- Whales have continued selling, and large derivative traders face massive liquidation losses if ETH drops.

- Massive supply ahead of ETH and selling pressure threaten to push the asset’s price lower.

Recent market activity hasn’t favored Ethereum [ETH]. In the past week alone, it declined by 12.75%, with the possibility of a further drop looming as market sentiment turns increasingly bearish.

AMBCrypto found that whale selling activity might not be the only catalyst for a market decline, as a potential liquidation cascade could cause a demand squeeze, sending ETH’s price plummeting.

Whales and potential liquidation could affect ETH

In the past 24 hours, ETH movements by traders controlling a notable supply—also known as whales—signal a potential sell-off.

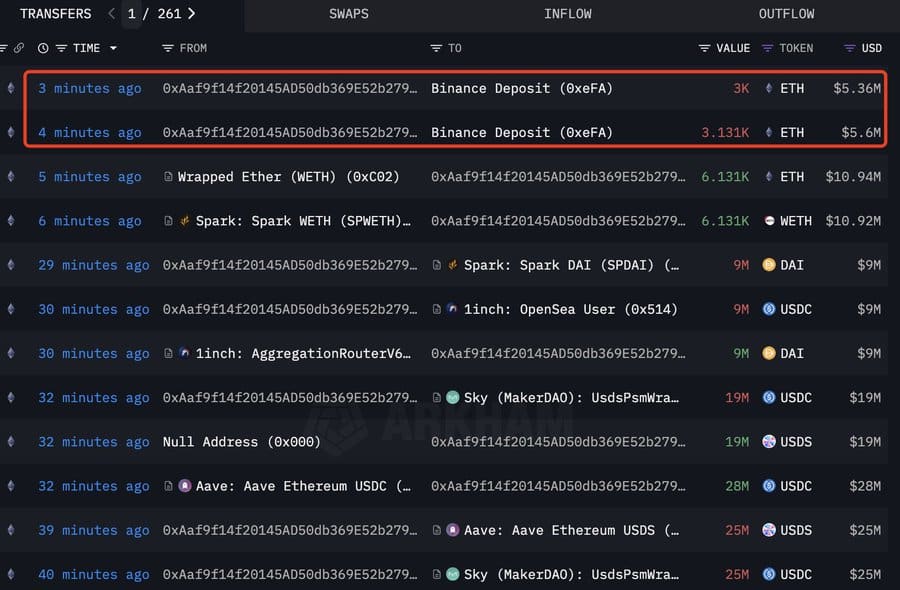

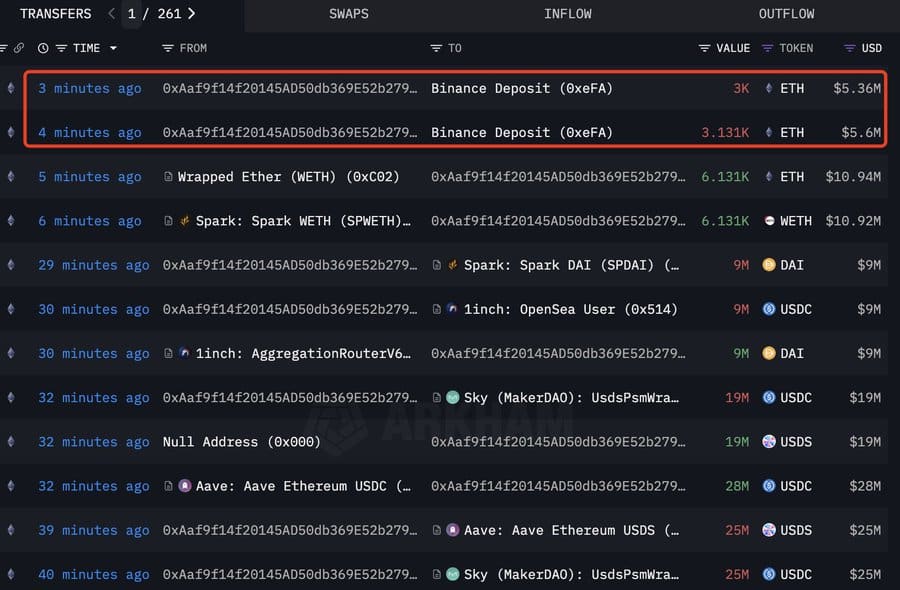

During this period, Lookonchain reported that a whale holding 6,131 ETH worth $10.94 million had moved their assets into Binance, a centralized cryptocurrency exchange.

Typically, when an asset is moved from a private wallet to a centralized one, it implies an intent to sell. If this selling begins in full force, ETH will likely experience a major price decline.

Source: Arkham Intelligence

Adding to ETH’s potential downside is a 125,603 ETH ($229 million) contract at risk of liquidation. Positions held by two whales on Maker would be forcefully closed if ETH reaches $1,787.75 and $1,701.54, respectively.

If this happens, it could ignite fear in the market, influencing derivative traders to open more short positions while spot traders sell their ETH to avoid a downward spiral, further exacerbating the demand squeeze.

Bearish sentiment would prevail

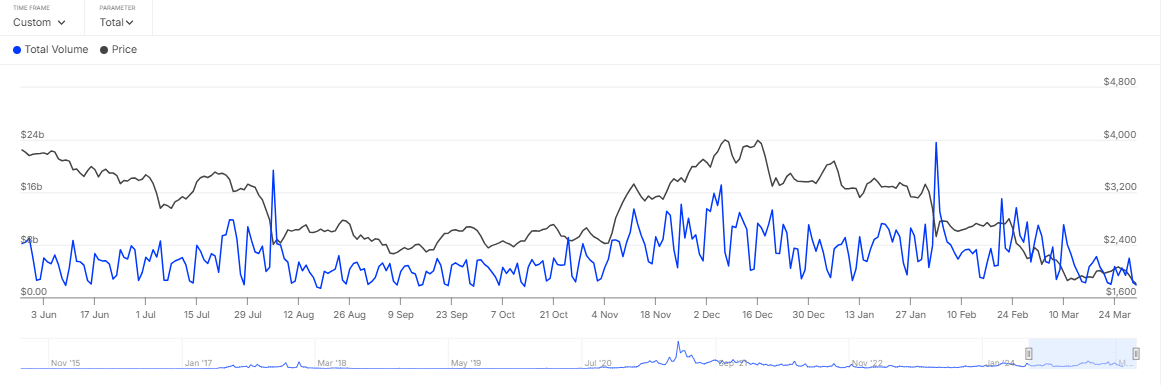

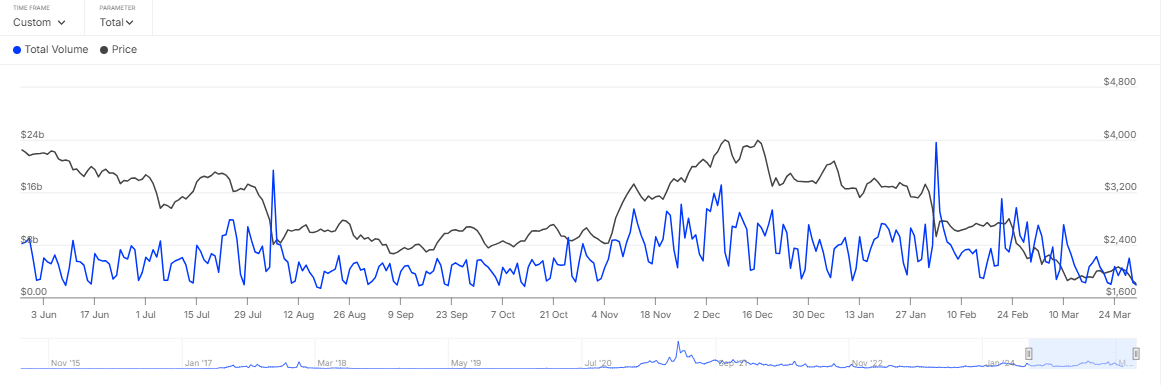

In the past 24 hours, there’s been significant transaction activity among large traders—defined as those who trade between 0.1% and 1% of the total asset supply.

Source: IntoTheBlock

According to IntoTheBlock data, these large traders have transacted approximately $1.87 billion worth of ETH. This movement is likely dominated by whale sellers, as ETH’s price dropped 1.85% over the same period.

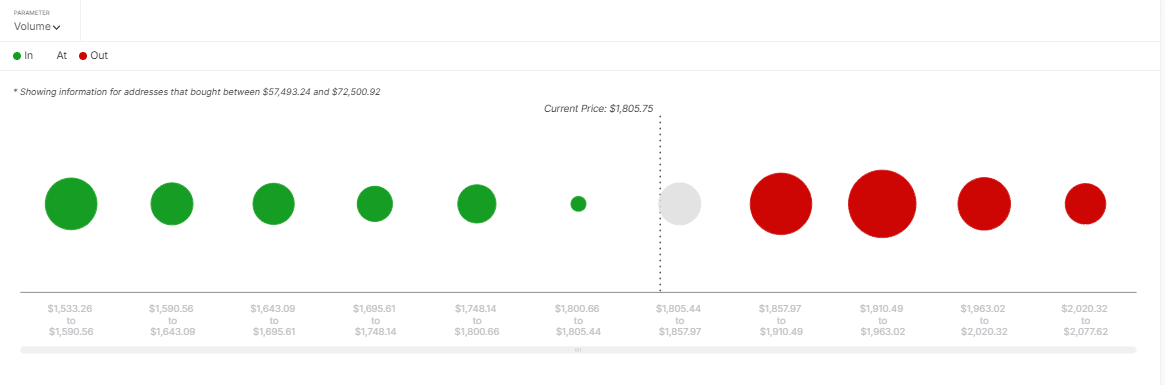

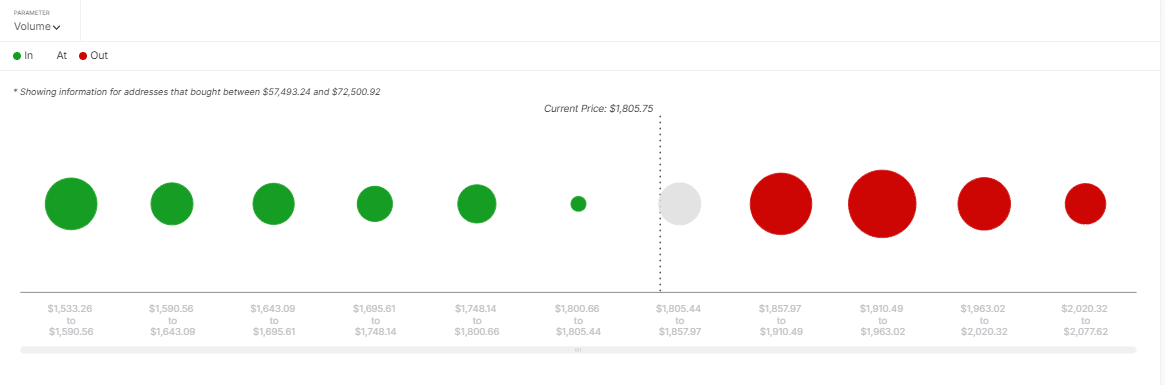

AMBCrypto analyzed market possibilities should ETH rally instead of continuing its bearish trend. Using the In/Out of the Money Around Price metric, the analysis shows ETH would face massive resistance moving upward.

Between $1,857.97 and $1,963.02, a total of 7.89 million ETH sell orders from 5.82 million addresses potentially exist at this level, which could restrict upward movement or even force the price lower.

Source: IntoTheBlock

For now, transaction volume in the market has continued declining. The amount of ETH traded in the past 24 hours keeps dropping, reflecting a lack of interest and willingness to trade the asset.

Currently, with 614,000 ETH being traded, a spike in token transfers—while price and sentiment remain bearish—suggests more traders are selling than before, further adding to the decline.

With more datasets presenting bearish scenarios than bullish ones, ETH’s downside risk remains higher than its chances of an upward move.