- Aptos achieves new ATHs in terms of TVL and stablecoins, confirming positive network growth.

- Assessing the potential for an APT bullish breakout as things get heated up in the derivatives segment.

The Aptos Network [APT] just concluded November with a surge in network activity. Most top blockchains pulled back or slowed down considerably in the last week of November.

Aptos sustained the momentum as has been the case in the last four weeks. This was evident by the recent new highs.

The network’s total value locked soared to a new ATH of $1.203 billion on 1st December. Its stablecoin marketcap also clocked a new historic high of $311.45 million.

Source: DeFiLlama

The new highs underscore the robust network activity that has been building up in the network in the second half of 2024. For context, Aptos TVL grew by over $400 million in November.

Also a considerable recovery by almost $1 billion from its lowest level in July at around $309.63 million. This was the network’s lowest TVL figure in the second half of 2024.

While these key metrics underpin the network’s robust performance, could they also signal what is to come for APT?

Is APT on the verge of a breakout from November resistance?

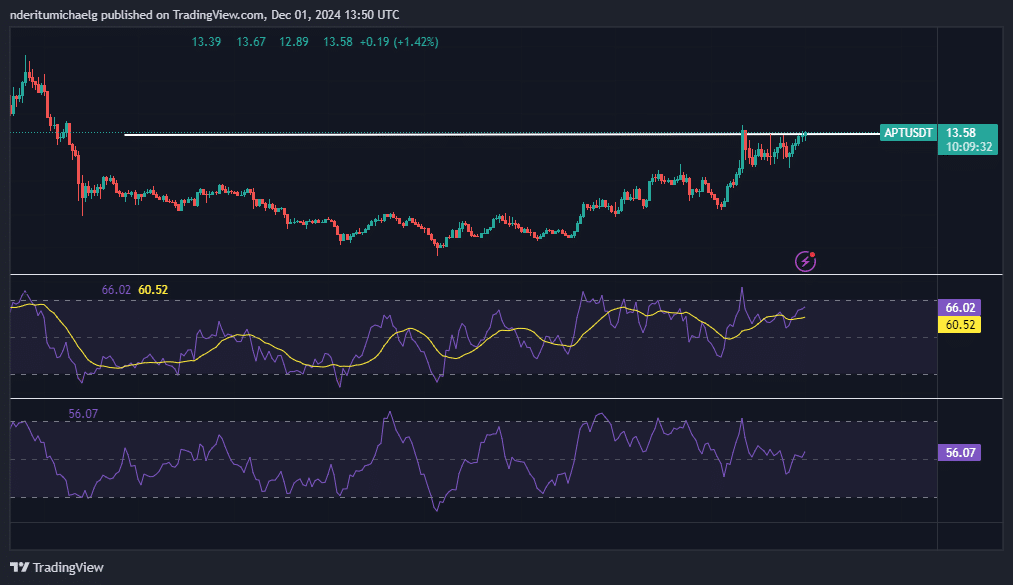

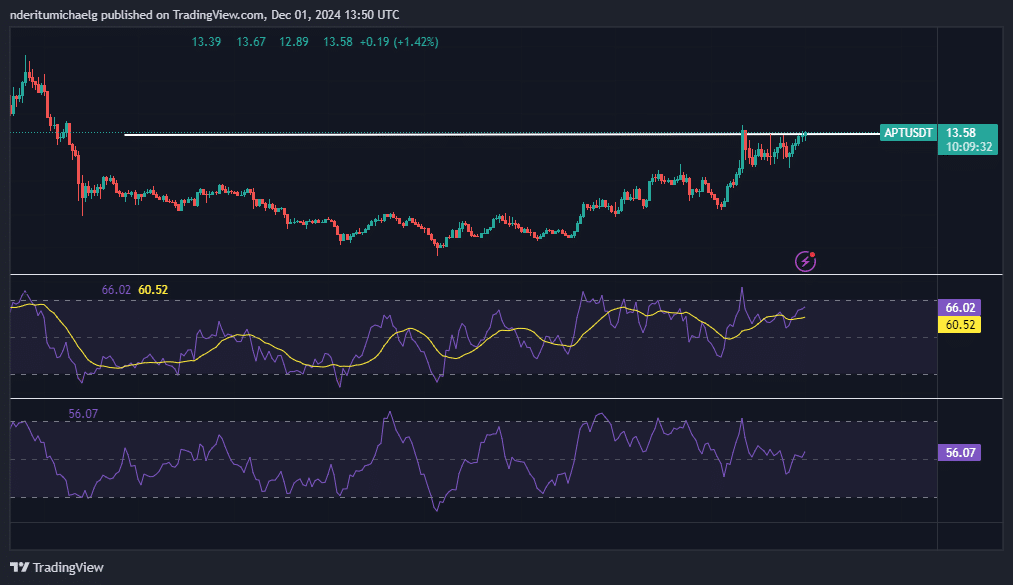

Aptos native crypto APT had a bullish start in November that appears to have been curtained in the middle of the month. It has since moved relatively sideways, with clear resistance forming in the $13 price zone.

The cryptocurrency has since struggled to overcome the resistance but could potentially do so this week. APT exchanged hands at $13.55 at the time of writing and was once again pushing up on the aforementioned resistance zone.

source: TradingView

APT’s RSI and MFI regained upside trajectory above their 50% levels. This signaled that bullish momentum was building up. It is possible that the recent Aptos TVL and stablecoin marketcap highs may boost investor confidence.

Such an outcome could potentially trigger a bullish extension well into the first week of December.

These observations were also complemented by a surge in open interest to $326.09 million at press time. However, it was still below the $359.26 million peak observed at the start of November.

Nevertheless, the open interest buildup signaled that momentum was building up in the derivatives segment.

Source: Coinglass

Read Aptos’ [APT] Price Prediction 2024–2025

Funding rates provided further directional clarity since open interest cuts both ways.

There was a noteworthy surge in positive funding rates for Aptos on most of the top exchanges, providing further clarification regarding the potential for a bullish breakout during the week.