- Cardano’s range formation since December has curtailed all price expansion

- The $0.78 support zone is likely to see a strong price bounce towards $0.9 next week

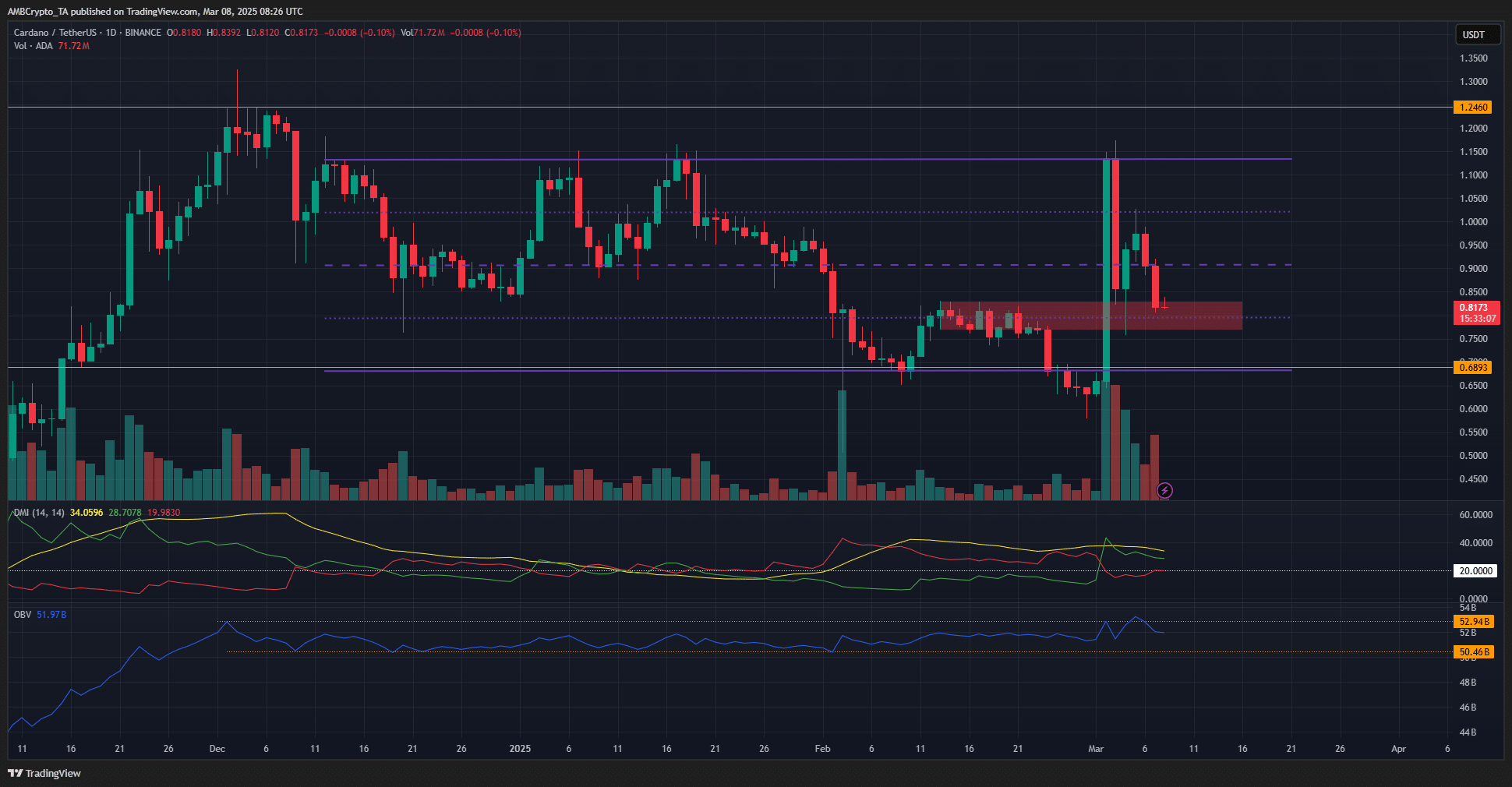

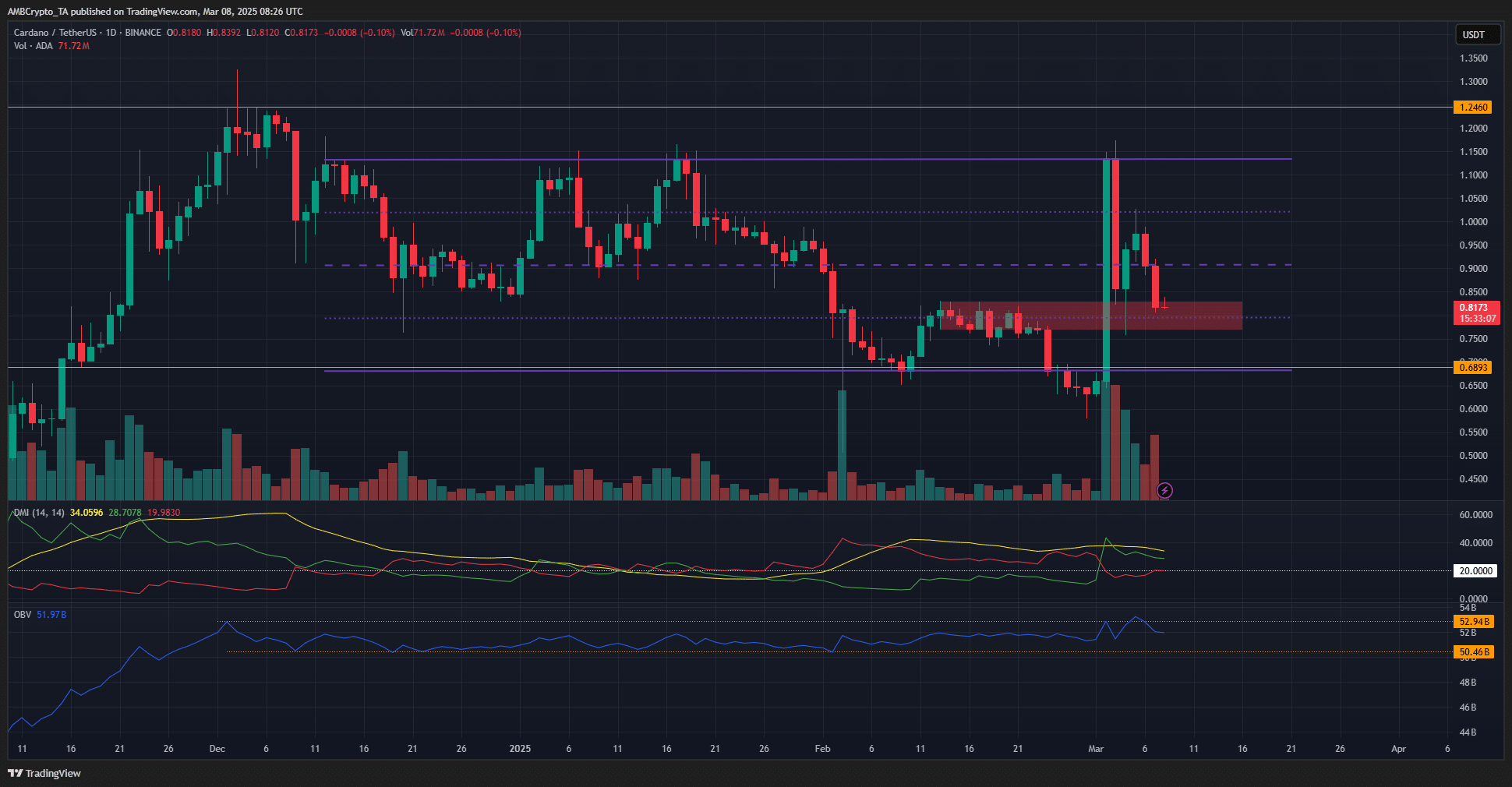

Cardano [ADA] saw a 72% price rally on Sunday, 2 March, on the back of the news that the U.S crypto strategic reserve would include Cardano too. Since then, ADA has retraced most of its gains on the charts.

At the time of writing, it was trading within a key support zone that had been a resistance level in February. From a technical perspective, Cardano seemed to present swing traders with a buying opportunity.

Cardano falls below the mid-range support, but buyers should be looking to bid

Source: ADA/USDT on TradingView

The strong pump last weekend meant the market structure was bullish. And yet, the structure was not too important right now, given that ADA has traded within a range (purple) since December. This was the fourth day within the past week that the price was testing the $0.8 demand zone.

The Directional Movement Index highlighted a strong uptrend in progress, with both the ADX (yellow) and +DI (green) above 20. On the other hand, the OBV was yet to decisively break its range formation.

