- At press time, ONDO’s price seemed to be consolidating, with a 6.26% decline raising short-term uncertainty

- Large transactions have been declining, and liquidation risks could increase volatility

Ondo [ONDO] Finance has taken the decentralized finance (DeFi) space by storm, surpassing $1 billion in total value locked (TVL) in just 30 days. This remarkable 57% surge has firmly established Ondo at the forefront of the tokenized U.S. Treasuries market, which now exceeds a total market value of $4 billion.

As a result, the project is now quickly becoming a major player in this rapidly growing sector.

What does ONDO’s price action indicate?

Analyzing the altcoin’s recent price action revealed some interesting patterns. The token has been trading within a symmetrical triangle formation after its sharp hike, with its price nearing the lower boundary of the pattern.

At press time, ONDO was trading at $0.96, down 6.26% in the last 24 hours. This hinted at some level of short-term uncertainty. Although the overall trend has been positive, the prevailing downtrend in price raises some questions about the token’s short-term stability.

Source: TradingView

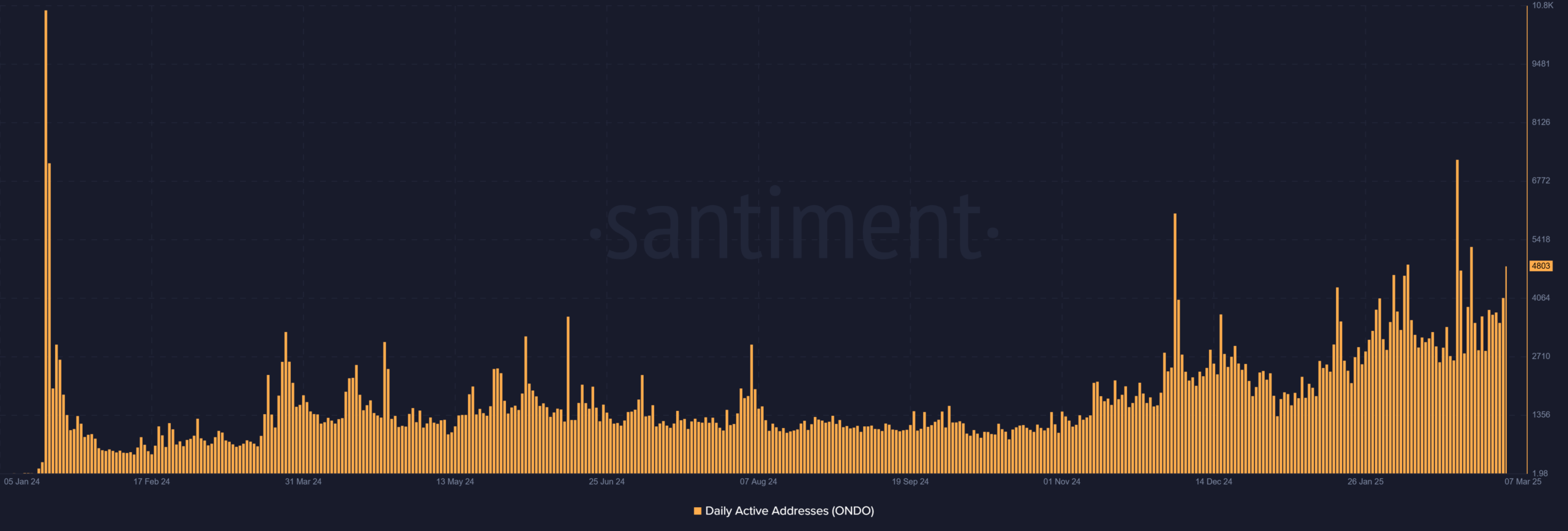

How have daily active addresses evolved?

ONDO recorded 4,803 daily active addresses, highlighting a moderate uptick in user activity. This hike in daily engagement is a positive indicator, especially considering the growing adoption of tokenized treasuries.

Furthermore, this growth in daily active addresses signified that more investors have been interacting with the platform and participating in the expanding DeFi ecosystem. However, it remains to be seen whether this trend will continue, given the volatility across the market.

