- BTC has been stuck within the $80K-$85K range for a while.

- Analysts remained cautious despite hopes of a potential Fed’s dovish tilt.

On Tuesday, Bitcoin [BTC] triggered another bout of crypto market sell-off after dipping to $81K from $84K and closed the daily session with a 1.54% loss.

It was the first day of the FOMC (Federal Open Market Committee) meeting, and analysts also linked the sell-off to geopolitical tensions.

According to the crypto options trading desk QCP Capital, renewed tensions in the Middle East fueled the sell-off. Part of its daily market report read,

“In the absence of fresh tariff headlines, geopolitics has returned to the forefront. Israel’s renewed strikes on Gaza following a temporary truce have pushed gold soaring past $3,000, while BTC continues to exhibit a negative correlation.”

What’s next post-FOMC?

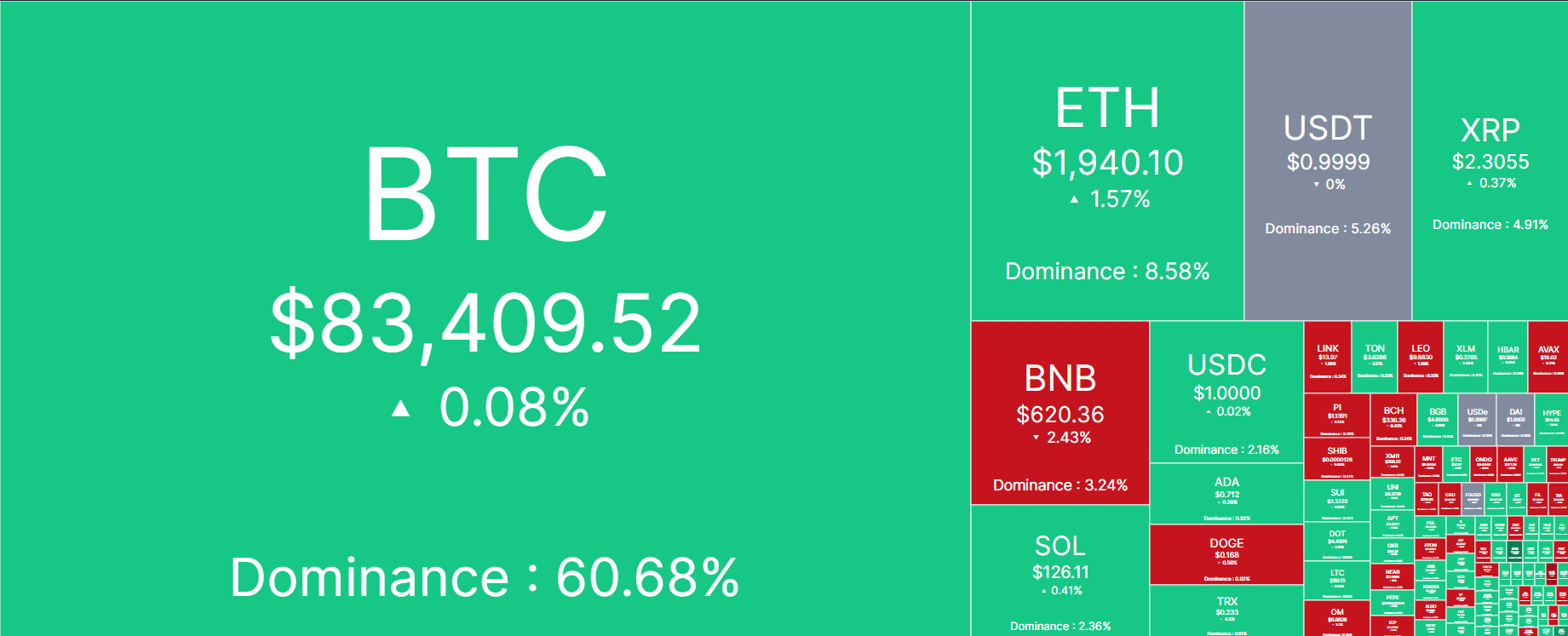

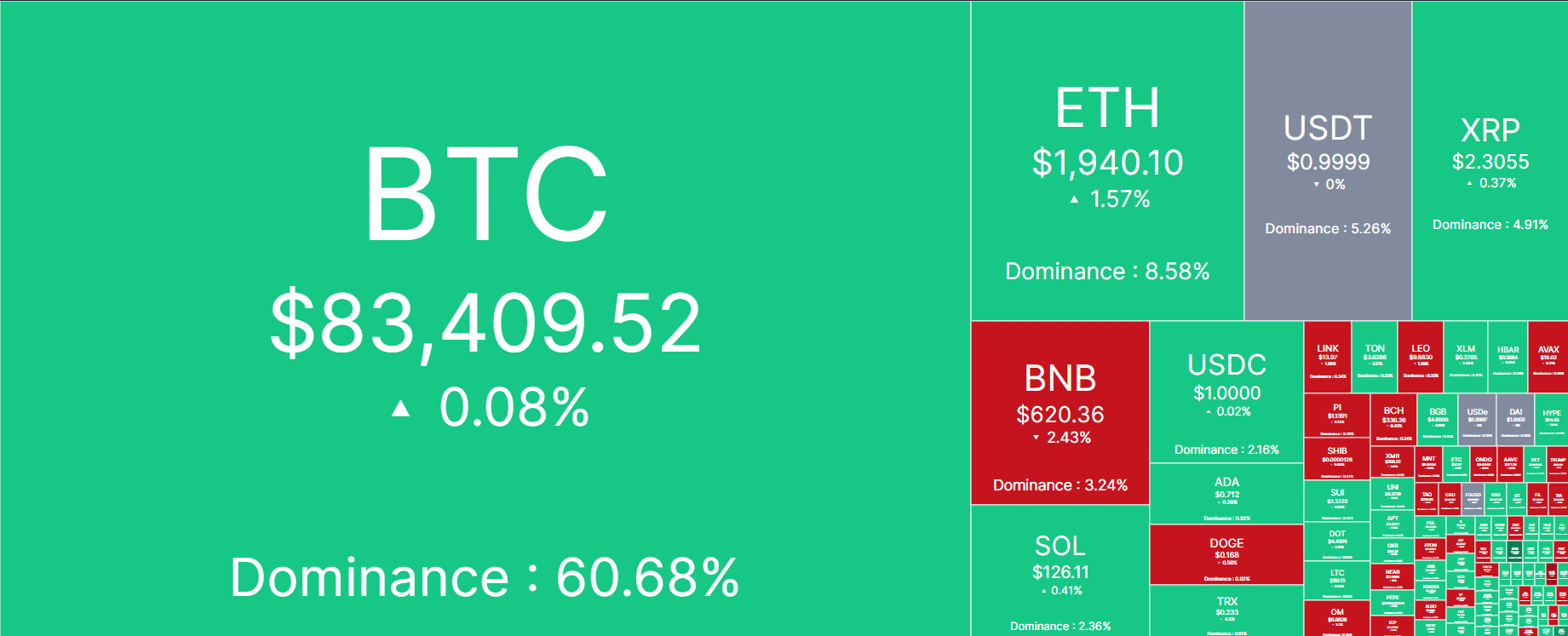

The BTC decline saw top altcoins post varied retracements. Solana [SOL] dropped 5% but closed the session with only 2%. XRP also posted a 2.2% loss on Tuesday, similar to ADA.

Only Ethereum [ETH] stabilized with a 0.27% gain during the trading session.

On the contrary, EOS [EOS] and Hyperliquid [HYPE] were top performers with 17% and 7% gains, respectively, over the same period.