The lack of persistent buying pressure meant Cardano might remain range-bound in the coming days or even weeks. Here, the significance of the past month’s resistance being retested as support was also noteworthy. Hence, bulls would be targeting a move to $1.15-$1.2 next, with the range high at $1.135.

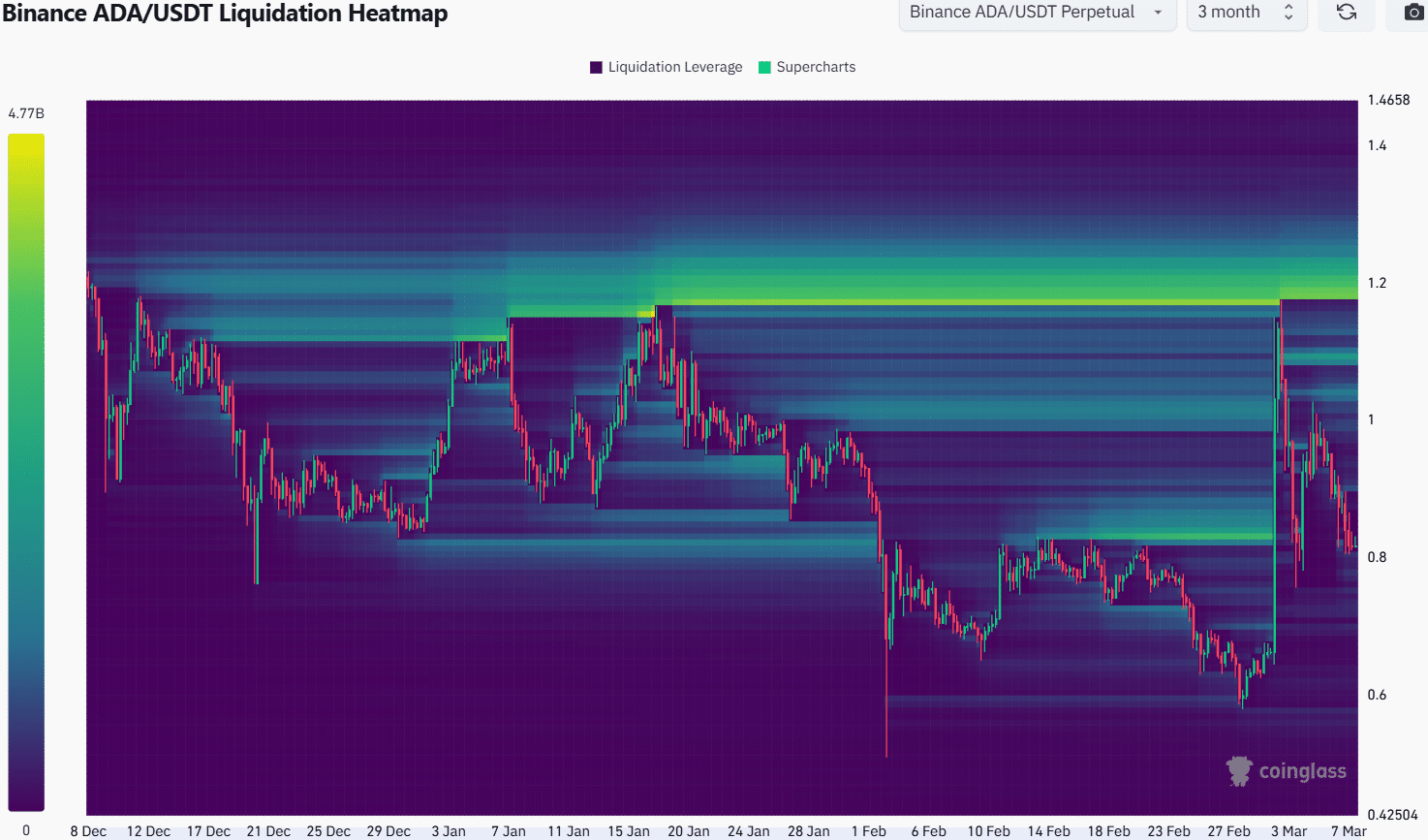

The 3-month liquidation heatmap highlighted the $1.2-level as the magnetic zone to look out for. The density of liquidation levels here means that bulls might have a difficult time pushing the price any further north.

