In brief

- The price of Ethereum fell by more than 10% following its very recent all-time high.

- Was it enough to shake off ETH bulls?

- Myriad data suggests market sentiment remains bullish. And technical market indicators largely agree.

The recent crypto market dip isn’t deterring Ethereum bulls: They’re still betting ETH goes higher.

Prediction market traders on Myriad, a market developed by Decrypt’s parent company Dastan, remain convinced that Ethereum hits the $5,000 price mark sooner rather than later, notching a new all-time high in the process.

While Ethereum currently hovers near $4,500 after a wild up-and-down weekend, traders on Myriad place the odds of ETH hitting $5K in the next four months at around 80% on one market, and nearly 73% odds on a separate market.

Sure, those odds are down a bit in the last few days, peaking at around 90% to 95% when Ethereum mooned to just a hair shy of $4,950 and $5K looked like a lock. But the fact that they didn’t drop any lower than 70% even as ETH began heading in the other direction speaks to the overall sentiment and conviction among bulls at the moment.

And the charts tend to agree.

Ethereum (ETH) price: Where does it go next?

Overall, crypto markets today are bouncing after a turbulent weekend. A single Bitcoin whale unloaded $2.7 billion worth of BTC on Sunday, setting off cascading liquidations as long positions were forcibly closed and the price of BTC plunged.

Naturally, when the market leader goes down, other crypto assets follow—and Ethereum was no exception, falling by 10% after briefly hitting an all-time high above $4,900.

But, today, ETH is in the green, and the technical setup is one traders would largely interpret as positive. With ETH likely ending the day in the green, it suggests the overall bullish trend over the long term remains solid despite the brief panic attack.

Among the technical indicators, Ethereum’s Average Directional Index, or ADX, sits at 39, which shows bulls still are in command. The ADX measures trend strength on a scale from 0 to 100, where readings above 25 confirm a strong trend and above 40 indicate extremely powerful momentum. At 39, we’re seeing a strong trend, with yesterday’s dip cooling it down from levels above 41 points just a few days ago.

The Relative Strength Index, or RSI, for ETH is currently at 58—which traders would say is the sweet spot for continued gains. RSI measures momentum on a scale of 0-100, with readings above 70 signaling overbought conditions where profit-taking often emerges, and below 30 indicating oversold levels.

At 58, ETH has successfully recovered from oversold conditions without entering dangerously overbought territory, meaning there’s still fuel in the tank for further upside before triggering algorithmic selling from traders who use RSI as an exit signal.

And when examining average price supports and resistances, Ethereum’s exponential moving average configuration remains decisively bullish. With the 50-day EMA positioned well above the 200-day EMA, we’re seeing a heavy bullish trend in the long run after the golden cross formation last month. This setup typically indicates sustained buying pressure across multiple timeframes and suggests that both short-term momentum traders and long-term position holders are aligned bullishly.

The Squeeze Momentum Indicator shows “on” status, which is particularly significant after yesterday’s selloff. This indicator identifies when markets transition from consolidation to trending phases. When it fires “on,” it signals that a breakout from consolidation is underway. Combined with today’s recovery candle, this suggests caution. Even inside a solid bullish trend, short-term traders could still change direction.

Key levels to watch

- Immediate Resistance: $4,800 (yesterday’s pre-crash level)

- Strong Resistance: $5,000-$5,200 zone (ATH and Fibonacci extension targe)

- Immediate support: $4,000 zone (psychological target a bit below the previous price bounce and a bit over the EMA 50)

- Strong support: $3,500 level that has held throughout the recent bull run.

Remember, remember: Red September

But bulls may have a strong opponent approaching the ring: history.

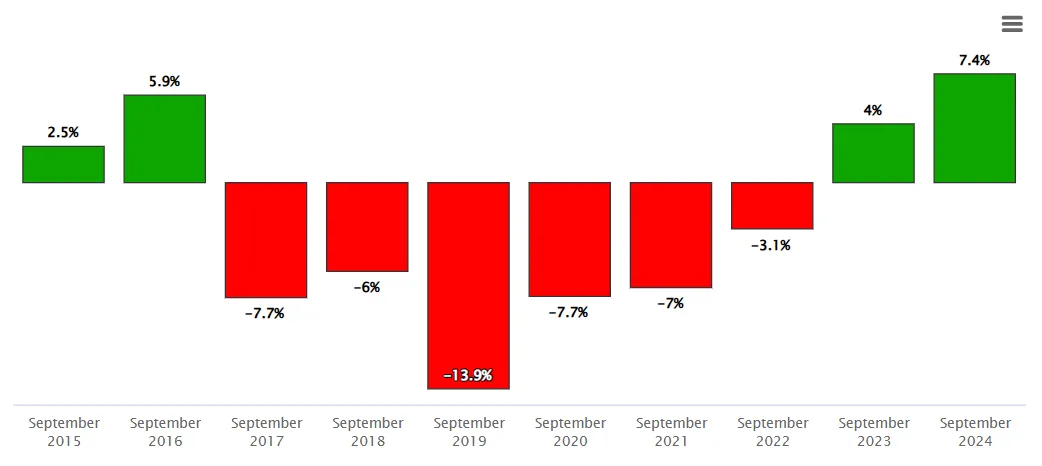

Trading data from 2015 to 2024 shows Bitcoin typically underperforms in September, with average returns during the month coming in at -4.89%. During “Red September”—not to be confused with Uptober (which comes right after!)—the price of Bitcoin has dropped by 4.5% on average, making it the worst month of the year for Bitcoin holders.

