- Profit-taking on Bitcoin has continued to shrink, as sellers in the market waned

- Market liquidity flows revealed that Bitcoin investors could be gaining confidence once again

As the cryptocurrency market gains ground, Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing. However, that’s not all as several concurrent developments seemed to hint that a rally may be brewing. Especially as signs of seller fatigue begin to surface.

Naturally, when comparing the prevailing market performance to past episodes of turbulence, the setup feels eerily familiar.

Seller exhaustion is nearing

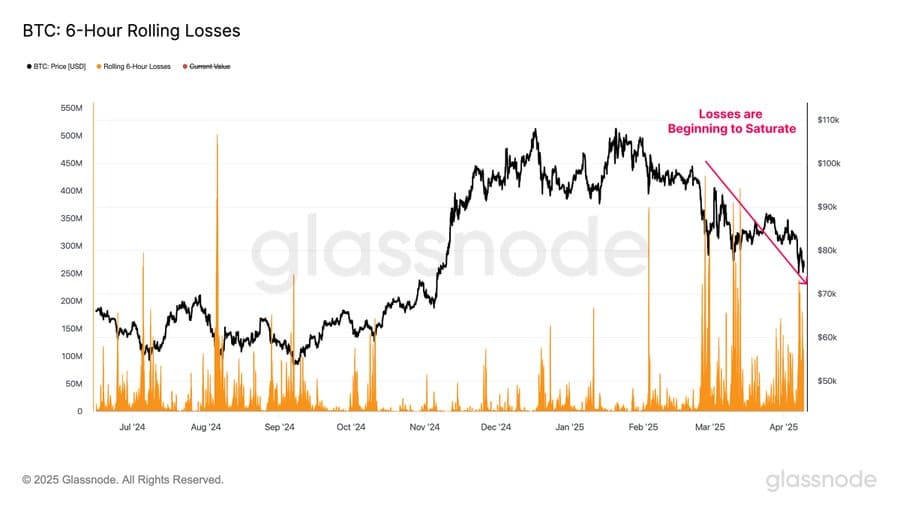

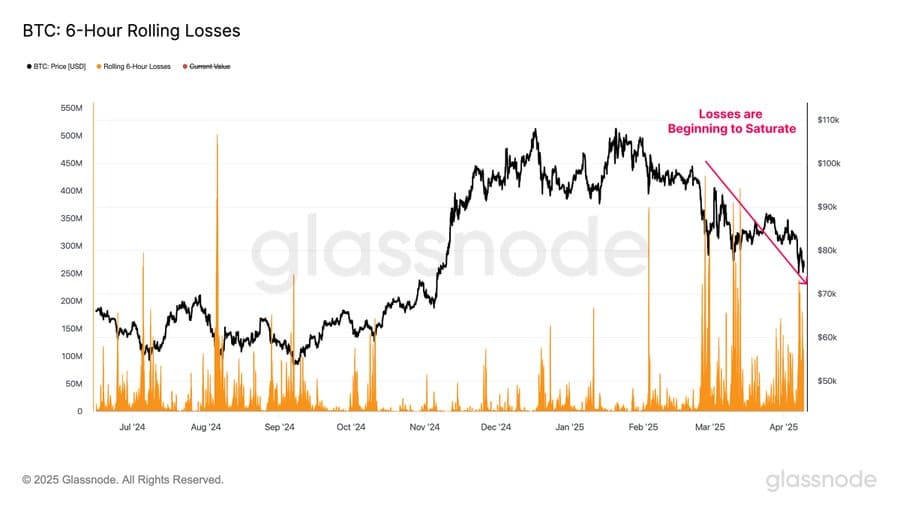

During the latest market drawdown – one of the largest in crypto market history – investors recorded major losses of upto $240 million. Such episodes typically invite aggressive selling pressure. In this particular case, the realized profits have continued to shrink.

This contraction could be a sign that sellers may be evidently running low on ammunition.

In fact, it pointed to exhaustion setting in among market participants – A condition that often precedes a rebound.