Source: Santiment

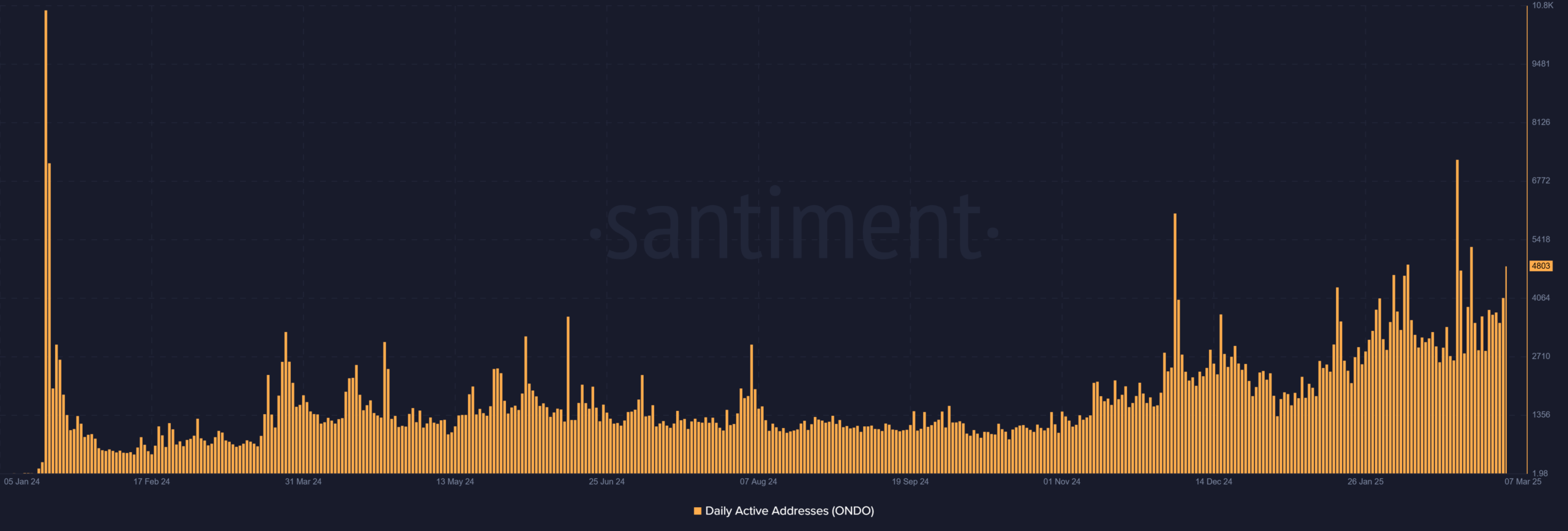

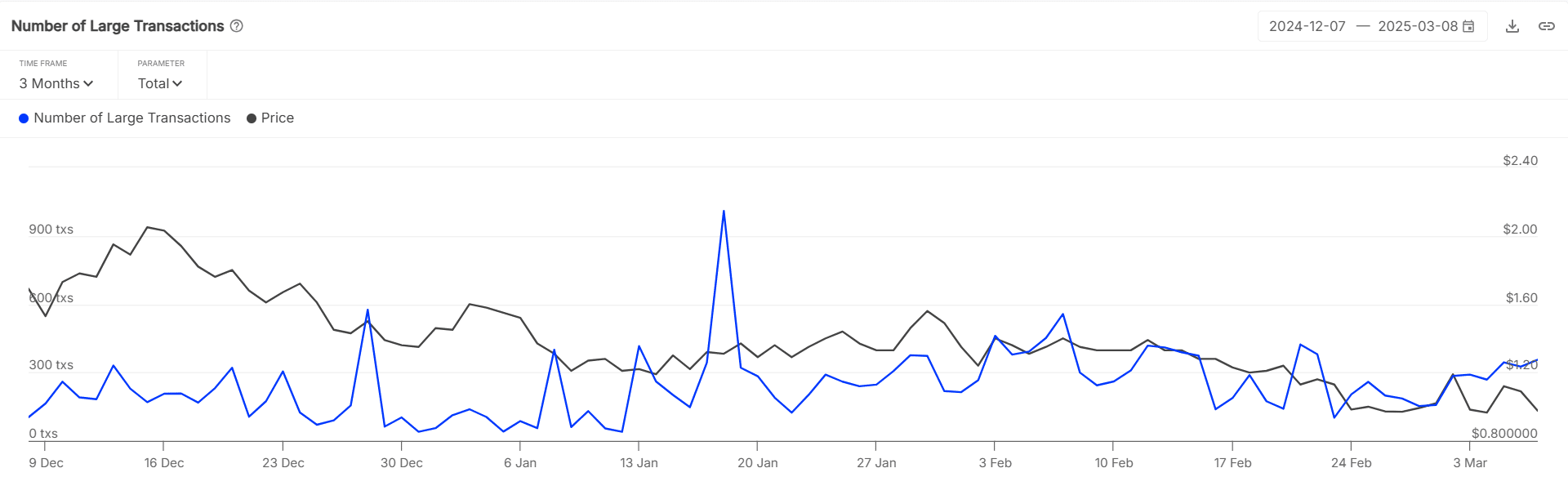

What do large transactions tell us?

Large transactions have been on the decline, with a 1.09% drop in large transaction activity. This meant that some of the major players may be retreating from Ondo, possibly due to its latest price correction.

Additionally, it could be a sign that institutional investors are taking a more cautious approach, waiting for clearer signals before committing more capital.

The fall in large transactions highlighted the need to monitor sentiment across the broader market.

