- Ethereum’s CME short pressure eased as arbitrage trades unwinded, reducing structural drag on the price

- ETH’s fundamentals remain strong, but fresh catalysts are needed to ignite a sustained breakout

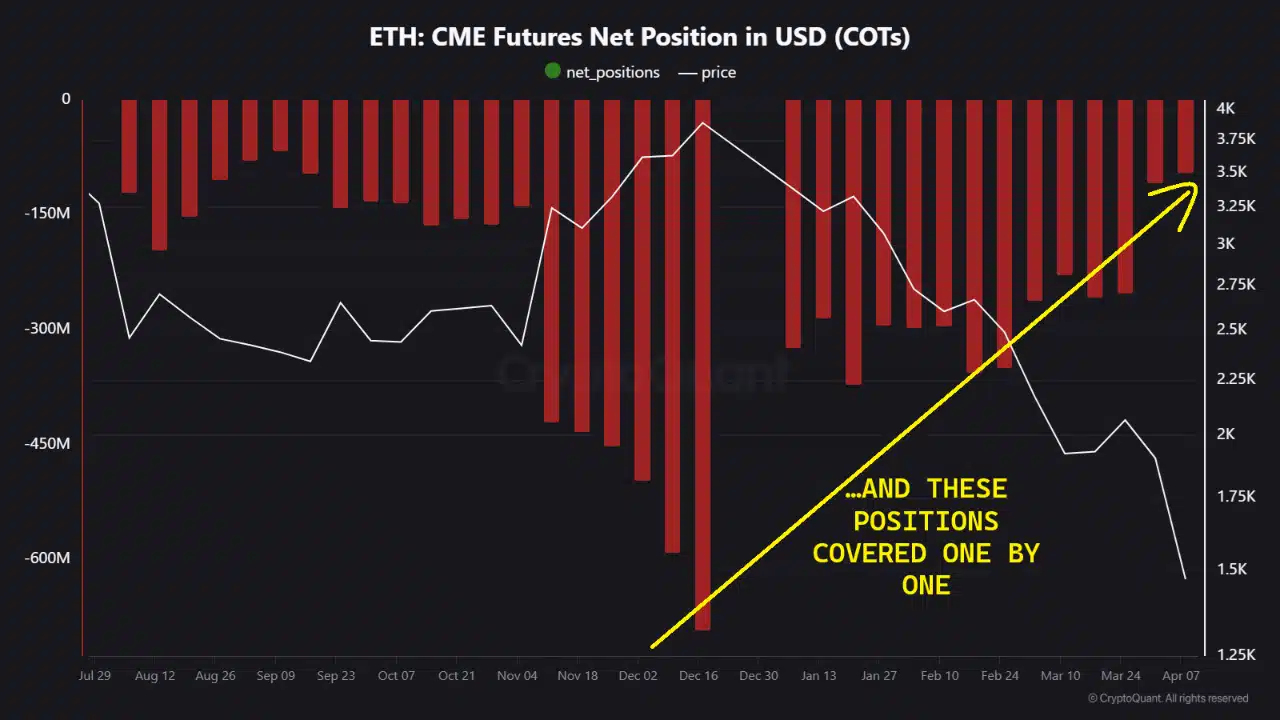

Ethereum [ETH] may still be waiting on a macro spark to rally; but the structural weight that’s been dragging it down is finally easing. The massive short positions opened on CME Ethereum Futures late last year, driven by arbitrage trades exploiting a sky-high basis, have now been largely unwound.

While not an outright bullish trigger, this cleanup removes a key source of market pressure, resetting the stage for a potential breakout.

If the right catalysts emerge.

Structural strength, stalled price

AMBCrypto recently reported on Ethereum’s resilient fundamentals – Rising whale accumulation, strong DeFi dominance with over $190 billion in TVL, and a historically undervalued MVRV Z-Score. On-chain data pointed to growing network activity and early signs of re-accumulation, hinting that ETH could be gearing up for a reversal.

And yet, despite these signals, the price action has remained muted.

One overlooked reason? A wave of short futures positions on CME. Not out of bearish conviction, but as part of a massive arbitrage trade. That structural pressure may now be fading and it could change things.