The liquidity cluster would likely attract prices to it, but be followed by a quick rejection. This has been the pattern since January. Alternatively, a strong momentum move could drive a liquidation cascade, but the buying volume has been absent so far.

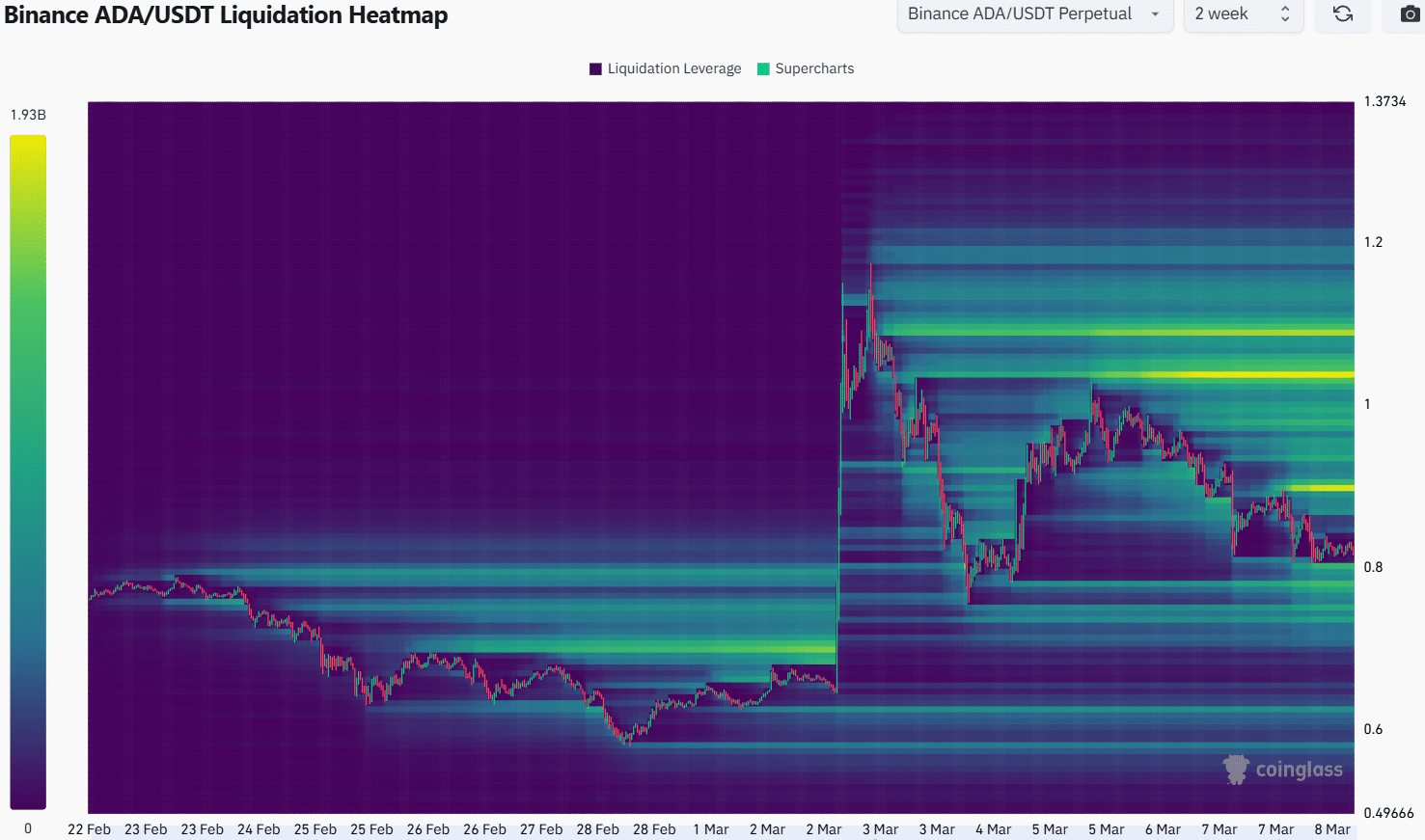

The 2-week liquidation heatmap outlined other threats to ADA bulls, apart from $1.2. The closest, relatively dense liquidity pockets, were at $0.78-$0.8 and at $9. Hence, it can be anticipated that a move to $0.78 would likely be followed by a strong bounce to $0.9.

Further gains would be dependent on volume, sentiment, and the state of the rest of the market, especially Bitcoin [BTC].

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion