- Long-term holders have been selling as Bitcoin consolidated on the charts

- Bitcoin derivatives volume surged by 74%, signaling cautious optimism

Bitcoin’s recent rally past $109,000 has slowed down lately, with the cryptocurrency now consolidating just above $100,000. In fact, Bitcoin (BTC) was trading at $104,982 at press time, gaining by 2.18% in the last 24 hours and by 3.58% over the past week.

Its 24-hour trading volume was $104.8 billion, while the market cap stood at $2.08 trillion, according to Coingecko data.

Long-term holders see selling activity

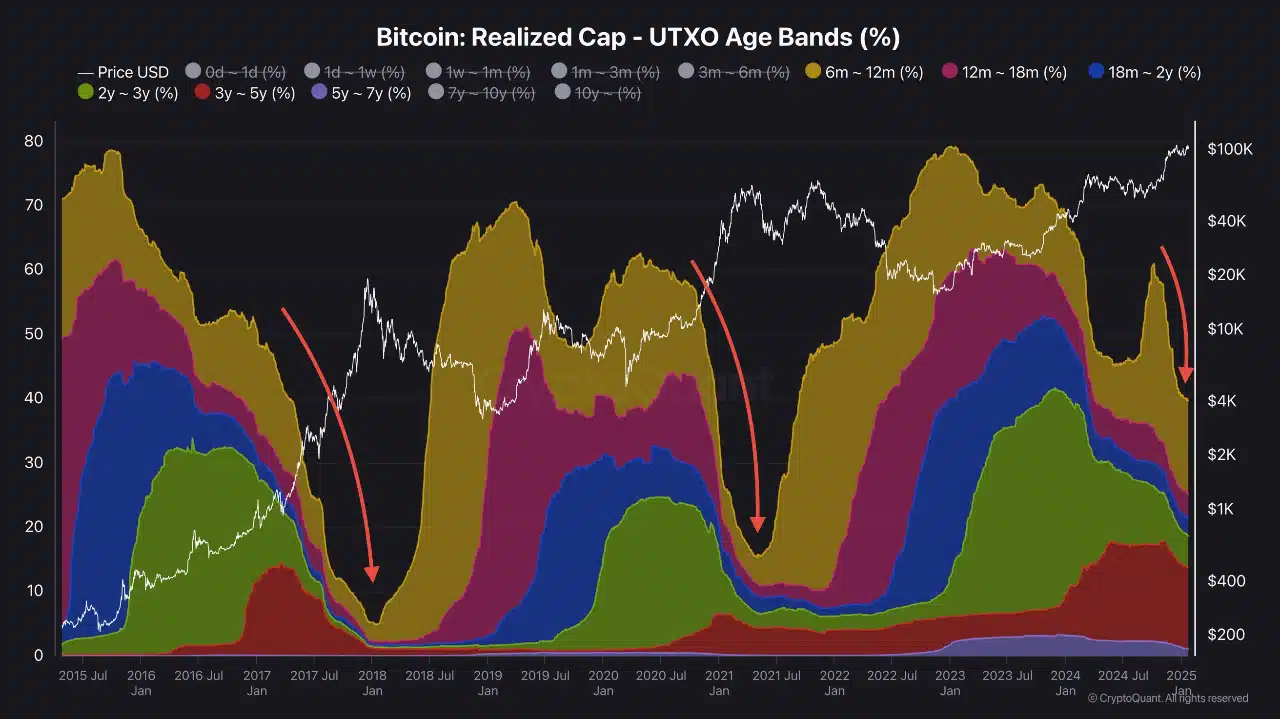

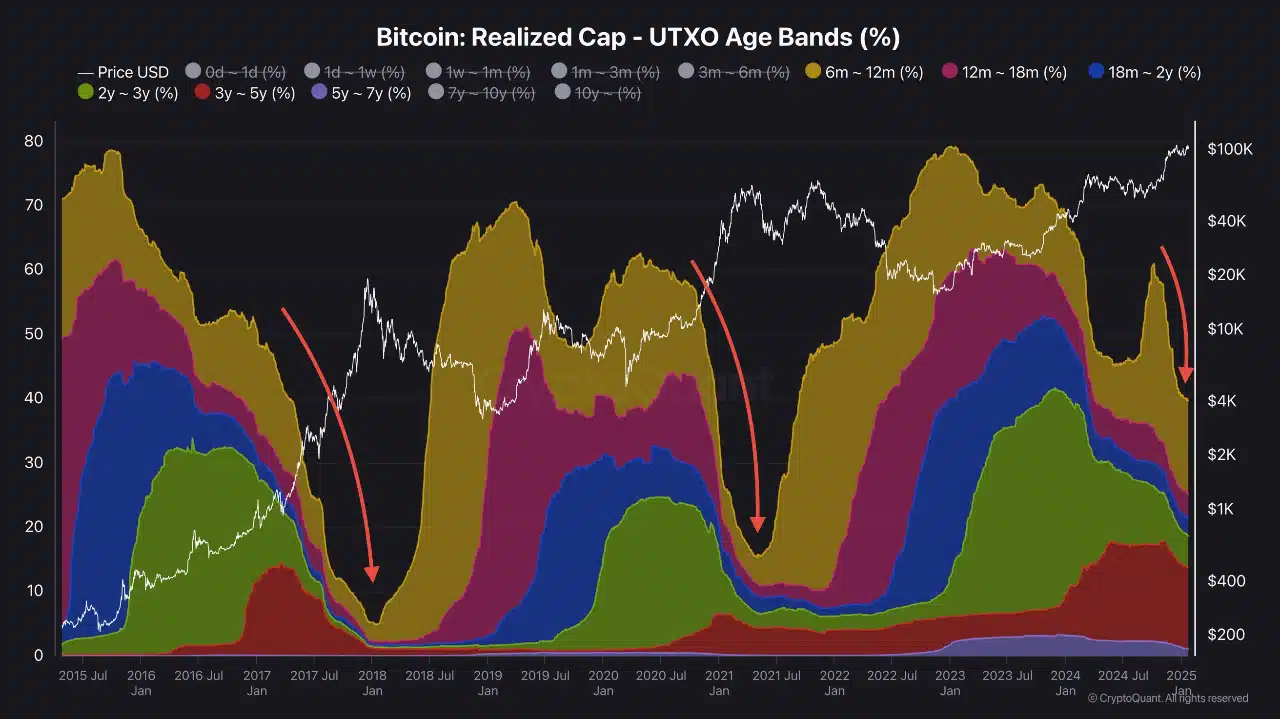

Long-term Bitcoin holders have started selling after months of holding through the correction period from March 2024, according to the SOPR (Spent Output Profit Ratio) data. During this period, these holders refrained from selling and accumulated Bitcoin.

However, as the price surged past $100,000, long-term holders resumed selling —A behavior previously seen during the 2021 bull market.

Source: CryptoQuant

Source: CryptoQuant

Short-term holders, on the other hand, continue to take profits more frequently. SOPR data for short-term holders revealed several instances where the ratio exceeded 1.02 – A sign of profitable selling.

However, SOPR values above 1.06, often seen during market cycle peaks, have not yet appeared. This means that there may still be room for additional price growth before short-term profits peak.

Despite the selling activity, UTXO data highlighted that long-term holders still retain substantial holdings. This seemed to support the notion that the ongoing cycle has not ended yet.

Source: CryptoQuant

Source: CryptoQuant

