- Bitcoin is experiencing an increase in institutional demand.

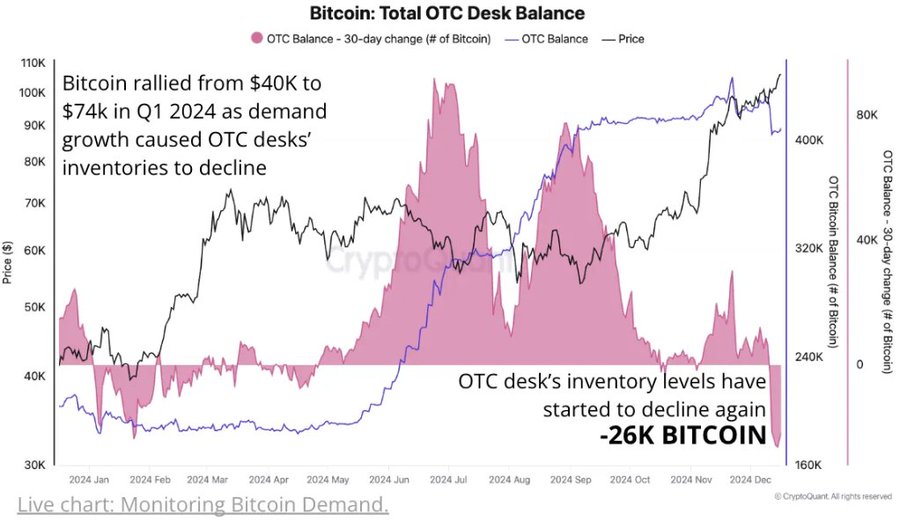

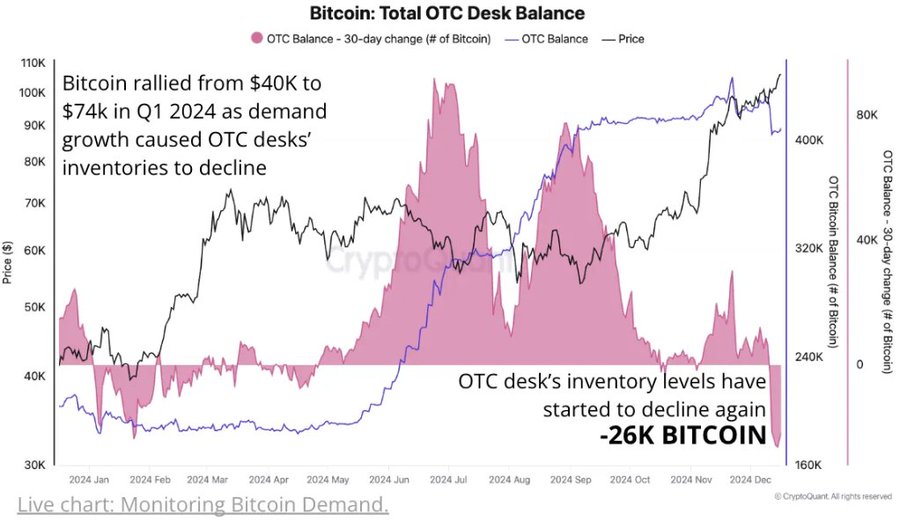

- OTC desks see their largest monthly inventory decline for 2024 dropping by 26k BTC.

After declining to a 2-week low of $92,118 in the past day, Bitcoin’s [BTC] has shown resilience and made a considerable recovery.

BTC has recovered from the market crash, reaching a high of $98,125. However, it has experienced a slight pullback. At the time of writing, Bitcoin was trading at $98,086, marking a 1.25% increase over the past day.

This market strength is largely credited to the increased demand BTC is experiencing, especially among institutions, according to Cryptoquant analysis.

Rising institutional demand for Bitcoin

In their analysis, Cryptoquant observed that Bitcoin demand is surging. According to them, OTC desks are experiencing their largest monthly inventory decline of 2024. This is currently down by 26k BTC tokens for this month alone.

Source: CryptoQuant

Since the 20th of November 2024, Bitcoin’s supply has declined by 40k BTC, signaling continued supply tightening.

The significant drop in supply indicates increased institutional demand for Bitcoin. Current market conditions position Bitcoin for a potential supply squeeze.

When Bitcoin’s supply decreases and demand continues to increase, the price typically rises. Limited supply, coupled with growing demand, drives prices up.

