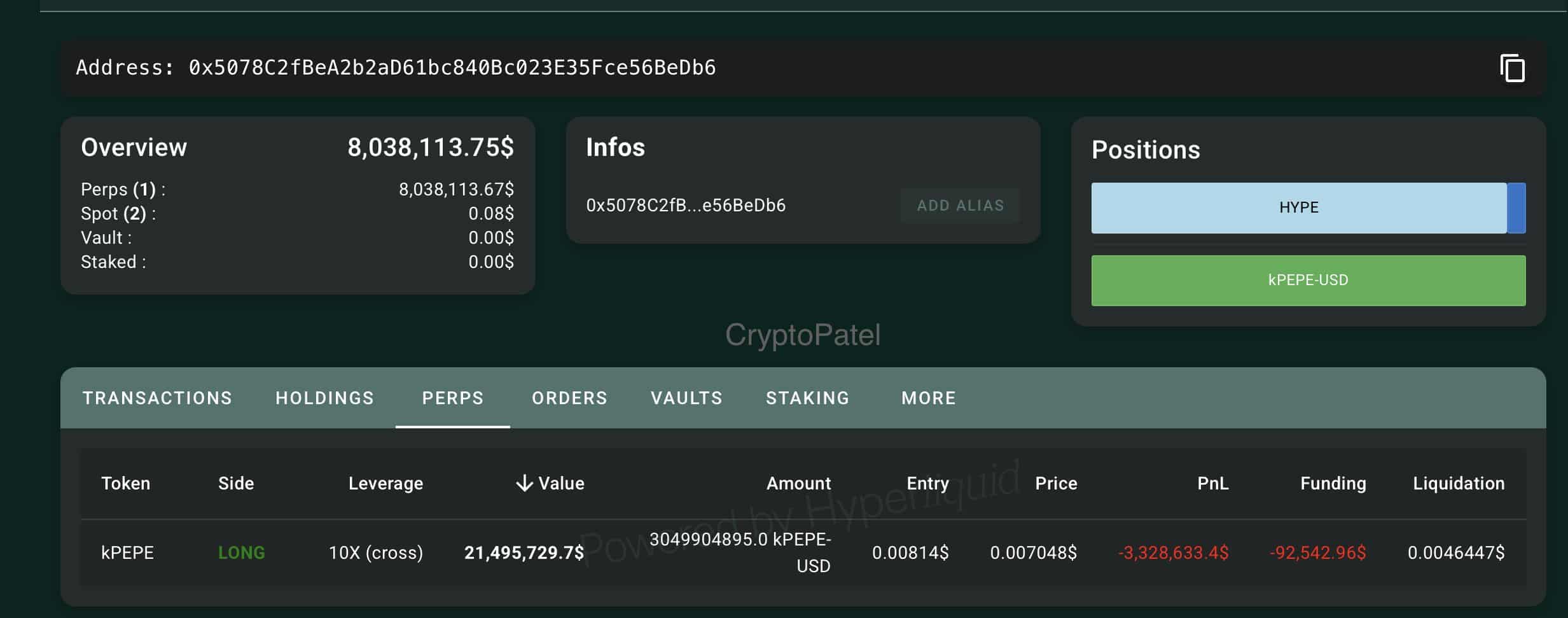

Another trader who maintained a massive $21.6M PEPE investment also delt with a $3.23M unsatisfied loss.

The trader prevented liquidation by injecting $3.8 million USDC into Hyperliquid which turned part of their PEPE position into cash and booked a $1.3 million loss.

The whole PEPE token supply observed over 1 trillion token sales, which drove prices down through multiple important support regions.

Liquidations on a vast scale generated bearish sentiment until investors start buying tokens that approach fresh support areas.

Source: X

Risk management st00d as a key factor in this whale’s leveraged trading, as another $3.23M was left in unrealized losses. Traders displayed negative sentiment while they monitored potential price decreases.

Market sentiment stood in opposing directions because traders either believe prices could keep declining. Or, that selling pressure could reach its peak, leading to market recovery.

The trader introduced additional capital to cut their exposure risk because they wanted to stabilize their current trade position.

PEPE establishing new support ranks might slow down bearish forces while creating conditions for upward movement toward recovery.