Source: IntoTheBlock

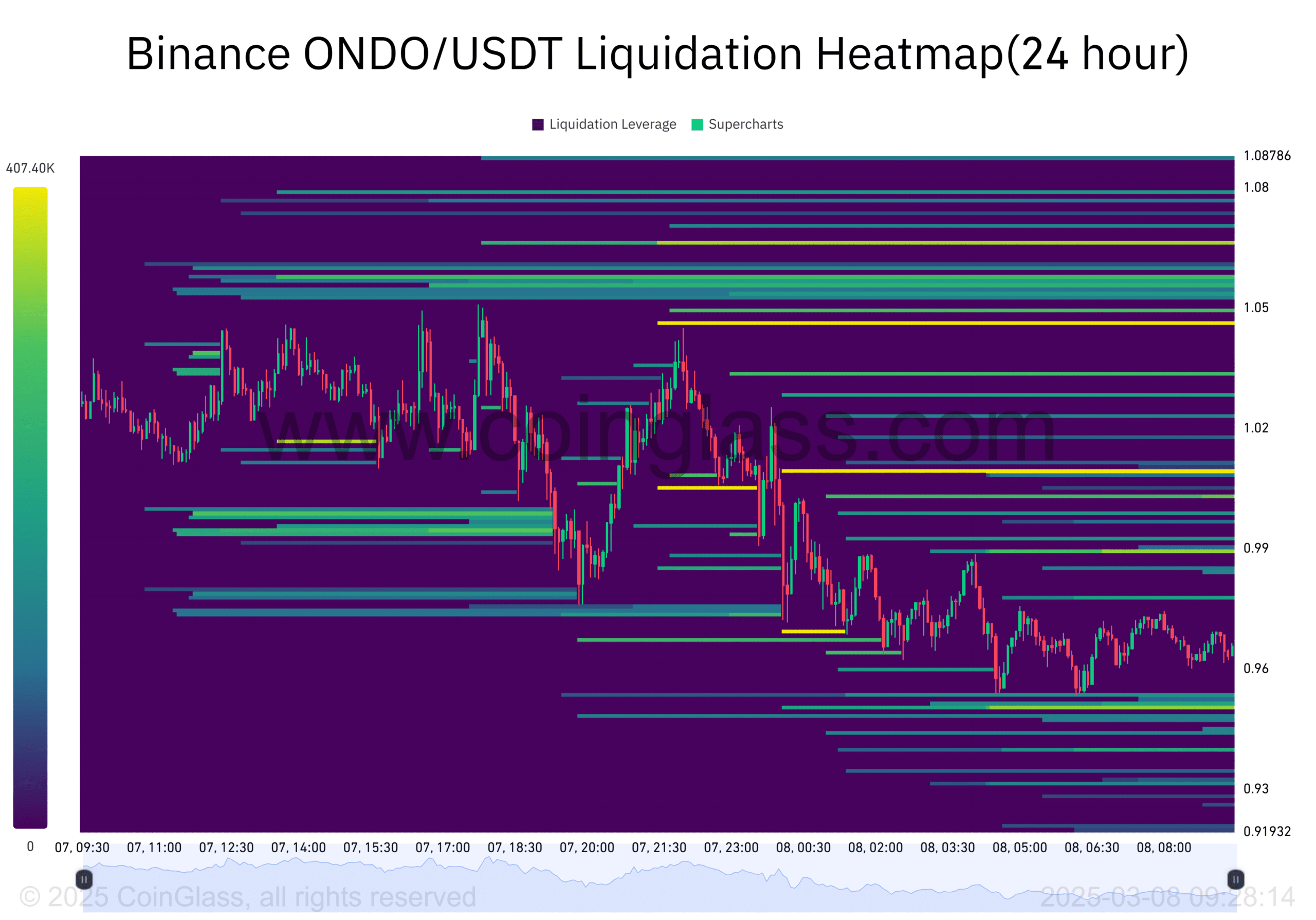

What does the liquidation heatmap reveal about market sentiment?

The liquidation heatmap for Ondo also added to the cautious outlook. Significant liquidations seemed to be happening in the 0.96–1.00 price range – A sign that many traders are exposed to risk near these levels.

As the price continues to approach this range, we could see a hike in liquidation activity, which may contribute to further volatility. Therefore, watching the liquidation levels will be essential. Especially as it could signal potential for sharp price fluctuations if a wave of liquidations takes place.

Source: Coinglass

Despite Ondo’s remarkable growth in TVL and hike in user activity, several factors hinted at potential volatility in the short term.

While its position in the tokenized treasuries market remains strong, the recent price decline, decreasing large transactions, and liquidation risks suggest that it may face challenges ahead.

Therefore, while Ondo has undoubtedly established itself as a dominant player in the DeFi space, sustaining this growth in the face of these risks remains uncertain.