- AAVE’s new yield options allow it to compete with popular fintech solutions like Wise and Revolut

- Market has reacted positively since the development, with buying activity rising over the last 24 hours

Aave [AAVE] might be appealing to investors in the market right now after a month of major sell-offs brought the altcoin’s price down by 19.42%. In reaction to this positive sentiment, the crypto climbed by 3.57% soon after? That’s not all though as at press time, there were more indications that the rally could continue.

During this phase of the market, traders have purchased a significant amount of AAVE. All while the ecosystem value accrued during this period has continued to climb.

Aave protocol outperforms fintech solutions

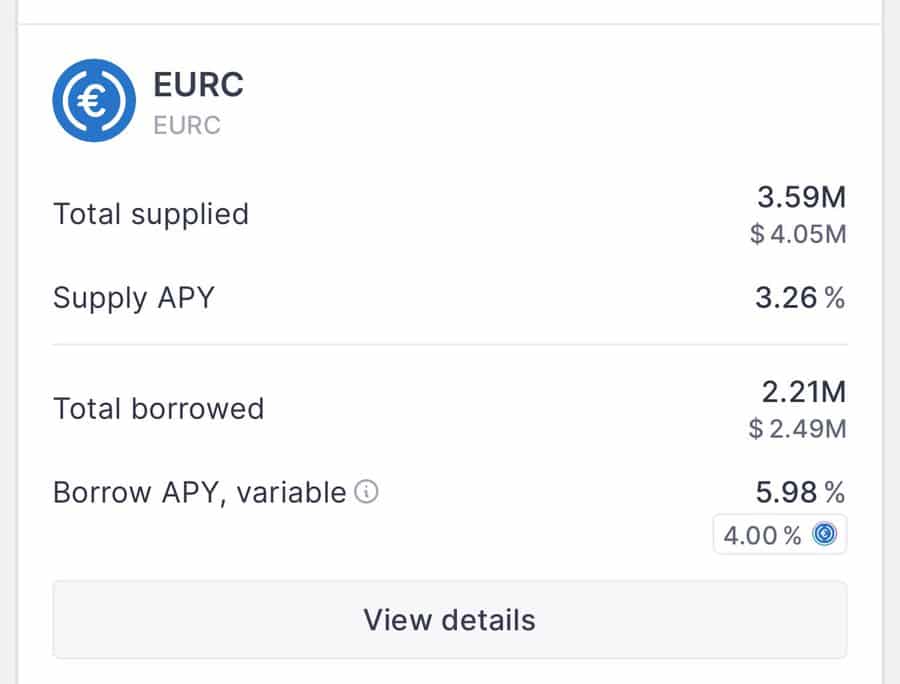

According to a recent post by Founder Stani Kulechov, Aave now provides more yield on its EUR Coin than popular fintech solutions Wise and Revolut, which offer lower interest rates.

Source: Aave

Lenders on Aave now earn up to 3.28% APY – Higher than Wise’s 2.24% and Revolut’s 2.59% (Ultra plan).

Naturally, these elevated returns reshape Aave as a lucrative magnet for yield-hungry users seeking better capital efficiency.

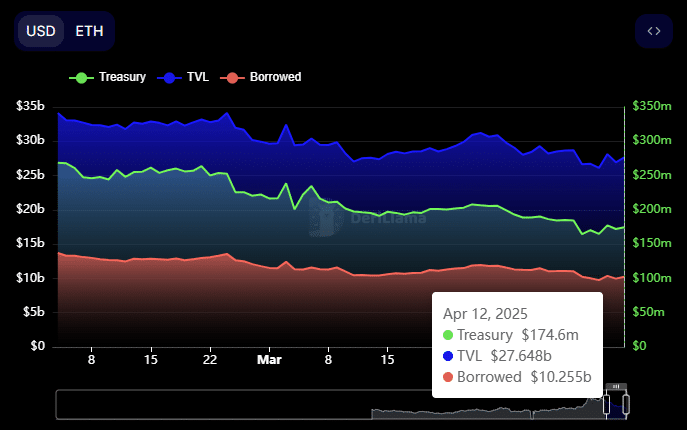

On top of that, DeFiLlama data revealed a surge in activity across the protocol, with liquidity inflows marking a visible uptick. Borrowing on Aave climbed to $10.255 billion – Indicative of growing user engagement across the board.

Meanwhile, the protocol’s TVL rose to $27.648 billion, hinting at more deposits and stronger trust in Aave’s ecosystem.

