- BTC struggles as its price continues with a drop by 1.4% over the past week.

- Bitcoin’s short term investors have entered a period of extreme panic and fear.

Over the past day, Bitcoin [BTC] has declined to hit a low of $81k. The king coin remained in the red zone, with a 1.40% fall on the weekly charts and 0.51% drop on daily charts.

These price fluctuations and rising volatility has left short-term investors in a panic.

Extreme panic and fear

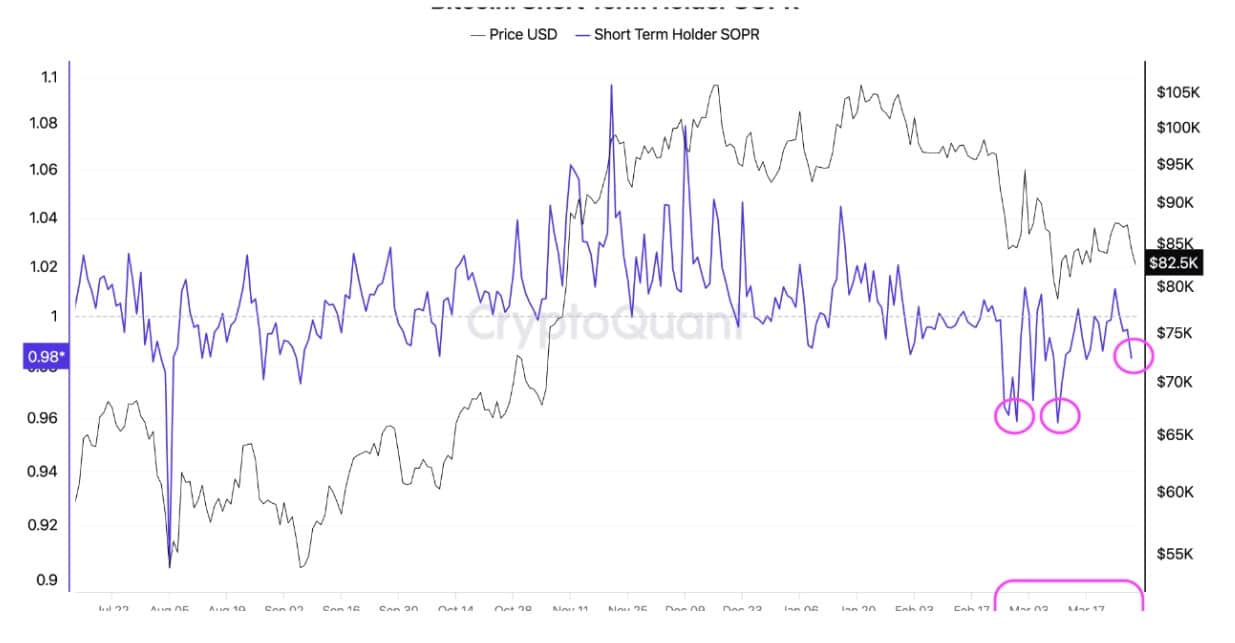

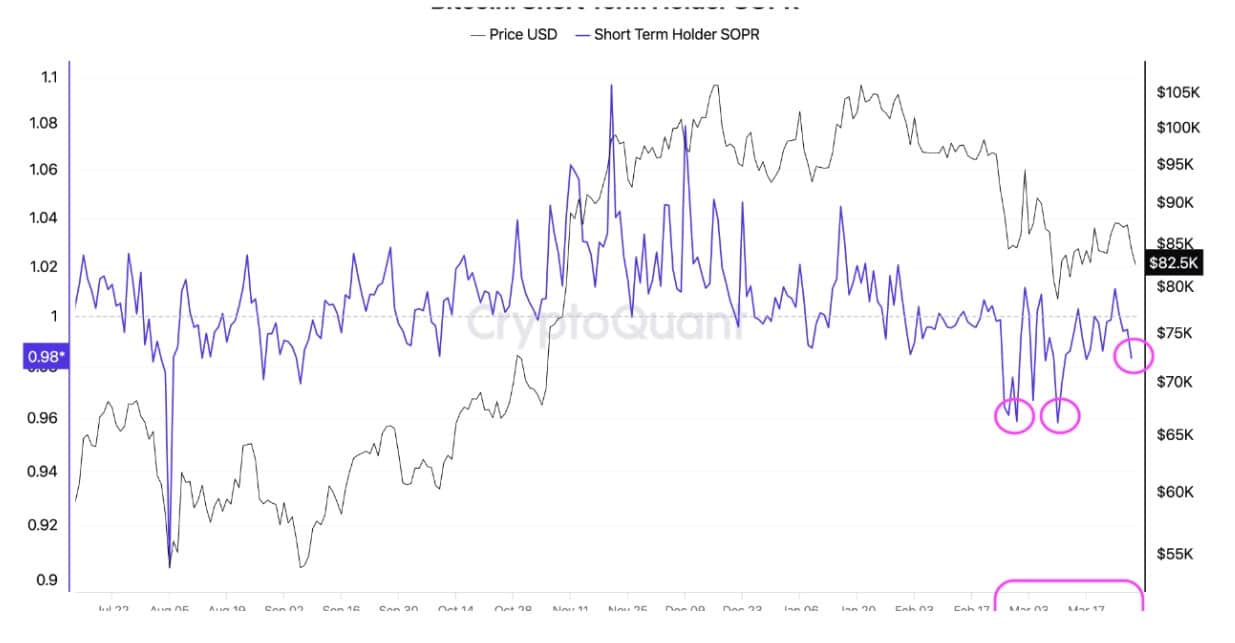

According to CryptoQuant, Bitcoin’s short-term investors are in a state of extreme panic and fear. As per the analysis, since the beginning of February, short-term holders have been consistently selling their coins at a loss.

Source: CryptoQuant

With investors deciding to sell at a loss, it signifies their lack of market confidence. As such, this cohort appears to be lacking a clear direction.

Inasmuch, they sell to avoid further losses, reflecting extreme fear over market uncertainty.

Looking at STH SOPR, it sat below 1 at press time, suggesting that most movements on-chain are at a loss.

During the declines in March, short-term investors sold more at a loss, indicating that panic and fear prevailed on their part.

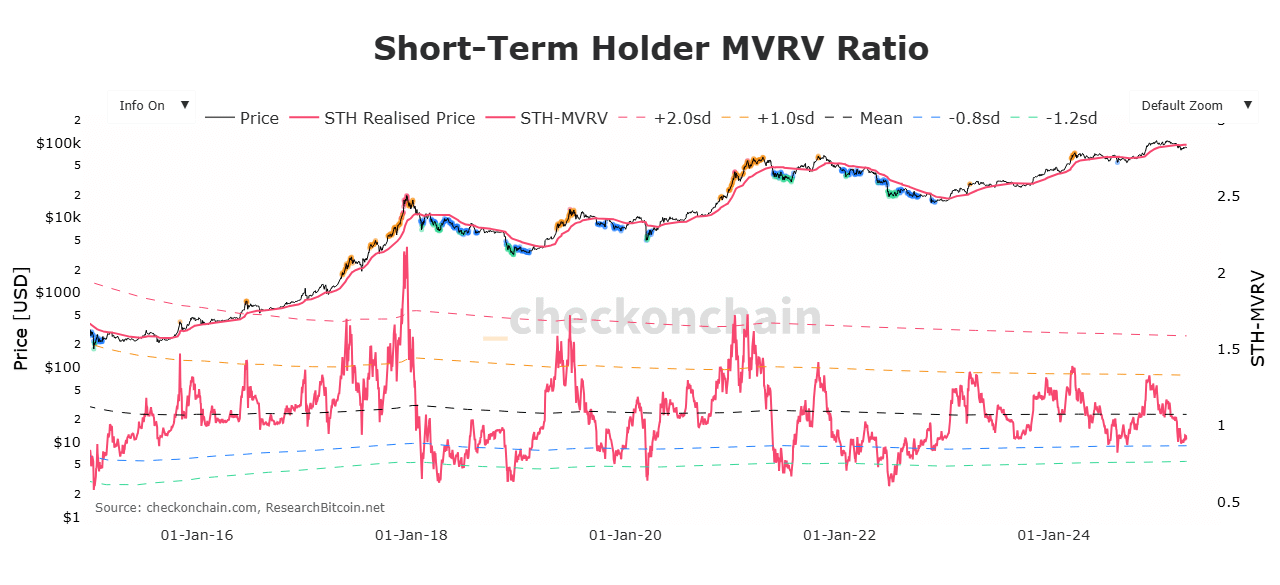

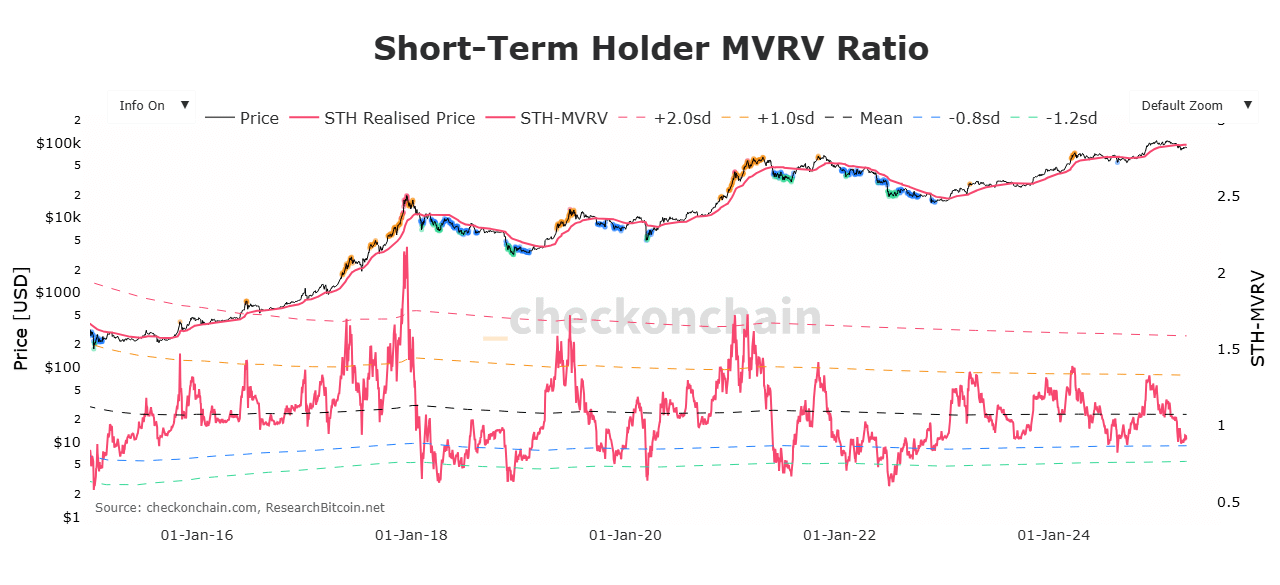

Source: Checkonchain

This lack of market confidence among short-term investors is further validated by a declining short-term holders’ MVRV ratio.

According to Checkonchain data, STH MVRV has declined to 0.86, implying that STH holders are holding at a loss.

Historically, when STH MVRV drops below 1 for a sustained period, it has been followed by further price declines as Bitcoin sees weak demand. With a higher selling rate from STH than buying, prices drop further.

