- BNB has seen a 13% increase in DEX volume, a development that has positively impacted its price action.

- The altcoin has outperformed both Solana and Ethereum in recent on-chain activity.

Binance Coin [BNB] has seen a 13% increase in decentralized exchange (DEX) volume, a development that has positively impacted its price action.

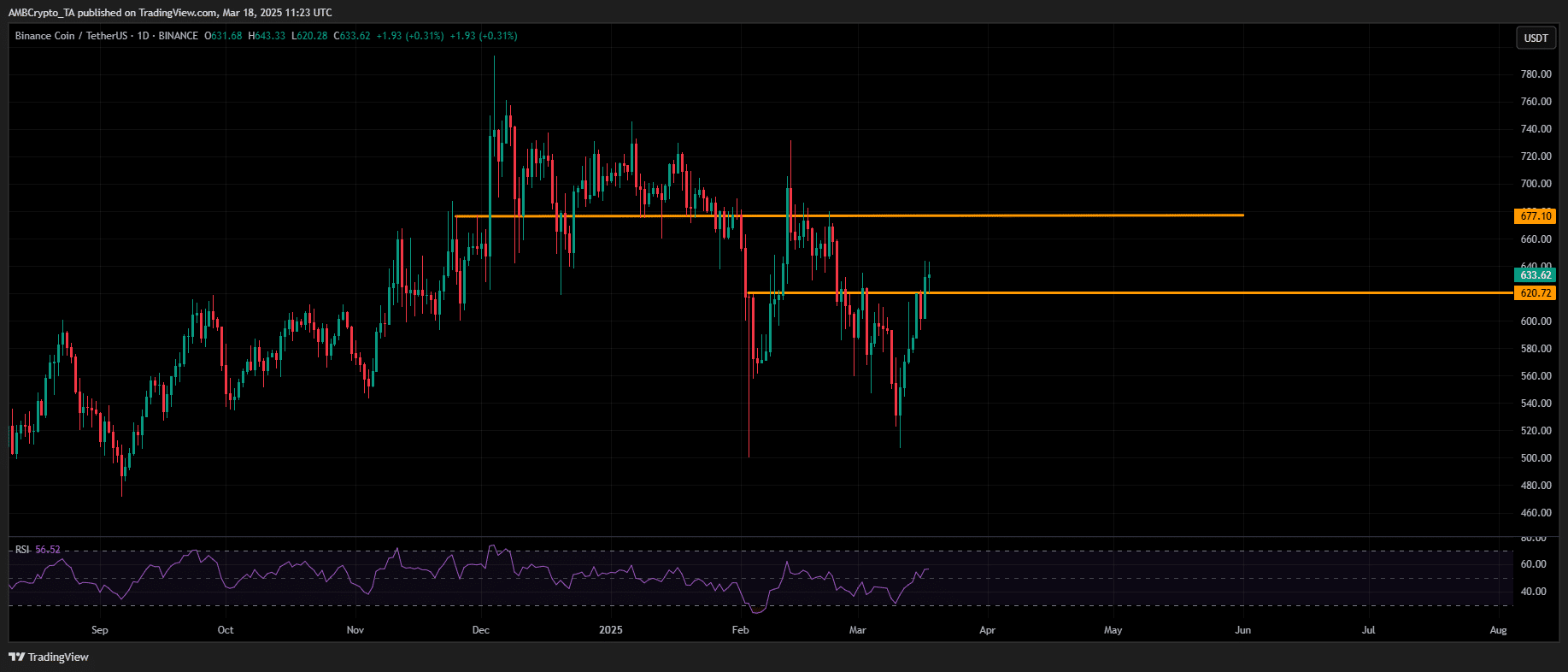

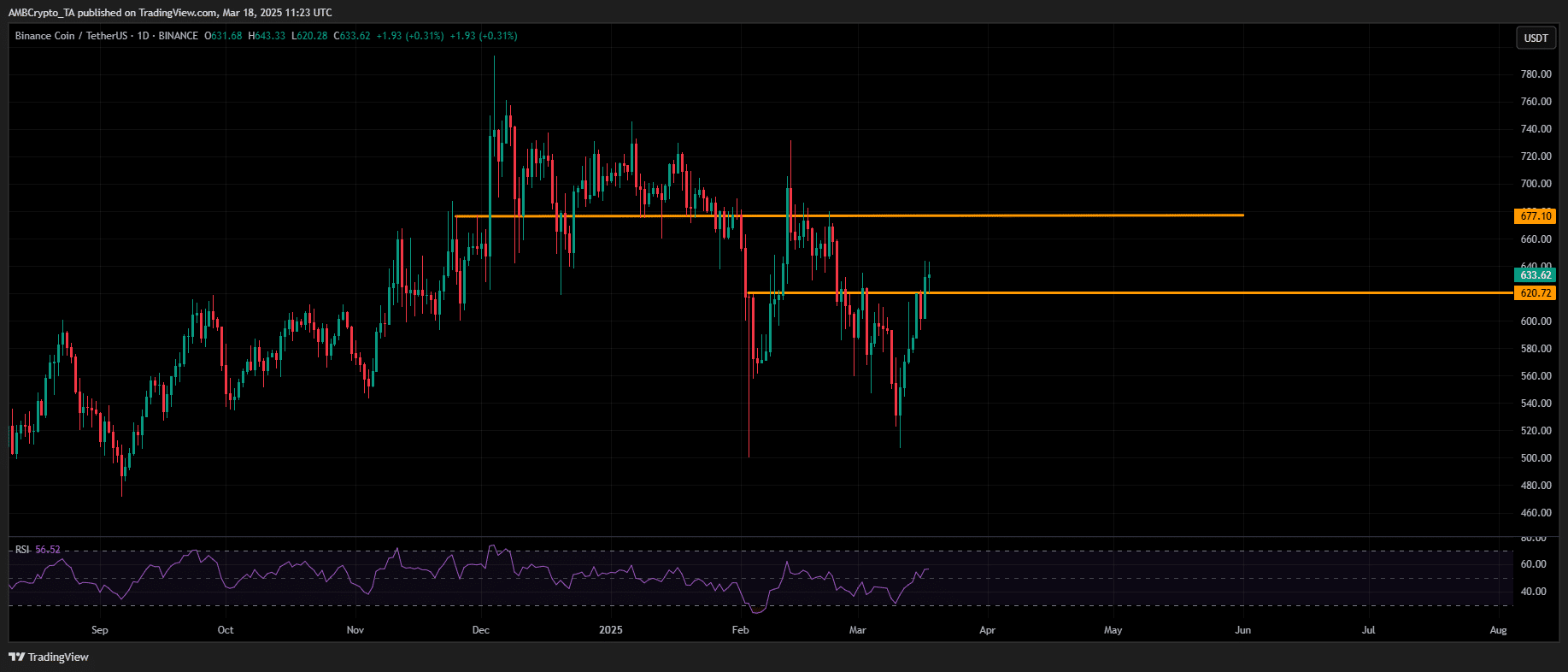

Over the past week, BNB has cleared three major resistance zones and is now approaching its early-February high of $640.

