- XRP’s impressive rally clears short liquidations, but raises risks of a long squeeze

- Elevated risk metrics and thin liquidity below $2.50 hinted at heightened volatility ahead

XRP investors have enjoyed significant gains lately following the token’s impressive rally. However, looming risk metrics seemed to hint at potential turbulence ahead. With over 90% of bearish liquidation levels exhausted and normalized risk hitting extreme levels, could this be the perfect moment to lock in profits before the momentum shifts?

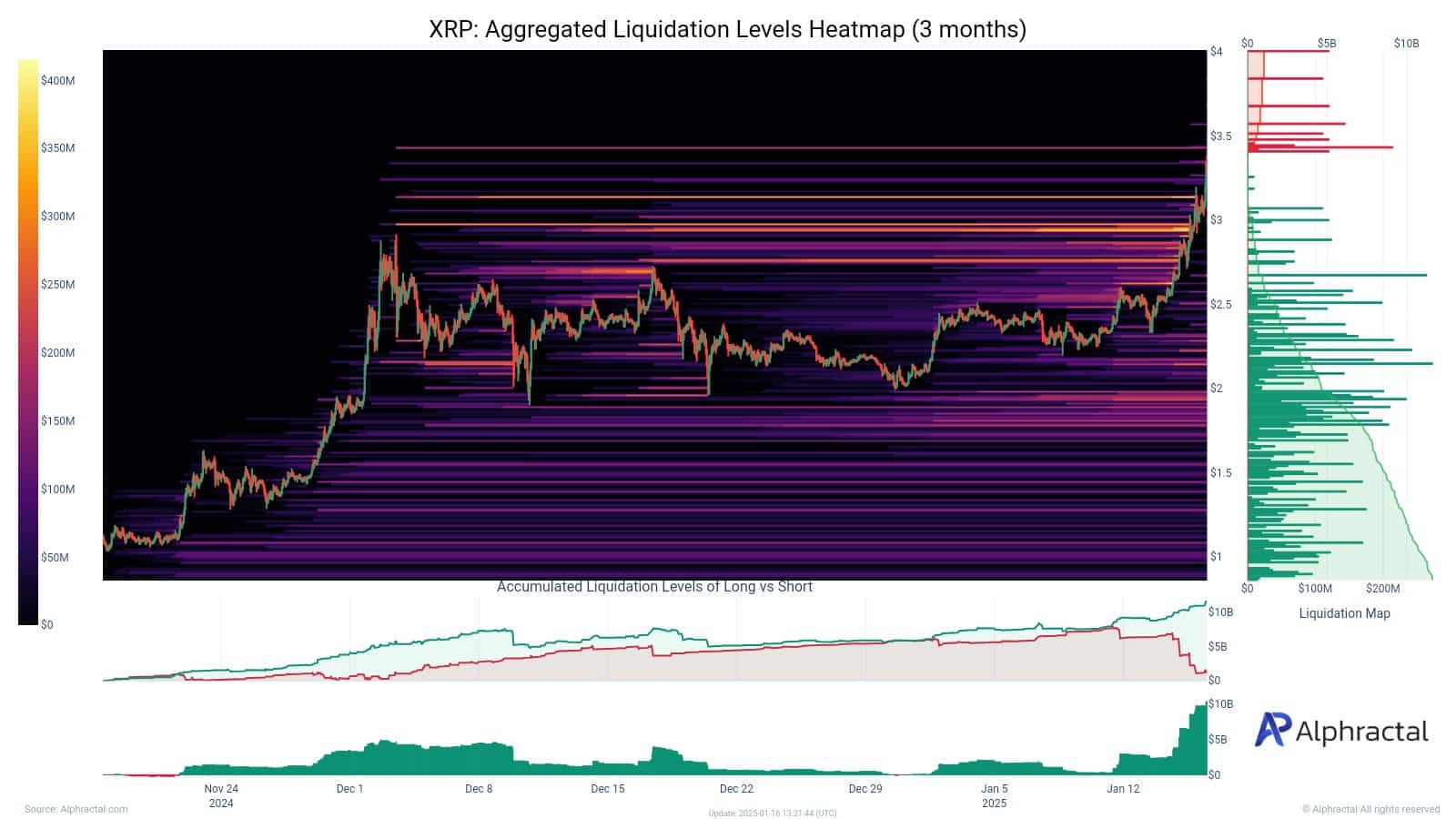

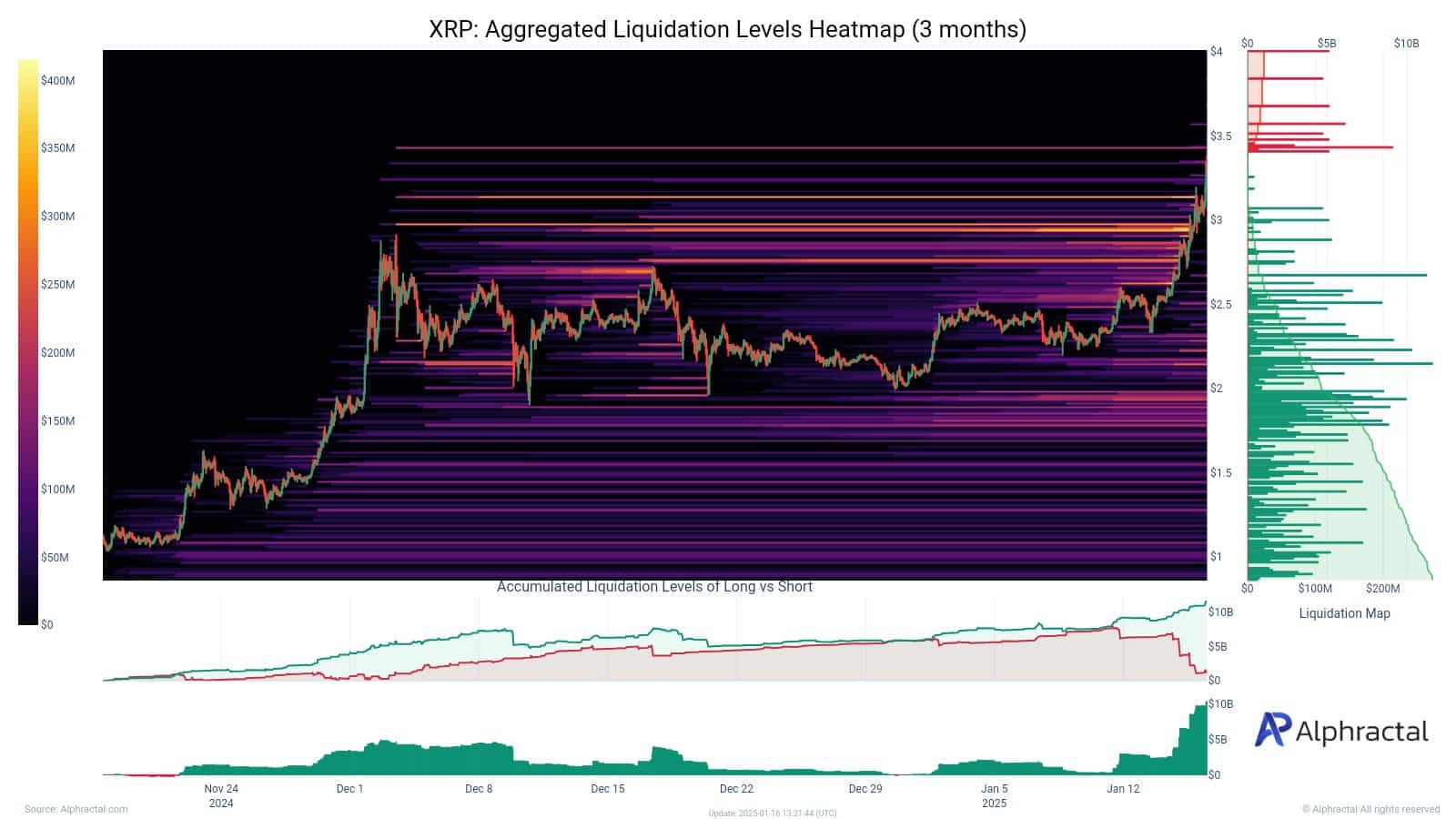

Liquidation heatmaps reveal XRP’s fragile market dynamics

While XRP’s liquidation heatmaps highlighted the token’s impressive rally, they also exposed growing market vulnerabilities. The three-month heatmap revealed dense liquidation clusters in the $3.00-$3.50 range, where most short positions have been cleared, fueling the rally.

However, below $2.50, liquidity thins considerably, suggesting limited support if the price drops on the charts.

Source: Alphractal

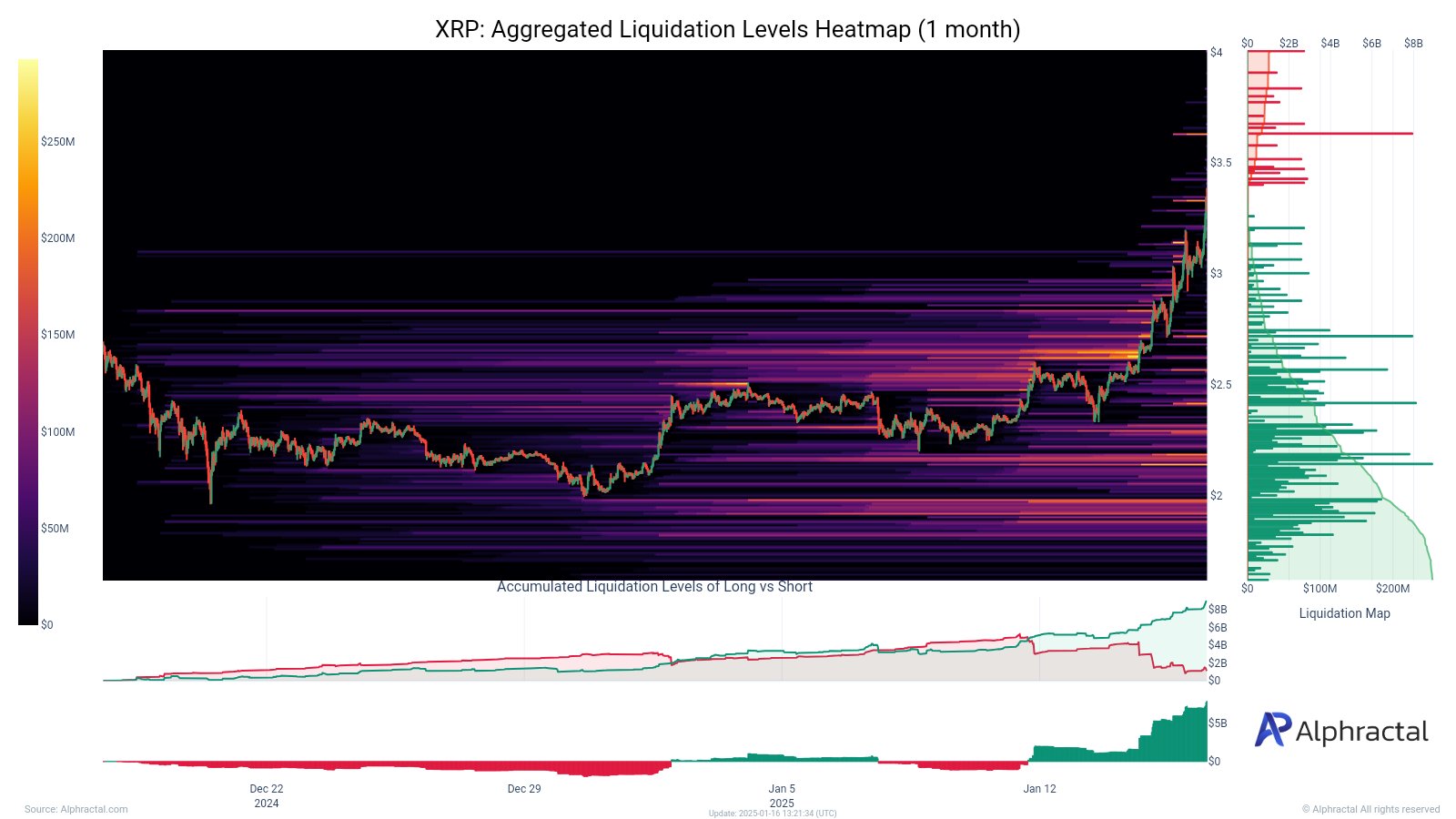

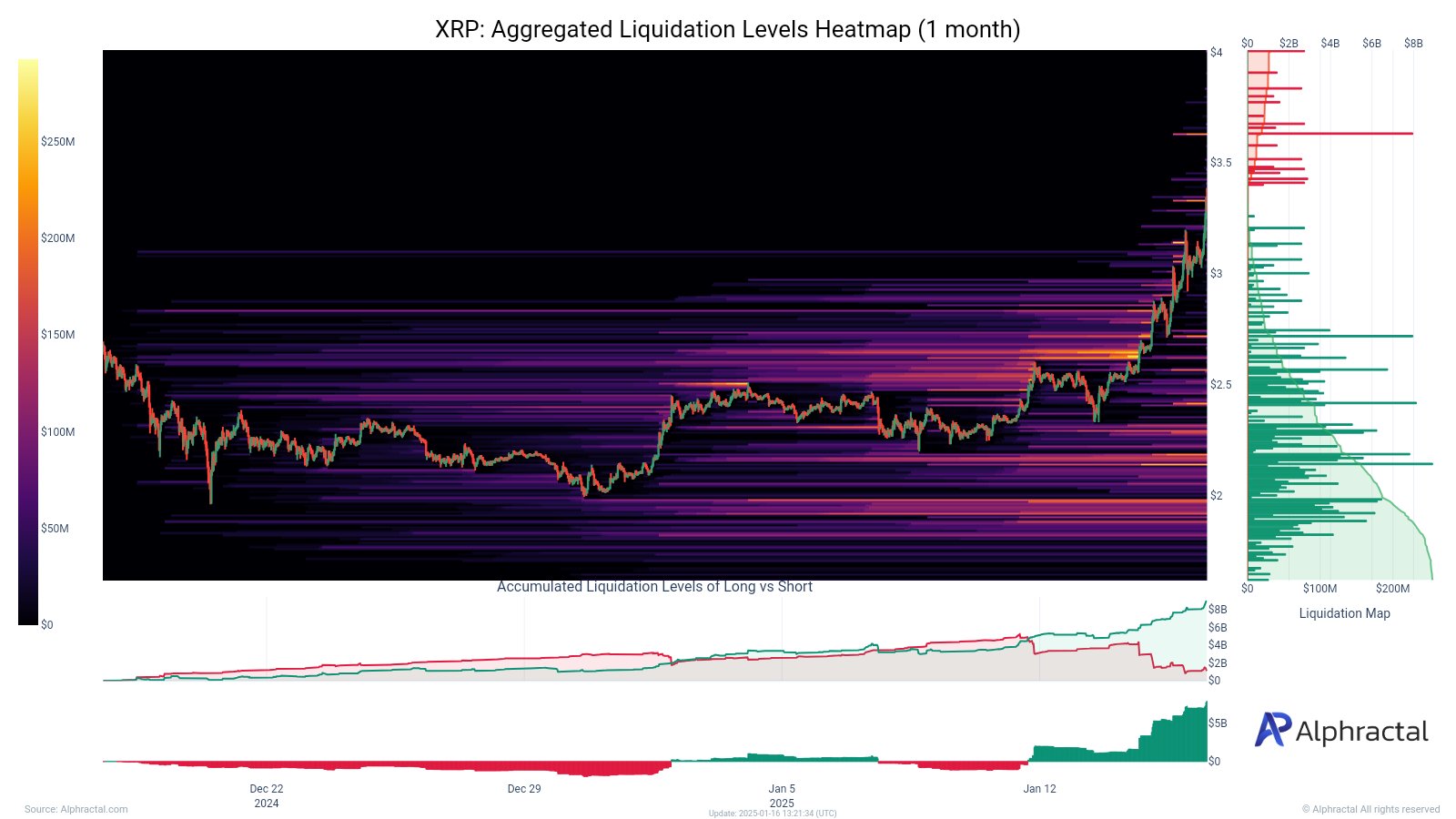

The one-month heatmap reinforced this view, revealing near-total exhaustion of bearish liquidation levels and a buildup of long positions in the $3.25-$3.50 range.

This raises the risk of a long squeeze if XRP loses momentum, potentially triggering a sharp sell-off.

Source: Alphractal

Additionally, the imbalance between plateauing short liquidations and rising long liquidations is a sign of a market skewed towards bullish sentiment.

While XRP’s rally has thrived on short squeezes, the lack of bearish liquidity and concentrated long positions mean there might be heightened volatility ahead.

XRP’s elevated risk metrics

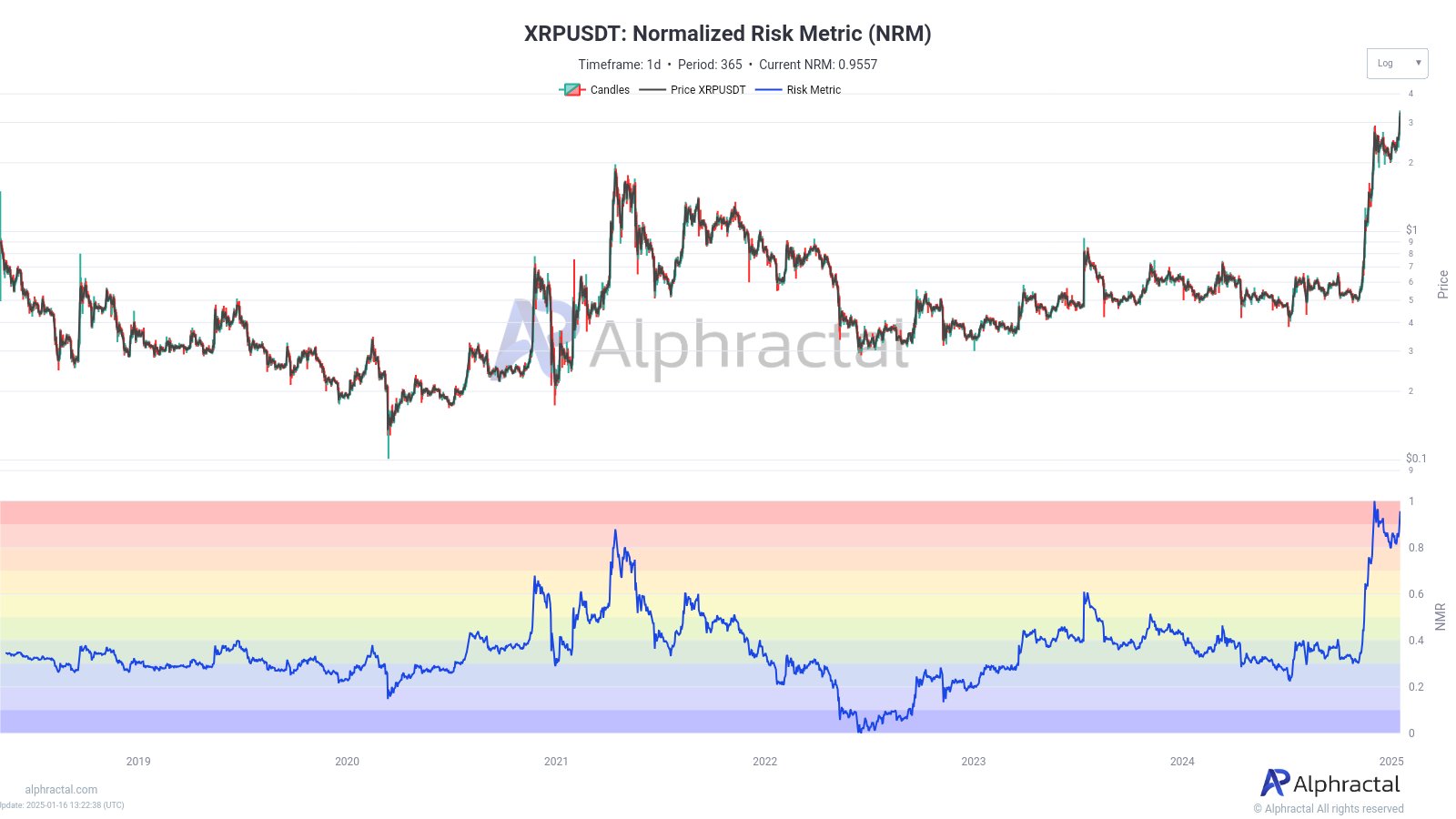

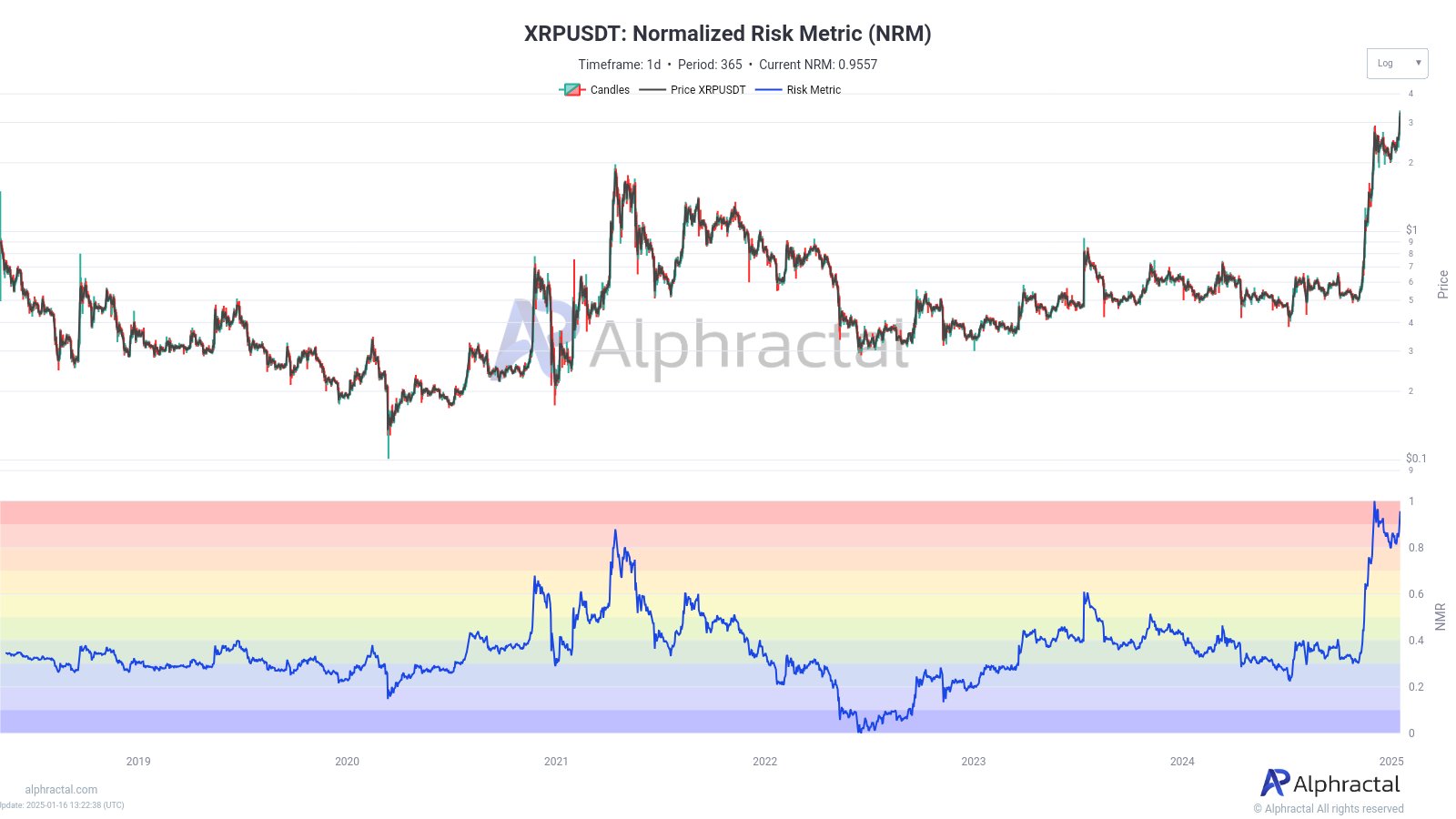

XRP’s recent rally has been accompanied by concerning signs of heightened risk, as both the Normalized Risk Metric and Sharpe Ratio approached extreme levels.

The NRM’s press time reading of 0.9557 seemed to be nearing historical highs that have preceded major market corrections in the past – A sign of overheated conditions. With XRP firmly in the red zone of the risk chart now, the likelihood of a price pullback will be high.

Source: Alphractal

Similarly, the Sharpe Ratio, which measures risk-adjusted returns, is hitting unsustainable positive levels too – Echoing patterns seen before previous market corrections.

Source: Alphractal

This means that XRP’s risk-reward balance is skewed, making the current market dynamics precarious.

A combination of these risk metrics, alongside an already overheated market, raises the probability of heightened volatility and a potential retracement on the charts.

Realistic or not, here’s XRP market cap in BTC’s terms