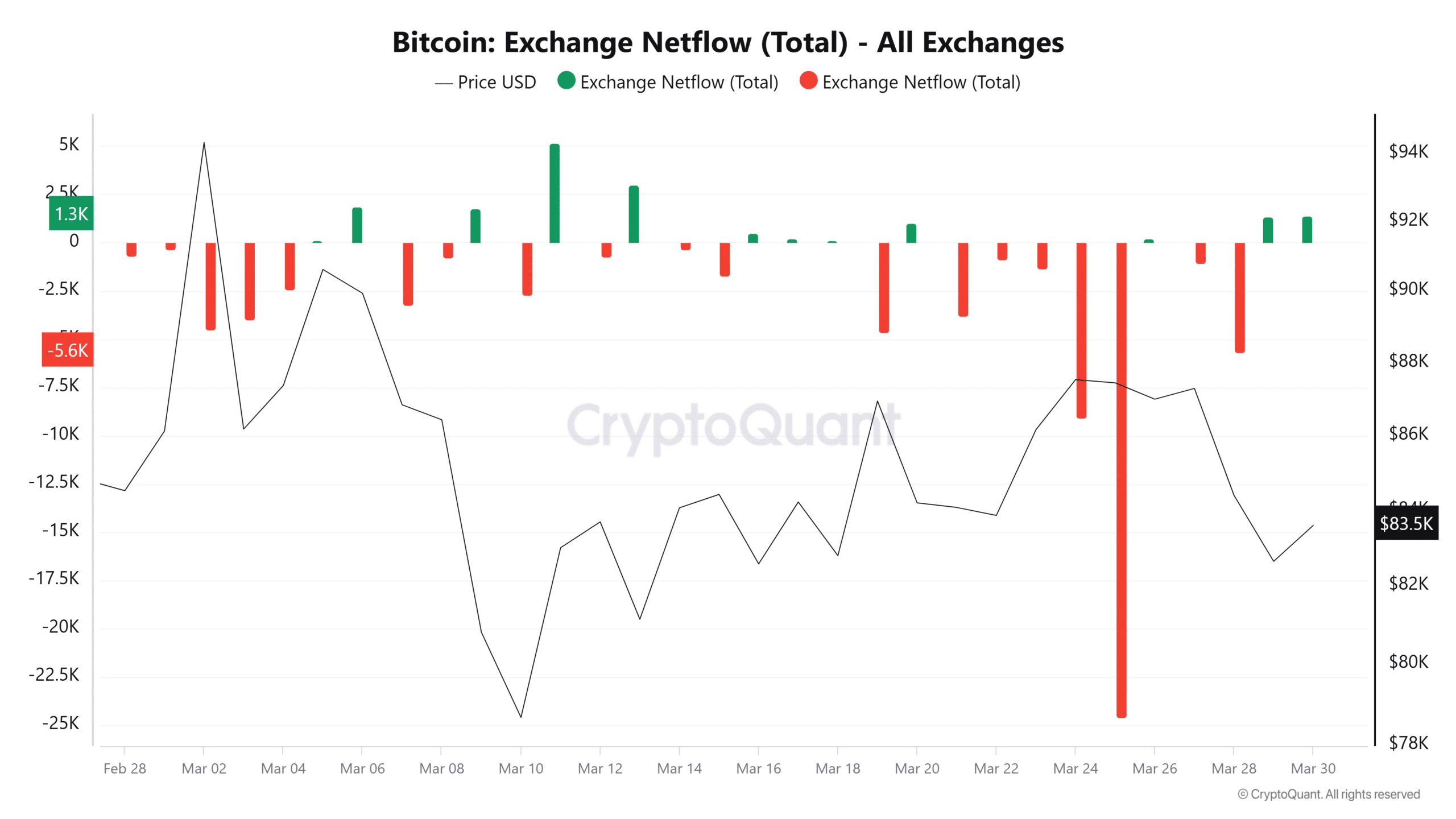

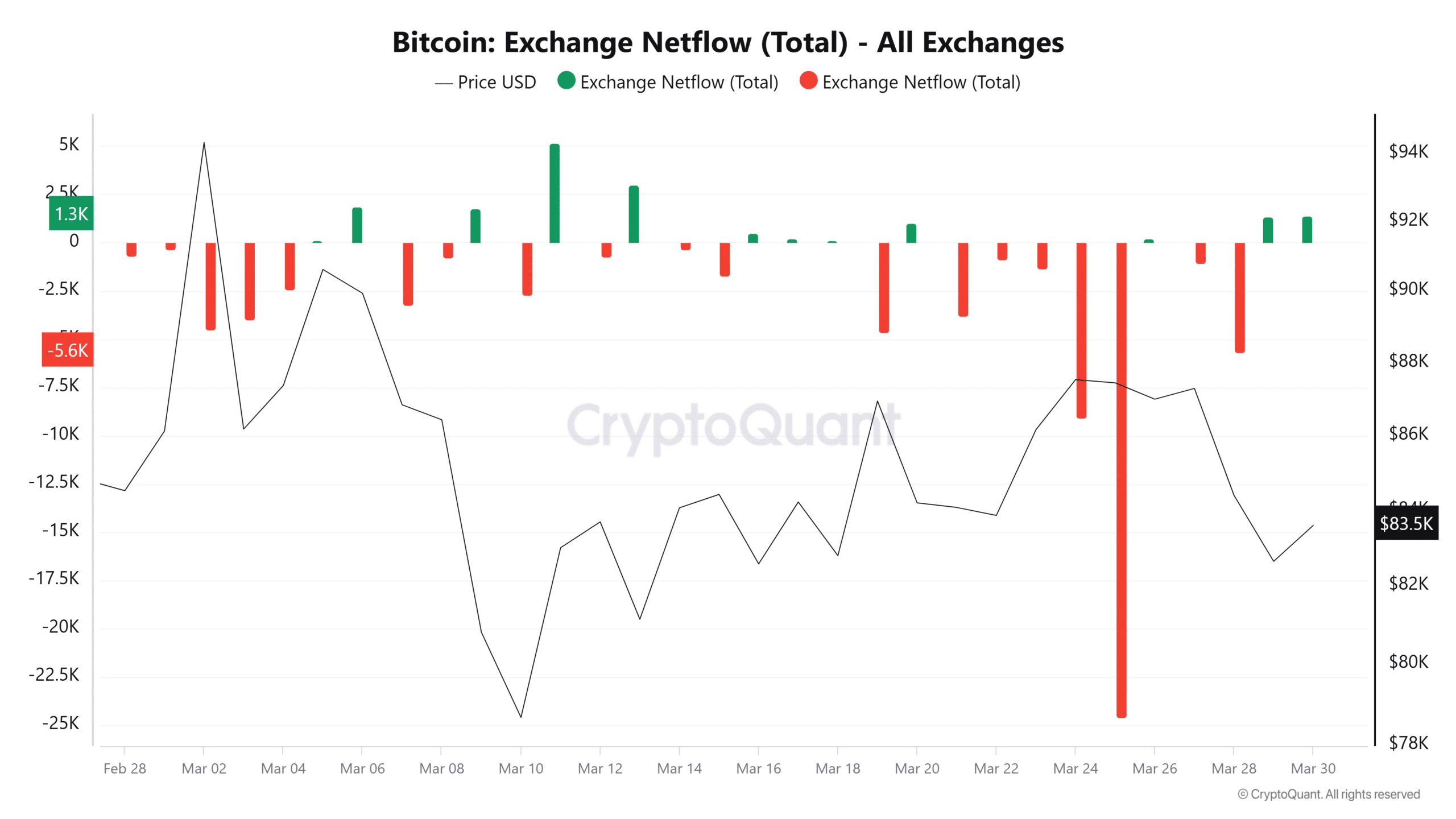

Source: Cryptoquant

Looking at Bitcoin’s exchange netflow, we can see that investors have turned to aggressively selling. As such, BTC has recorded two consecutive days of positive netflow for the first time in 12 days.

This suggests that panic among short-term investors has resulted in higher selling activity from the cohort, with exchange inflows outpacing outflows.