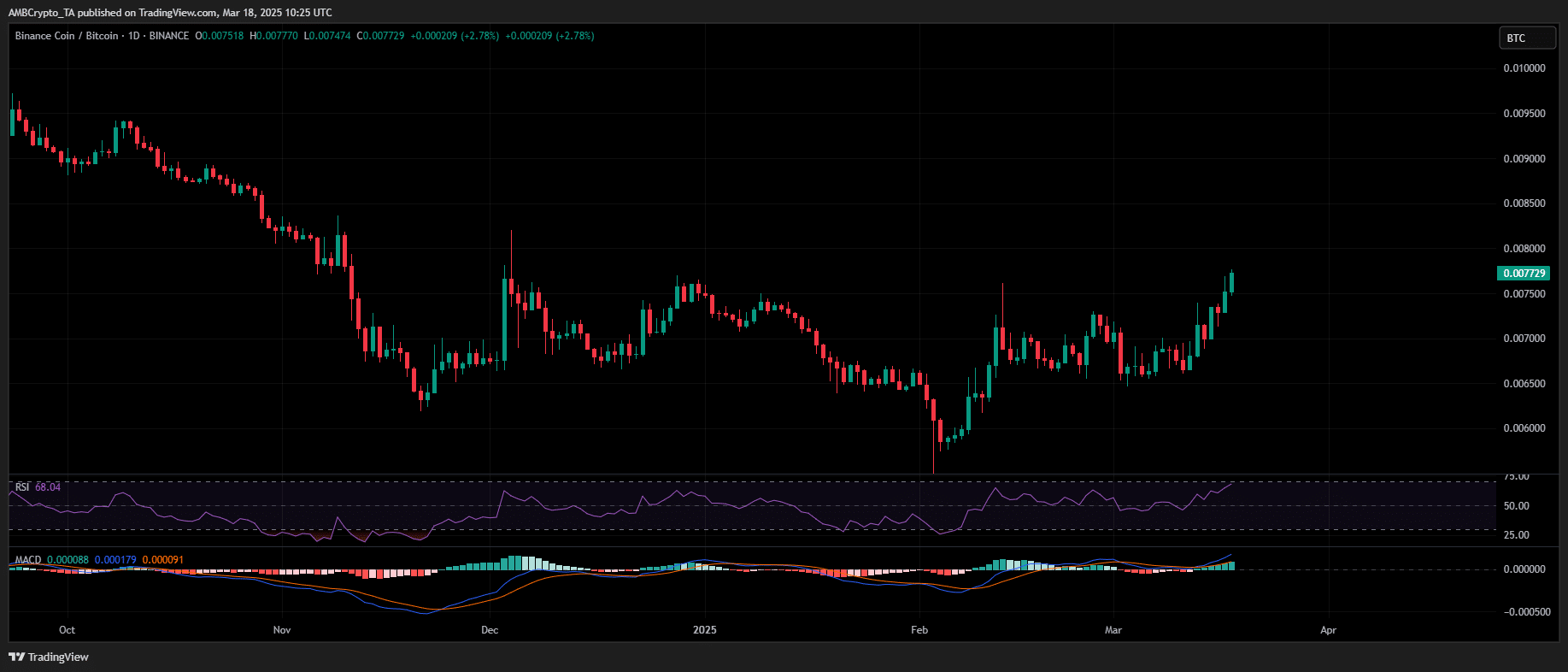

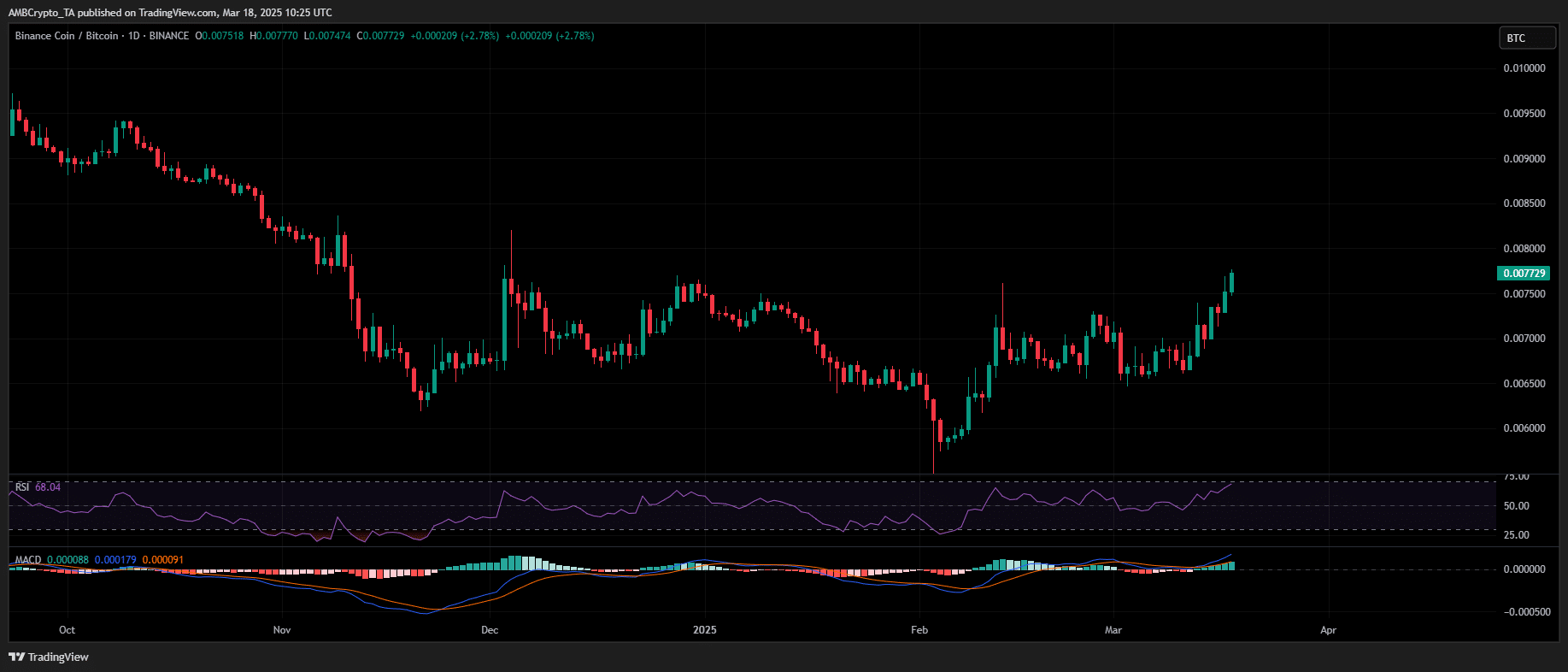

A 50% spike in trading volume confirms strong capital inflows, while the BNB/BTC pair has hit a yearly high, signaling growing relative strength against Bitcoin.

However, with RSI nearing the overbought territory, traders should monitor potential exhaustion signals for a possible short-term cooldown.

Source: TradingView (BNB/BTC)

Notably, unlike Solana and Ethereum – both posting two-year lows against Bitcoin – BNB has gained dominance.