Mechanics behind the short pressure

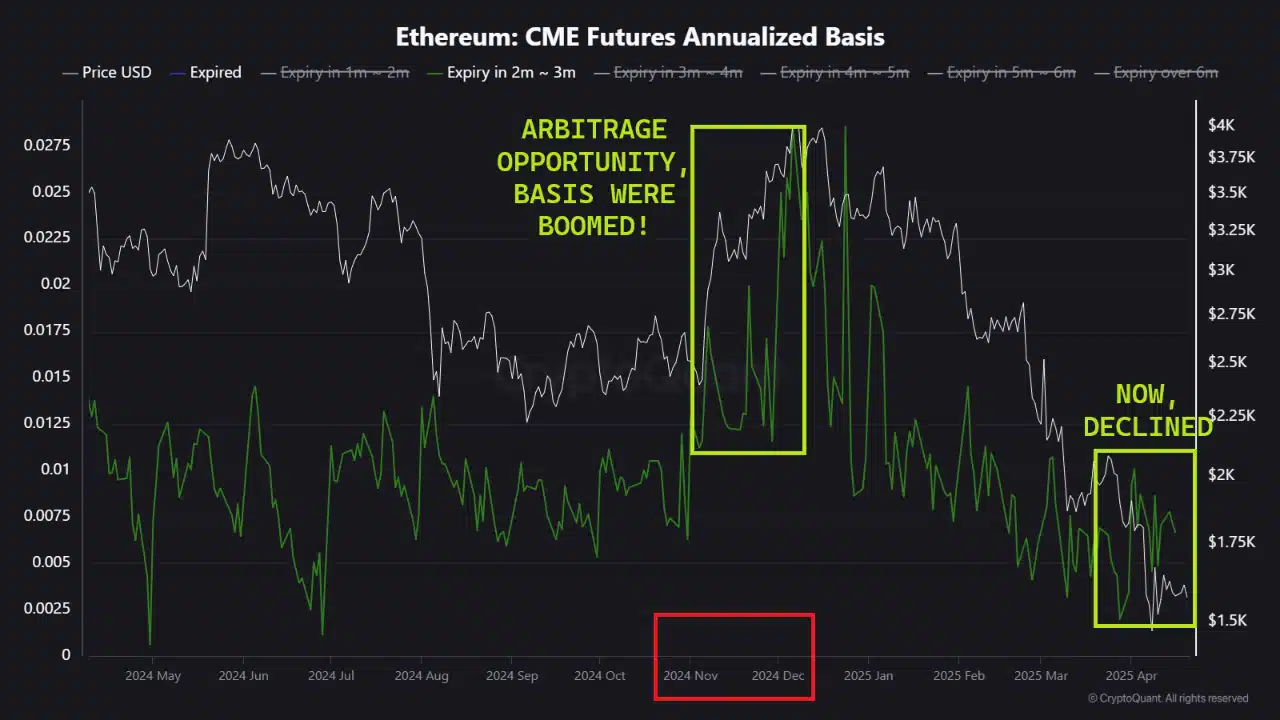

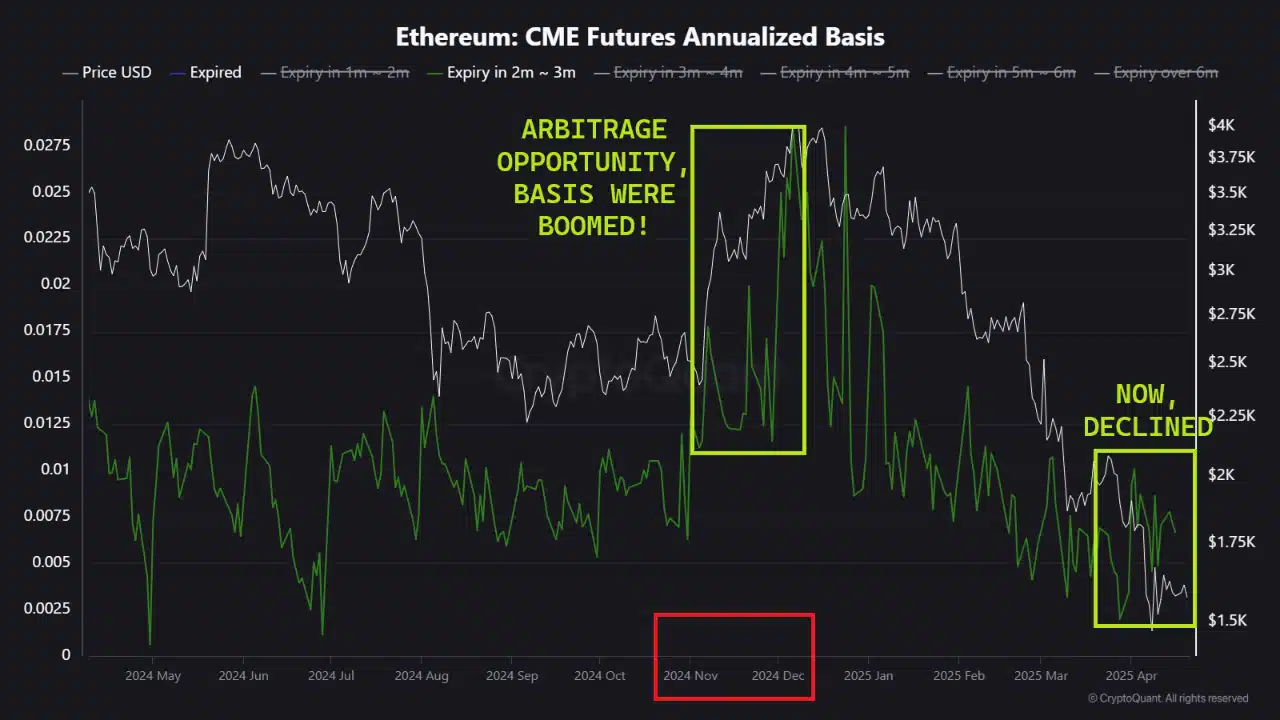

Source: Cryptoquant

In November 2024, Ethereum’s CME Futures basis surged past 20%, creating a textbook arbitrage opportunity. Traders – mostly institutional – capitalized by buying spot ETH, often via ETFs, while simultaneously shorting CME Futures. This wasn’t a directional bet against Ethereum. but a structured arbitrage trade exploiting the premium between Futures and Spot markets.

