- Trump’s Executive Order introduces a federal task force to regulate and promote innovation in cryptocurrency markets

- Bitcoin reacted with volatile price movements, reflecting optimism and uncertainty about the order’s impact

President Donald Trump hit the ground running by signing several executive orders during his first three days in office. On 23 January, after much anticipation, President Trump finally signed an Executive Order on cryptocurrency. Needless to say, this move has led to speculations about what may be next for the asset class.

Key highlights of the Executive Order on cryptocurrency

Trump’s executive order on cryptocurrency, dubbed “Strengthening American Leadership in Digital Financial Technology”, is a landmark decision laying the groundwork for a more structured approach to digital asset adoption. Among its primary objectives, the order seeks,

- Establish a federal task force to oversee cryptocurrency regulations, ensuring consumer protection while encouraging innovation.

- Promote the development of U.S. dollar-backed stablecoins as a counterweight to other digital assets, signaling the country’s intent to maintain dominance in global financial markets.

- Prohibit the introduction of a U.S. central bank digital currency (CBDC), citing risks to monetary sovereignty.

- Explore a reserve system for cryptocurrencies acquired through enforcement actions, signaling an openness to integrating digital assets into governmental financial systems.

These provisions highlight a nuanced approach, blending support for innovation with a cautious eye on risks such as fraud and market volatility.

How the market reacted to the executive order on cryptocurrency

The executive order on cryptocurrency generated a mix of excitement and caution across markets. Bitcoin (BTC), the largest cryptocurrency by market capitalization, saw immediate volatility following the announcement. While some investors saw the move as a positive step towards regulatory clarity, others hesitated due to lingering uncertainties about implementation.