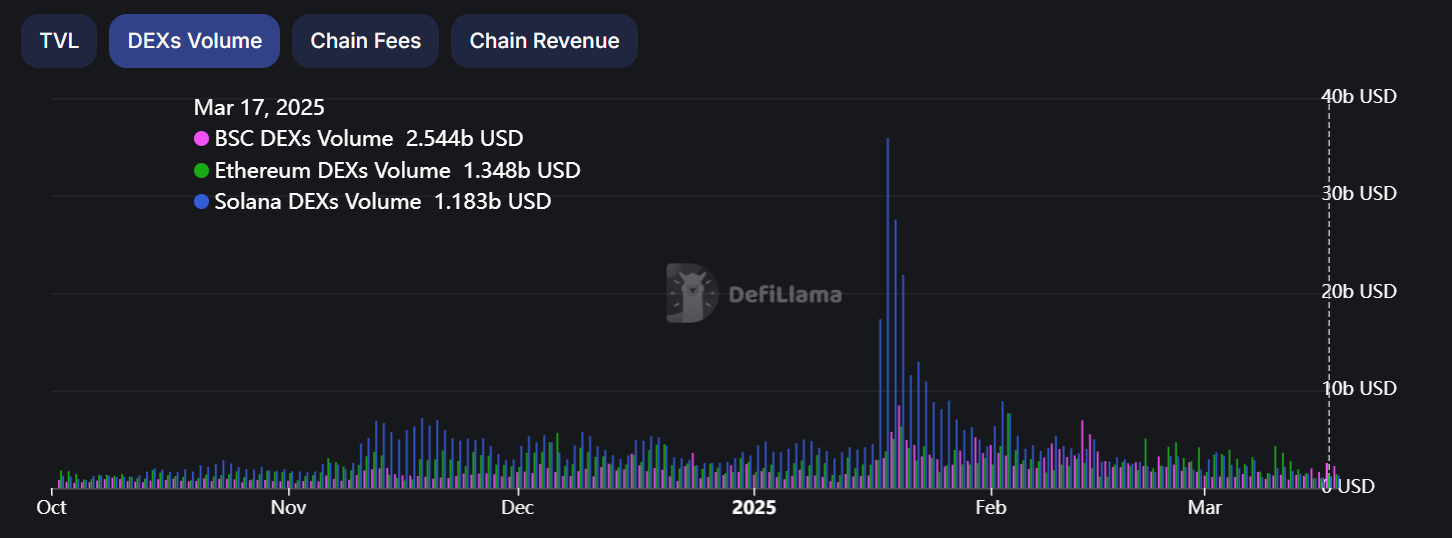

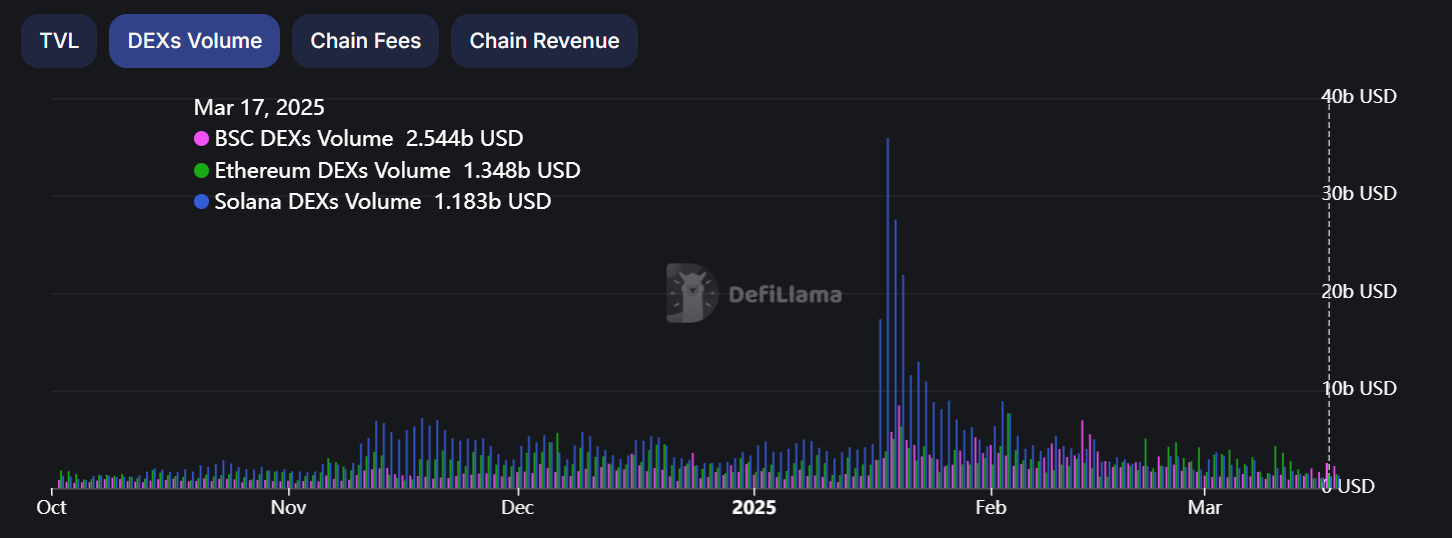

This divergence is reflected in DEX volume, where Binance Smart Chain [BSC] saw $2.544 billion (up 13%), while Solana and Ethereum recorded 20% declines, dropping to $1.183 billion and $1.348 billion, respectively.

Source: DefiLlama

Interestingly, the shift extends beyond trading volume. While Solana’s Total Value Locked (TVL) has dropped to pre-election levels of $8.66 billion due to de-staking, Binance’s DeFi ecosystem has seen steady growth, with TVL rising to $6.53 billion.

With BNB outpacing high-cap rivals in DEX volume and staking activity, is a return to its $100 billion market cap now within reach?

BNB’s path to reclaiming a $100 billion market cap

A breakout above $700 could help BNB regain its $100 billion market cap status. Strong capital inflows and a bullish structure support a near-term move toward $670, assuming market conditions remain stable.

However, at press time, the RSI indicated that BNB was approaching overbought levels, increasing the risk of profit-taking.

If buyers maintain momentum, $670 could turn into a support level, enabling further gains.

Source: TradingView (BNB/USDT)

Otherwise, a retracement to $620 or even $600 may be on the cards before another breakout attempt.