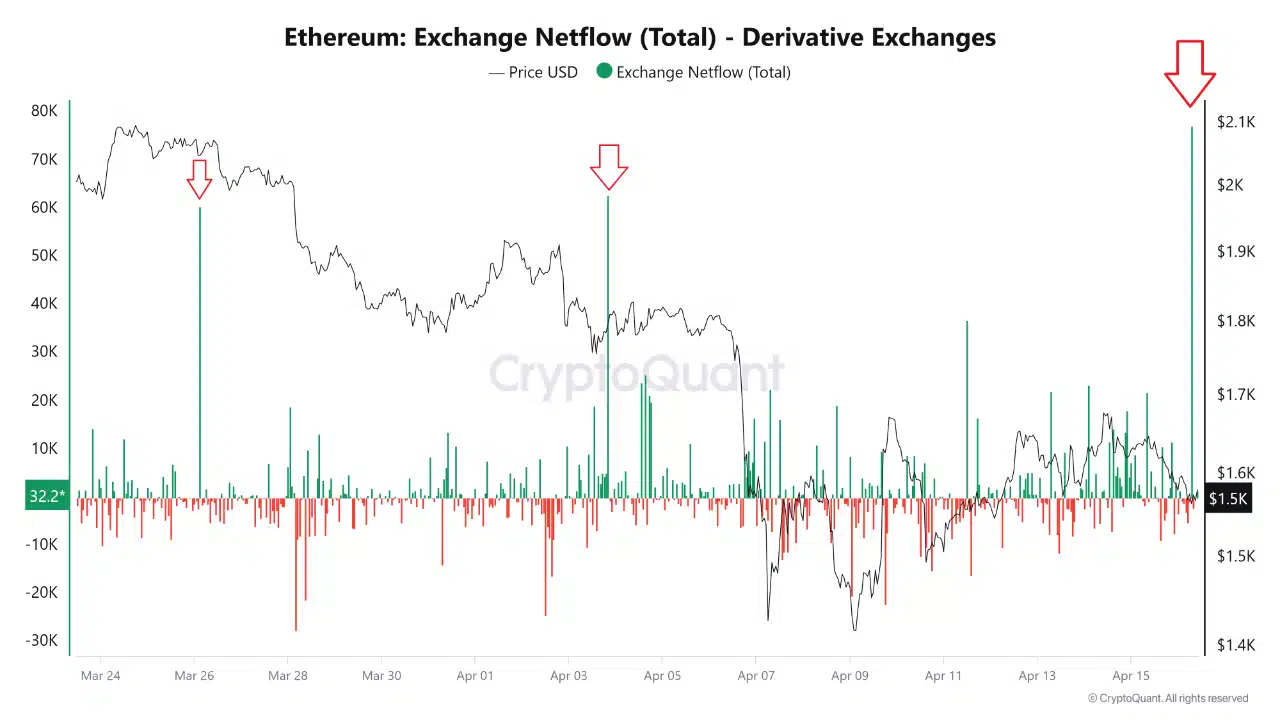

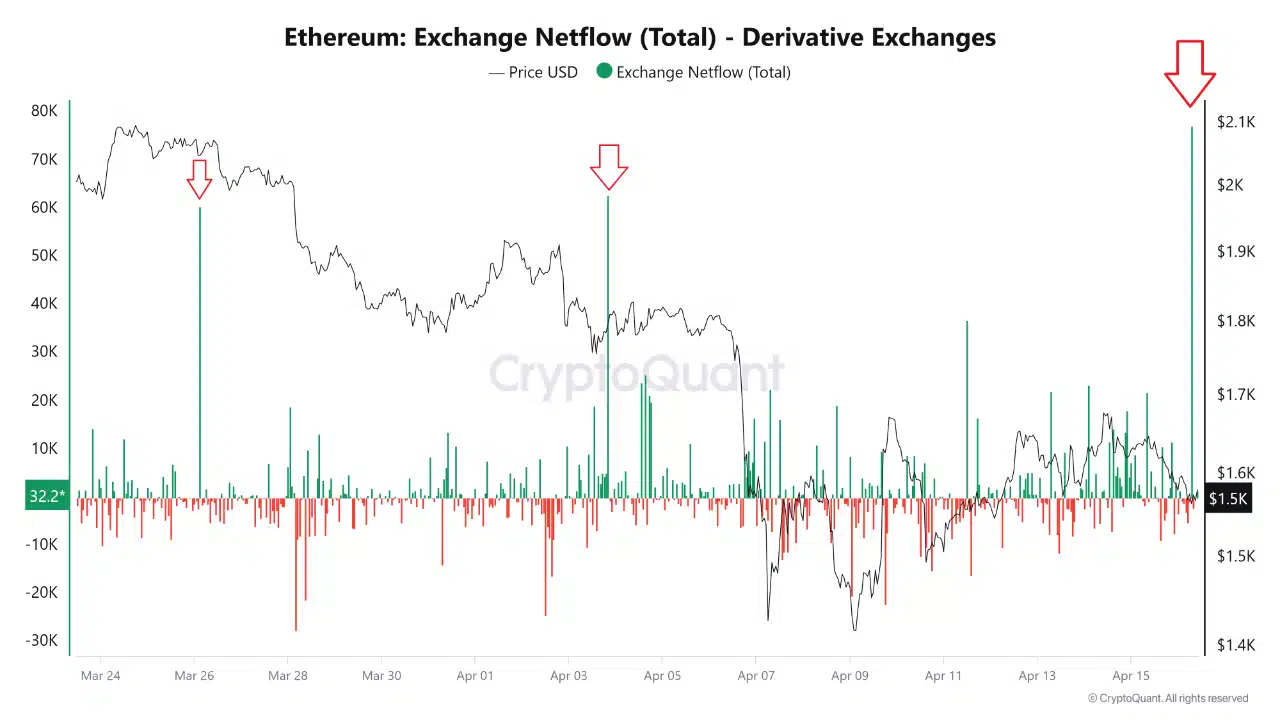

A massive move: 77K ETH hits derivatives

On the 16th of April, over 77,000 ETH flooded into derivative exchanges — Ethereum’s largest single-day net inflow in months.

This makes the previous spikes of 65K ETH on the 26th of March and 60K ETH on the 3rd of April look like chump change.

Source: Cryptoquant

The sudden surge, shown clearly in the chart, represents a significant increase in supply entering markets typically used for leverage, hedging, or speculation.

Crucially, Ethereum’s price hovered around $1.5K during the inflow — its lowest level since late 2023 — indicating that this movement isn’t driven by euphoria, but likely caution.

With markets still rattled by uncertainty, such a scale of inflow suggests institutional players are repositioning — and potentially preparing for more downside.

Bearish repeats

Ethereum’s latest spike in derivatives inflow mirrors two prior events — the 26th of March and the 3rd of April — both of which preceded notable price declines.

These inflows correlate with rising bearish sentiment, as traders move ETH to derivative platforms to open shorts or protective hedges.

The pattern is clear: large ETH inflows cause market retreats. What’s different now is the scale and context.

This week’s surge follows China’s retaliatory tariffs, which have sparked a broader risk-off sentiment across global markets.

If history repeats, ETH could see further weakness; but if macro conditions stabilize, this inflow might mark capitulation at the bottom, not a prelude to more pain.