- If the Shiba Inu’s price stays above $0.0000136, it could rise by 15% to reach the next resistance level at $0.000017.

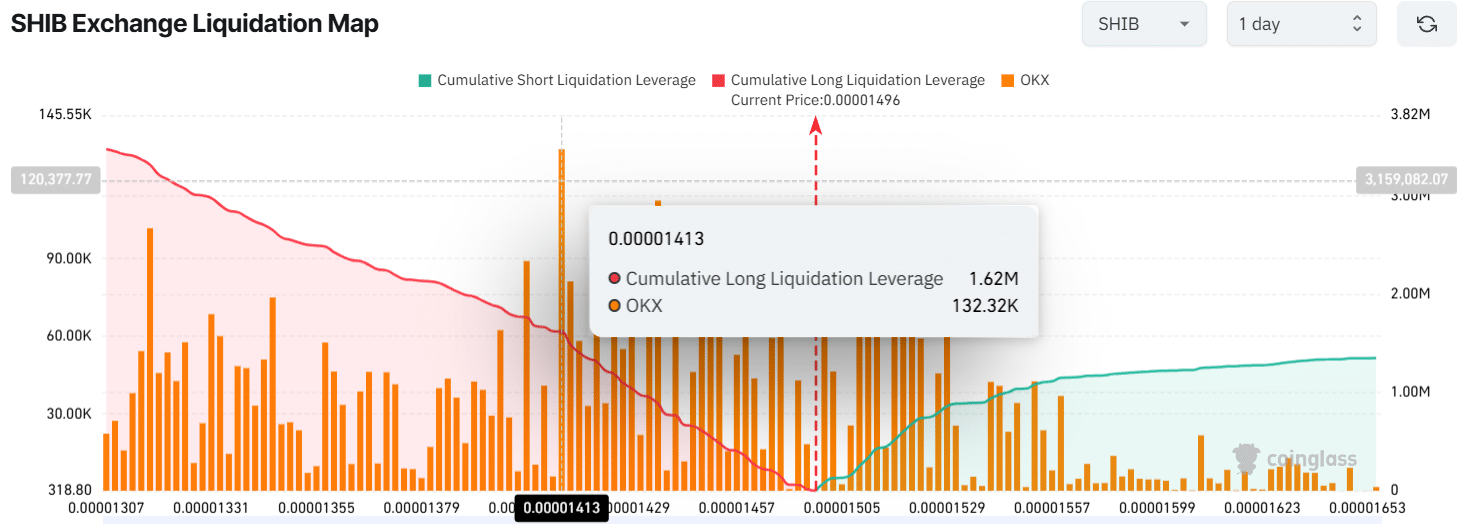

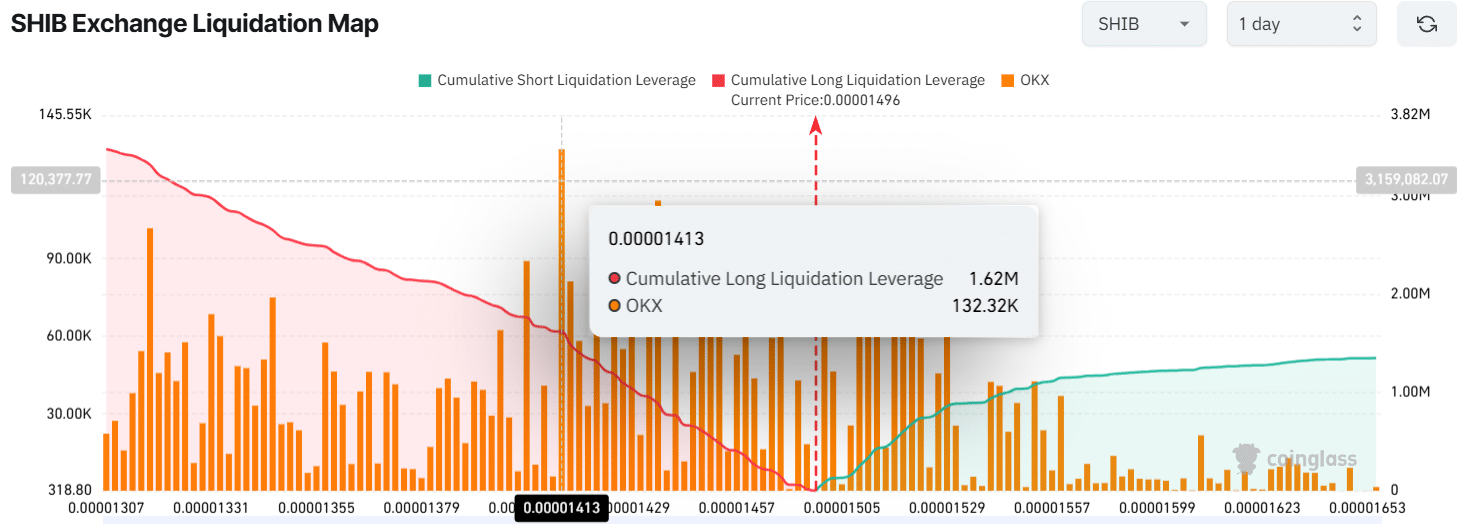

- Traders were over-leveraged at $0.00001413 on the lower side and $0.00001513 on the upper side.