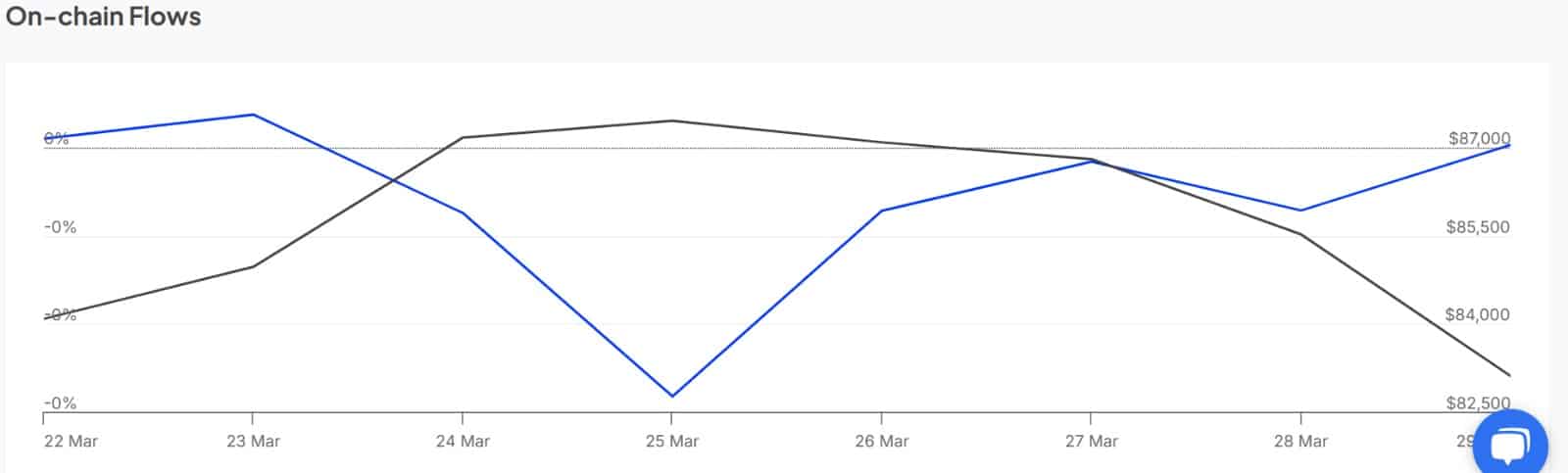

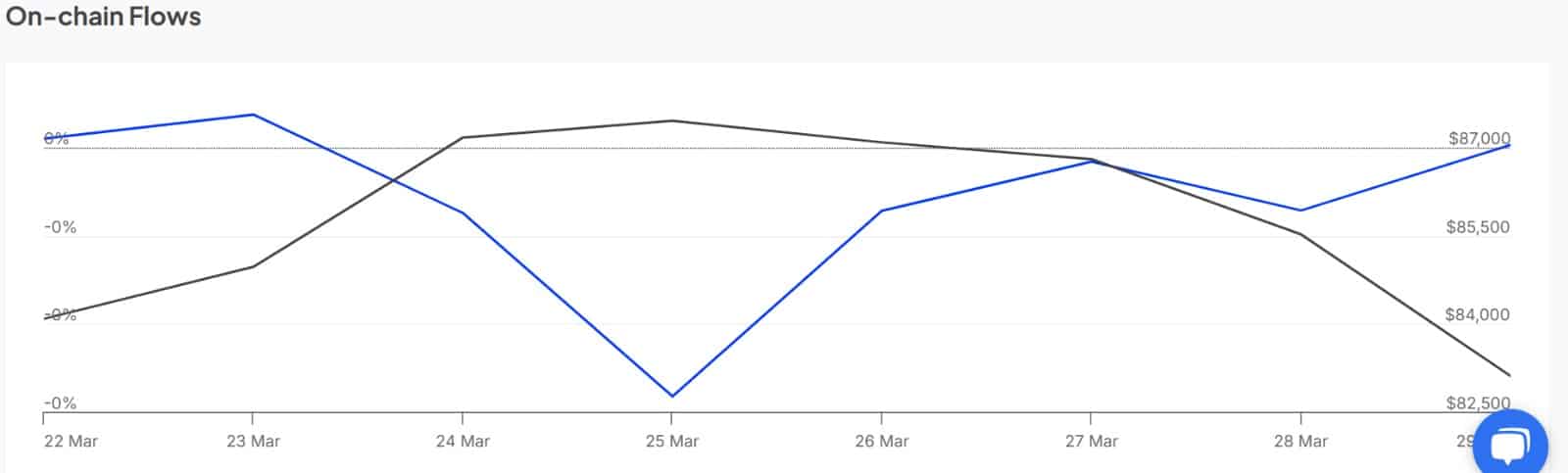

Source: IntoTheBlock

This market behavior is not isolated to retailer traders but also whales. According to IntoTheBlock data, Large Holder’s Netflow to Exchange Netflow Ratio has turned positive over the past day, hiking from -0.09.

A shift to the positive side here implies that whales are sending more BTC into exchanges, further causing pressure on its price charts.

What it means for BTC

According to AMBCrypto’s analysis, as short-term investors enter a period of extreme fear and panic, Bitcoin is experiencing significant bearish sentiments.

This bearishness is seen among whales and retailers in equal measures. Usually, when whales and retailers increase their exchange inflow, it reflects a strong lack of confidence in the market.

Historically, a combination of both small investors and whales on the sell side has resulted in higher selling pressure.

Therefore, if the prevailing fear holds in the market, we could see BTC record more losses on its price charts. A decline here could see BTC drop to $81617.

However, if buyers take the drop in STH MVRV as a buying opportunity, Bitcoin will reclaim $84900 and attempt a move towards $87k.