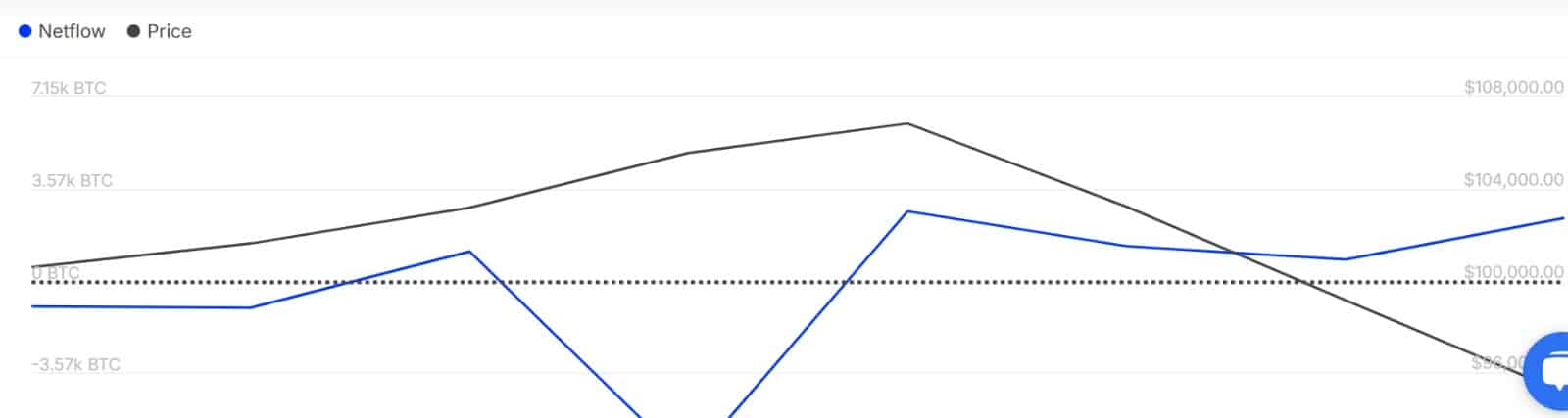

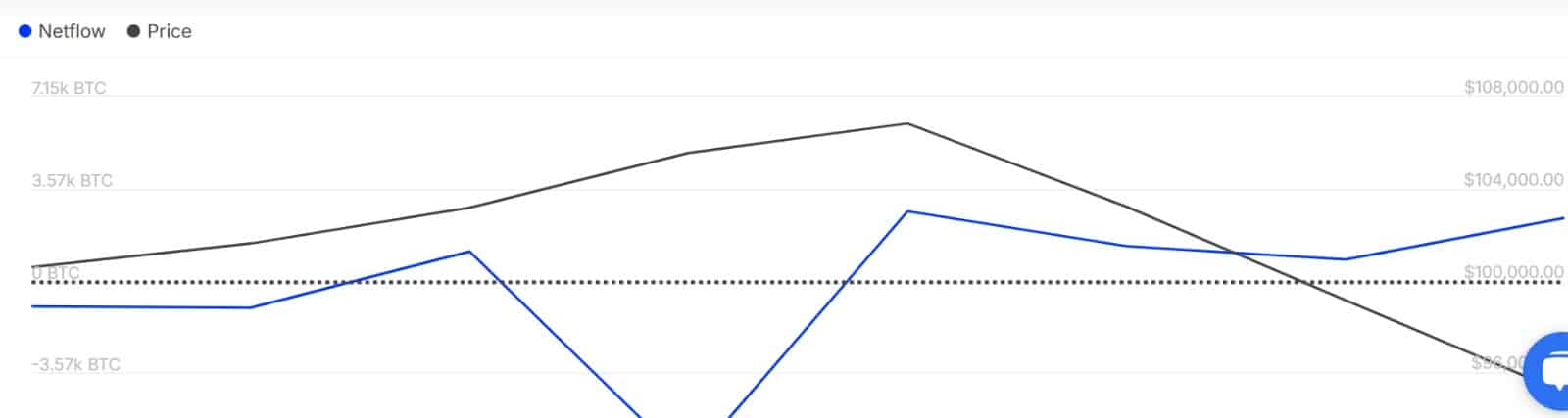

Source: IntoTheBlock

AMBCrypto observed this demand among large holders through the rising large holder netflow. It has surged from -7.15k to 2.44k over the past week, signaling increased capital inflow from large holders into BTC.

These increased purchases from institutions could reduce supply, thus causing upward pressure on prices.

What do BTC’s charts say

While the analysis provided above offers a promising outlook for BTC, it’s essential to counter-check other market indicators and determine what they suggest.