$97,530 identified as crucial support level

According to popular crypto analyst Ali’s latest tweet,

“The key support level to watch for Bitcoin is $97,530. Holding above this level is crucial to maintaining the current bullish momentum.”

Recent data from Glassnode confirmed that this price point aligns with high activity levels, making it a pivotal zone for price stability. Should Bitcoin lose the $97,530-level, it could retrace to $93,856 or $90,000. Especially since these are areas of strong historical activity.

On the upside, resistance is expected near $100,967–$105,118, as many holders may begin to take profits in this range.

Trading and derivatives activity shows market caution

According to Coinglass, Bitcoin’s trading volume surged by 73.27% to $172.56 billion, with Open Interest climbing by 1.19% to $68.52 billion. Options trading also saw greater activity, with a 74.28% hike in volume to $6.61 billion and Open Interest increasing by 3.95% to $40.62 billion.

Meanwhile, funding rates have steadily declined, with the OI-weighted funding rate at 0.0038% on 24 January, 2025.

This hinted at reduced leverage in the derivatives market, reflecting cautious sentiment among traders.

Hashrate shows sustained strength

Finally, Bitcoin’s hashrate was at 746.7 EH/s at press time, reflecting consistent growth in network security and miner activity.

While not at its all-time high, this elevated level demonstrated strong miner confidence and sustained investment in mining infrastructure, aligning with Bitcoin’s press time price of $104,994.

Source: CryptoQuant

As Bitcoin consolidates, traders and investors should closely watch key levels to determine the next move in the ongoing market cycle.