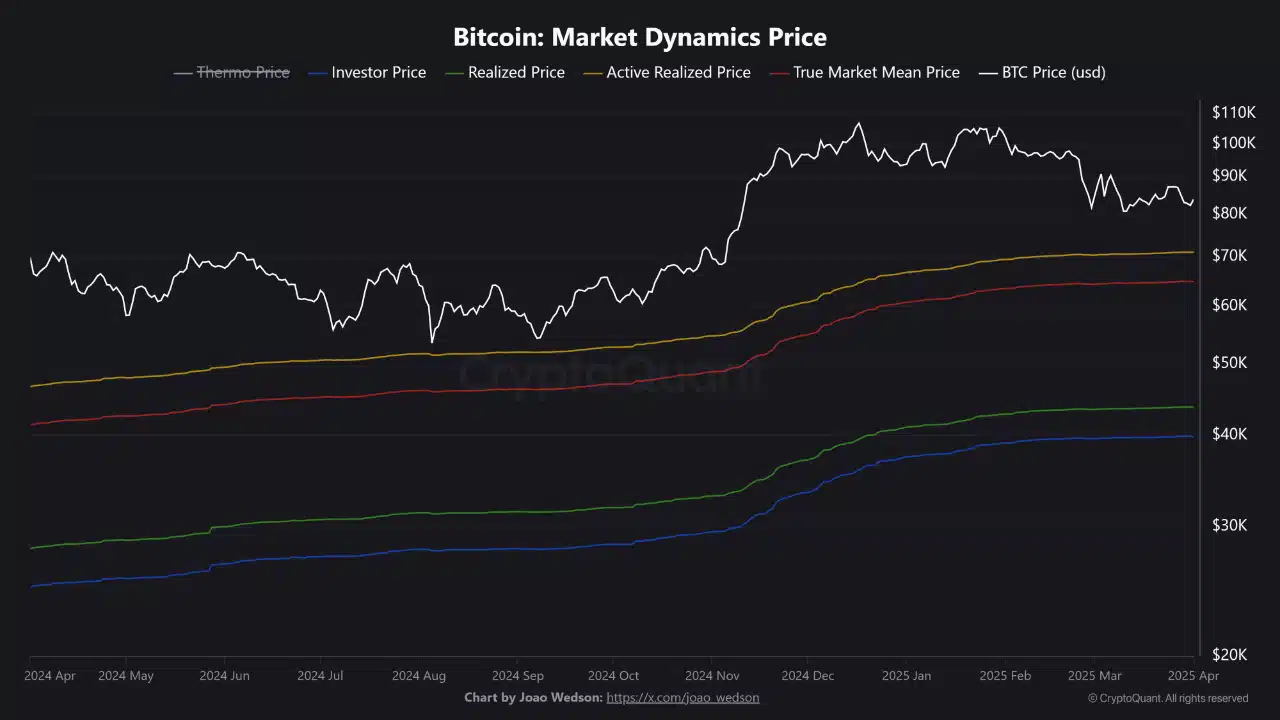

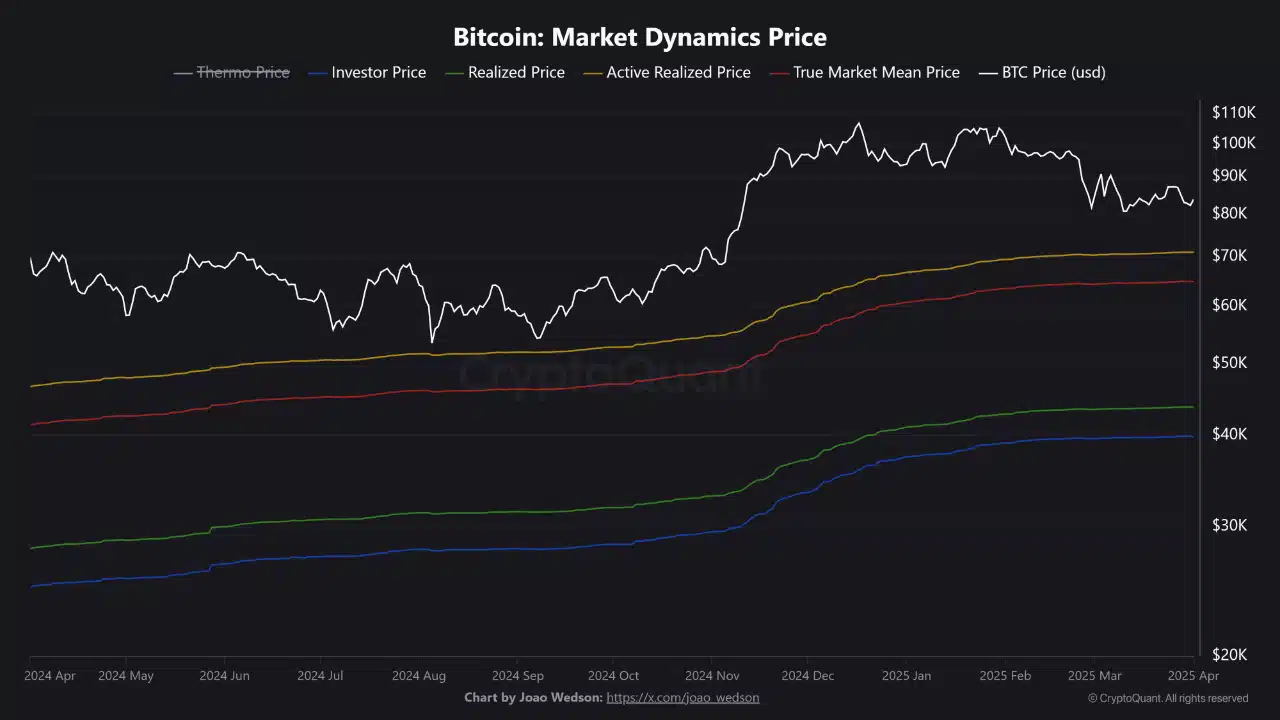

- Bitcoin’s support zone between $65,000 and $71,000 is key for LTHs, signaling strong demand

- An active realized price of $71,000 and true market mean at $65,000 reinforce Bitcoin’s support zone

Bitcoin’s [BTC] price action has been nothing short of a rollercoaster, but the current support zone between $65,000 and $71,000 could be the market’s safety net.

With the active realized price hovering around $71,000 and the true market mean price reinforcing support at $65,000, long-term investors may see any dip as a golden opportunity.

Why is the support zone significant?

Bitcoin: What does the data say?

The data demonstrates how Bitcoin’s market dynamics align with the identified support zone. The realized price, active realized price, and true market mean price define support between $65,000 and $71,000.

This suggests that LTHs are unfazed by short-term volatility. The narrowing gap between these metrics shows that recent price moves reflect genuine investor engagement, not speculation.

Source: CryptoQuant

Such alignment between fundamental support metrics is uncommon, highlighting that the market’s perception of value is consolidating in this zone.