Source: Glassnode

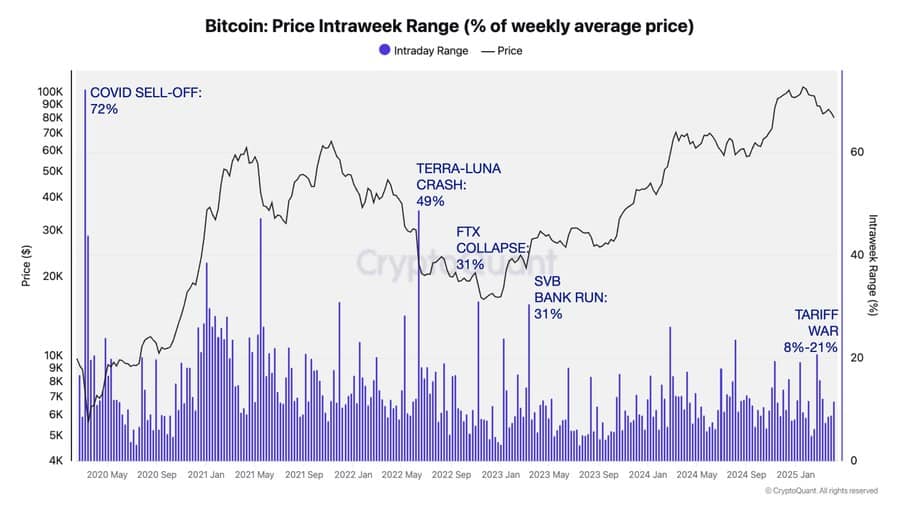

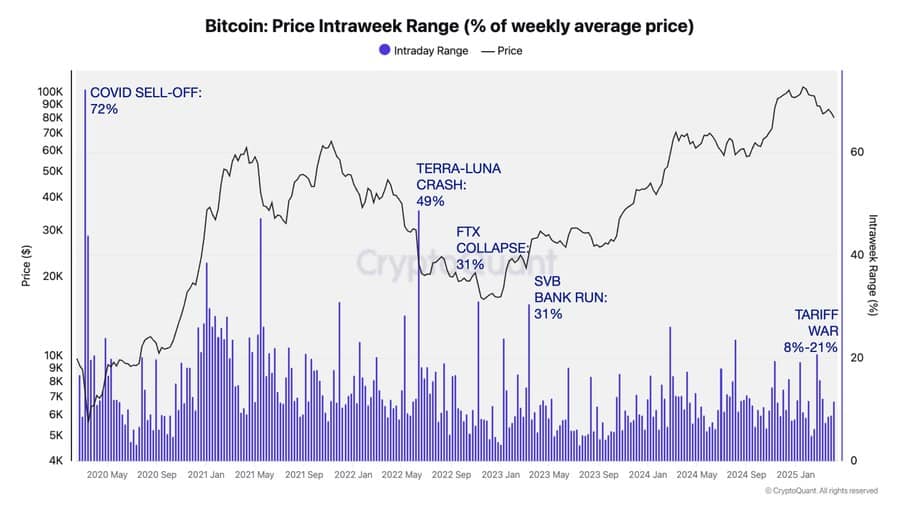

When we juxtapose the current setup with previous capitulation phases, like the U.S. tariff-triggered slide, the Covid-19 crash, the Terra-Luna and FTX meltdowns, or even the SVB banking scare, the resemblance is striking.

All of them were followed by periods of renewed buying energy.

Source: CryptoQuant

To provide clearer guidance on potential market movements, AMBCrypto examined additional metrics to understand the actions of major investors. We discovered that a significant rebound may soon be approaching.

A major rebound could be closer

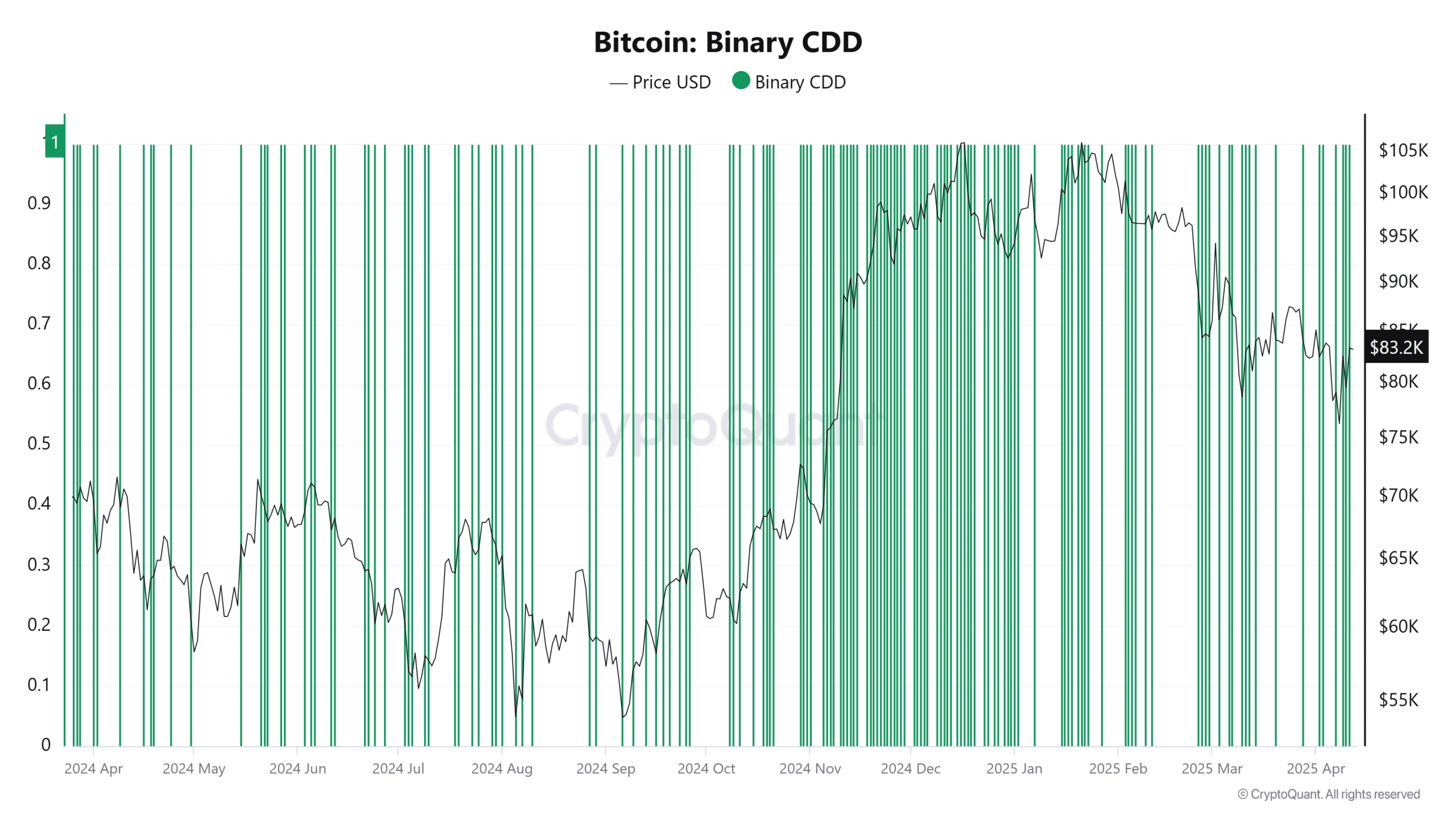

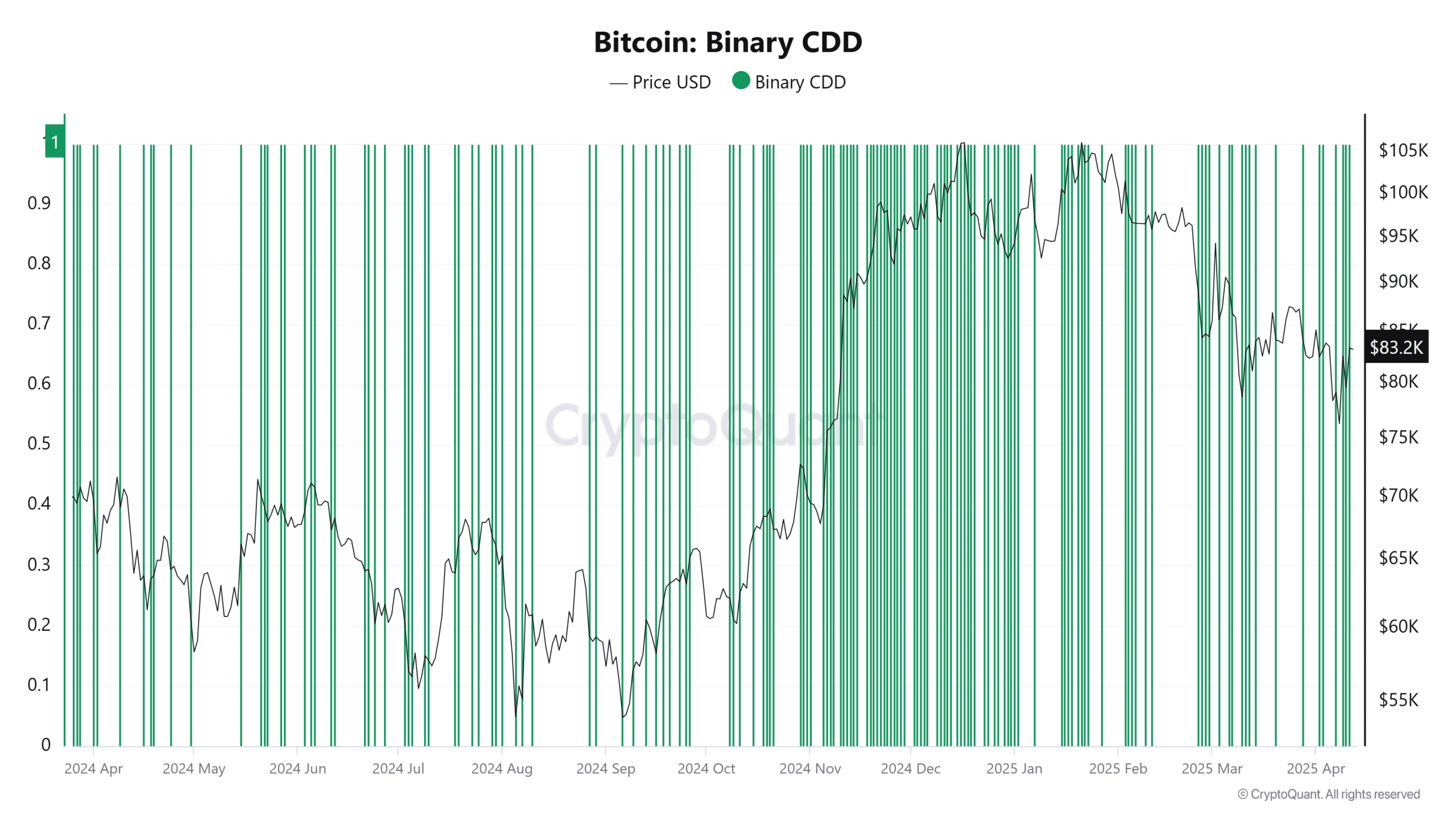

On top of that, the Binary Coin Days Destroyed (CDD) metric tells us a story of its own.

At the time of writing, it was flashing a reading of 1 – Indicative of the fact that long-term holders, often the stoic believers in Bitcoin, have joined the selling cohort.

That’s a potent signal. When long-term holders offload post-drop, it’s either to lock in gains or cut losses. These are both signs of capitulation.

Now, even though the market sentiment may be skewed towards selling, the tempo has been slowing down.

This blend of metrics—shrinking realized profits, a Binary CDD reading of 1, and historical parallels—all converge towards a familiar narrative. It is – Seller fatigue is here and a relief rally could very well be the next chapter.

Source: CryptoQuant

In fact, building on signs of seller exhaustion, long-term holders may now be nearing their final phase of selling.