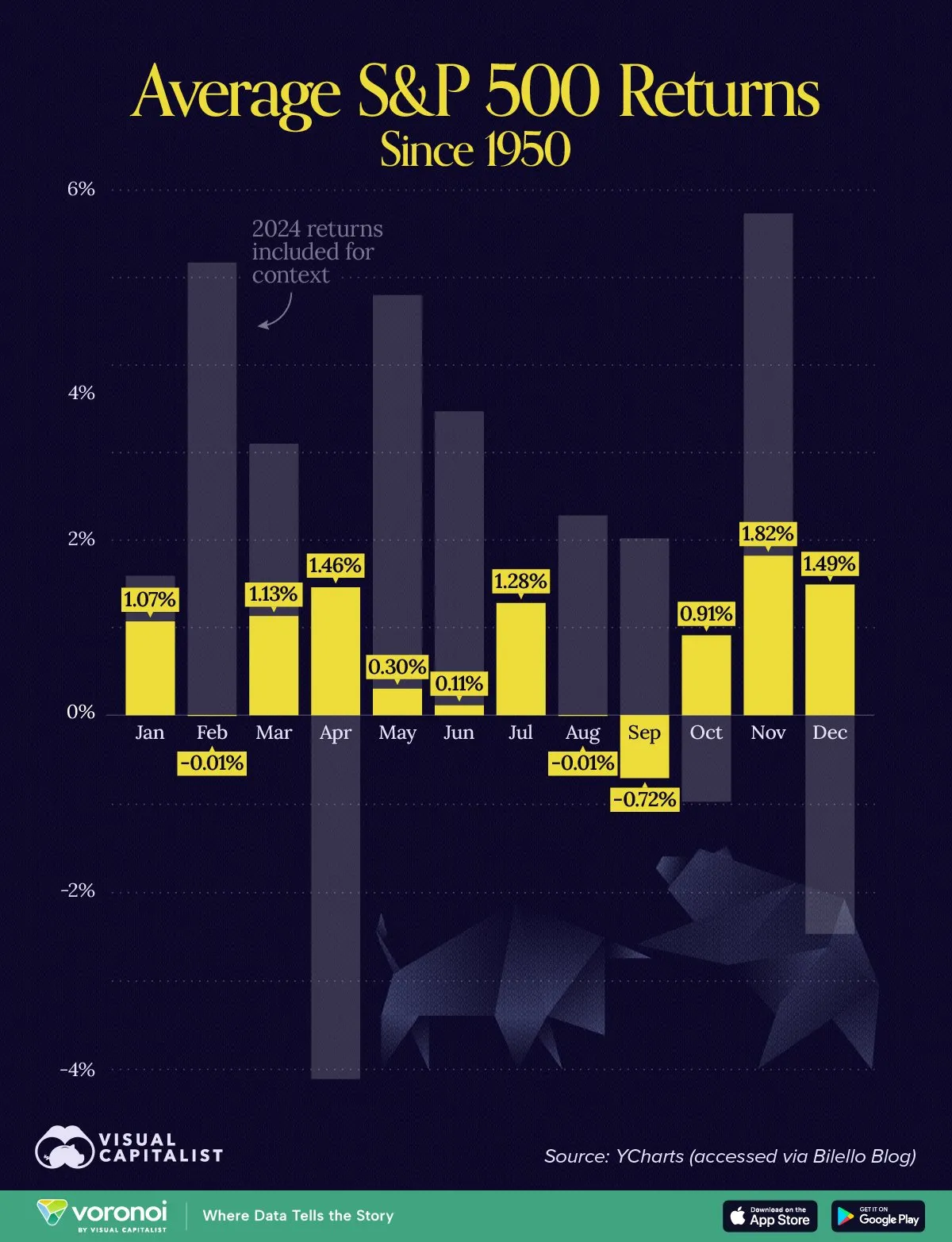

But this isn’t crypto-specific either. For the last 75 years, the stock market has also experienced a pattern in which September tends to be, on average, the worst-performing month of the year.

This historical headwind creates some tension. If the $4,300-$4,500 support holds through what’s traditionally crypto’s worst month, the technical setup suggests ETH could indeed reach that $5,000 target—potentially as early as October. During “Uptober,” the crypto market has recorded gains of as high as 60% and an average of 22% historically.

If ETH respects the support that triggered its current trend, the natural movement would take it to $5K by October—assuming September isn’t red enough to kill momentum.

At the moment, the technical data supports the bullish view among Myriad traders. The 73% odds on the “moon or dip” market, which asks traders to predict if ETH will moon to $5K or dip to $3.5K, might be a little high based on the available data, but it still lines up.

For the “ETH hits $5K in 2025” market, it’s hard to imagine this not happening in the next four months. October historically brings fireworks, and the current technical setup with RSI at 58 leaves plenty of room for upside. Even if September ends up being rough and ETH repeats the 14% dip of 2019, the drawdown would only test the 50-day EMA support, leaving ETH positioned for an October rally.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.