- Cardano’s FOMO premium is under pressure, driven by deteriorating on-chain fundamentals

- Is ADA at growing risk of entering a broader distribution phase?

Despite a 28% rebound from its $0.50 low, Cardano [ADA] remains pinned near a key inflection point. Its recent rally, while notable, might just lack a strong follow-through.

More critically, ADA’s FOMO factor has been fading fast too. Especially since it slipped from 8th to 10th by market cap, with the psychological hit being significant.

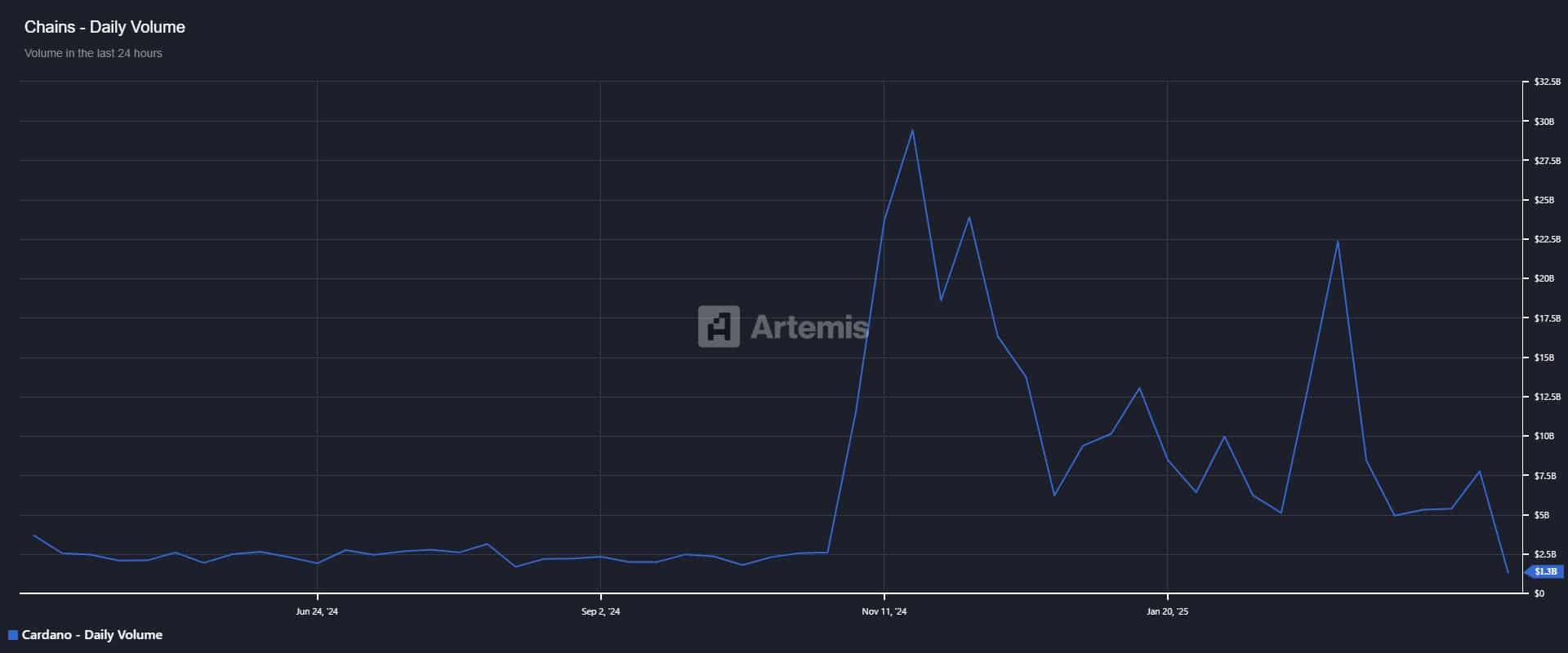

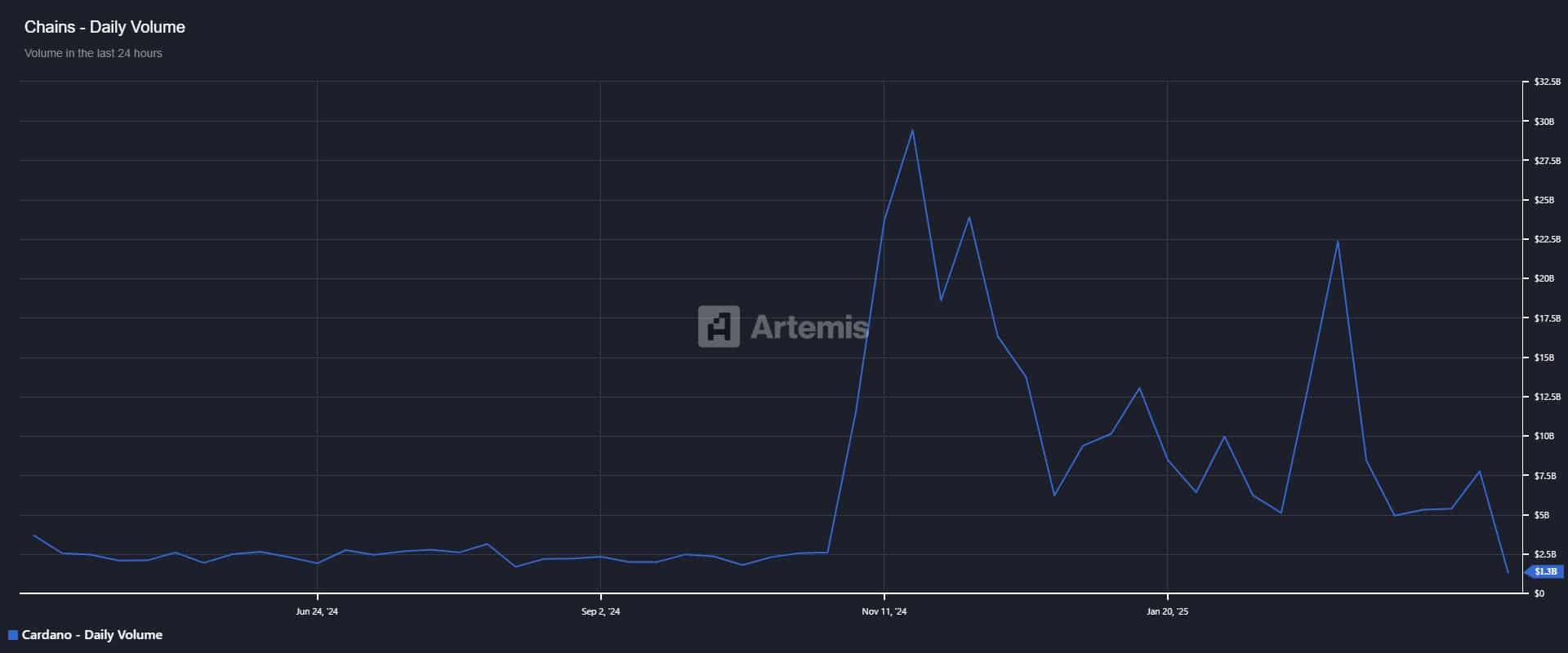

On-chain metrics confirmed this decline. Cardano’s network throughput has fallen to $1.35 billion, retracing to pre-election levels. In fact, it is down from the $7.80 billion peak recorded on 07 April.

Source: Artemis Terminal

To put it simply, Cardano has ceded ground to rivals Tron [TRX] and Dogecoin [DOGE]. This has been driven not by external strength, but by its own deteriorating fundamentals and lack of fresh liquidity entering the ecosystem.

With ADA’a structural support under threat, the spotlight now shifts to ADA’s long-term holders. Are HODLers beginning to lose conviction or is this just a shakeout before reaccumulation?

Key LTH metrics for Cardano’s distribution risk

Interestingly, Cardano’s current market value is hovering around the same levels last seen in November – Approximately five months ago.

This places a significant portion of Long-Term Holders (LTHs), who entered during the election-driven rally, at or near their cost basis. As a result, many are now either sitting at breakeven or holding unrealized losses.

In this context, AMBCrypto examined whether Cardano is sliding into a broader distribution phase. Especially as pressure mounts on these LTHs to offload, rather than continue HODLing in hopes of a market rebound.