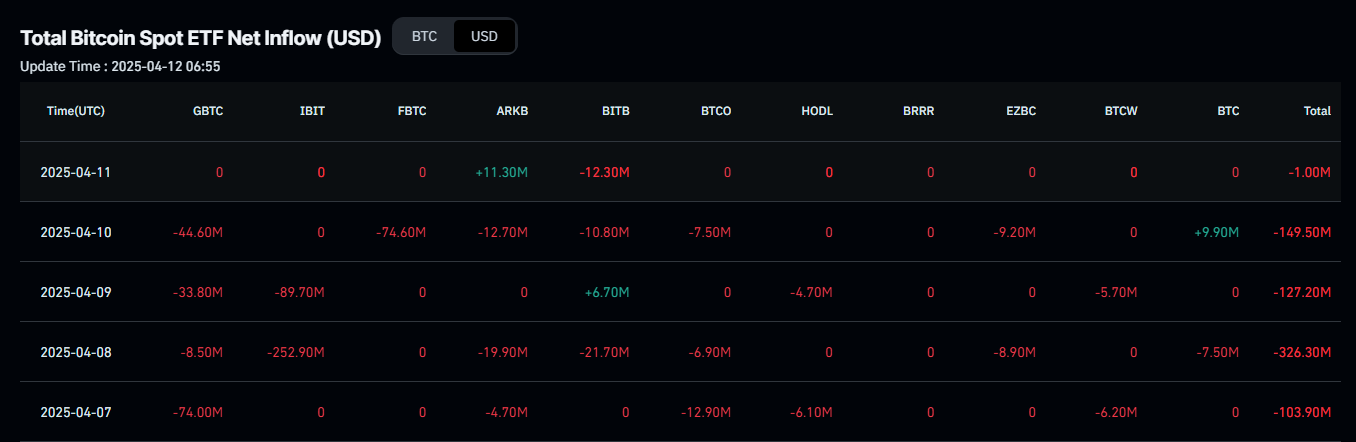

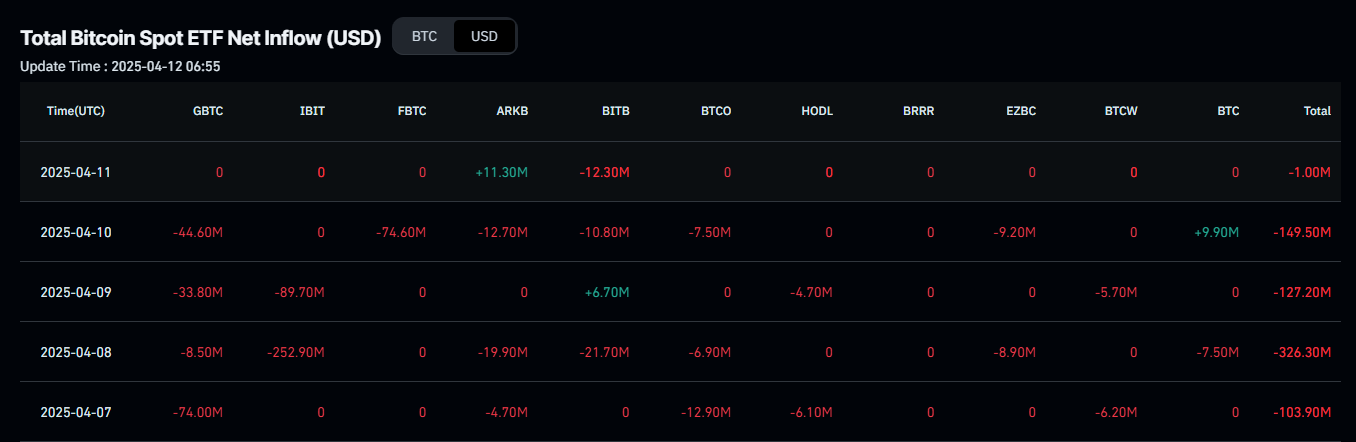

They could soon hold onto the rest. That’s especially true for institutions, who are shifting gears too.

For example – Institutional netflows have dried up. Only $1 million in Bitcoin was sold recently, down from a $176.72 million four-day average.

Source: CoinGlass

That’s a massive drop. Naturally, this means confidence is creeping back into the hands of big-money players. These institutions don’t trade lightly. Their actions often shape Bitcoin’s next major move.

In the spot market, CryptoQuant’s data highlighted a new trend. Netflows flipped negative – Always a bullish signal. That suggested that accumulation is on and that Bitcoin is being moved into private wallets and away from exchanges.

In this phase, 1,959 BTC have been scooped up – Worth around $162 million. Average buy price? $83,000. If this pace holds, Bitcoin could continue soaking up the remaining sell pressure. A breakout may be closer than expected.