Amid the ongoing market recovery, Shiba Inu [SHIB], the popular dog-themed memecoin, has stolen the spotlight from major assets with its impressive performance.

At the time of writing, the memecoin has surged over 10%, paving the way for further upside momentum.

Shiba Inu price action and upcoming levels

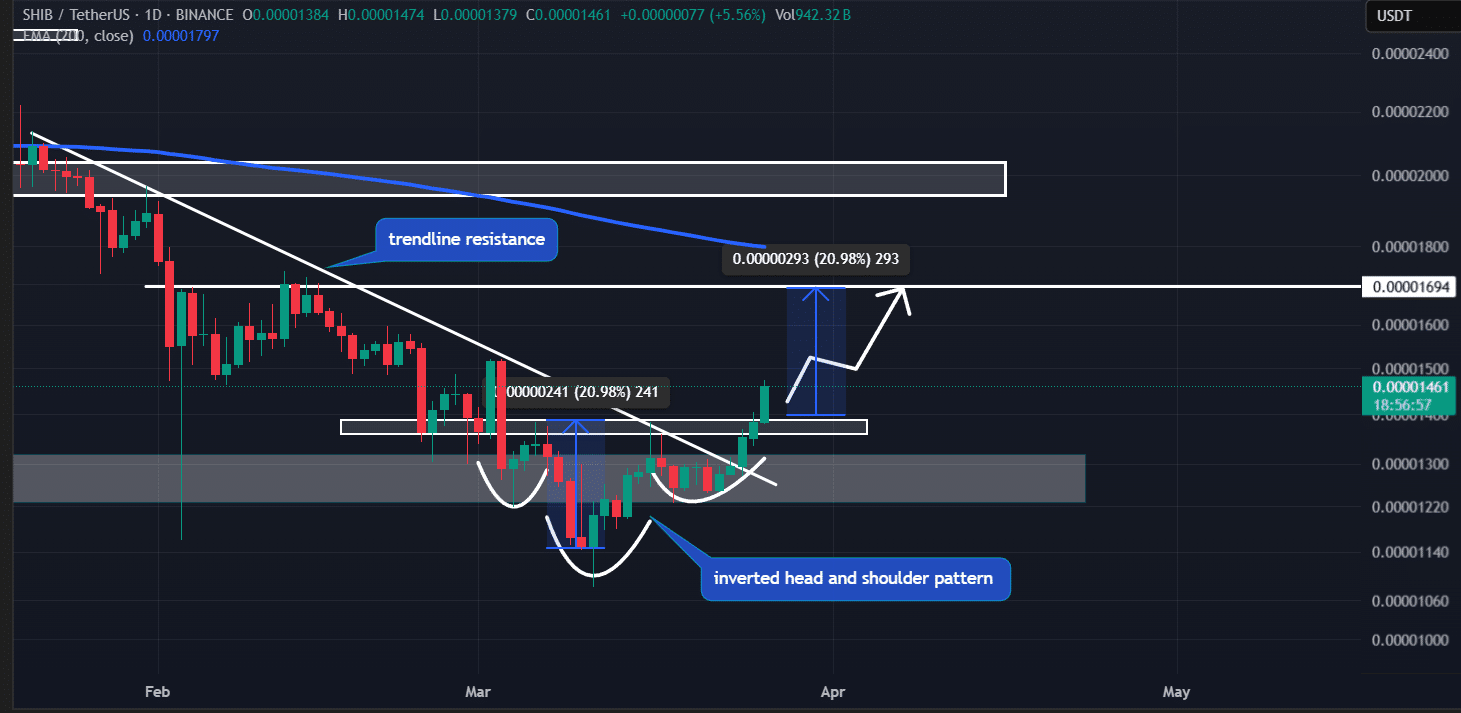

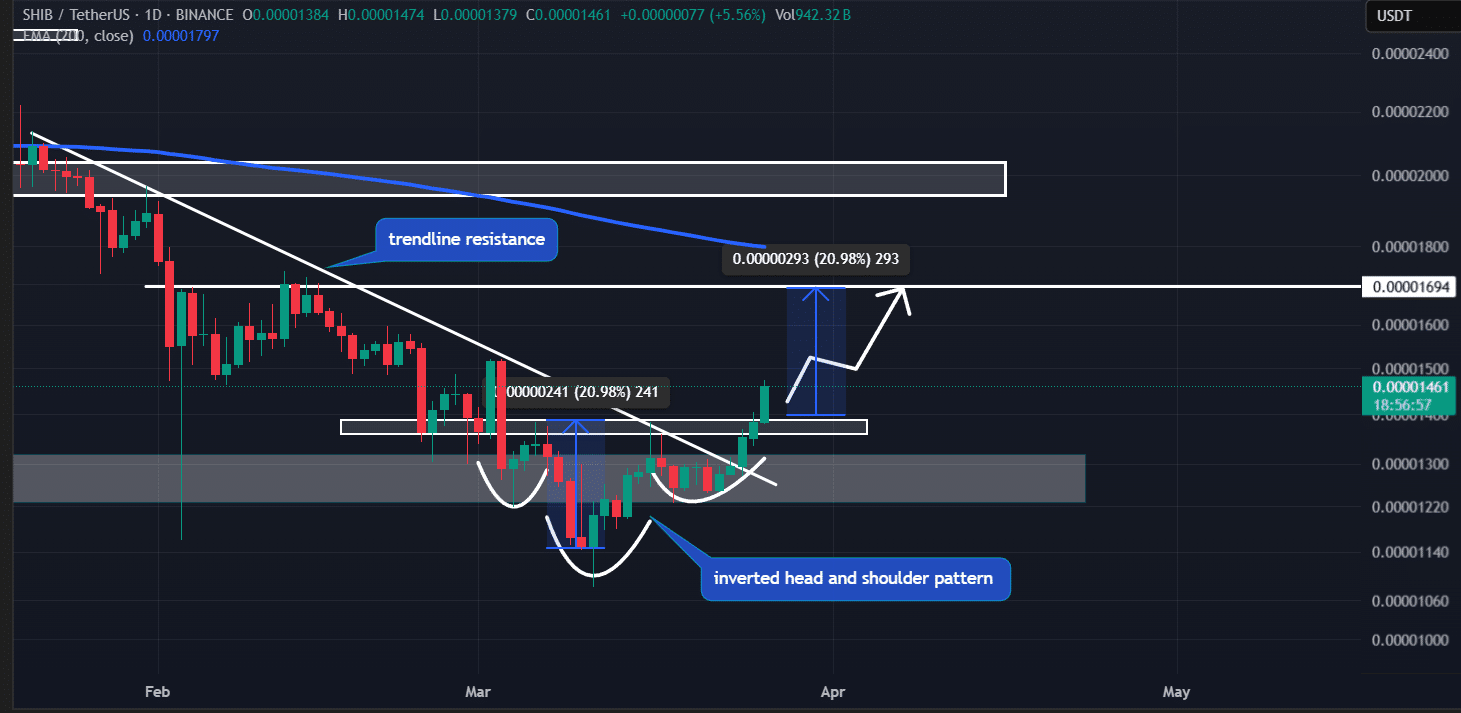

If you’re wondering why Shiba Inu’s price is rising, it began after breaking through a crucial resistance level and forming a bullish inverted head and shoulders pattern. As of now, SHIB remains bullish.

AMBCrypto’s analysis suggests that if SHIB stays above $0.0000136, it could potentially rise by 15% in the coming days.

This 15% increase matches the length of the head from the neckline and could push SHIB to the next resistance level at $0.000017.

Source: Tradingview

At press time, SHIB was trading near $0.0000149, recording a surge of over 10% in the last 24 hours. Its trading volume also rose by 45% during this period, highlighting increased trader and investor participation following the bullish breakout.

SHIB’s Relative Strength Index (RSI) was at 62, reflecting a strong bullish trend with room for growth. The memecoin remained below the overbought territory, suggesting further potential upside in the coming days.