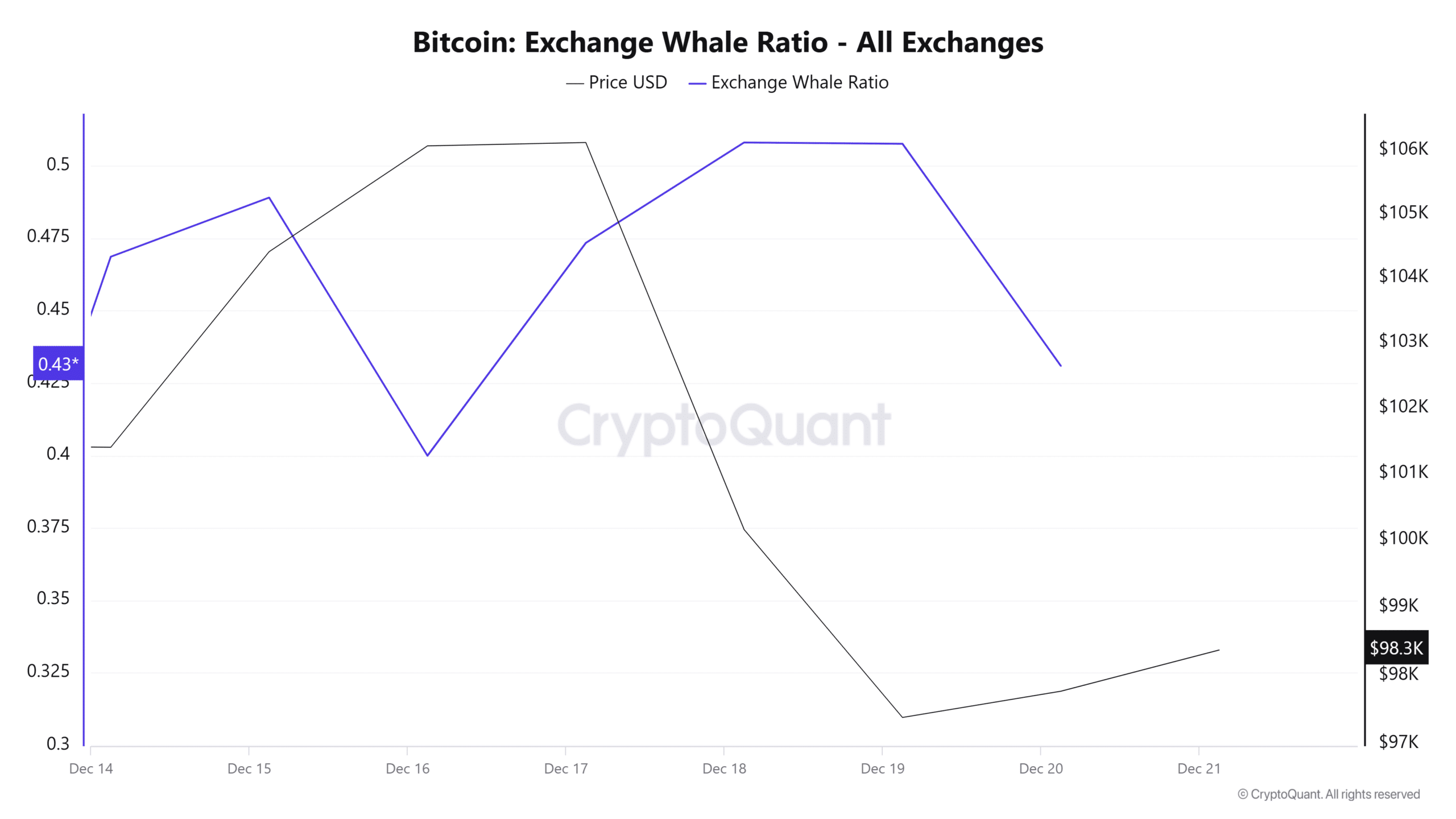

Source: CryptoQuant

For starters, Bitcoin’s exchange whale ratio has declined over the past three days, from 0.5 to 0.43. This drop suggests that large holders and institutional investors are accumulating BTC through OTC markets or private transactions, avoiding exchanges.

Such accumulation is a bullish signal as it reflects growing institutional confidence in Bitcoin’s long-term potential.

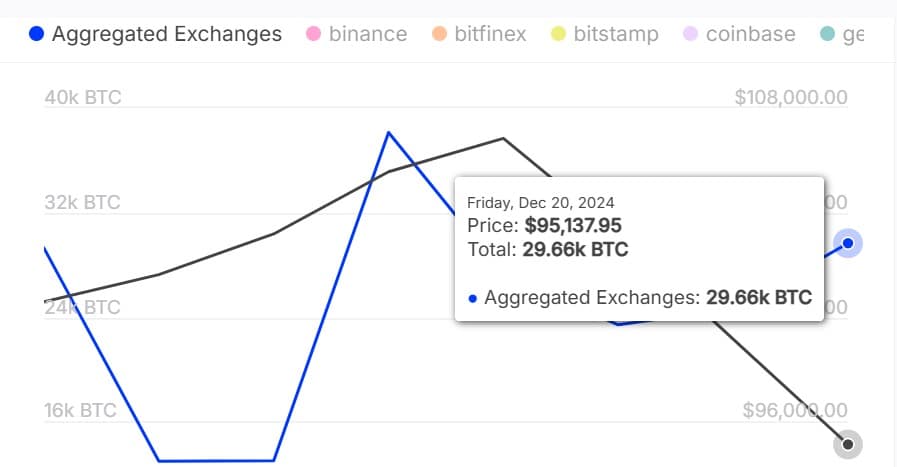

Source: IntoTheBlock

Additionally, Bitcoin’s outflow volume from aggregated exchanges has increased after the initial drop, rising from 23.2k to 29.66k over the past three days. When outflow from exchanges spikes, it reflects accumulation and holding behavior.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Simply put, BTC is experiencing significant demand among investors, which continues to increase upward pressure on BTC prices. If these sentiments hold, Bitcoin will reclaim the $99,206 resistance in the short term.

However, if sellers reenter the market, as witnessed in the past day, BTC will find support around $95,830.