Source: DeFiLlama

This suggested that there’s a trend of growing interest among participants in the market. By extension, it could affect AAVE’s value on the charts – The platform’s native token.

How did the market react to AAVE?

Buyers in the market have continued to accumulate AAVE following news of its development and attractive yields.

In fact, data from IntoTheBlock highlighted a notable hike in the amount of AAVE purchased on exchanges for long-term holding. At the time of writing, approximately $1 million worth of AAVE had been bought from the market.

Source: IntoTheBlock

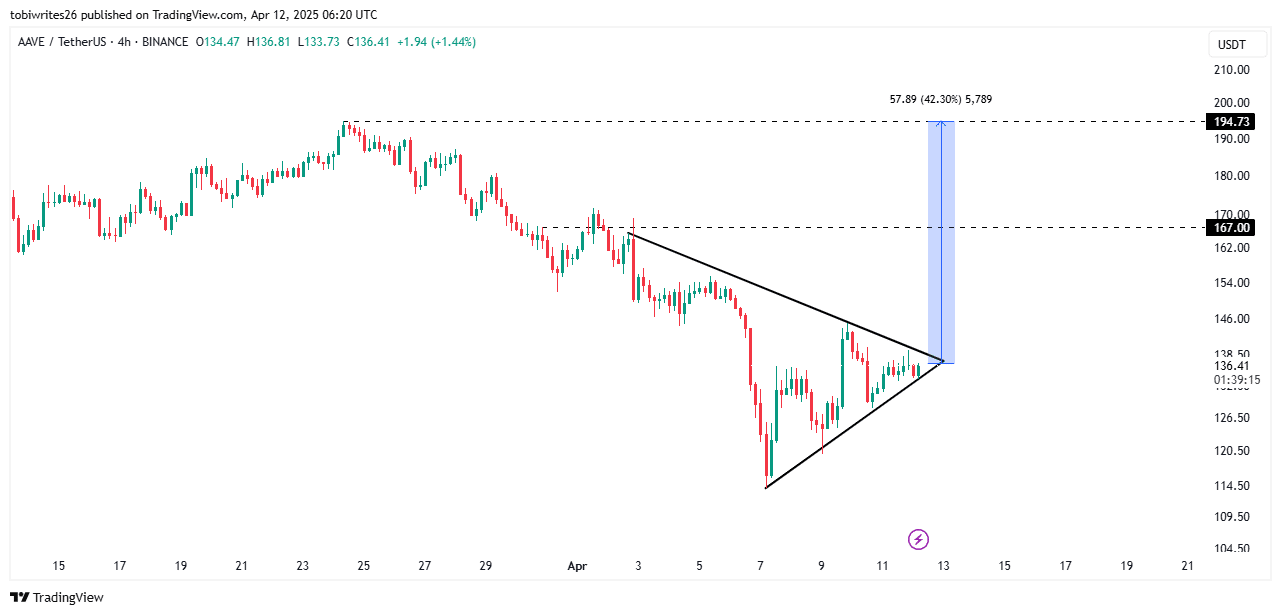

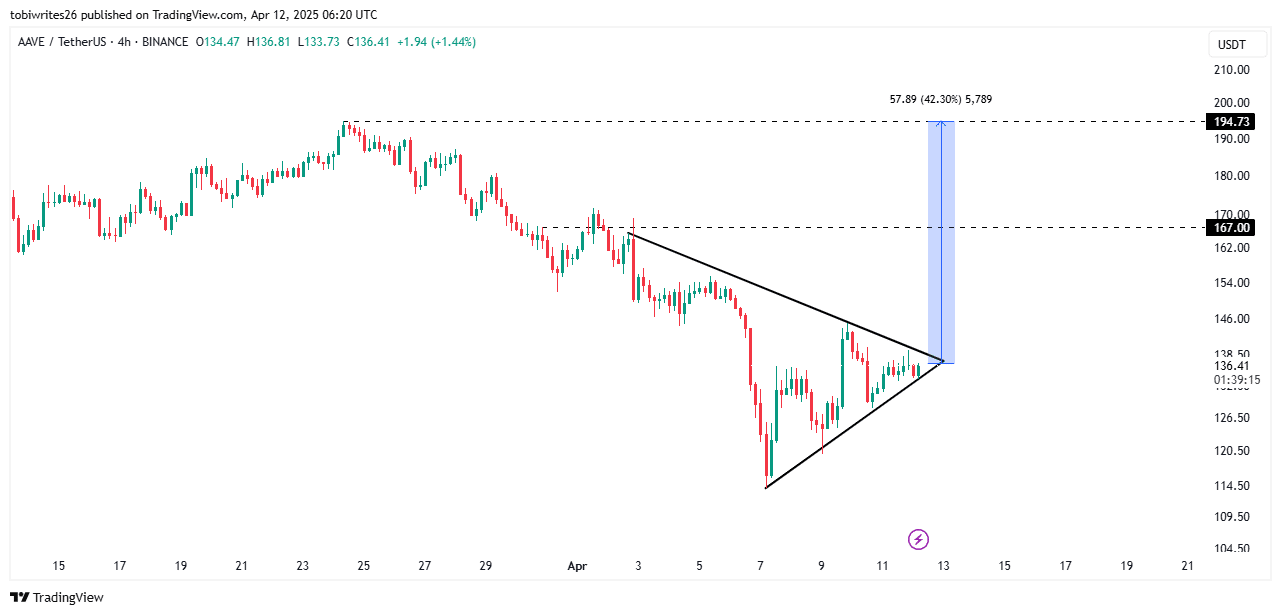

This growing interest, if it continues, could lead to a massive rally of 42%, with the altcoin climbing to $194. This could be the case since the asset has been trading within a symmetrical triangle pattern known as a bullish pattern.

This pattern is made up of converging support and resistance lines. A breach of the resistance line would signals the start of a rally for AAVE, with a short-term target of $167 and a long-term target of $194.