Rising positive sentiment

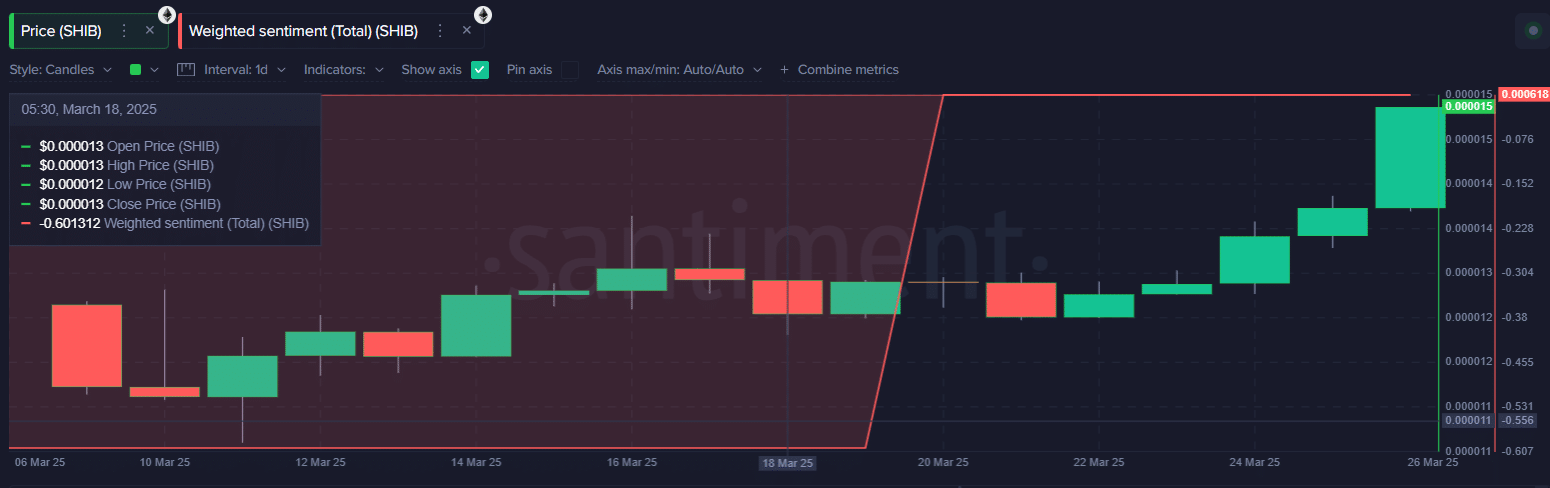

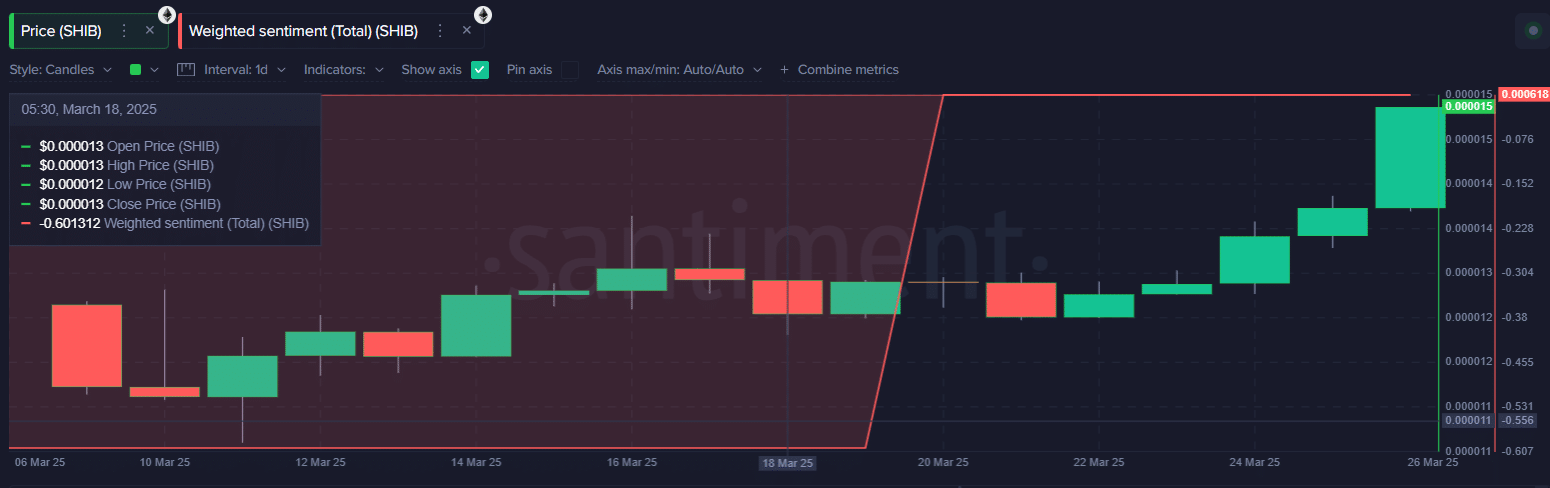

Shiba Inu’s bullish price movement is further reinforced by on-chain metrics.

According to data from Santiment, Shiba Inu’s overall weighted sentiment has shown a substantial recovery in recent days, rising from -0.601 to 0.00061.

This improvement reflects increasing optimism among traders and investors on social media, playing a key role in driving the price surge.

Source: Santiment

However, if the weighted sentiment continues to improve, Shiba Inu’s price could continue to experience an upward move.

Key liquidation levels

The bullish outlook is reinforced by intraday traders, who are heavily betting on the long side, according to Coinglass.

Data shows traders are over-leveraged at $0.00001413 on the lower side and $0.00001513 on the upper side. They have built $1.63 million in long positions and $430K in short positions at these respective levels.

This suggests that bulls currently have the upper hand in dominating the memecoin’s market activity.

Source: Coinglass