- Whales have accumulated 1.35 million LINK tokens in the past 24 hours.

- From a technical perspective, LINK’s price has maintained support levels near $19, signaling strong buying interest at this threshold.

In the past 24 hours, Chainlink [LINK] has seen a remarkable surge in whale activity, with large holders accumulating 1.35 million LINK tokens. This significant accumulation points to rising confidence in Chainlink’s long-term potential.

This development could be linked to upcoming network upgrades, the project’s expanding utility, or a recovering broader cryptocurrency market.

Current market performance

At the time of writing, LINK was trading at $20.40, reflecting a 3.39% increase over the last 24 hours. The 24-hour trading volume stood at approximately $496 million, indicating robust market activity and heightened trader interest.

LINK has been consolidating within a range of $19 to $25 over the past week. Despite this recovery, the coin remains 61.55% below its all-time high of $52.99, achieved in May 2021.

This gap presents potential for further upside, particularly as fundamental indicators show growth.

Chainlink’s resilience in holding above the $20 mark reinforces its position as a major player in the cryptocurrency market, appealing to long-term investors.

LINK’s price analysis

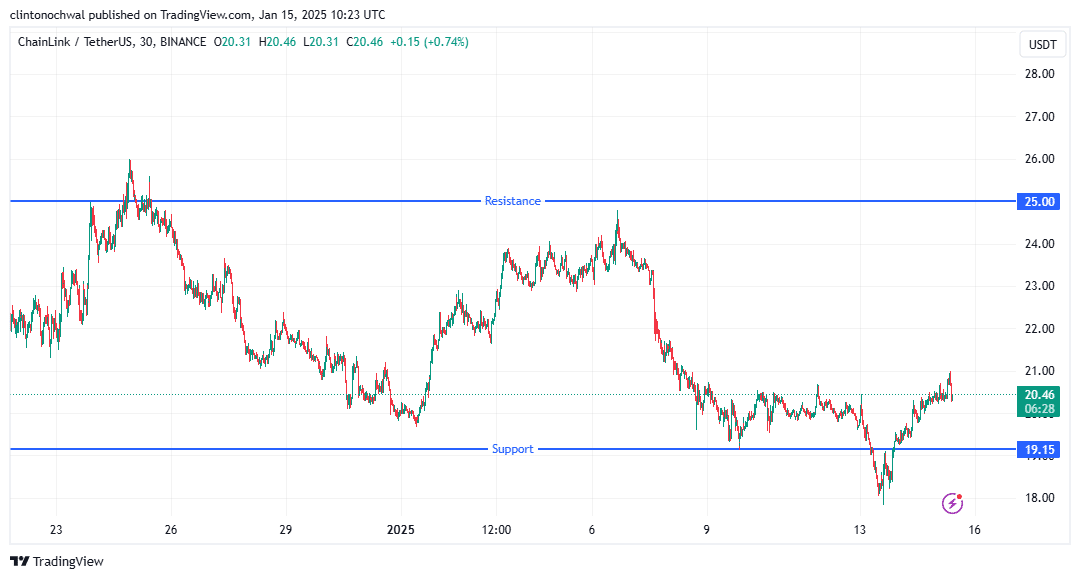

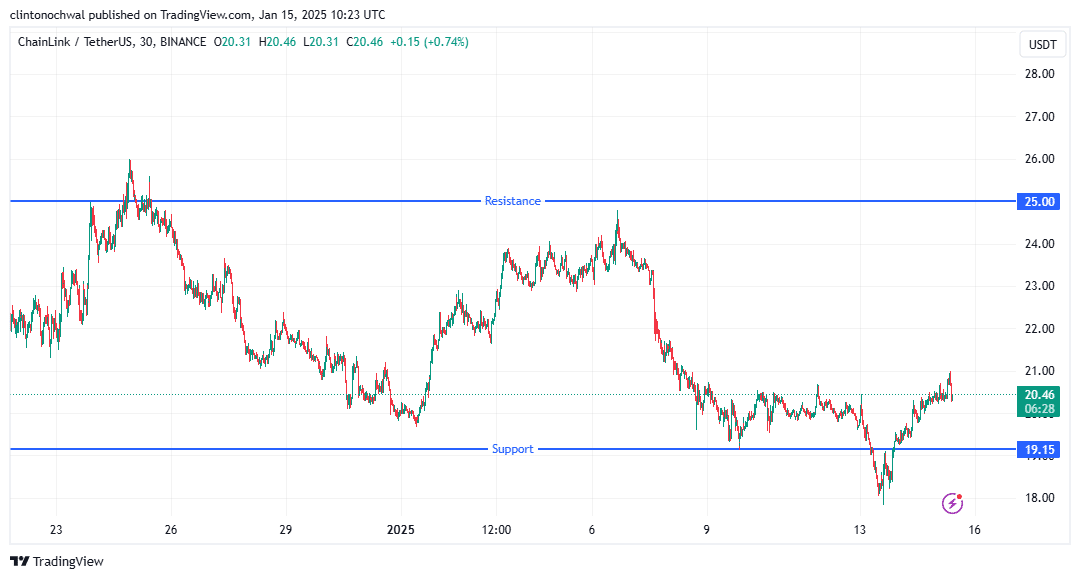

Chainlink’s recent price performance suggests consolidation, with fluctuations between $19 and $25. This range-bound movement implies traders are anticipating a decisive breakout.

Source: TradingView

The recent whale activity could act as a catalyst for upward momentum, as significant accumulation often precedes price surges.

From a technical perspective, LINK’s price has maintained support at $19.15, signaling strong buying interest at this threshold. If buying momentum persists, the $25.0 resistance could be tested.

Historical trends suggest that when whales accumulate, prices often follow an upward trajectory, making this a key factor for traders to monitor.

