- The stablecoin ratio channel indicates a potential buying opportunity for Bitcoin and altcoins.

- Rising stablecoin market cap suggests liquidity buildup, hinting at possible bullish momentum ahead.

The stablecoin ratio channel is signaling a potential market shift, hinting at a buying opportunity for Bitcoin [BTC] and altcoins.

An increase in stablecoin market caps often marks an accumulation phase, as investors move funds from risk assets to stablecoins, waiting for optimal entry points.

Historically, when this ratio reaches critical levels, it has preceded significant price movements, suggesting that the market may be preparing for a new trend.

An uptrend on the horizon?

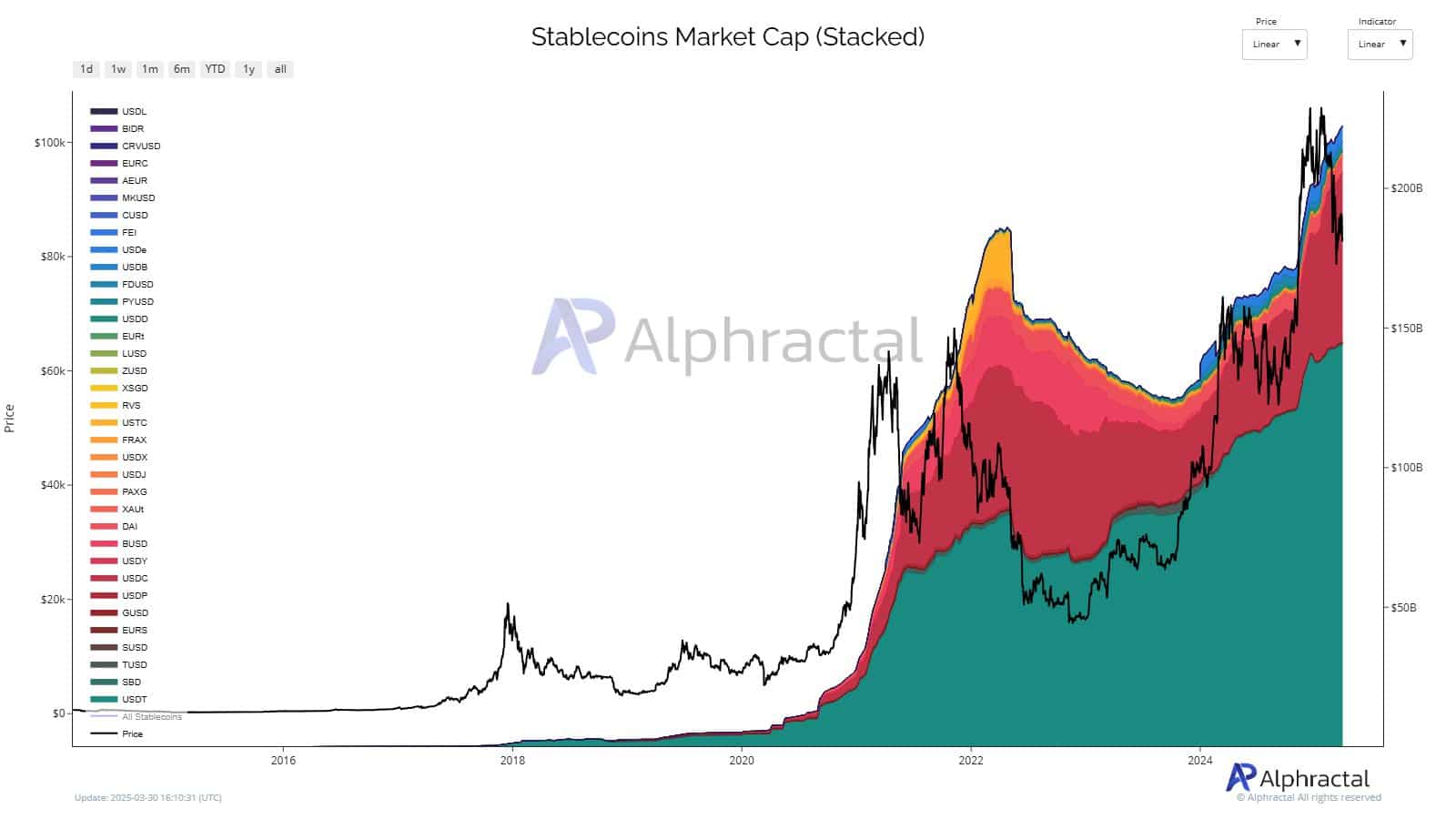

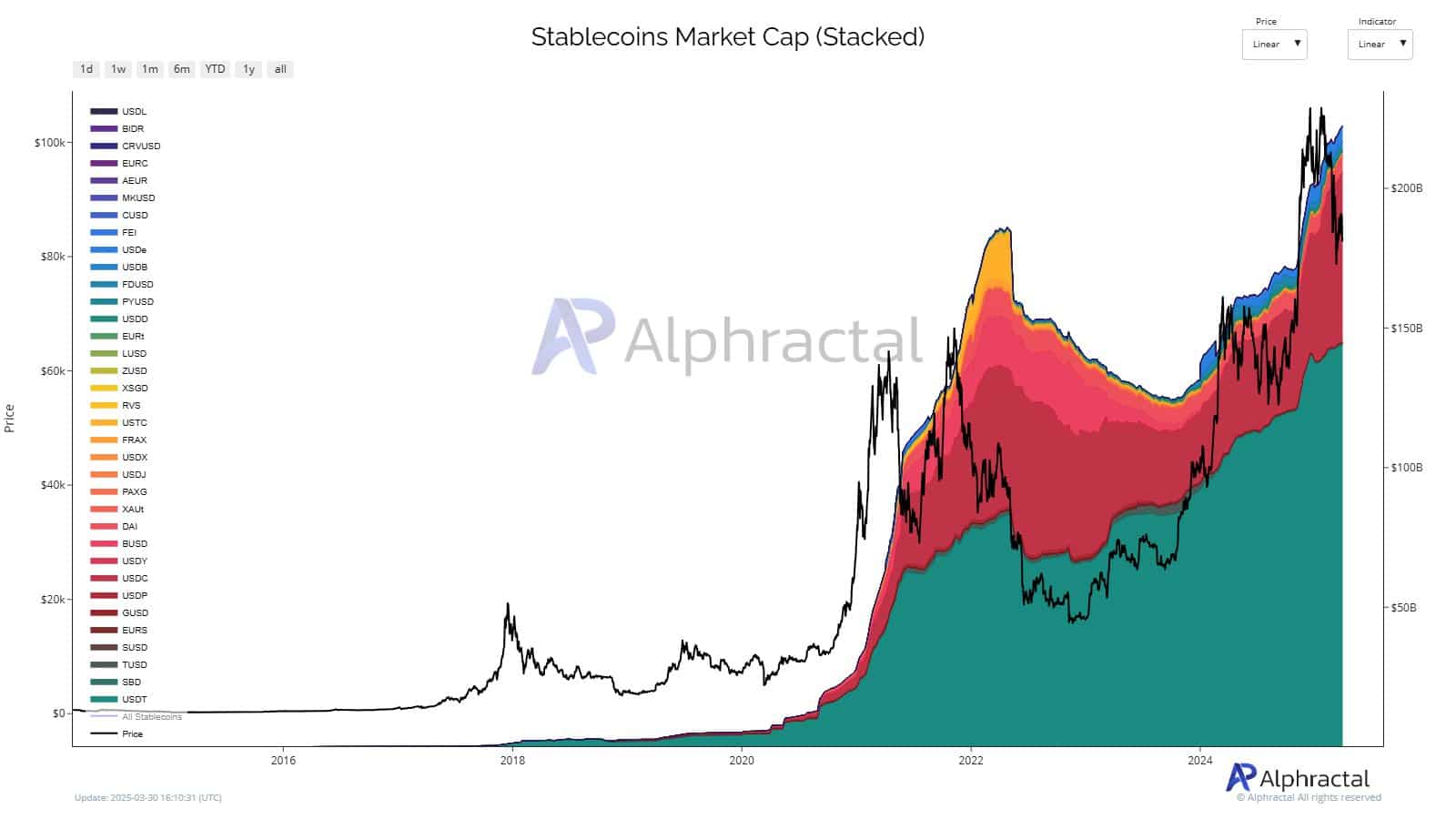

Source: Alphractal

The stablecoins market cap chart reveals a cyclical pattern where stablecoin supply tends to expand during bearish phases and contract when the market turns bullish.

Currently, the surge in stablecoin market cap suggests increased liquidity, indicating that investors may be accumulating stable assets while waiting for an optimal re-entry into Bitcoin and altcoins.

Historically, such expansions have often preceded notable price rallies.

Source: Alphractal

Meanwhile, the stablecoin ratio channel chart shows the indicator reaching a historically significant accumulation zone.

Previous cycles suggest that when the ratio hits this level, it often signals a bullish shift in Bitcoin’s price movement.

The recent drop near the oversold region indicates that the market could be entering an accumulation phase, hinting at potential upward momentum ahead.