At press time, BTC reclaimed $83K, while ETH was above $1.9K a few hours before the FOMC announcement. But Binance Coin [BNB] and Dogecoin [DOGE] still had sustained sell-offs as of this writing.

Source: CoinMarketCap

Whether the Fed rate decision will fuel crypto recovery or extend the decline remains to be seen.

That said, Jake Ostrovskis, an OTC (over-the-counter) trader at Wintermute, noted that BTC and crypto would remain capped given its positive correlation with risk-on U.S. equities than gold.

“With correlations firm with the former (Nasdaq), the market will struggle to turn higher without being led by wider risk. You cannot trade Crypto in a vacuum.”

For its part, the Swissblock blockchain analytics firm reiterated that the market was in a ‘high-risk’ state and that downside risk couldn’t be overruled.

The risk-off sentiment was corroborated by the crypto fear and greed index, which was at ‘fear’ levels of 32. While this could be a ‘buy’ opportunity for long-term investors, the Fed policy outlook could offer clues for such a move.

In the meantime, QCP Capital cautioned that President Trump’s new round of tariffs scheduled for the 2nd of April could be key data to watch after the Fed meeting. It stated,

“BTC at $80K: A real floor or a mirage? Momentum & carry trades are unwinding. While BTC has found some support, the macro backdrop suggests it could be short-lived. Looking ahead, we remain cautious…”