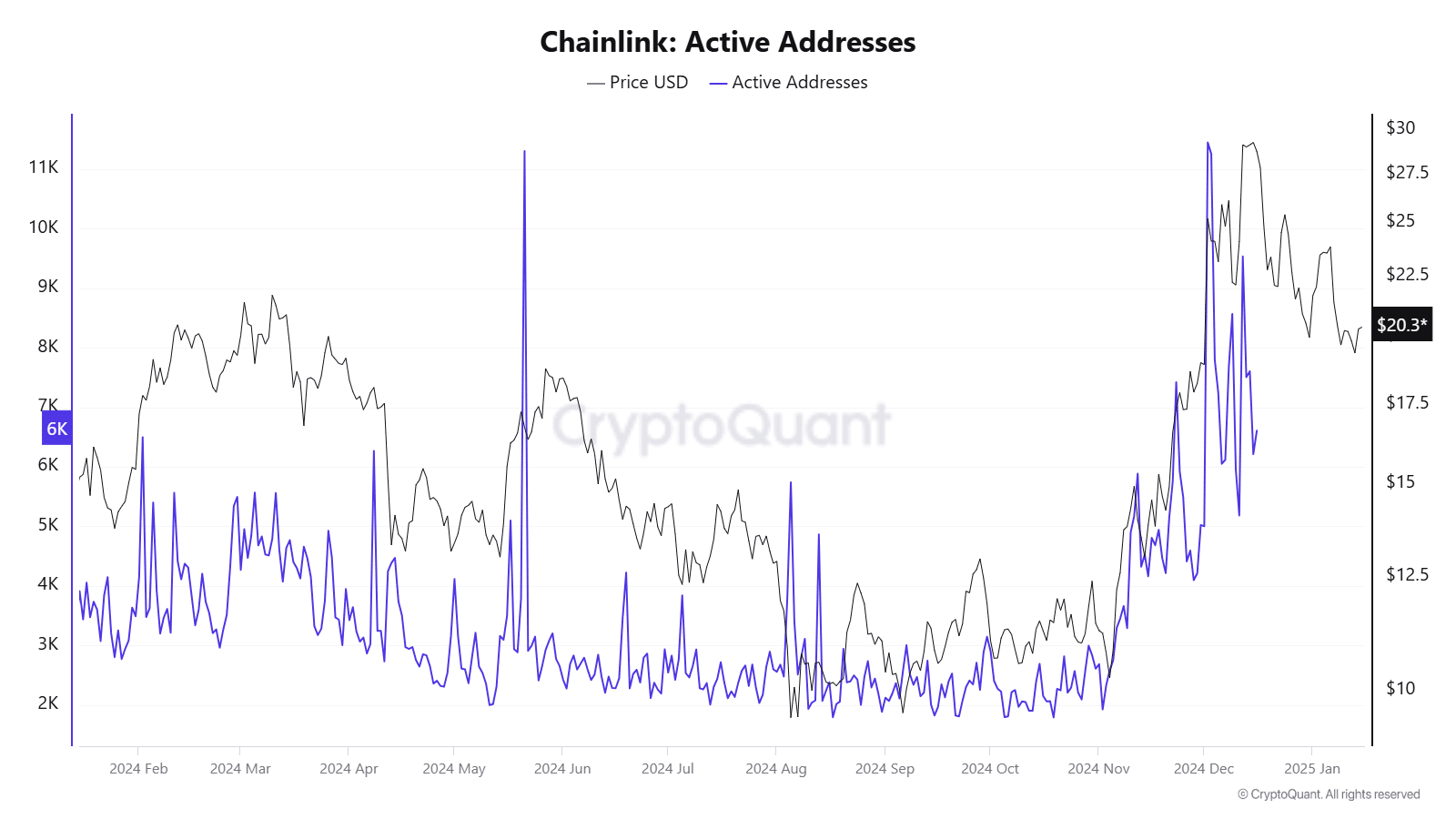

Active addresses analysis

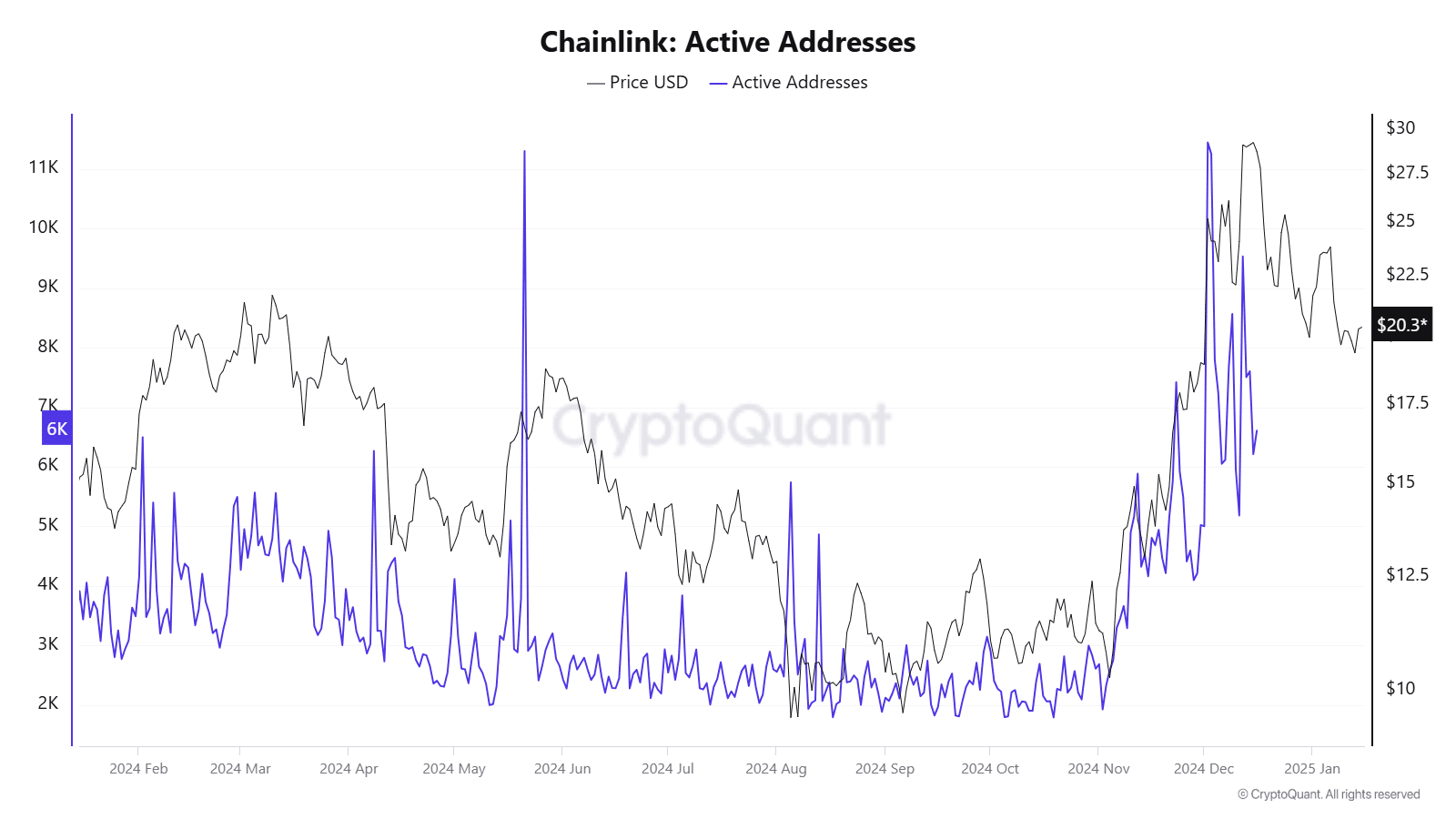

Chainlink’s active addresses have shown consistent growth over recent weeks. This trend reflects increasing adoption and interest in the network’s capabilities, particularly its role in Decentralized Finance (DeFi) and blockchain oracles.