Source: TradingView

Such a rally will also depend on the strength of market momentum. If it remains high, then the breach is more likely.

On the contrary, AAVE may continue to consolidate within this pattern, where accumulation keeps occurring.

Adoption remains high

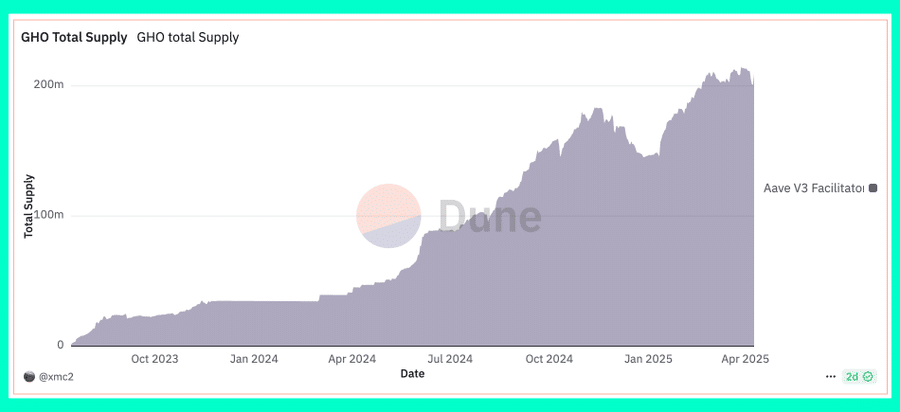

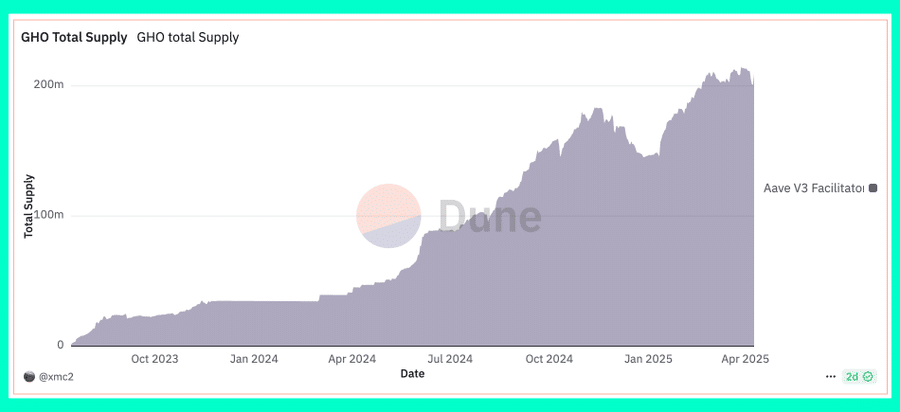

There’s been growing adoption of Aave’s native stablecoin, GHO, with the same seeing massive growth of 442% over the past year alone.

Such an uptick in stablecoin supply implies sustained utility of the stablecoin and, by extension, the Aave protocol. If the total supply surges, it would mean growing demand. This would most likely be reflected in AAVE’s value climbing higher on the charts.

Source: Dune Analytics

Finally, market sentiment has remained bullish lately. AAVE has a higher chance of reaching its near-term target of $167 if this trend is maintained.