As the data revealed, this period saw an aggressive spike in the annualized basis. Once macro factors hit, the trade began to unwind, dragging spot ETH down as arbitrageurs exited. With the basis now around 4-5%, the pressure from this trade has largely dissipated.

What’s changed in the last two months?

The arbitrage window has closed.

CME Futures basis has dropped sharply to just 4–5%, now aligning closely with U.S. Treasury yields. This collapse heralded the end of the trade. Over the past two months, funds have begun unwinding their structured positions; covering shorts on CME and offloading spot ETH in tandem.

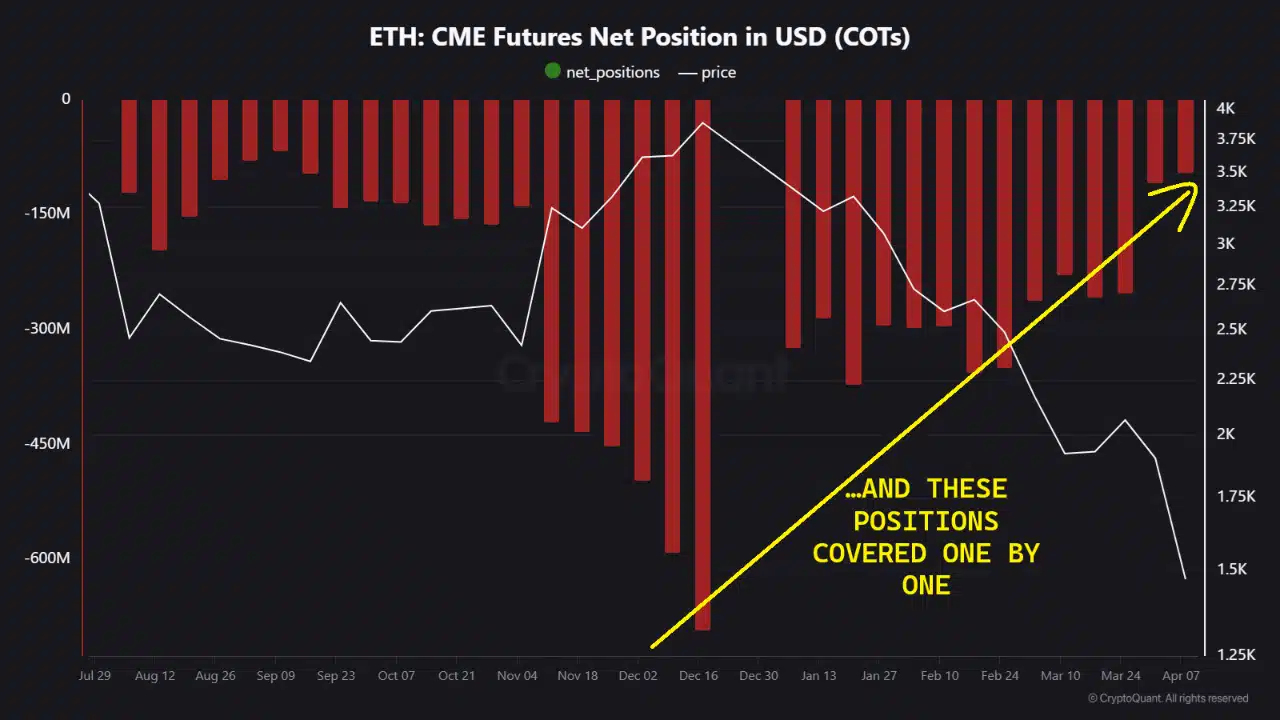

Source: Cryptoquant

The once-deep net short positions (over $600M at their peak) have been progressively covered.

However, this hasn’t come cheap. It contributed significantly to Ethereum’s Q1 price correction as ETF flows dried up and spot market pressure mounted.

Not bullish yet, but the deck is clearer

The unwinding of CME short positions is a structural cleanup and NOT a bullish trigger. While it removed a major technical headwind, it didn’t quite inject fresh buying interest. With no macro-driven spot demand and tepid ETF flows, Ethereum’s Futures basis is flat and conviction longs are still absent.

That being said, ETH is now more reactive to upside catalysts.

A lukewarm pivot from the Federal Reserve, the approval or inflow surge into an Ethereum spot ETF, or a wave of L2 migration and adoption could reignite momentum. With the deck cleared, the next breakout depends on real demand stepping in.