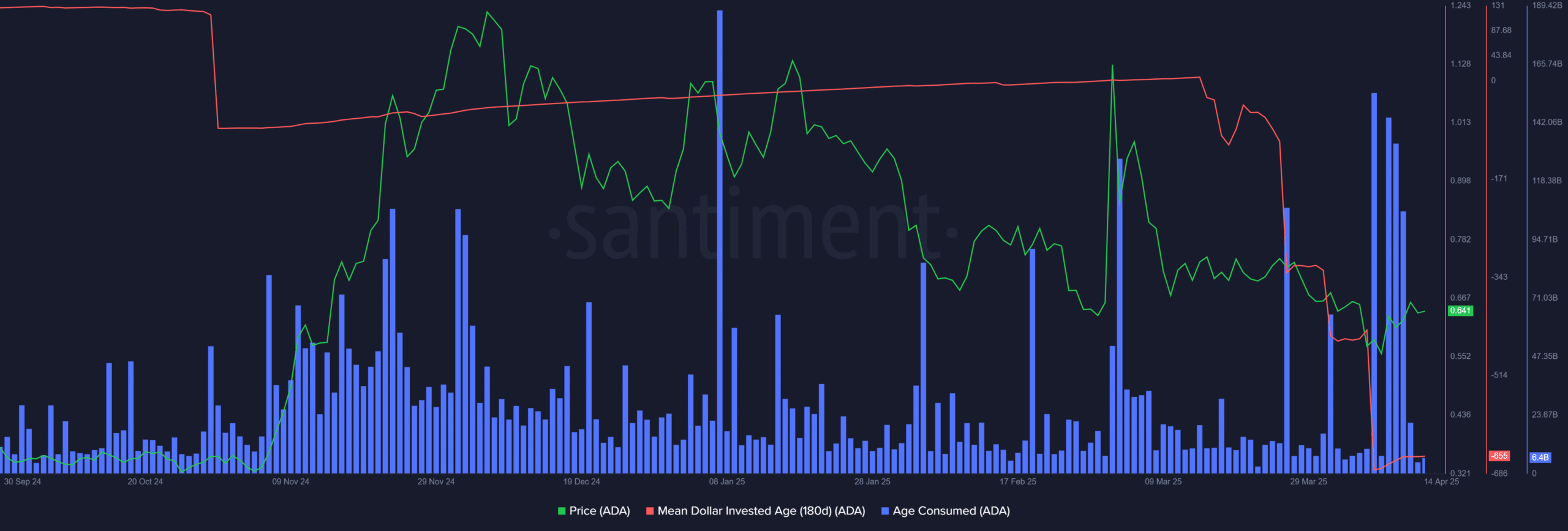

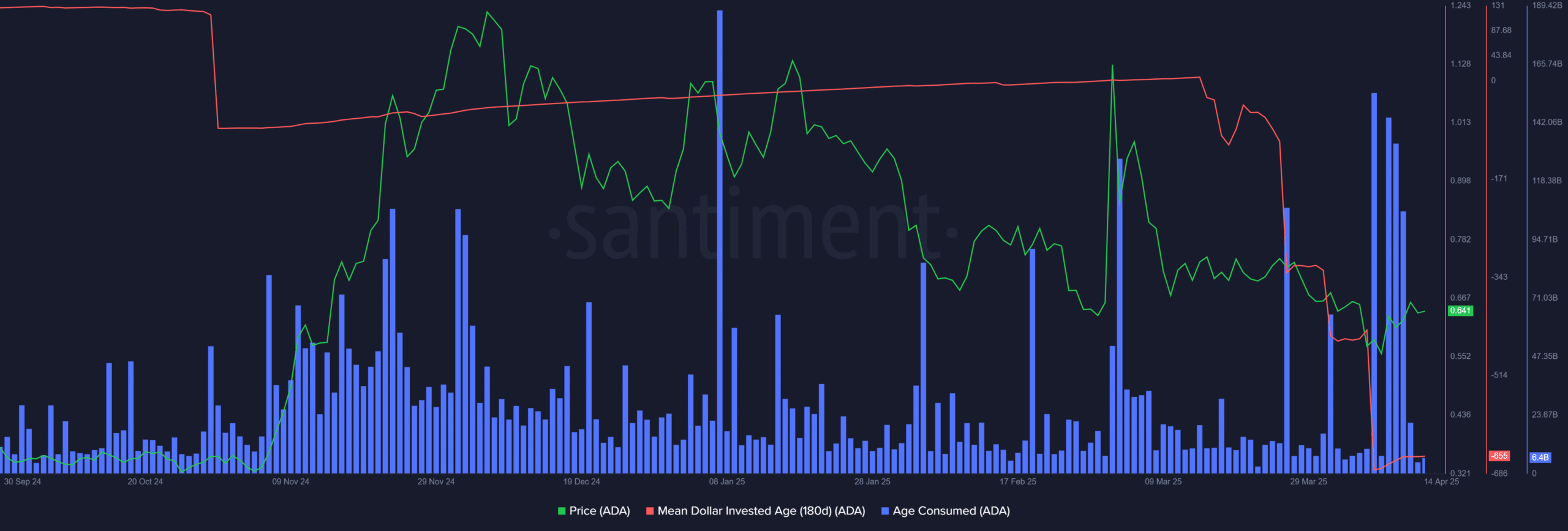

A key signal comes from the Mean Dollar Invested Age (MDIA) – 180 Days, a metric that captures the average “age” of capital invested in ADA.

Since mid-March, MDIA has shown a pronounced downtrend, aligning with ADA’s failure to hold two critical resistance zones. This drop seemed to indicate that older coins are being moved or sold – A classic hallmark of LTH distribution behavior.

Source: Santiment

Adding further weight to this thesis is the sharp spike in Age Consumed, a metric reflecting the movement of dormant coins. Elevated levels here suggested that long-held assets are being reactivated, signaling strategic offloading by long-term holders.

The combined decline in MDIA and surge in Age Consumed highlighted rising sell-side pressure from conviction wallets – An unmistakable sign of distribution.

More critically, as older coins re-enter circulation and Cardano’s network fails to show solid accumulation, ADA might be on the cusp of losing its $0.63 support.

A breakdown here would likely trigger a deeper correction, particularly if any market rebound proves short-lived.