ource: CryptoQuant

The rising number of active addresses indicates a robust and engaged user base, crucial for network growth and sustainability.

Active address growth often correlates with heightened network utilization, suggesting Chainlink’s technology is being increasingly adopted for real-world applications. This could positively influence investor sentiment and potentially drive the price higher if sustained.

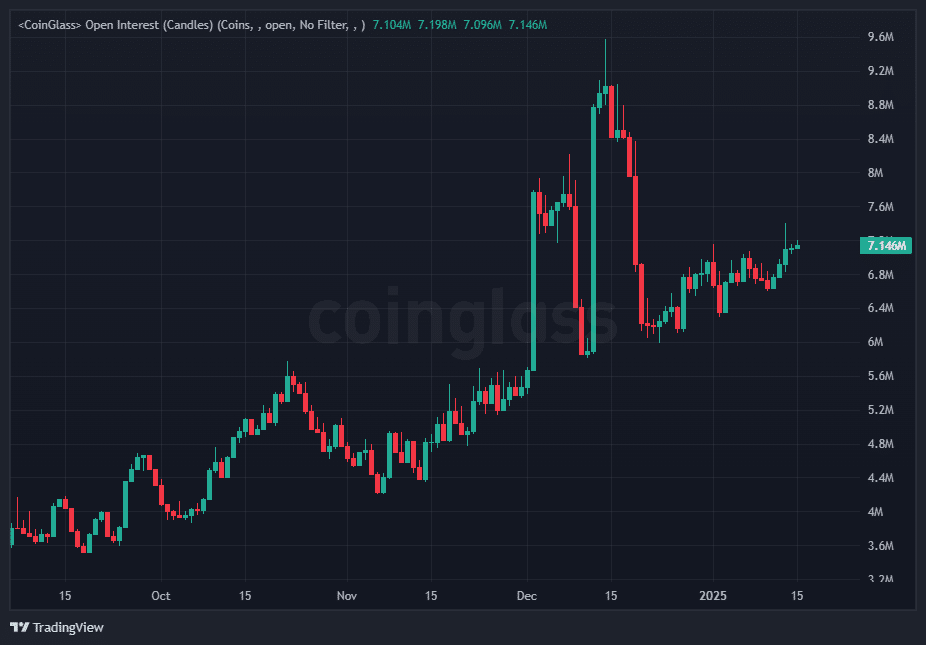

Open Interest surges for LINK

Open Interest(OI) in LINK futures contracts has surged, highlighting increased trader engagement and speculation.