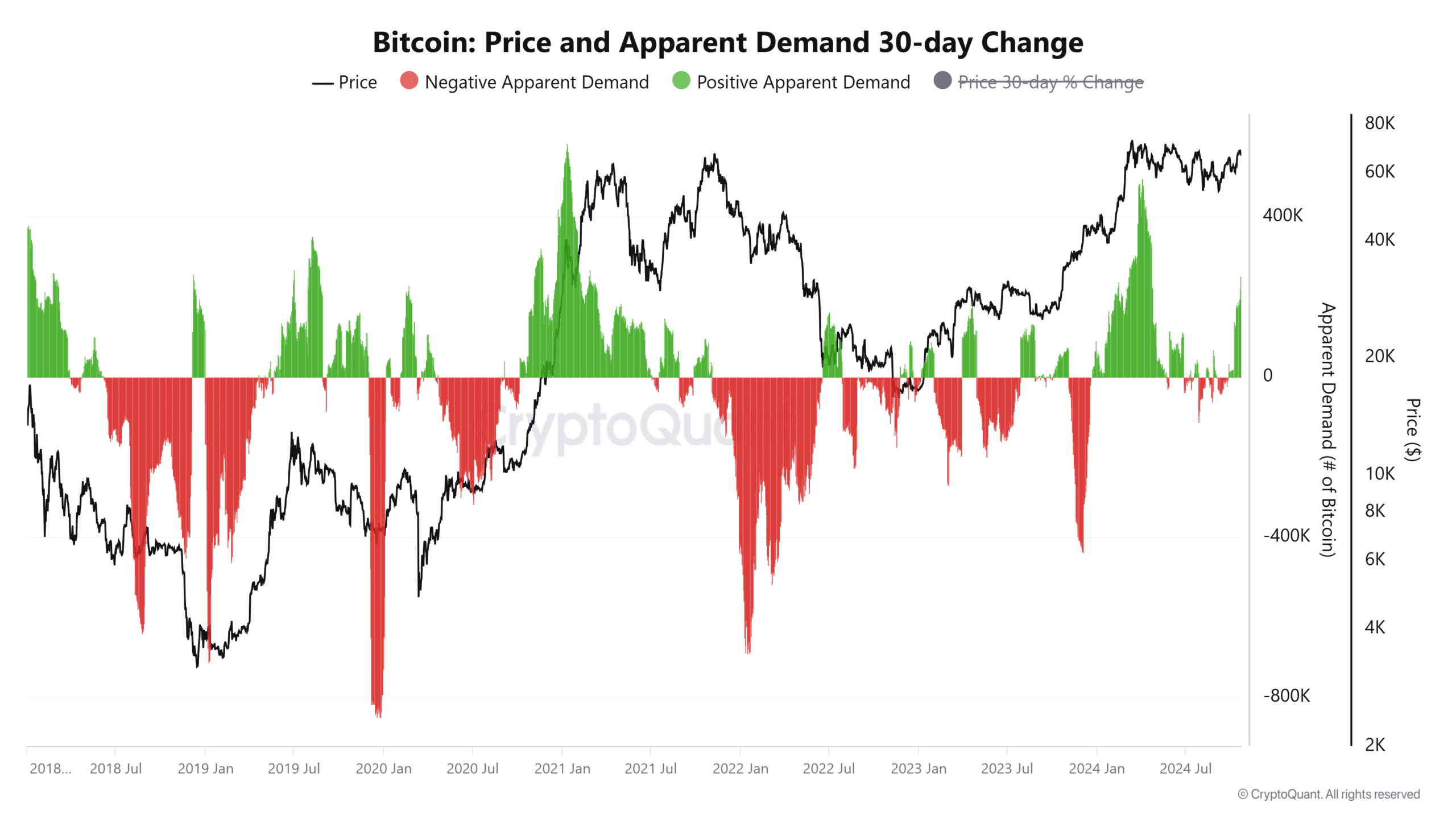

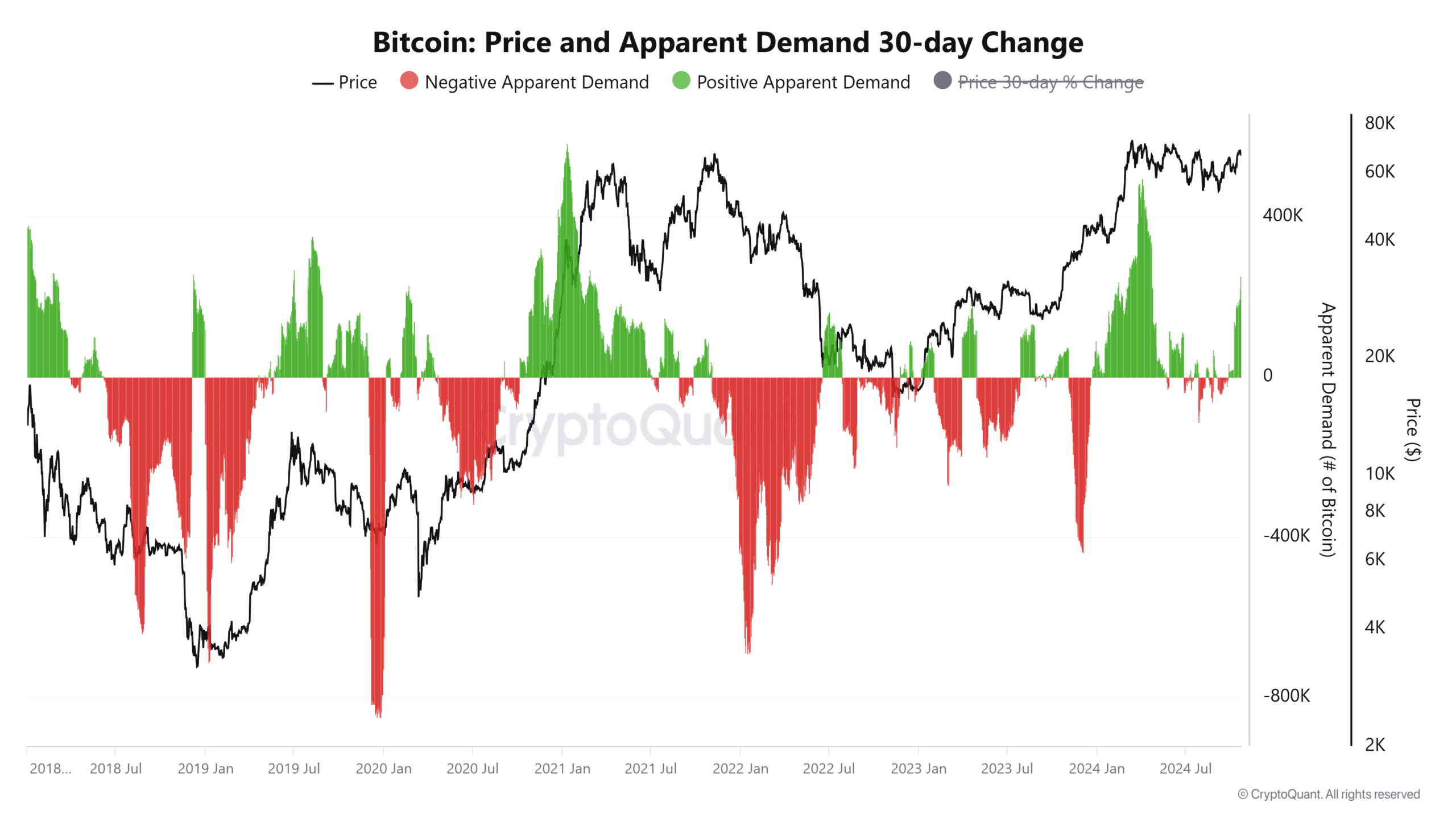

AMBCrypto analyzed Bitcoin’s price and apparent demand changes to understand the market’s response better, as visualized in the accompanying chart.

Bitcoin’s price and apparent demand: A detailed look

The chart illustrated Bitcoin’s price trajectory alongside 30-day changes in apparent demand. During the days surrounding the Executive Order, Bitcoin’s price saw heightened volatility.

The initial announcement spurred a slight uptick, reflecting market optimism. However, the price retraced as traders digested the long-term implications of potential regulatory oversight.

Source: CryptoQuant

At the same time, a sharp hike in positive apparent demand coincided with the order’s release. This trend hinted at heightened buying interest, likely driven by renewed confidence among investors that clearer regulations could attract institutional capital.

However, the chart also revealed periods of negative apparent demand, reflecting profit-taking and uncertainty among retail investors. These fluctuations highlighted the delicate balance between optimism for regulatory clarity and apprehension over tighter controls.

Implications for the cryptocurrency ecosystem

Trump’s Executive Order on cryptocurrency could mark a pivotal shift for the industry. By prioritizing stablecoin development and opposing CBDCs, the order seeks to safeguard U.S. economic interests while enabling blockchain innovation. However, the market’s mixed reaction signals the need for more detailed implementation plans to address investor concerns.

For Bitcoin, the Executive Order reinforces its role as a barometer of market sentiment. Its price movements and demand dynamics underlined the cryptocurrency’s sensitivity to policy changes, underscoring the importance of regulatory predictability for fostering long-term growth.