Source: CoinGlass

The current trend suggests traders are actively positioning themselves, possibly expecting volatility in LINK’s price.

If OI continues its upward trajectory while prices hold steady or rise, it could reinforce bullish momentum. A decline in OI, conversely, might indicate profit-taking or waning enthusiasm, making it an important metric to watch in the coming days.

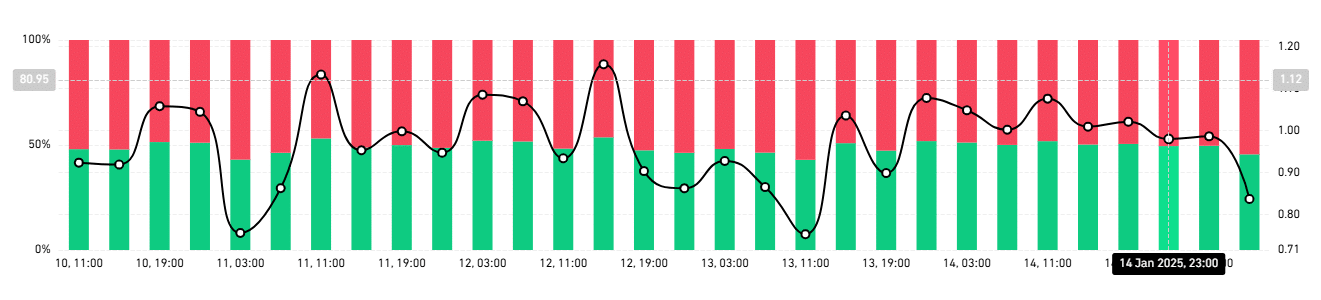

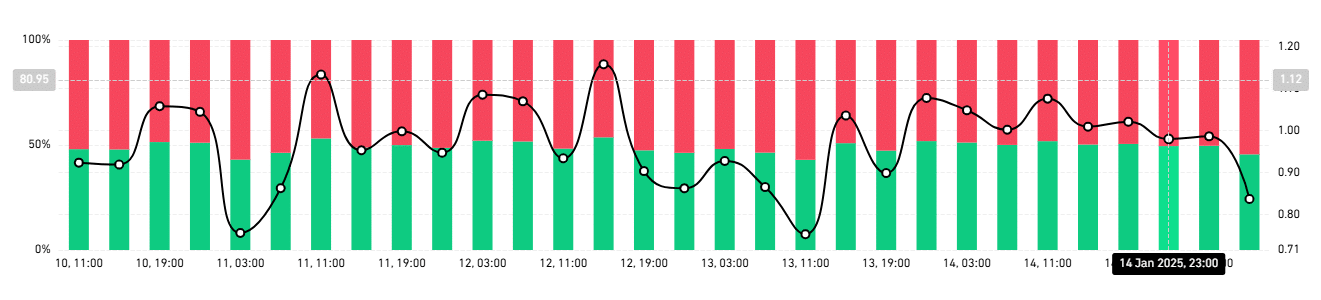

MVRV Long/Short Difference points to…

The Market Value to Realized Value (MVRV) Long/Dhort Difference for LINK is narrowing. This metric compares the market value of LINK tokens to their average acquisition cost, providing insight into holders’ profit levels.

A narrowing MVRV indicates convergence between the values of long-term and short-term holders, suggesting the market is nearing equilibrium.

Source: Coingalss

Historically, such phases of equilibrium often precede sharp price movements, either upward or downward. If the MVRV shifts further in favor of long-term holders, it could signal increasing confidence in Chainlink’s long-term value proposition.

Is your portfolio green? Check out the LINK Profit Calculator

Traders should remain vigilant, as this metric often highlights potential market inflection points.

Chainlink’s whale activity, growing active addresses, increased OI, and narrowing MVRV difference paint a positive picture of its potential.